Tech investing feels like an impossible balancing act these days.

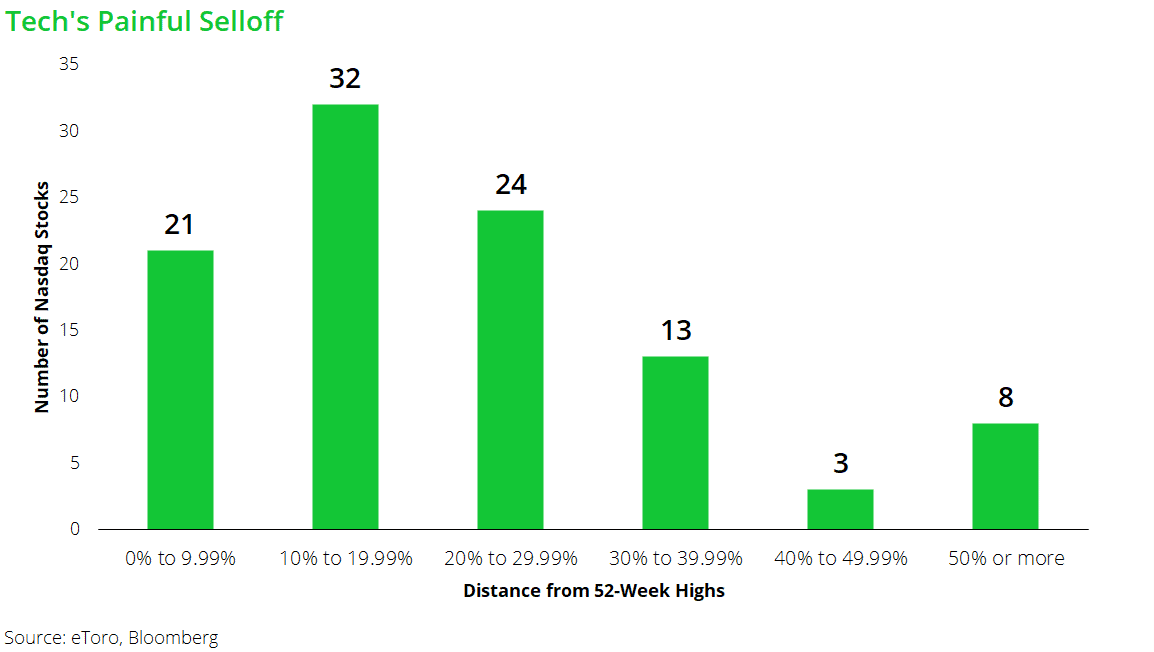

On one hand, tech stocks just endured a painful selloff. The Nasdaq has dropped as much as 15% since December, and about half of its members are down 20% or more from their highs. Popular names like Meta, PayPal, and Spotify were punished this week after disappointing forecasts. The market’s focus has shifted from what could work in the future to what is working now.

On the other hand, the prospects for tech have rarely felt this promising. We’re in year 2 of a COVID-fueled innovation boom, and we have yet to realize the exponential benefits of new-age technologies like the blockchain and mRNA vaccines.

Tech’s short-term reality feels especially grim. But its long-term opportunity still seems compelling.

Both statements can be true.

Short-term reality

Last week, we talked about how the overall stock market tends to shake off rate hike worries.

