The Daily Breakdown looks at FedEx, which is hitting 52-week highs after the company reported earnings. Other earnings are on deck, too.

Thursday’s TLDR

- Russell Reconstitution, PCE report in focus tomorrow.

- Amazon joins the $2 trillion club.

- Micron slips despite earnings and revenue beat.

What’s happening?

Investors are seeing big moves out of Levi’s and Micron this morning, with both moving lower on earnings. We’ll also hear from Nike when the company reports today after the close.

Investors will also be watching for today’s final Q1 GDP update. Originally, economists had expected growth of 2.5%, but the result came in lower at 1.6%. Since then, it has edged even lower down to 1.3% — which is today’s expectation as well.

Softening economic numbers could help get inflation down to the Fed’s target — that’s good. However, “soft” numbers are one thing, while “weak” numbers are another. We don’t want the economy to weaken too much.

Speaking of inflation, we’ll get the PCE results on Friday. Remember, this is the Fed’s preferred inflation gauge, so it will likely impact rate-cut expectations for the second half of this year, which will affect the S&P 500, Bitcoin and other assets that have moved on rate estimates.

Friday also marks the Russell’s Reconstitution, which is an annual event that reshuffles the Russell 1000, 2000, and 3000 (along with other indices). As institutions readjust their holdings to reflect the changes, it translates to one of the busiest trading days of the year. It can also increase volatility in the short term.

Want to receive these insights straight to your inbox?

The setup — FDX

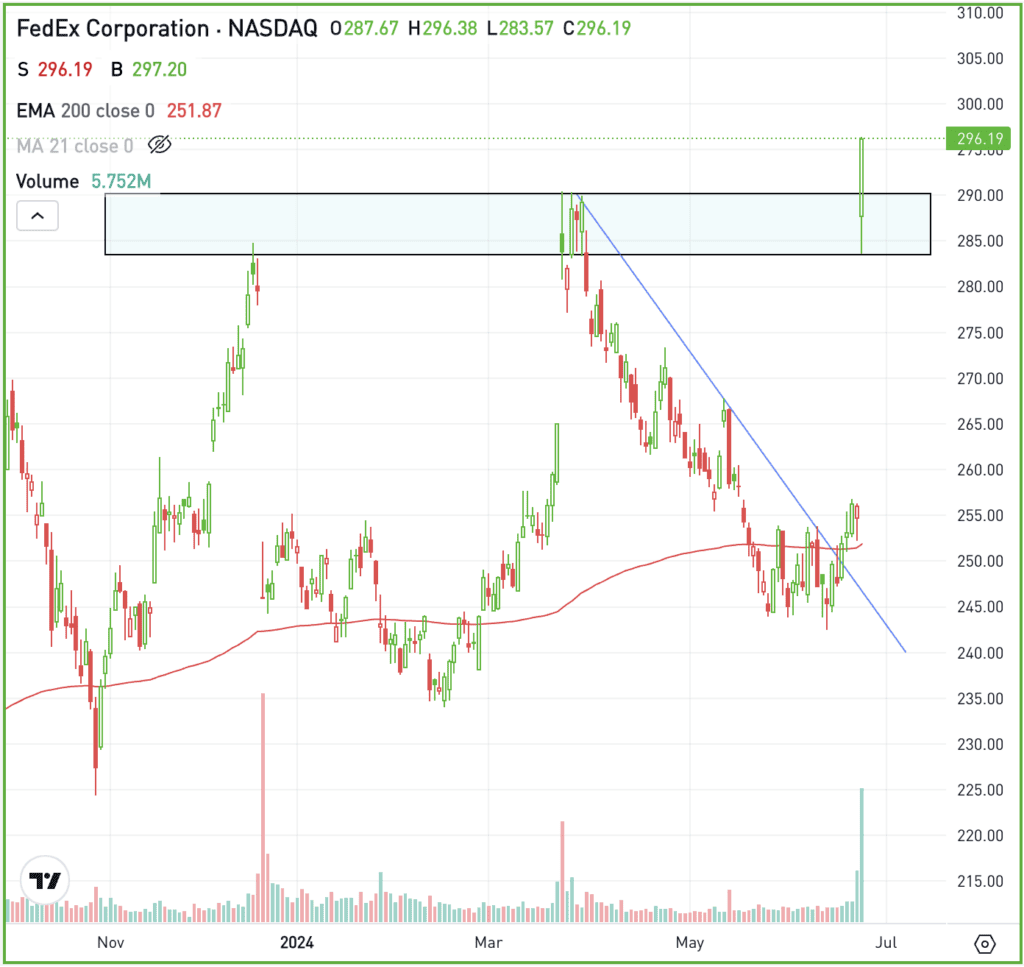

FedEx shares exploded higher on Wednesday, rallying 15.5% and hitting new 52-week highs after reporting earnings.

Shares gapped higher and opened near $288.50, dipped, then ripped higher and closed near the session high. For investors who liked the results and want to participate in FedEx stock, keep an eye on the $283 level.

That level is near the session low, but it also comes into play near the Q4 and Q1 highs, as the mid-$280s proved to be stiff resistance. Now, bulls want to see this prior resistance area turn into support.

For what it’s worth, a break below $283 doesn’t necessarily spell doom for the stock. However, it would likely have more active investors on guard for a potentially larger dip. If FedEx shares can continue higher, the all-time high up near $320 could eventually be in play.

Options

One downside to FedEx is its share price. Because the stock price is so high, the options prices are high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the options outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options and spreads, consider visiting the eToro Academy.

What Wall Street is watching

AMZN — Amazon’s market cap exceeded $2 trillion during Wednesday’s trading session, joining Nvidia, Apple, Alphabet, and Microsoft in the exclusive $2 trillion club. The milestone comes amid a 27.4% jump in 2024.

CMG — Chipotle’s first-ever stock split aims to make shares more accessible after a 50-for-1 split went into effect. The move took effect on Wednesday, with shares eking out a small gain on the day. So far, shares are up about 44% so far this year.

MU — Despite delivering an earnings and revenue beat on its fiscal Q3 results, Micron shares dipped in after-hours trading. Sales jumped 81.6% year over year and 17% from last quarter to a tally of $6.8 billion as “robust AI demand and strong execution” contributed to the growth, according to Micron’s CEO.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.