Today, the message is clear for long-term investors:

Be patient, as history shows your portfolio can make it out of this bear market on stronger footing.

But it’s one thing to talk about opportunity, and another to actually grasp it. Bear markets can be painful, and they’re often uniquely personal. They can threaten your job security, drain your savings, and upend your personal goals ― all while weighing heavily on your portfolio.

As someone in their second bear market as an investor, even I’ve felt the emotional weight of this year creep up on me. And I do this for a living.

This week, I want to showcase how to stay invested in and focused on your goals from a first-hand perspective of someone more seasoned than I am. So I tapped Lule Demmissie, eToro’s US CEO, to tell me how she survived the last three market meltdowns ― the dot-com bubble, the Global Financial Crisis, and the COVID-19 pandemic ― as a person, an investor, and a finance professional.

The first bear

Many of you are in the throes of your first bear market. So far, the drop has been excruciating: a surge in inflation, an overseas crisis, an epic slide in tech stocks and crypto, etc.

Twenty-odd years ago, Lule was in the same boat. Her first bear market was in the early 2000s, when the tech-heavy Nasdaq-100 dropped 80% as new-age startups boomed and subsequently busted. The US economy, also reeling from the fallout of the September 11th attacks, plunged into an eight-month recession.

Lule was also at a pivotal point in her life. As a first-generation immigrant from Ethiopia, she was in business school when tech stocks started sliding. Lule graduated in 2001 and took a job in equity research, saddled with student loan debt and supported by a work visa.

“The tech bubble was the first time I was an adult experiencing a serious cycle in the economy,” Lule said. “I had read history, but I hadn’t lived history. And it’s different to live history. Everything felt bigger and more consequential. There were underlying life things that could’ve gone real bad.”

To cope, Lule was more intentional than opportunistic. She invested gradually, maxed out her 401(k), and opened up an IRA. She also boiled down her panic into fear ― defining what made her afraid and how she could solve it, knowing that rough times come and go.

“Being able to have the mental framework of ‘this too shall pass’ allowed me to make what was big seem smaller, so I could psychologically digest what was going on.”

Assess your situation

Then came the Global Financial Crisis, when the housing market crumbled and almost took the financial system down with it. The S&P 500 fell 57% and the US dealt with its longest recession since the Great Depression. Lule was working at a major bank, and she and her wife had started family planning.

“The financial crisis felt like the end of the world to me,” Lule said. “It was a consequential time, even more than the tech bubble. And that’s when muscles I had developed from the tech bubble really kicked in. I was like, ‘it’s time to be opportunistic’.”

But that opportunity didn’t come without sacrifice. Lule and her wife parsed through their budget, cutting out expenses they could do without. This seems like a given ― save money during a crisis! ― but it also carries an important psychological benefit of feeling less weighed down by expenses. They prioritized retirement savings, delayed the purchase of a new home, and moved in with friends to ride out the storm. Even if you’re not ready to limit spending, planning what you’d cut in an emergency can help you prioritize investing in hard times. You could even plan out your portfolio moves.

To Lule, those decisions boiled down to controlling what you can control in an uncontrollable situation.

Remember the program

Markets selloffs come and go. Any Wall Street analyst will tell you that.

But not every selloff looks the same ― an unsettling thought when you’re in the middle of one.

In Lule’s eyes, the scariest part of the Global Financial Crisis was the unpredictable nature of the catalyst. The system was sick, and some smart minds weren’t sure if the economy would make it through.

Same deal with the COVID crisis. The world was trapped in a global pandemic, a humanitarian crisis with economic repercussions. You had to worry about your health and your money, and that can take a toll on the psyche. Your body’s natural reaction is to run from danger, no matter what it is. But not all doom and gloom is created equal.

“In 2008, there was a crisis of confidence in the system,” Lule said. “Right now, we have a crisis of consumer confidence and inflation. Doesn’t mean the crisis won’t be painful, but it’s a different process to go through an organized crisis than a crisis with so many externalities that can’t be organized.”

In other words, our struggles today are within the system, instead of a shock to the system. In a way, that may make the playbook a little easier for the Fed. After all, the Fed has embarked on 13 hiking cycles over the past 50 years in an effort to balance growth and inflation.

Staying abreast of the situation can also help keep you engaged so you don’t sway from your goals. Remember to stay intellectually curious, because you may see some patterns from the past.

Find your song

It hasn’t been easy for any investor who has weathered the past few crises. Frankly, they weren’t a walk in the park for society in general.

