This November was one for the books.

The S&P 500 rose 8.9%, its ninth best month since 1990.

But it wasn’t just higher prices that made November special. It feels like something deep in the market’s DNA changed after the Federal Reserve’s latest meeting.

While fierce rallies can turn into fakeouts, this latest surge of optimism trade feels like it could stick around for a while.

Here’s why.

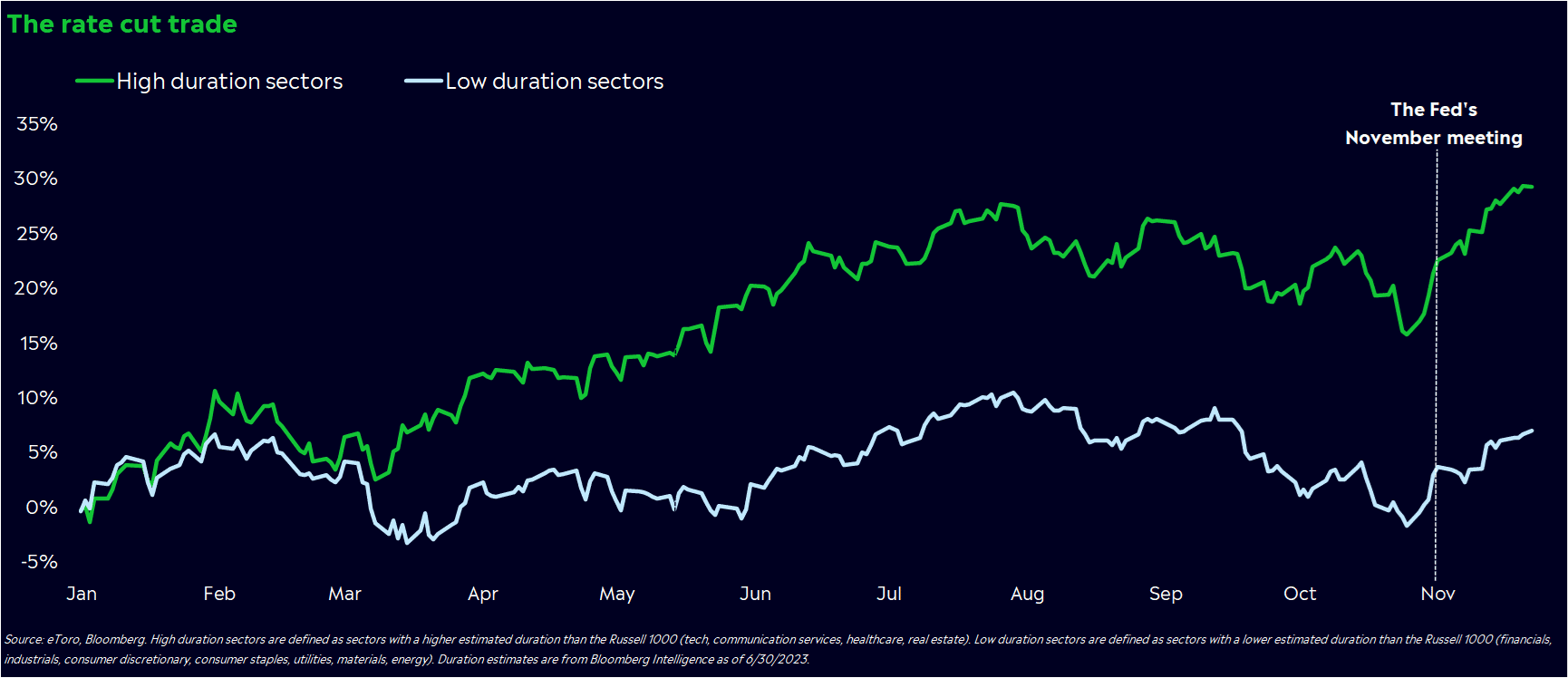

The rate cut trade

There are a few reasons why stocks have rocketed higher, but one sticks out above the rest: the expectation of rate cuts in the first half of 2024.

