The Daily Breakdown readies for earnings from Apple, Amazon, Intel and others, as the quarterly reports continue to roll out.

Thursday’s TLDR

- Fed lays out the roadmap for a September rate cut.

- Apple and Amazon earnings in focus today.

- AMD pops, Nvidia soars.

What’s happening?

Between Wednesday afternoon and Friday morning, there is an avalanche of news, which is why I’m here to help.

Yesterday, the Fed kept rates unchanged (as expected) and as hoped, Chair Powell laid out a roadmap for cutting rates in September. He said a cut at the Fed’s next meeting “could be on the table” provided that the data remains favorable — basically, as long as the data comes in like it has been the past few months.

Great. Now we have our recipe for getting rate cuts later this quarter, however, earnings still loom large.

Meta is the latest Magnificent 7 name to report, beating on earnings and revenue expectations. Apple and Amazon will hope to do the same when they report earnings later tonight. They’ll do so alongside Intel, Coinbase, Block and others.

Lastly, we have the monthly jobs report tomorrow morning before the open. The report will tell us how many jobs were added in July and give us the revised numbers for June. It will also provide the updated unemployment rate.

One note here: While we all want to see a good jobs report, too strong of a result could have the Fed feeling more confident in waiting to cut rates. To lower rates, the Fed is watching inflation (which is cooling) and the labor market (which has softened lately). If the jobs market starts to heat back up, it could delay rate cuts.

That said, a stronger-than-expected jobs market is hardly a bad problem to have.

Want to receive these insights straight to your inbox?

The setup — AMZN

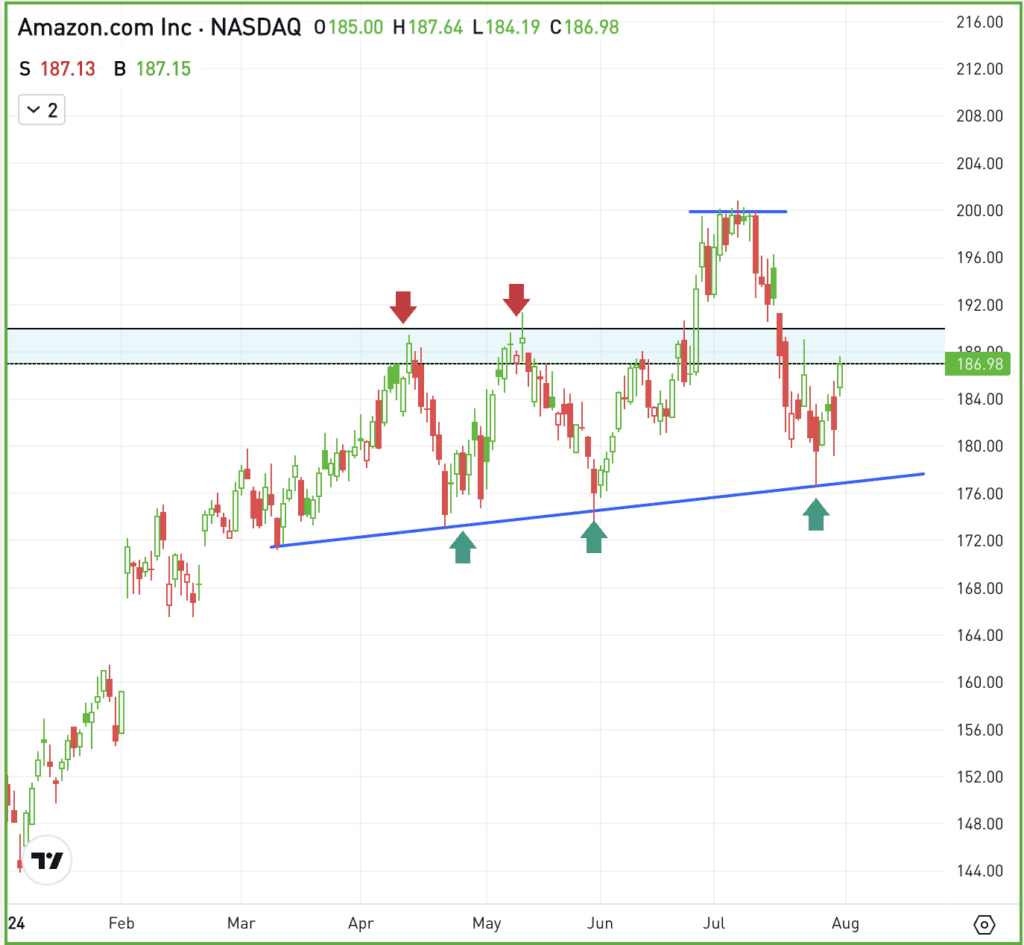

As mentioned, Amazon is scheduled to report earnings tonight. Will it be enough to get the stock back over the key $190 area?

About a month ago we talked about this level, as it was not only resistance in April and May, but also marked the prior bull-market high for Amazon back in July and November 2021.

Put another way, this is a big level on the charts.

If Amazon regains $190, bulls will look for a possible push back to $200, which was resistance in June and July before the recent pullback. Above $200 and the stock could enjoy a breakout to new all-time highs.

However, if AMZN struggles to regain $190, then support back in the mid-$170s will be on watch. This zone has buoyed the stock over the last few months as it continues to chop around the key $190 level.

Speculating around earnings is difficult due to the potential for a binary, unknown outcome. Be careful if you’re trading AMZN on earnings, but keep the technical levels in mind.

Options

For options traders, calls or call spreads are one way for investors to speculate on more upside, while puts or put spreads allow them to speculate on further downside — or allow bulls to hedge their long positions.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

META – Meta reported strong Q2 sales, driven by AI-powered ads. This progress underscores the effectiveness of Meta’s AI investments in delivering targeted and personalized ads. The firm beat earnings and revenue expectations, earning $5.16 per share on sales of $39.07 billion, while management provided a strong outlook for the current quarter.

AMD – Advanced Micro Devices reported earnings, but Nvidia is the one that stole the spotlight. At one point, shares of AMD rallied almost 11% yesterday, but ended higher by just 4.4% despite beating on earnings and revenue estimates and providing better-than-expected guidance. For its part, Nvidia rallied almost 13% on the day.

ARM – Arm Holdings is under pressure in pre-market trading after forecasting Q2 earnings of 23 to 27 cents a share, the midpoint of which (25 cents) came in below consensus earnings expectations of 27 cents a share. The miss overshadowed a top- and bottom-line beat for Q1.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.