Record highs are exciting milestones for the stock market.

But for some reason, they bring out the worst of bad investing advice.

Here’s the truth about all-time highs, compiled by my trusty technical analyst, Bret Kenwell, and myself.

We’ve heard all the excuses in the book. So we’re here to set the record straight on, well…records.

Myth #1: Stocks are about to crash

Yes, some big market crashes have happened after record highs.

Still, new highs should make you hopeful, not skeptical.

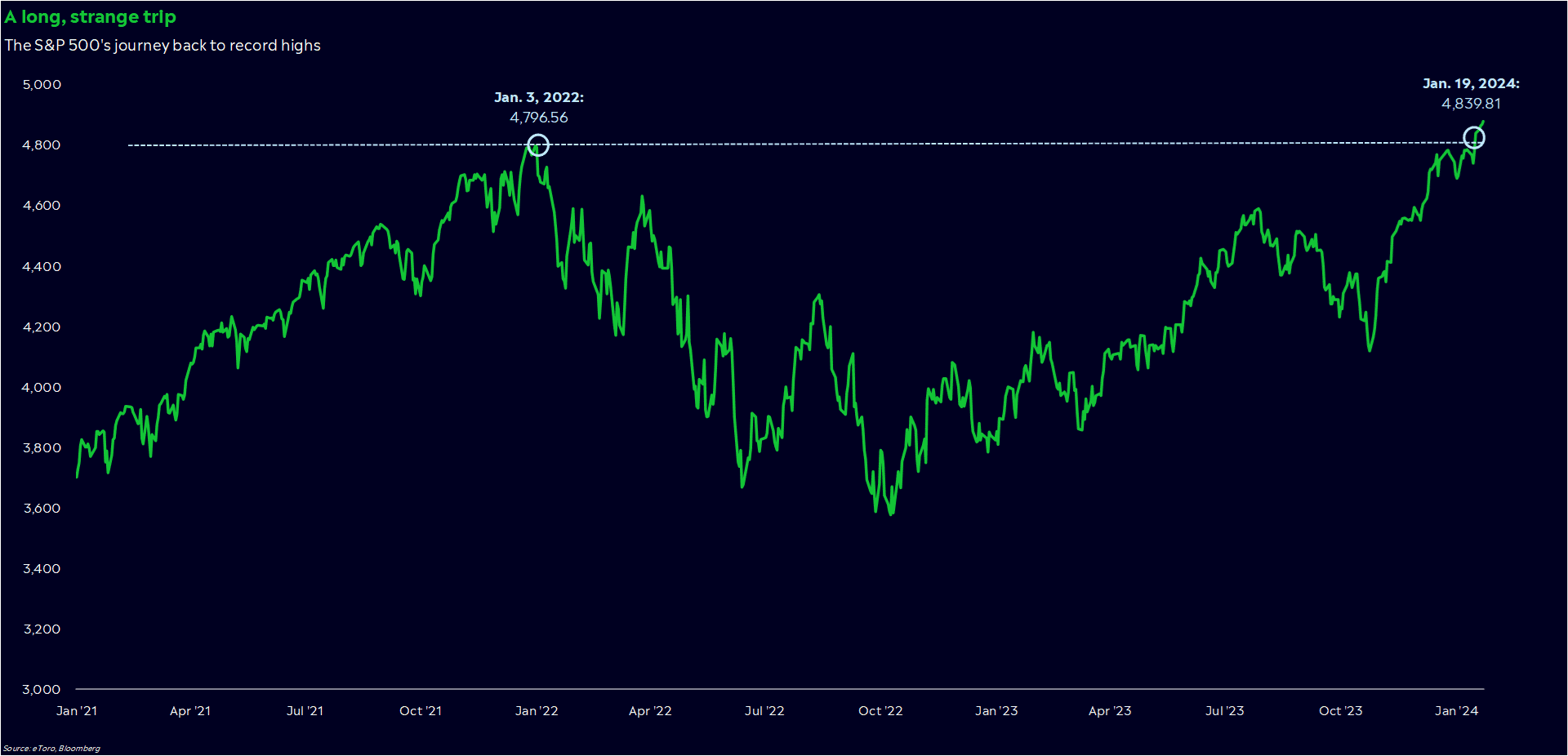

In fact, that’s how I’m feeling after the S&P 500 closed at a record high this week.

