We’ve closed the book on another tumultuous, yet transformative, year for society.

The news was full of doom and gloom — inflation, economic stress, and global conflict dominated the headlines.

Yet under the radar, there was incredible progress in tech, manufacturing, and employee power.

To kick off the new year, let’s crack open our investors’ almanac — a compilation of the biggest trends that could define this bull market in 2024.

One year ago, society was heralding AI as the next big thing.

In our 2023 almanac, we talked about the rise of the robots. ChatGPT was just a few months old, and Americans were coming around to the fact that AI can do a lot of what we can — but cheaper and better.

Today, the optimism continues with a tinge of noticeable caution. This fall, OpenAI manufactured one of the biggest corporate messes in decades when they fired — and rehired — Sam Altman in a matter of weeks. Wall Street is increasingly calling AI a bubble instead of a revolution. And instead of talking about what ChatGPT can do, we’re hearing more about what it can’t do — like tell a funny joke or play rock, paper, scissors.

AI’s momentum isn’t faltering, though. It’s still one of the biggest themes to watch this year, and it’ll likely be the innovation that’ll define our lives for years to come.

The burden of proof is just higher.

We’ve heard all the incredible stories about what AI can do. Now, investors don’t just want to hear the C-suite talk about Al. They need to see evidence that AI can boost profits. Companies that can show receipts could lead the next wave of the AI trade.

Nvidia was the first major company to clear this hurdle. Nvidia beat its second- and third-quarter revenue targets by more than $2 billion each time, backing up the stock’s 200% gain last year. Amazingly enough, Nvidia’s projected price-sales ratio is lower than the S&P 500’s today, despite its stellar performance — a good setup for another strong year.

If Wall Street is correct and AI stocks’ prices look too high for profits, you may have to dig for value using picks and shovels. Or, the picks and shovels trade, as it’s called in investing. Think about which businesses supply the classic AI companies, or could benefit from implementing AI technology.