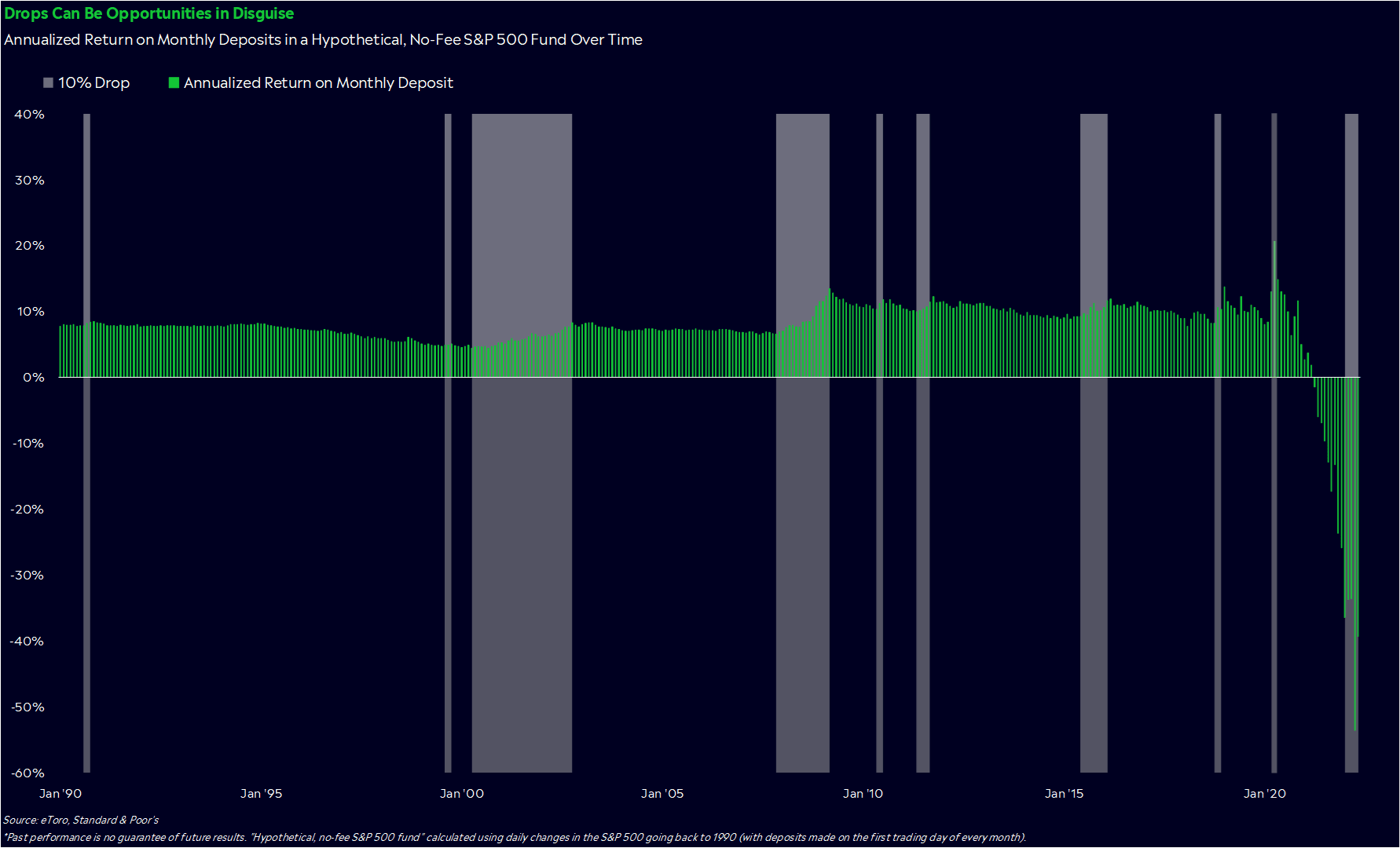

However, if you look at the stock market over decades, it’s not a story of doom and gloom, but of collective human adaptability. Since 1950, the S&P 500 has gone through 33 drops of 10% or more, through countless wars, humanitarian crises, financial crises, and a global pandemic. Yet over that time, the S&P 500 has returned 8% per year on average.

When you’re in the midst of a storm, it’s important to stay grounded. One of Lule’s favorite sayings is a Swedish proverb: “he who wishes to sing will always find a song.” Don’t get too wound up in the darkness ― search for the light instead.

Easier said than done, right? During the Global Financial Crisis, Lule was more intentional about relying on friendship, meditation, and exercise to make it through the toughest days.

“I stopped trying to control my emotions long ago,” Lule said. “I listen to them and when they’re getting hot and heavy, I back out, do some journaling and meditation, and be kind to myself as a human being.”

To be clear, we realize breathing deeply won’t get you through an economic crisis alone. But to protect your psyche, you may have to be extra intentional about taking care of yourself, not just your money.

Full disclosure: I’m a sucker for meditation. I also love making lists of what is versus what if, because I tend to get caught up in a spiral of rumination. So I’ll second Lule’s suggestions.

*Data sourced through Bloomberg. Can be made available upon request.