It’s official: After more than a decade of speculation, spot Bitcoin ETFs are here.

It’s a huge accomplishment for crypto, no doubt about that.

But now that the big news is out, there seem to be more even questions than answers.

Here’s what you need to know about the new Bitcoin ETFs — what they are, how they could benefit you, and if they’re worth your time and money.

What just happened?

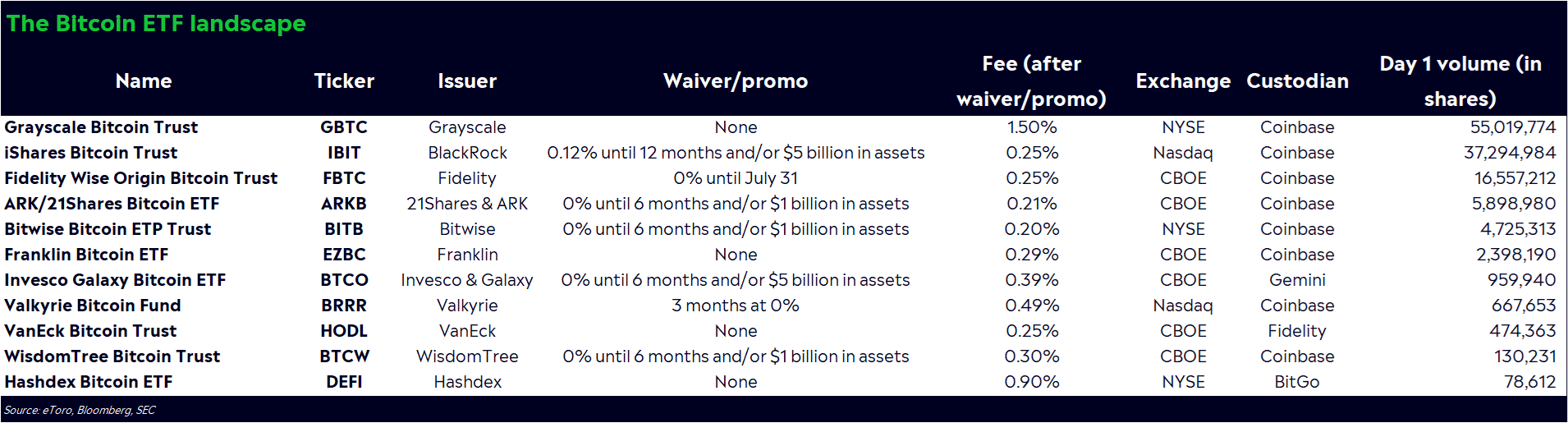

The SEC just allowed 11 spot Bitcoin ETFs to start trading on stock exchanges. Bitcoin-focused ETFs have been around for a while, but none have been able to hold pure crypto…until now.

This is a big deal, too. Not only could spot Bitcoin ETFs become big buyers of Bitcoin, but they’re a drastic improvement from the crypto-linked funds that we had access to. Bitcoin futures ETFs, for example, suffered from roll costs incurred when the fund had to adjust its contracts.

Spot Bitcoin ETFs could also open up your options for speculating on crypto. Literally.

There aren’t many ways to express a bearish view on Bitcoin — especially on the price of the actual coin. We could eventually see options listed on these ETFs, or inverse versions roll out.

You can still trade options on crypto-related stocks, plus a few Bitcoin-focused funds.

But for now, spot Bitcoin ETFs are the first piece of the puzzle.

Will these funds be as successful as people think?

Bitcoin ETF volume exploded on the first day, with the iShares Bitcoin Trust and the Grayscale Bitcoin Trust bringing in the seventh and 13th most volume among ETFs, respectively. It’s similar to what we saw with the first gold- and silver-backed ETFs in the early 2000s and the first Bitcoin futures fund in 2021.

I’m not surprised, either. Crypto is a fascinating world, and people love exploring new markets through familiar vehicles.