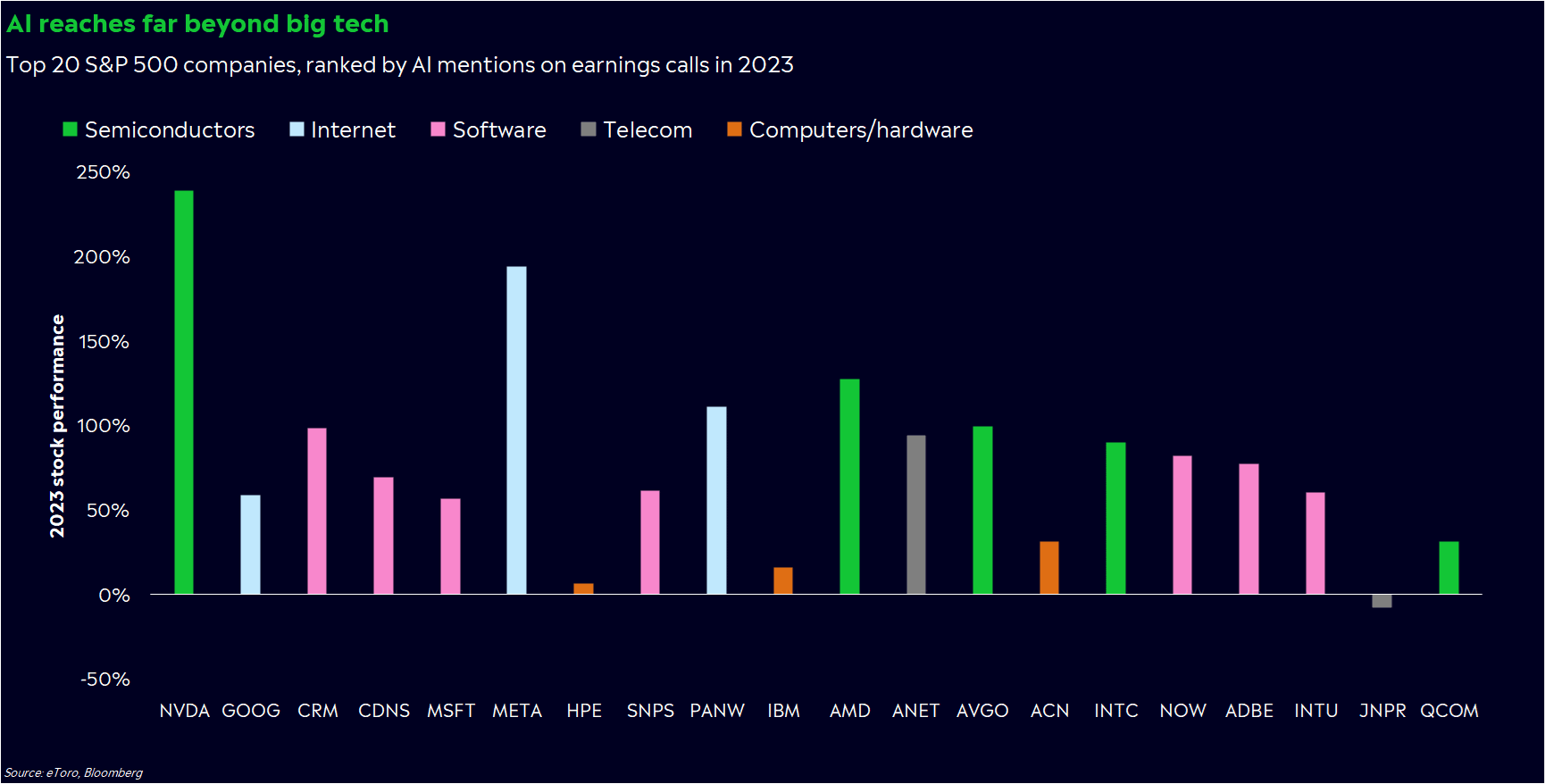

Semiconductor companies, which manufacture chips that power AI training and inference, have been the obvious beneficiaries of the AI-specific picks and shovels trade. There could be a vast amount of possibilities for monetization, too.

Look at the 20 S&P 500 companies that mentioned AI the most in earnings calls last year, and you’ll see five different industries: semiconductors, internet companies, software firms, telecom networks, and hardware makers. Not all of these names flourished last year, either. Three underperformed the S&P 500, and one even fell.

Like many of you, I’m excited about AI. And unlike many people on Wall Street, I’m not ready to call it a bubble yet. 2024 could show us just how transformative AI could be for corporate America — not just tech nerds.

Yes, but… A bubble is only a bubble in hindsight. And right now, all we know is that prices are high. Profits may not follow through. If that’s the case, we may have to rely on the AI hype train to start up again. Or a new ChatGPT release.

Take a road trip across the US, and one economic trend is abundantly clear: Manufacturing is way past its glory days. Smokestacks don’t dot skylines any more, and empty plants are being turned into apartments, restaurants, and breweries.

Yet behind the scenes, domestic manufacturing may be in the early stages of revitalization.