This is evident from the rally’s timing and leadership. Fed chair Jay Powell strongly hinted that rate hikes were done in his post-meeting press conference on November 1. Since then, high duration stocks have powered the market higher.

Duration is a wonky term for how long it takes a stock to recoup its value through cash flows. Don’t get distracted by the jargon, though. People are piling into stocks that benefit from lower rates.

How do I know? Higher duration stocks are expected to generate more profits in the future versus today, and high rates decrease the value of future profits. Many tech, communication services, real estate, and healthcare stocks fall into this high duration group, according to a Bloomberg Intelligence analysis.

I understand if you’re a little skeptical here. After all, we’ve seen this movie before.

This time, though, the yearning for rate cuts seems legitimate. Bond market expectations now align with the Fed’s dot plot projections. Powell and Fed presidents are talking openly about the progress in inflation and the prospect for cuts. As long as the Fed’s narrative sticks, the rate cut trade could continue through cheaper high-duration sectors like real estate and healthcare.

And that, in turn, could push prices even higher.

Wall Street’s performance chasing

Professional investors account for about 80% of total stock market trading every day. So when a large swath of Wall Street decides to buy stocks, they can turn prices on a dime.

Right now, that’s exactly what’s happening. Portfolio managers are buying stocks at the fastest pace in two years, according to NAAIM survey data.

Seems desperate, but it makes sense when you consider that Wall Street is beholden to benchmarks. It’s year end —or judgment time for professional investors who have to report 2023 performance to clients — and pros are feeling the pressure.

It’s been a rough year for stock-picking, too, with about 70% of S&P 500 stocks underperforming the index.

That’s turned into performance chasing in certain sectors. In November, portfolio managers gobbled up tech and real estate after entering the month historically light on exposure in both sectors, according to Bank of America data. Coincidentally, pros are buying into the rate cut trade as a last-ditch effort to beat their benchmarks.