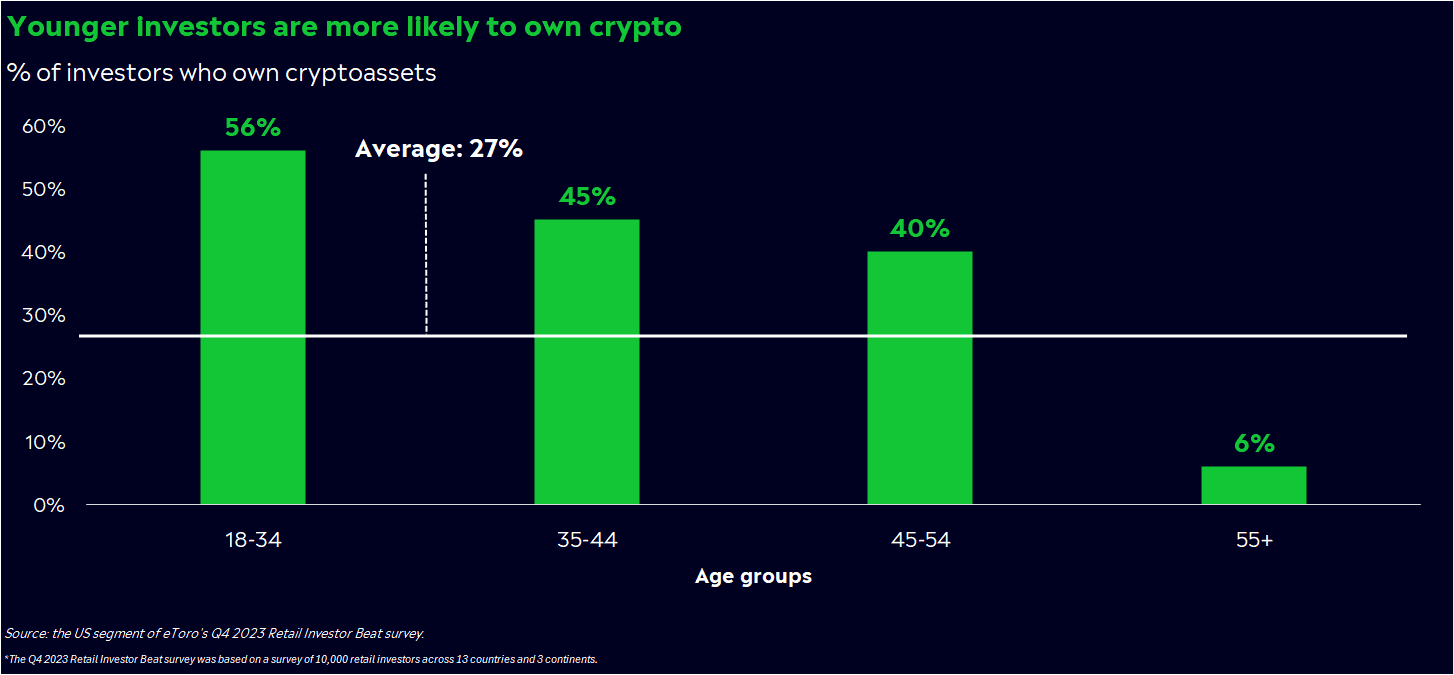

Crypto has barely penetrated the masses, too. Survey data tells us as much — just 27% of investors hold crypto, according to the US segment of our Retail Investor Beat survey conducted in December.

Unsurprisingly, many crypto investors are younger and more willing to take on risky, newer investments. In March, we asked Retail Investor Beat respondents why they didn’t invest in crypto, and 28% of investors told us they prefer traditional asset classes and investments.

There are also practical reasons why crypto hasn’t caught on. Until now, it was difficult to add pure crypto to retirement accounts, and crypto-focused funds on the market weren’t the best experience for long-term investors. Financial advisors were wary of adding crypto to client accounts. Many traditional brokerages didn’t even offer crypto. An ETF could help solve all of these issues.

Is Bitcoin going to the moon?

You’d think, given that prices are ultimately a function of supply and demand.

Nobody knows, though. And with Bitcoin down 3% since the approval (as of Thursday afternoon), we’re all getting familiar with the old “buy the rumor, sell the news” market phenomenon.

Still, there are plenty of reasons to be optimistic about the road ahead.

Bitcoin is in a solid uptrend and just hit new one-year highs. That’s a good foundation, even though it’s hard to say exactly how Bitcoin will react to headlines over the following days and weeks. From a technical perspective, Bitcoin looks quite healthy, as long as it can stay above the $40,000 to $42,000 zone, which was prior support.

Innovation in crypto is a good thing, especially when it ushers in a whole new wave of investors. Flows from these investors may be stickier, which could help stabilize Bitcoin prices and shield the space from nasty bear markets.

Bitcoin may have a big year ahead of it, too. The next Bitcoin halving — an event that’s historically preceded big gains — is expected in April. Rate cuts may be coming later this year, which could unleash more appetite for riskier investments like crypto. Lower — but relatively high — rates could be the best recipe for Bitcoin and Ethereum, too.

Should I sell all my Bitcoin and buy the ETF?

The news is exciting, but let’s not make rash decisions with our money.

Like all investments, the Bitcoin ETFs have pros and cons you need to consider.

First, the Bitcoin ETFs are cheap, even in a corner of finance known for low costs and efficiencies. Five of the ETFs have expense ratios of 25 basis points or fewer, which is cheaper than 75% of ETFs on the market.

This can work to your advantage, if you’re a trader. Expense ratios are baked into the ETF’s price, not based on the number of transactions you make (like commissions are).

There’s more than just fees to consider, though. Bitcoin ETFs are structured to be cash creation/redemption ETFs, which means the ETF provider and custodian have to take extra steps to ensure you get cash. This could result in higher tax costs, which could subsequently cause a performance gap between the ETFs and Bitcoin.

Plus, ETF investors don’t actually own Bitcoin. They own shares of the ETF. This is a big consideration. A lot of crypto investors value holding actual crypto that they can use as they please. If that’s you, maybe the ETF isn’t the best choice.

Speaking of costs, you also have to be mindful of how easy it is to trade these ETFs. There are now a bunch of ETFs on the market, which is great if you want choices. But with 11 funds to choose from, some of them may not attract enough volume to trade quickly and effectively.

Your Bitcoin checklist

There’s a lot to think about in this new era for Bitcoin.

I’ll make it easy for you — here’s a list of some key questions you should ask yourself before diving into these ETFs.

Am I a trader or a HODLer?

From a fee perspective, traders may have a more compelling reason to use the ETFs, while HODLers may want to opt for actual crypto.

If I’m a trader, how often am I trading?

Once a year? Once a week? Multiple times a day? Volume and liquidity matter more as your trades increase.

Do I value having ownership of my crypto? Do I want to spend my Bitcoin?

If so, the ETF likely won’t meet your needs.

*Data sourced through Bloomberg. Can be made available upon request.