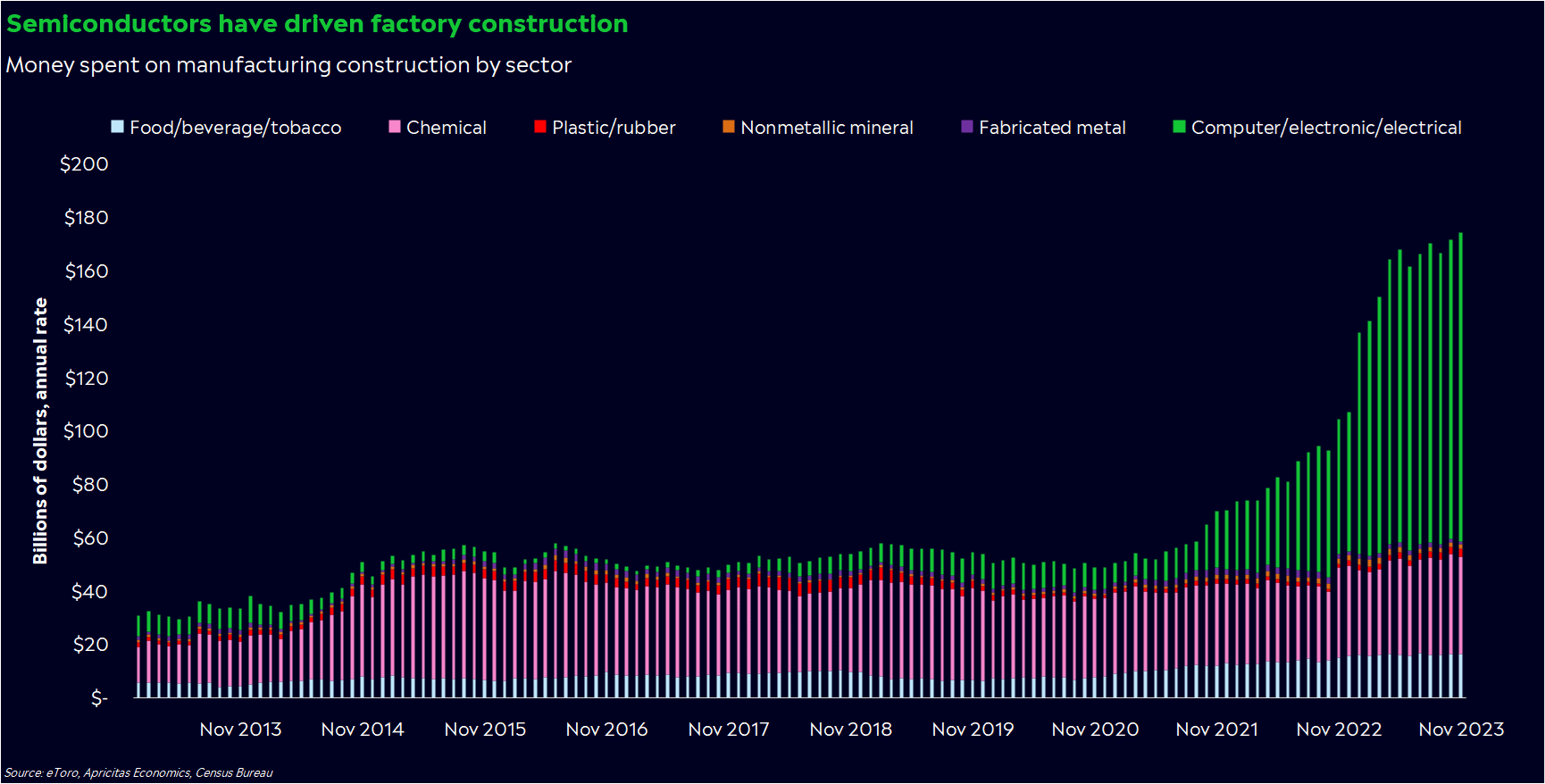

The data tells us as much. Companies are spending a record amount of money on factory construction, which increased a whopping 65% year over year in November. Not only that, but manufacturing’s share of total business investment in the third quarter was its highest in 40 years.

So why is there suddenly so much interest in American manufacturing?

First, companies are still thinking about how to improve their operational resiliency after COVID broke supply chains. For many companies, that’s involved moving their manufacturing closer to the US (or “reshoring”), so the final steps of assembly are closer to home.

New policies have incentivized domestic production even more. The Inflation Reduction Act offered tax credits for manufacturers involved in renewable energy production, while the CHIPS Act encouraged investment in US-based semiconductor manufacturing.

This has arguably been one of the biggest drivers, evidenced by a surge in manufacturing-related construction spending for computer and electronics factories.

Smokestacks won’t be dotting the skylines any time soon. But if you’re looking for the story of the next bull market — or just a reason to feel hopeful for tomorrow — you may want to take a look at what’s happening in the old economy.

A new-age manufacturing boom could touch several different industries, from transportation to machinery and natural resources. We’re also seeing supply chain and automation improvements lift economic productivity.

But we’ll get to that in a second.

Yes, but… This is a trend that could be years in the making. And all manufacturing isn’t suddenly going to move stateside. Overseas manufacturing is still enticingly cheap, and some countries could opt to deal with future trade headaches simply because of lower costs. Economies of scale can be a powerful motivator.

