Tuesday’s TLDR

- AMD and Super Micro earnings are in focus for AI stocks.

- Amazon stock eyes possible breakout with earnings on deck.

- Ethereum and Bitcoin slip despite Hong Kong ETF launch.

What’s happening?

Remember, Monday was supposed to be a quiet day for markets — and it was. We have a pretty loaded schedule this week, which starts with Tuesday’s earnings.

Plenty of names will report this morning, including PayPal, Coca-Cola, McDonald’s, and Eli Lilly, among others. However, things really heat up after the close.

That’s as Amazon reports earnings, alongside Advanced Micro Devices and Super Micro Computer.

Amazon is a major focus because of its $1.9 trillion market cap — making it the fifth-largest company in the US. Its role in tech is undisputed and investors will be keying in on management’s comments on both e-commerce and the cloud.

As for AMD and Super Micro Computer, these two will be a major focus for chip-stock enthusiasts and those interested in AI. Both stocks are involved in this space and while Nvidia doesn’t report earnings for a few more weeks, it too could move based on the results and commentary from these two firms.

Keep a close eye on how these stocks trade after their reports, as it could have broader implications for the semiconductor space this week.

Want to receive these insights straight to your inbox?

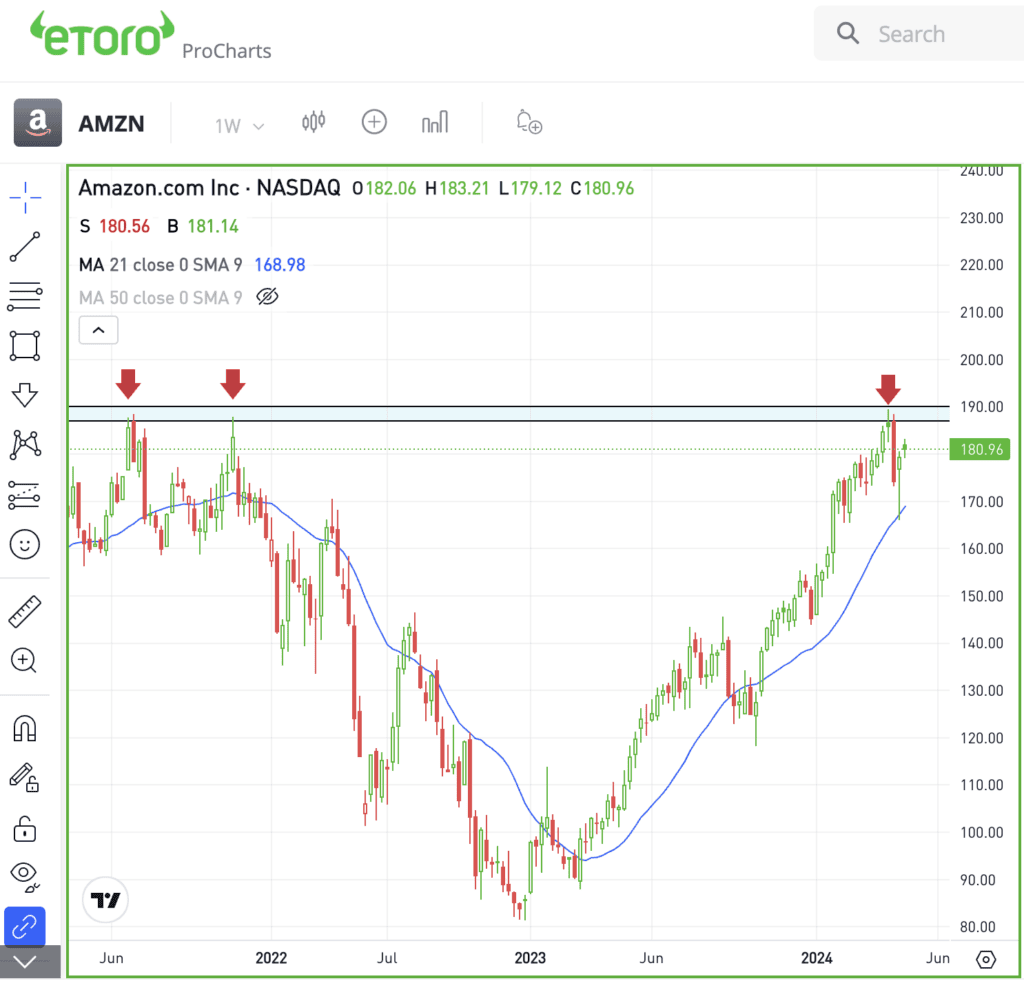

The setup — AMZN

As Amazon gears up for earnings, the stock has been on fire. Shares are up almost 20% so far this year and have rallied more than 70% over the past 12 months.

Now, the charts are setting up with an interesting look ahead of the report. Notice the weekly chart below, which shows resistance between $187 to $190.

If Amazon has a bullish reaction to its earnings, bulls will be looking for a breakout over this zone. If the reaction is bearish, it could cement the $187 to $190 zone as resistance as we push through the second quarter.

Options

Earnings are one scenario where options can come into play. That’s because investors who buy options limit their risk to the price paid for the option. Why does that matter?

Think about the risk going into earnings when long common stock. Shares could rally 5%, 10%, 20%, etc. They could also fall 5%, 10%, 20%, etc. In other words, the risk is unknown.

With options, we already know the risk that we’ve taken — we know the worst case scenario, which is that we lose 100% of the premium paid.

That doesn’t mean investors should speculate on earnings with options, only that it’s a limited-risk approach to doing so. Bulls can utilize calls or call spreads to speculate on a rally, while bears can use puts or put spreads to speculate on a pullback.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

AAPL — Apple stock rose following an upgrade by Bernstein to Outperform from Market Perform ahead of its Q2 results on Thursday. Despite current challenges in China and a slow iPhone upgrade cycle, Bernstein anticipates gains from AI integration and a robust replacement cycle.

PARA — Paramount Global inched higher on news that the Redstone family and Skydance Media enhanced their takeover offer — including stock purchase benefits and extended voting rights. Paramount also beat on earnings expectations, while CEO Bob Bakish stepped down.

ETH — Ethereum is hitting its lowest prices since April 19, with the cryptocurrency tumbling about 7% as of 8:15 a.m. ET. Bitcoin and Ethereum ETFs began trading in Hong Kong on Tuesday, although initial trading volumes were reportedly below the issuers’ initial expectations.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.