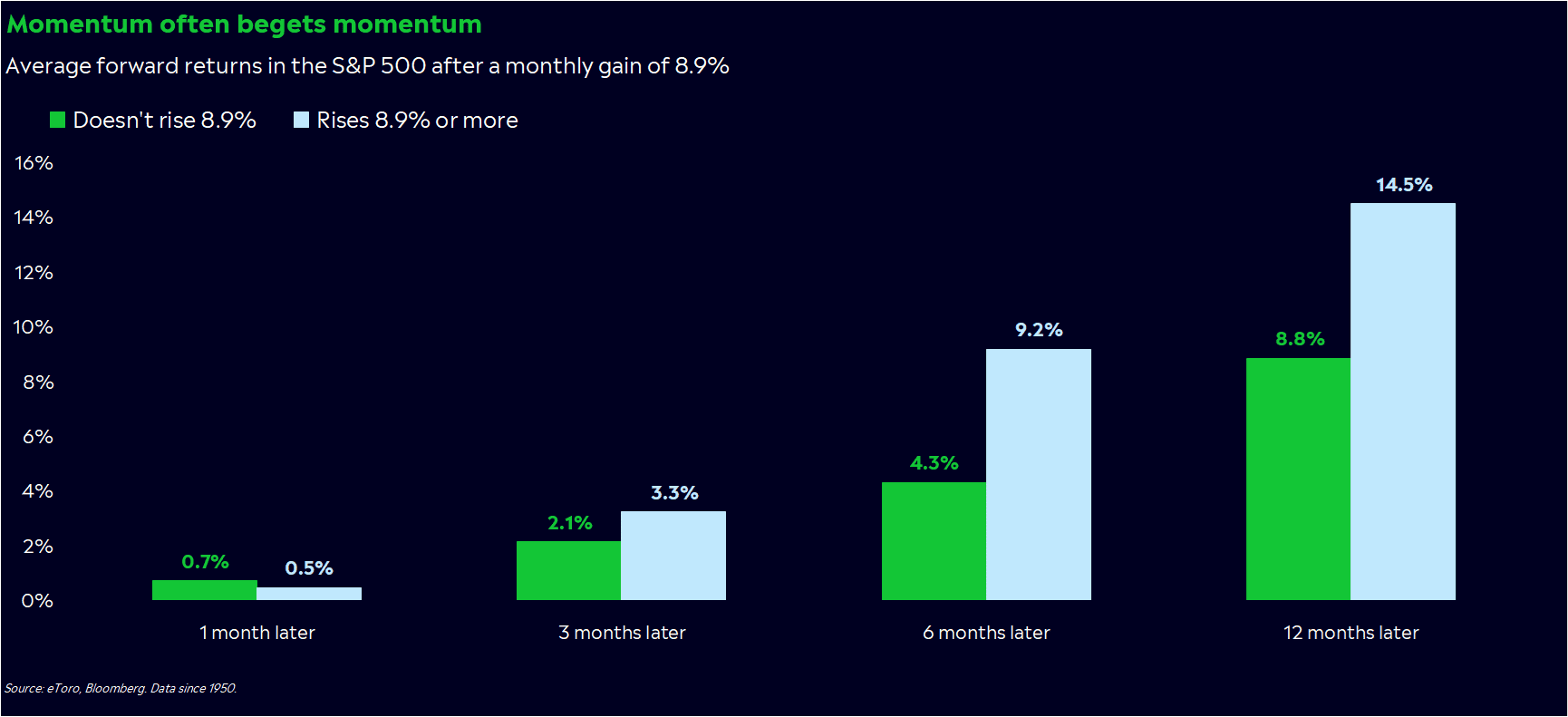

An object in motion

The optimistic case for stocks may boil down to Isaac Newton’s first law of motion: An object in motion will stay in motion — unless an external force comes in to stop it.

Stocks are the object in this scenario, and they’re moving persistently higher. In fact, we haven’t seen a decline of 0.25% or more in the S&P 500 in 14 days, the longest streak since 2019. Historically, big rallies like the one we’ve seen tend to precede even more gains, too. Since 1950, when the S&P 500 has rallied 8.6% or more in a month, it’s posted above-average returns in the future.

But what’s even more important to recognize is the path that could be ahead of us, at least for the next few weeks.

Earnings season is mostly over and the holidays are in full swing. So barring any crazy Apple product launches or Elon Musk tirades, we’re likely free of company-specific headlines until the new year. In terms of market catalysts, economic data and Fed headlines are what separate us from Christmas.

And for now, a large swath of signs point to lower rates ahead.

A technical wall

A strong market can take a breather from time to time, though. Bret Kenwell, our options analyst, thinks one could be brewing based on the technicals.

Bret’s thoughts:

It’s noteworthy that the S&P 500 has roared higher by more than 11% from the October 27 low, but hasn’t even had a 1% pullback amid this month’s rally. Not only does that suggest buyers aren’t willing to part with their long positions yet; it suggests that they want to own more, highlighted by their willingness to gobble up seemingly any type of pullback.

However, markets are looking a bit tired as we push higher. The S&P 500 is nearing 4,600 — a level technicians and options dealers are looking at as resistance, with the 2023 high near 4,607. That said, there looks to be ample support down in the low-4,500s in the short term.

Longer term, bulls are looking for a push above 4,600. If the index can clear that level — and more importantly, hold above it — there’s not a whole lot standing in its way from a resistance perspective until it reaches its all-time high up near 4,796.

So what does this mean for me?

Don’t count stocks out just yet. Yes, the classic investing advice is to buy low and sell high. And when prices rise this fast, it can make people nervous. But sentiment looks healthy and a soft landing still seems to be in the cards. That’s good news for the stock market.

Think about duration. If you believe the Fed will cut rates soon, you might want to look into high-duration stocks. The rate cut trade could be just beginning.

Prepare for surprises. Any good investor will tell you that it’s important to have a plan in good and bad times. Even though the bullish case for stocks seems strong, the technicals present a good case for a pause in the rally. Besides, you always need to be prepared for surprises, even while celebrating progress.

*Data sourced through Bloomberg. Can be made available upon request.