Utilities have been the best-performing sector so far in Q2 and The Daily Breakdown takes a deep dive on this group.

Friday’s TLDR

- The utilities sector is up double-digits this year.

- But its valuation and earnings remain compelling.

- Bitcoin is trading better, but remains below resistance.

What’s happening?

Of the 11 S&P 500 sectors, who would have thought that utilities would be the only one that’s up double-digits — up 15.1% — over the last three months? The next-best performer is energy, up 5.6%.

We’re about two-thirds of the way through Q2, with utilities up 8.9% in that stretch. There’s only two other sectors that are in positive territory this quarter, that being technology and communications, which are up 0.9% and 0.8%, respectively.

So let’s dive a bit further into utilities, starting with its valuation and then look at forward growth expectations.

Valuation

This sector trades at about 16 times the next 12 months of forecasted earnings — this is known as a forward P/E ratio. That’s below the roughly 20x forward multiple that the S&P 500 trades at, and more importantly, utilities are cheap on a relative basis.

The sector traded at almost 18x forward earnings a year ago and at roughly 21x forward earnings in January 2020 (before the pandemic).

Further, just 21.4% of utility stocks trade above their 2015 to 2019 median forward P/E ratio — the third-lowest measure among sectors in the S&P 500. That’s also down from 25% in January, 67.9% a year ago, and 89.3% in January 2020.

Earnings Growth

A low valuation wouldn’t mean much if there wasn’t growth. However, the utilities sector is poised for its best year of growth since 2009, with estimates calling for 10.8% earnings growth in 2024.

The sector is working off back-to-back quarters of double-digit earnings growth in Q4 and Q1, which is expected to slow to just 0.02% in Q2. That could act as a bearish catalyst in the short-term and lead to profit-taking.

However, earnings growth estimates re-accelerate to 9.6%, 8.2%, 1.7% and 11.6% in the next four quarters, which could act as a bullish catalyst for longer term investors.

The Bottom Line

With utilities already up double-digits on the year — up 13.3% when including the dividend — it’s hard to call this group a slam-dunk. However, is there a case to be made that the sector can continue higher over the longer term, potentially after a dip? Certainly.

Want to receive these insights straight to your inbox?

The setup — BTC

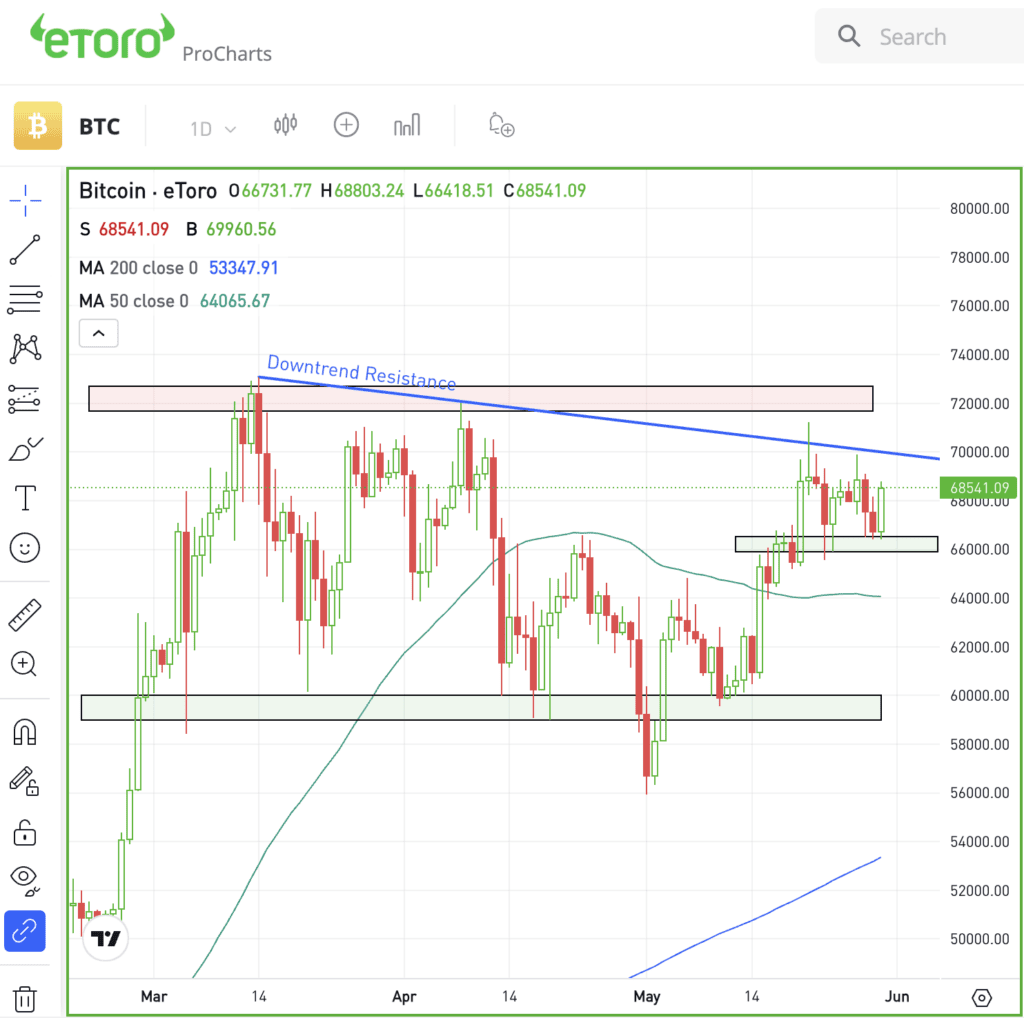

Shifting gears a bit, let’s take another look at Bitcoin. We last discussed Bitcoin as it was running into downtrend resistance earlier this month, but ahead of the SEC’s (now favorable) ruling on Ethereum.

Since the ruling, Bitcoin prices have continued to chop around. Support has materialized around the $66,000 level while downtrend resistance continues to keep the rallies in check.

In the short term, these are the levels to watch.

If support breaks, it could open the door down to the mid-$60,000s area, and potentially, all the way back down toward the key $60,000 level.

However, if Bitcoin is able to clear downtrend resistance — presently, that would require a rally above $70,000 — it could put more upside in play, potentially all the way to new highs.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.