This was the first record high of this bull market, and bull markets are rarely a one-and-done event. Bulls since 1950 have lasted for an average of 4.5 years beyond their first record high.

Stocks rise for a reason, too. Today, people think the economy is solid and the war on inflation is over. Frankly, they may be right. Confidence is coming back, and economically sensitive stocks like retailers and banks have led this three-month rally.

Myth #2: Stocks are expensive

Sure, the S&P 500 is as high as it’s ever been, and at least some stocks in the index are more expensive.

But you can’t judge the value of a stock by its price tag. Steep prices can still be good deals if they’re low relative to profits.

The way you measure that is through the price-earnings ratio — a measure of where a stock or index is trading relative to the earnings it’s expected to generate over the next year. The S&P 500’s price-earnings ratio is expensive, yet the story is different if you look outside the largest tech stocks.

Check out the equal-weight S&P 500, which strips company size out of the equation. Its price-earnings ratio is 18, around where it was at the end of 2019. This, even though the index is 30% higher.

Not every stock is at a record high, either. Many are still battered by the bear market we just experienced. 43% of Russell 3000 stocks are 20% or more below their 52-week highs — a wild fact that demonstrates just how narrow this bull market has been.

From these perspectives, record highs are a bargain if you’re willing to think outside of tech.

Myth #3: The Fed can’t cut rates at record highs

If you believe this, you’re confusing correlation with causation.

Rate cuts have a bad reputation as the Federal Reserve’s way of saving the stock market. And yes, the Fed tends to cut when stocks are falling.

However, the Fed doesn’t care about stock prices – it cares about balancing healthy inflation with minimal unemployment. That’s the Fed’s job. So if policy needs to loosen up to achieve this balance, the Fed will do what it needs to regardless of the market. About 20% of the S&P 500’s record highs have occurred within a month of a rate cut.

Could rate cuts help the stock market by boosting confidence and stimulating profits? Sure.

As far as the Fed is concerned, though, record highs are just a minor data point on Jay Powell’s radar.

Myth #4: Record highs lead to a double top

Technical analysis can help investors pinpoint ideal entries and exits, and it’s particularly useful when combined with other analyses — like fundamental analysis.

However, one drawback is that technical analysis can be manipulated to fit just about any bias. And worse, those manipulations can look pretty darn convincing.

When stocks make new highs, it’s common to see all sorts of pessimistic charts. Perhaps the most common one is the “double top,” or the notion that the market will again run out of steam after retesting its prior high.

Double tops make for easy visuals and simple arguments. But they’re not always realistic.

