The Daily Breakdown takes a closer look at the S&P 500 before zooming in on Bitcoin to see if the recent pullback will find support.

Tuesday’s TLDR

- How to spot winners when the market tides change.

- Bitcoin continues to consolidate.

- Nvidia slumps 16% in three trading days.

What’s happening?

When looking for opportunities, remember to look around the market a bit.

A few times a week I join a panel of investors and analysts on X to talk about markets. In that discussion, one of my key points has been that it’s a “stock-pickers” market.

When you look at the numbers, just four out of the S&P 500’s 11 sectors are higher this quarter (tech, communications, utilities, and consumer staples). Compare that to 10 of the 11 sectors finishing in positive territory in Q1.

Yet despite lower breadth and less participation, many stocks continue to report good news and trade well.

For instance, the financial and energy sectors look to be waking up. The biotech and consumer discretionary groups are at multi-month highs, while the healthcare sector is hitting a key resistance area as bulls speculate on a possible breakout.

Investors can approach many of these sectors via ETFs. However, they can also look for the sectors doing well and then delve into the groups to see which stocks are leading the charge. In many cases, there are still numerous charts and fundamental stories that show promise.

While it can be easy to overlook these groups, remember that sometimes we need to zoom out to find the strength.

Want to receive these insights straight to your inbox?

The setup — BTC

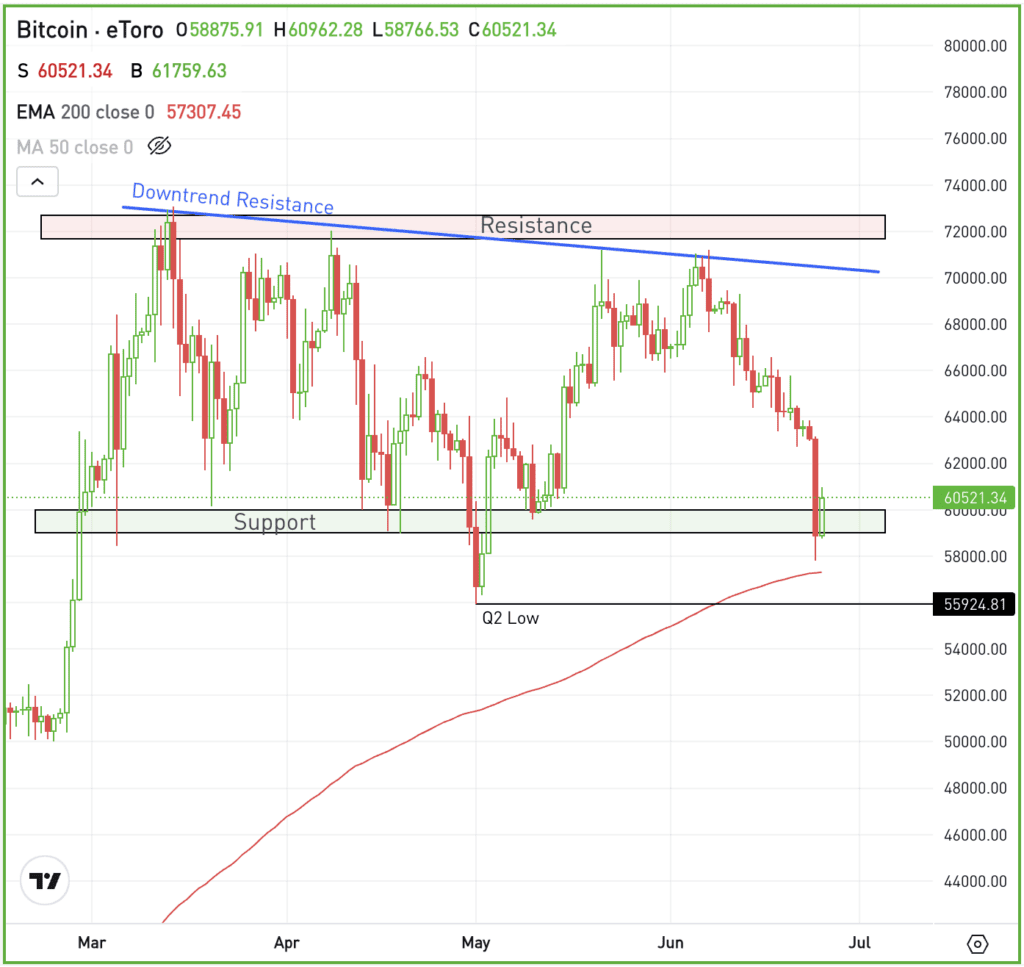

The action in Bitcoin has been discouraging lately, with BTC down 11.5% over the past month. The recent action has been punctuated by yesterday’s near-5% drop, as bulls’ patience begins to wear thin.

While the headlines may drive to the day-to-day narrative, the bigger picture still looks constructive.

From a fundamental perspective, Bitcoin still remains a case of “rising demand amid limited supply.” While that can fluctuate in the short term, it should bode well over the long term.

From a technical perspective, Bitcoin continues to chop between support near $58,000 to $60,000 and resistance near $72,000 to $75,000. Known as “consolidation” to technical analysts, this type of price action is generally seen as constructive after a large rally.

That all said, volatility can persist in the short term.

Ideally, bulls will see Bitcoin stay above the $58,000 to $60,000 support area. However, a break of the 200-day moving average and the May low just below $56,000 would be more worrisome.

What Wall Street is watching

NVDA — Nvidia stock is down more than 16% from its high three days ago vs. a decline of just 1% for the S&P 500. Nvidia’s value has dropped by almost $450 billion in that stretch, crossing the 10% correction level and signaling a possible pause in the tech-driven bull market.

DJT — Following weeks of falling prices, Trump Media’s stock surged 21% on Monday despite recent controversies and regulatory challenges. This comes after a significant loss in share value due to legal and operational setbacks. Momentum in the stock price has continued in Tuesday’s pre-market session.

RMD — ResMed shares tumbled as Eli Lilly announced an FDA decision that may allow label expansion of its weight loss therapy, tirzepatide, to include treatment for obstructive sleep apnea, impacting ResMed’s CPAP machine market.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.