You’ve probably heard a lot about the job market these past few years.

Massive strikes. Work-from-home and hybrid models. One and a half jobs for every unemployed person. Quiet quitting.These events made for eye-catching headlines. But more importantly, they point to a pivotal shift in the balance of power between employers and workers.

It’s about time, too. For much of this century, company executives were focused on profits over worker pay. In the 2010s, the focus on profits came to an ugly head. Sure, market returns were stellar. But at the same time, wages stalled, costs were cut, and GDP gains crept along at the slowest pace for an expansion since at least the 1940s. It was a damaging paradox that widened the wealth gap and sowed distrust within society.

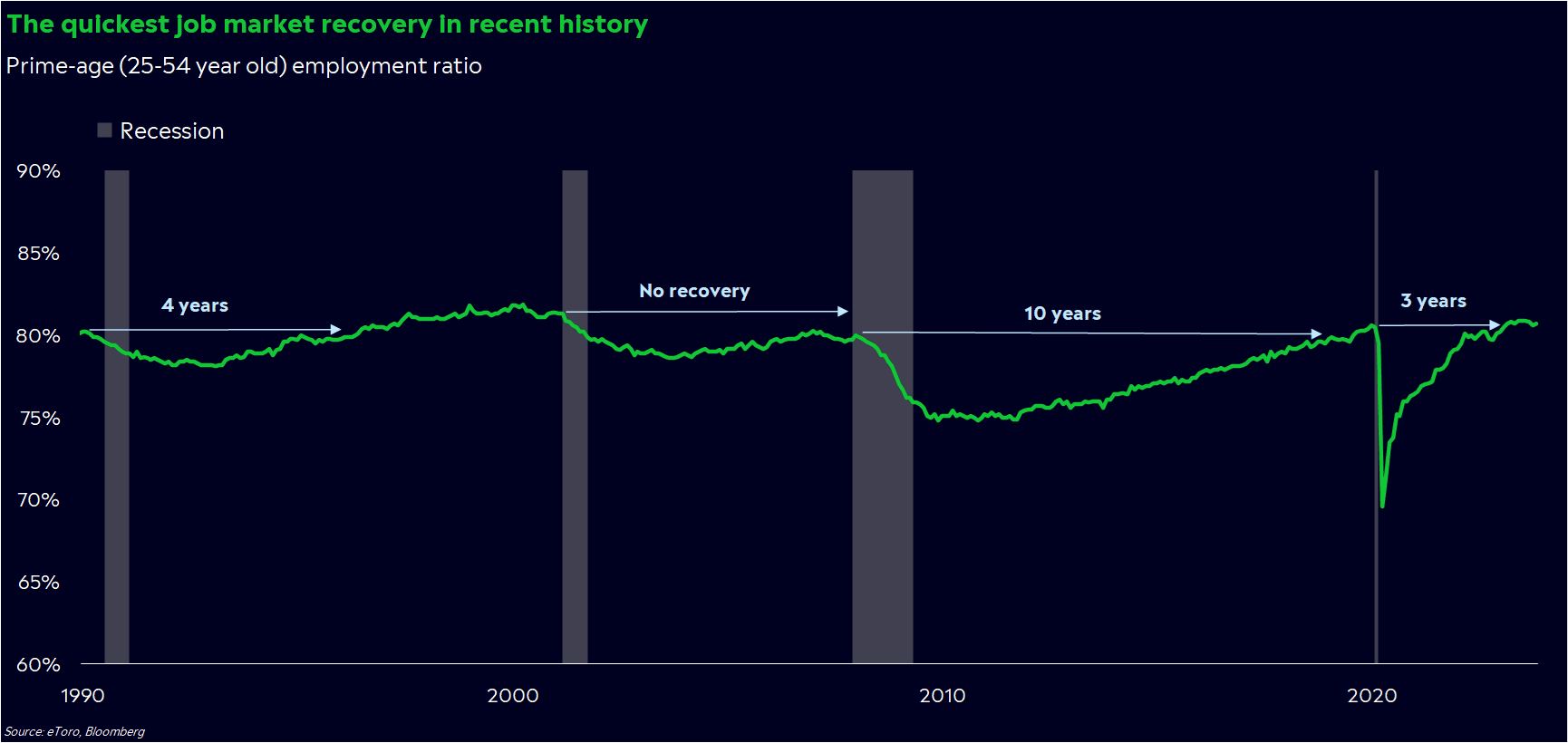

COVID changed everything. Shutdowns and unprecedented times required companies to accommodate employees, and the subsequent reopening unleashed a wave of demand that required a bigger workforce. Suddenly, companies needed workers more than workers needed companies.

