I’m sure you’ve noticed some of these headlines over the last few weeks:

Snap to Lay Off 10% of Workforce.

PayPal to Eliminate Roughly 2,500 Jobs.

Microsoft to Cut About 800 Jobs.

These are just a few of the many examples so far this year when we look at the job cuts taking place in tech.

Investors see these headlines and worry about potential weakness in the jobs market. Consumers see the headlines and worry about their own jobs. Both groups likely wonder if AI is the culprit.

There have been a lot of questions surrounding the labor market and for good reason. It’s the backbone of the US economy — roughly 70% of which is driven by consumer spending.

Is the jobs market falling apart?

First, the labor market is not cracking.

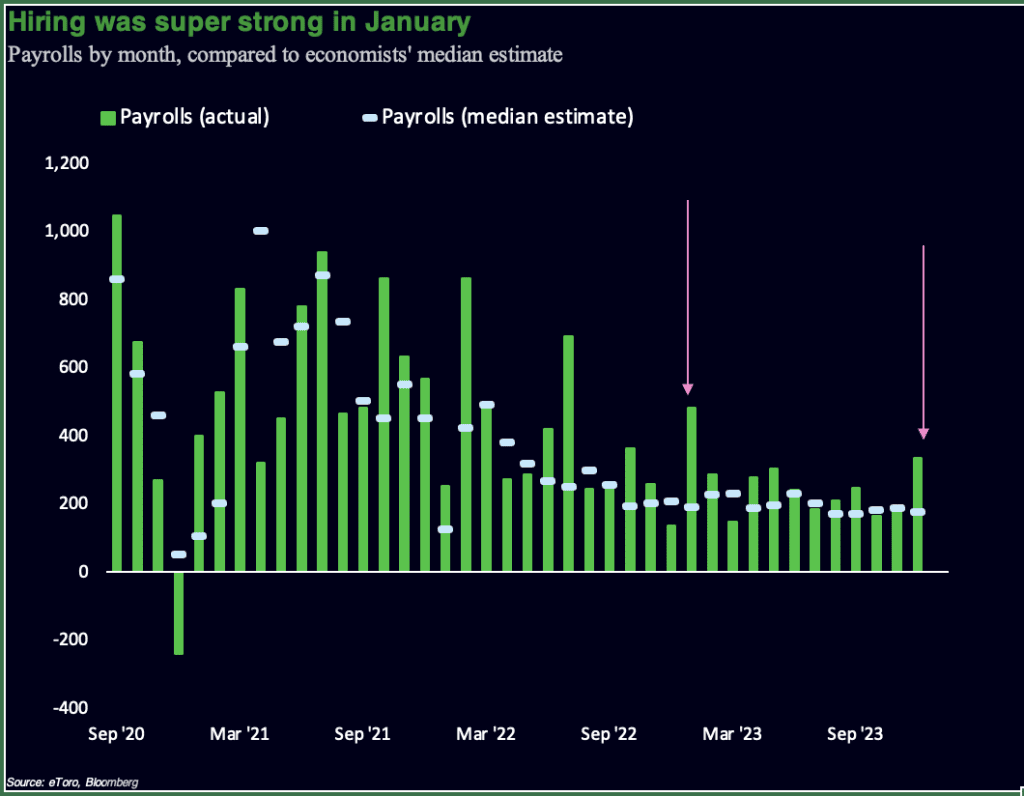

In January, 353,000 jobs were added to the economy, blowing past expectations of 175,000. In fact, it was the largest jobs beat we’ve seen since January 2023.

Further, December’s initial jobs gain of 216,000 was revised higher last month too, up to 330,000. That’s back-to-back months with jobs gains in excess of 300,000. Of course, January’s number could be revised lower, but for now it’s promising.

Lastly, the unemployment rate remained low at 3.7%, while average hourly earnings hit a new post-pandemic high. While economists would like to see wages ease in order to help with inflation, everyday consumers want to see this number increase so they can afford more.

So why so many bad headlines?

We’ve all heard the saying “bad news sells,” right?

While the optics make it seem like we’re seeing layoffs en masse, that’s not really the case. Admittedly though, there have been pockets of weakness in certain industries.

In some instances, companies simply hired too fast when they were basking in the post-pandemic boom. Now that some of the demand has worn off, these firms — many of which are in tech — are being forced to lay off a portion of their staff.

The reality is, people take notice when they see layoff headlines from Microsoft, Amazon or some other well-known tech firm. But that doesn’t mean we’re losing hundreds of thousands of jobs each month — in fact, just the opposite.

Where are the jobs

While 2023 featured declines in specific industries, other areas were booming.

Take education and health services, which added more than 1 million jobs in 2023. That’s its best total in at least 20 years.

If we exclude 2021 and 2022 — as the world rebounded from the pandemic — travel and leisure also had its best year in more than two decades.

When we look at areas that declined last year, such as transportation and warehousing, and “information” — which is made up of jobs like publishing, broadcasting, computing infrastructure providers, data processing, and other roles — there’s even positives to sift out as well.

While these groups lost jobs last year, they are still up notably from the declines they suffered in 2020. Transportation and warehousing lost about 36,600 jobs last year, but that’s after adding almost 1 million jobs between 2021 and 2022. And during Covid? This space didn’t even lose 30,000 jobs.

Information jobs weren’t as stellar, but have still managed to gain 164,000 jobs since we entered the 2020s.

What it means for you

Of course, things can go wrong.

With so much of the economy dependent on consumer spending, we need jobs growth to help fuel that spending. It’s a virtuous cycle that works until something disrupts it.

That’s something that we’re hoping to avoid, both for the sake of our jobs and our portfolios.

The good news is, the strength in the labor market helps reassure that the US economy should keep humming along.

The bad news — if you want to call it that — is that the Fed will likely be conservative when it comes to cutting interest rates. Everyone from prospective homebuyers to investors in the stock market have been waiting for the Fed to cut rates.

With the strength in the economy, the Fed feels that it has some leniency when it comes to cutting rates. The longer that the Fed maintains a restrictive monetary policy to fight inflation, the more it risks cooling off the economy too much.

But just because the Fed is taking a higher-for-longer approach to rates, doesn’t mean investors should look at this as bad news.

We’d rather have a cautious Fed and a strong economy than a weak economy and a Fed that’s slashing rates hoping to jumpstart the labor market and consumer spending.

The labor market is the engine of the economy, and right now, there’s strength under the hood. That should bode well for stocks, which continues to flourish amid the bull market. While there will be bumps along the way, it’s hard to get too bearish unless the economy takes a turn for the worst.

Want to receive these insights straight to your inbox?

*Data sourced through Bloomberg. Can be made available upon request.