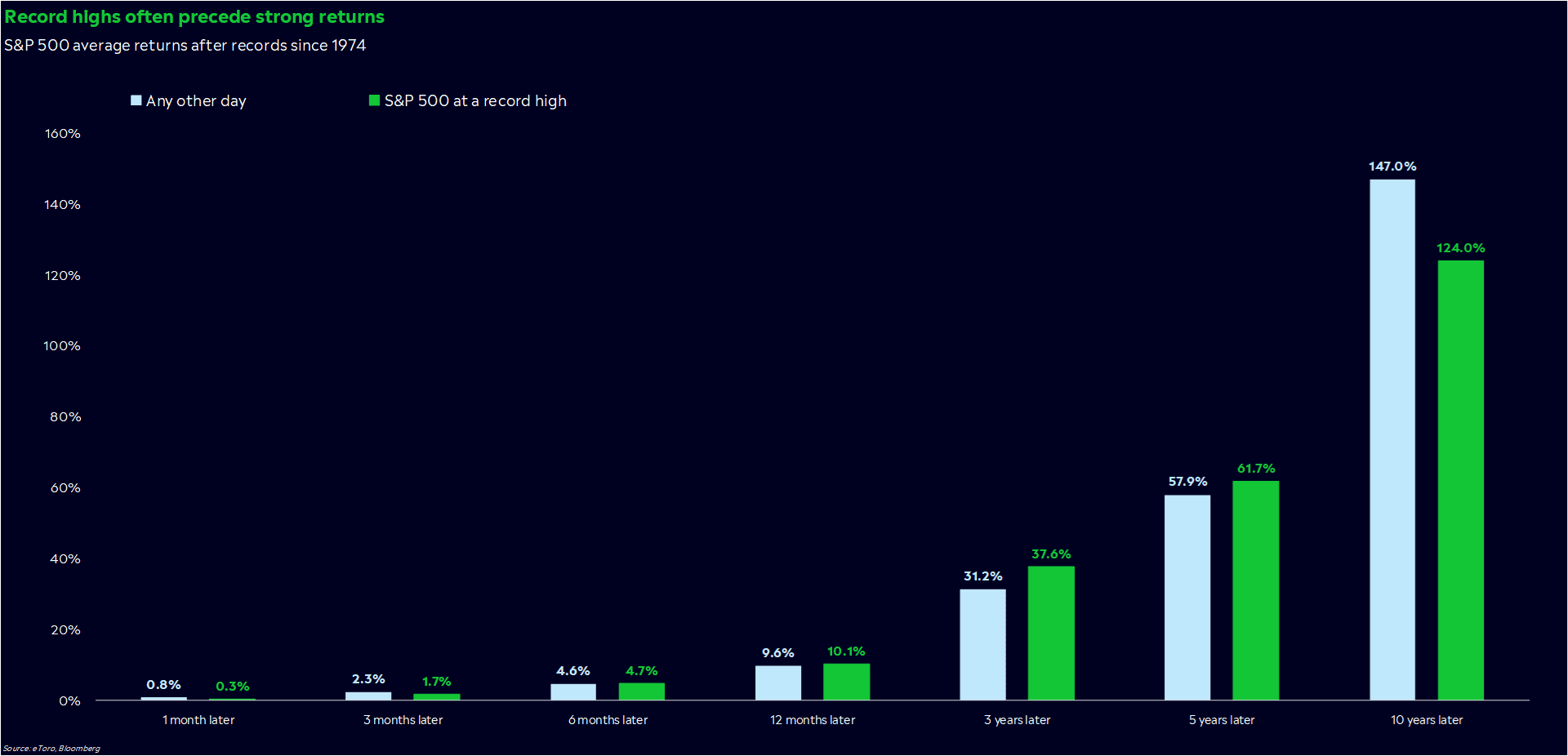

Record highs often open the door to more gains instead of slamming it shut. About 80% of S&P 500 record highs since 1950 have led to at least one more record high in the following week.

Admittedly, the record high hat is relevant in technical analysis — but that doesn’t mean it will act as long-term resistance simply because it exists.

Myth #5: Something bad is about to happen

If you wanted to dream up a doom scenario for the world right now, you’d have a lot to work with.

Spiraling government debt, declining money supply, eroding trust. There are a bunch of concerning headlines to pick from. And all could theoretically tip the scales for the stock market.

But will they? It’s hard to say if you don’t have a crystal ball (and nobody does). Plus, the environment always feels uneasy in some sense. We’re humans with complex emotions, after all.

I don’t have much to tell you other than this: selloffs will happen, regardless of how healthy the economy is or how strong the market looks. It’s not uncommon to lose 10% or more of your portfolio’s value either.

But fundamentally, people have a good argument to buy stocks when the economy is growing. And in bulls, investors are willing to look on the bright side of bad news, making selloffs shallow and short-lived.

Prepare for something bad — and unpredictable — to happen. But don’t let worry dominate your strategy.

Myth #6: It’s time to stop investing

A lot of our investing decisions are driven by emotions. Are you scared? Greedy? Complacent?

Sometimes you can trust your gut. But in investing, our emotions often drive us to make poor decisions when we should just stay the course.

For instance, when markets start to correct, investors have a tendency to stop investing, thinking that they’ll be able to time a low and buy back in at better prices. All too often though, they miss their chance. Markets tend to turn before the economy turns, and that can lead to record highs before the outlook is picture-perfect.

Buying low and selling high is classic investing advice. But don’t let that saying foolishly lead you into making portfolio decisions solely based on all-time highs. Selling at record highs is a strategy that hasn’t always worked well.

Want to receive these insights straight to your inbox?

*Data sourced through Bloomberg. Can be made available upon request.