This is still the case, evidenced by wage growth concentrated in lower-income jobs and a staggeringly low unemployment rate. By many measures, we’ve taken part in the strongest job market recovery in recent history.

The worker revolution is important for many aspects of our lives: our wallets, our well-being, and our perception of the economy.

But in your portfolio, productivity is the word you should focus on. It’s a measure of economic output per hours worked, and it grows when companies provide their workforces the resources they need to thrive. Productivity has also been the source of some of history’s longest economic expansions and bull markets.

The US economy has undergone a productivity slump in recent years, yet things seem to be turning around. In the third quarter, productivity increased at the fastest quarterly pace since 2009 (excluding 2020-2021). While it’s just one quarter, there’s a glimmer of hope that this new era of employee power could have broad benefits for society.

Productivity also matters for the stock market. In the 20 strongest years of productivity growth since 1948, the S&P 500 has risen an average of 12%. It was up in 17 of 20 years, too.

In summary, we could be at the dawn of an especially strong expansion, fueled by companies investing in workers.

It may also be time to ask for a raise or that hybrid situation. You have the power now.

Yes, but… Ugh, I hate to give the counter-argument to such an encouraging trend. But I’m an analyst, and that means we explore both sides of the equation.

The job market is decent, but there’s a lot of pressure on the economy at the moment. If companies get worried about the future, they could pull back on hiring and lay off workers. The job market has been a big buoy keeping the economy afloat. But if it breaks, we could lose the progress we’ve made in recent years, and the power could flip back to corporate America.

