The Daily Breakdown looks at the rally we’re seeing in Bitcoin and Ethereum, as well as the recent decline in Alphabet stock.

Tuesday’s TLDR

- Bitcoin, Ethereum hit 52-week highs

- Bitcoin ETFs hit new one-day volume record

- Alphabet falls 4.4%

What’s happening?

Markets wavered a bit on Monday, but it was a mixed bag. The S&P 500 and Dow dipped, the Nasdaq was flat, and small caps rallied as the Russell 2000 gained 0.6%.

Last week was all about semiconductors, but so far this week, it’s been all about crypto.

Bitcoin and Ethereum have surged to new 52-week highs, charging higher by 33% and 42.5% so far this month, respectively.

The Dencun upgrade is acting as a bullish catalyst for Ethereum, while the halving event in April is acting as Bitcoin’s bullish catalyst.

The recently approved Bitcoin ETFs are also likely helping give a boost to sentiment. It’s hard to know which one is driving the other — is ETF demand driving Bitcoin higher, are higher Bitcoin prices driving interest in the ETFs, or is it a combination of both?

Bitcoin ETF volume just hit a one-day record, surpassing the record set on the first day of trading. Whether that’s from investors who don’t have access to crypto via their current accounts or those looking to jump on the bandwagon, more access for more investors is being viewed as a good thing by investors.

Want to receive these insights straight to your inbox?

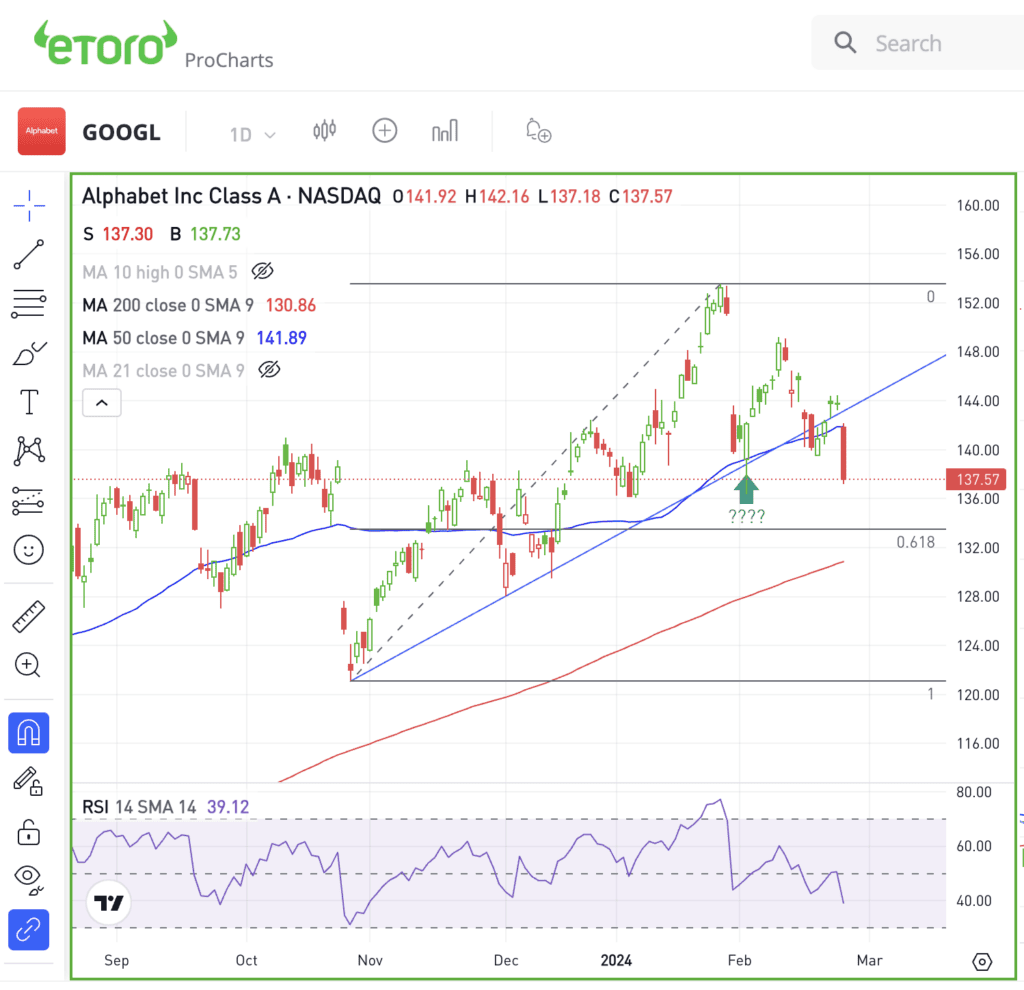

The setup — GOOGL

Alphabet is limping through 2024. After Monday’s 4.4% decline, shares are now down 1.5% so far on the year.

It’s not the worst-performing Magnificent Seven stock — Apple and Tesla are down 5.9% and 19.8% year to date, respectively — but Alphabet has struggled.

If that struggle continues, keep an eye on the low-$130s.

Support in early February initially held, sending Alphabet higher. However, the 50-day moving has now failed as support, as shares probe the prior February lows.

If selling pressure continues, Alphabet stock could dip down to the 200-day moving average and the 61.8% retracement — the latter of which measures from the recent high down to the Q4 low.

If the stock gets to this area, it’s not guaranteed to be support. However, bulls will be watching this zone closely to see if shares can stabilize and hopefully rebound higher.

If not, more selling pressure could ensue, and it’s possible that Alphabet stock settles into a sideways range until some event or catalyst can break it free.

What Wall Street is watching

ARM: Arm Holdings saw a surge in its stock price after Rosenblatt Securities raised its price target, citing improving royalty trends. Analysts anticipate double-digit royalty rates by the end of the decade, attributing it to strategic licensing talks focusing on AI-centric applications.

ZM: Zoom Video stock is up almost 10% following an impressive Q4 earnings report. The company earned $1.42 per share, beating analyst projections of $1.15 a share, while revenue of $1.15 billion beat estimates of $1.13 billion. Additionally, Zoom announced a $1.5 billion share buyback program.

BTC: Bitcoin surged past $57,000, its highest level since late 2021. For what it’s worth, Ethereum and Bitcoin both hit new 52-week highs, as renewed momentum in cryptocurrency continues to push these names higher.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.