Alibaba stock races to new 2024 highs, while The Daily Breakdown looks at what the 10-year Treasury yield has to do with the stock market.

Friday’s TLDR

- Stocks and crypto have had a bumpy week.

- Alibaba stock breaks out.

- Apple, Coinbase beat on earnings estimates.

What’s happening?

Congratulations…you made it to another Friday. This week was anything but easy with plenty of volatility in both stocks and crypto.

Bitcoin and Ethereum felt some selling pressure, while the S&P 500 and Nasdaq 100 had both good days and bad days while earnings and the Fed took center stage.

So where does that leave us?

It’s not clear if the low is in — both for crypto or the S&P 500 — but one thing investors should keep an eye on right now is the 10-year Treasury yield. One way to do so is by using the ticker “TNX.” Some investors may find it easier to watch bonds or something like the TLT — the most traded long-term government bond ETF.

Right now, investors want to see pressure come off of yields — meaning bonds (like the TLT) rally and yields (like the TNX) fall.

As yields go up, it puts pressure on borrowing costs, making many things (like mortgages and loans) more expensive.

The recent rise in the 10-year yield — which has risen from 4.03% in early March to a recent high of 4.73% — has been a headwind for US stocks lately. Keep in mind that when stocks were getting crushed in October, the 10-year yield rose to 5%.

It’s not a direct inverse relationship. But right now, it should benefit stocks if the 10-year yield cools off.

Remember: Pullbacks of more than 5% are normal — even in bull markets. We have averaged about three a year over the last 50 years. That doesn’t mean a 5% dip can’t turn into a larger correction, but remember that as uncomfortable as some of these declines feel right now, it is normal market behavior.

For now, keep an eye on the 10-year yield.

Want to receive these insights straight to your inbox?

The setup — BABA

Shares of Alibaba have struggled. While the stock is up almost 12% over the past three months, the stock is down 1.4% over the past 12 months. Alibaba is down significantly more than that over the last several years.

However, the stock has been trading better lately.

Shares rallied as much as 7.8% on Thursday, with Alibaba hitting its highest level since mid-November.

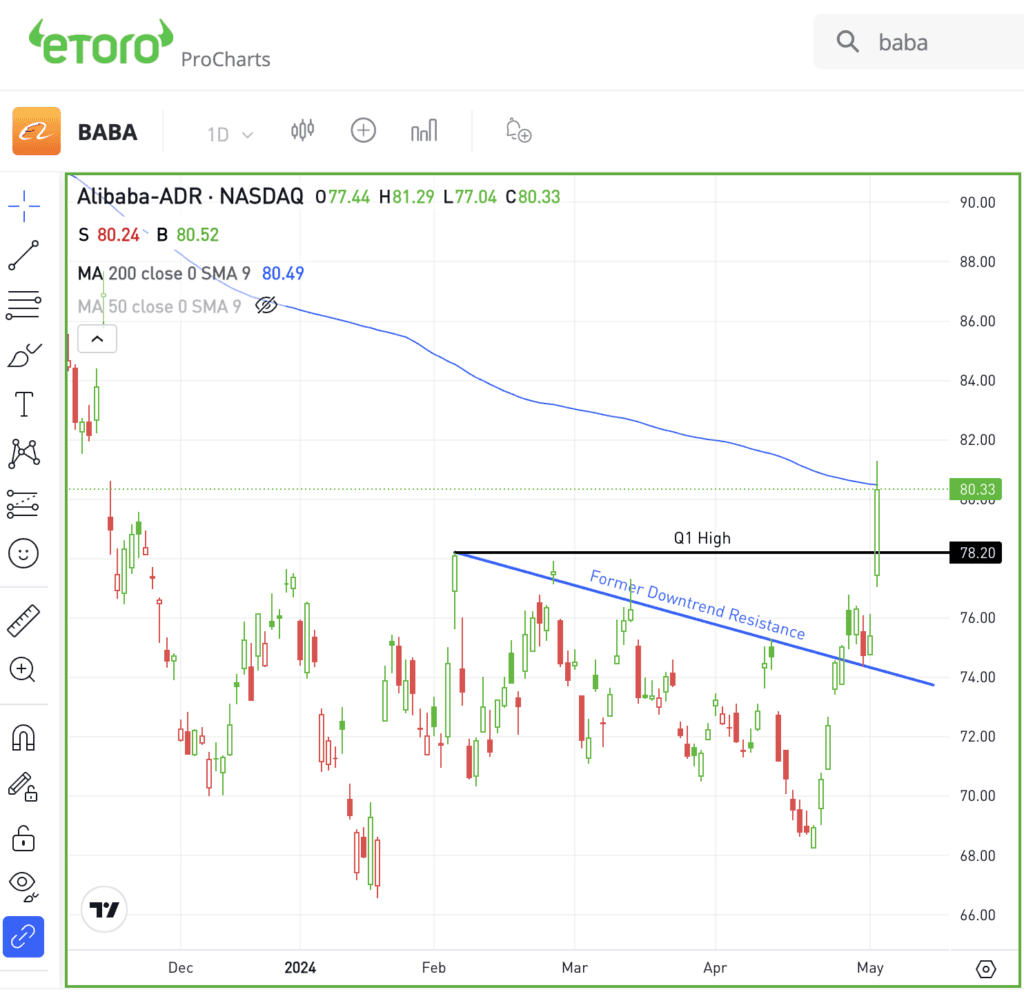

Look at the way shares broke out over former downtrend resistance last week, then consolidated above this level until Thursday’s big rally. Yesterday’s jump sent shares over the Q1 high and right into the 200-day moving average.

The 200-day moving average is a long-term measure of the trend, and it’s possible that this level acts as resistance. If that’s the case, bulls will want to see Alibaba stock hold up over the Q1 high near $78.

If it can do that, it’s possible that bulls will maintain momentum and could continue to benefit from an upward bias in Alibaba.

However, if shares break back below that Q1 high, then the mid-$70s could be back on the table.

What Wall Street is watching

AAPL — Shares of Apple traded higher in Thursday’s after-hours session after the firm delivered a top- and bottom-line earnings beat. While revenue slipped 4.3% year over year, the results were enough to beat expectations. iPhone revenue and Greater China sales also beat expectations, while management gave a slight boost to the dividend and announced a $110 billion share buyback plan.

COIN — Shares of Coinbase will be in focus on Friday after the firm delivered earnings after the close on Thursday. The company reported earnings of $4.40 a share vs. expectations of $1.07 per share (with an accounting change accounting for the big beat). Even without the change, the company would have beat expectations. Revenue of $1.64 billion more than doubled year over year and beat estimates of $1.34 billion.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.