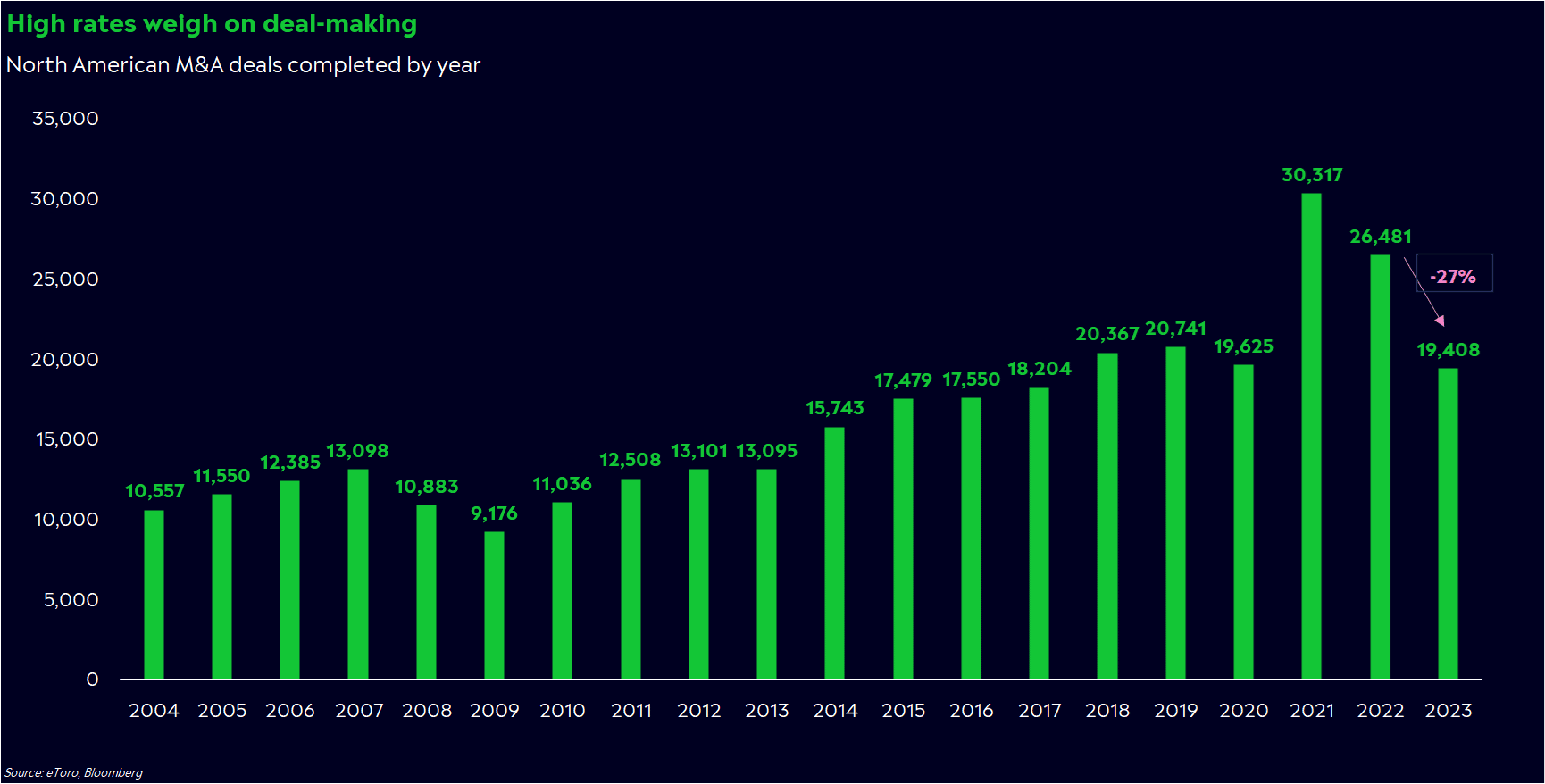

High interest rates have done a number on corporate America’s dating scene these last two years.

Public offerings — when companies debut on the stock market — dipped to one of the slowest years in the last decade. North American mergers and acquisitions — companies combining with other companies — slowed 27%.

Big companies like General Electric, Alibaba, and Johnson & Johnson went through painful breakups otherwise known as corporate spin-offs.

Now, lower rates could spark the opposite reaction. Rate cuts are like a love potion for corporate America. Some companies feel good enough to hard launch themselves to public markets. Others venture out into deal land to find the perfect match.

We already have some deals on our radar, with Shein, Reddit, and Skims rumored to go public in 2024.

This could be a good omen for the stock market. Companies often prefer to IPO or partner up in calm up years, in order to get the best reception from investors.

More importantly, it could transform specific industries, especially with so many stocks still suffering from 2022’s vicious bear market.

The crypto industry is one that comes to mind. It’s a young industry that was ravaged by scandal and scare capital. What’s left in the rubble is low valuations and a solid foundation, especially with a Bitcoin ETF on the horizon. Crypto’s fundamental thesis hasn’t changed. I’d argue it’s gotten stronger for reasons mentioned earlier. That’s a good setup for deal-making.

Tech may also go through its own wave of makeups and hard launches. Big tech is in an especially interesting position as it goes through a bit of a mid-life crisis. What worked for tech in the 2010s (ad revenue, new iPhones, subscriber growth) isn’t working as well now. The growth could come through acquired — or shed — business lines.

Pay close attention to new M&As and IPOs popping up this year. They could tell you a lot about the future of your portfolio — and the trajectory of your favorite companies and products.

Yes, but… Lower rates can spur dealmaking, but only if the economy is sturdy. A recession — or even lingering uncertainty — could keep companies from making big moves.

I’m an optimist by nature, so I have a tendency to find the good in a sea of bad.

And even though we had a good year on Wall Street, we’re still living in a broken society.

Don’t lose hope, though. Painful periods in history often lead to incredible progress, and you can find powerful narratives — and investment opportunities — if you’re willing to look.

After all, necessity is the mother of invention.

Want to receive these insights straight to your inbox?

*Data sourced through Bloomberg. Can be made available upon request.