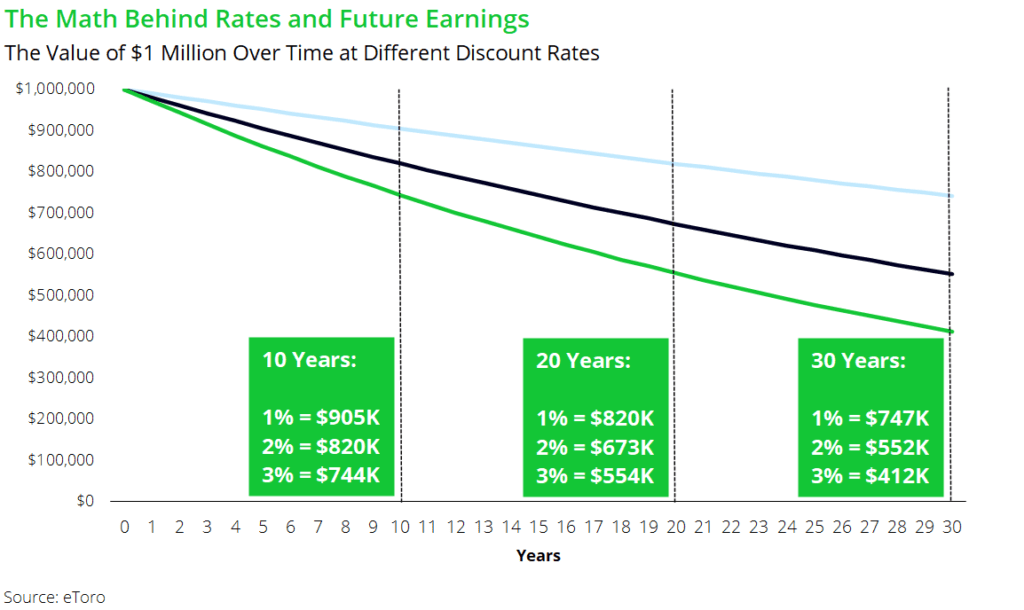

But unfortunately, not all stocks are created equal. Growth stocks and rising rates are like fire and ice – they don’t mix well together. Why? Investors tend to value growth stocks based on their future earnings, and they value other, more stable sectors based on their current earnings. Some investors even value riskier tech stocks based on their value years down the road. When rates rise, the value of a dollar in the future falls (versus the value of a dollar today).

Higher rates could theoretically lead to a reset in all tech stocks. But in this era, it’s important to recognize that tech isn’t just one flavor. The big tech companies — think FAANG (now called MAMAA) — are in a good position to handle the changing tide. They have strong balance sheets and competitive advantages, as we’ve seen in recent earnings reports. Investors may get extra skittish around big tech’s headlines (see: Meta’s flop on Thursday). But in general, big tech names may be in a decent position to weather rate hikes.

The concern is more about companies further down the food chain: the disruptive tech stocks, the stay-at-home names, the unprofitable unicorns, and the crypto and NFT-adjacent stocks. People are investing in these up-and-coming pockets of tech because of their future growth potential. But with rate hikes coming, the value of that potential growth is in question. And that’s why we’ve seen such brutal reactions to bad earnings reports this season.

To make matters worse, some tech names may become victims of their own success. Stocks like Plug Power, Zoom, and Peloton gained attention early on in the recovery for their high-flying performances and enticing products. Now, tech is coming back to earth, and we’re all wondering exactly what an investor should pay for these “story stocks.” Sure, it’s fair to pay a little more for a cool story, but what’s the appropriate markup when the short-term could be rocky?

It may take a while for the market to figure out just where the center of gravity is for tech. And the carnage may not be over.

Long-term vision

To be fair, investing in a stock’s long-term vision isn’t always a bad strategy. And there are likely some beaten-down tech stocks out there whose stories we’ll be marveling over in a few decades.

Take Apple, the quintessential market success story. If you invested $100 in Apple at its 1982 public offering, your $100 would be worth about $120,000 today. Sounds like a dream scenario for a tech investor, right?

Here’s the catch: Even if you’re confident you know how this story ends, you don’t know how the market will react. You also don’t know if you’ll have the capability to hold your investment until the market realizes the story.

How many investors have actually held Apple stock from 1982 until today without selling? The Apple of today looks a lot different than the Apple of 1980. And over that period, the stock has gone through 22 drops of 20% or more, including an 80% plunge when the tech bubble burst. Not to mention the four economic recessions and countless bad headlines that every investor has had to reckon with in that timeframe.

This is the tension between long-term vision and short-term reality. To realize the long-term vision, you have to stay invested through the short-term ups and downs.

Staying afloat

If you’re a tech investor, don’t fret. This isn’t a call to sell all your tech stocks and hide in a bunker. Risk is the price of investing, and unfortunately, it can sometimes be an expensive lesson.

Here’s how you can stay afloat:

- Understand the risk. Don’t let the golden days of 2020 fool you. Tech is typically a high-risk, high-reward investment. Ups and downs are par for the course, regardless of what the Fed is doing.

- Lower your expectations. Not every tech investment will knock it out of the park. For every Apple, there may be a Pets.com — a company that infamously imploded during the tech bubble. If you want to increase your chances of hitting that home run, consider spreading your money across a bunch of promising stocks. Diversification!

- Set your targets. If you don’t want to risk an emotional trade during a crisis, set price or return targets for your holdings. That way, you’ll have clear, level-headed rules on when you’ll buy and sell. No feelings required.

- Anchor your portfolio. It’s hard to know now how you’ll react in a market decline. Holding safer investments like bonds and cash could keep your portfolio anchored when your story stocks hit a rough patch.

Balancing long-term optimism with short-term pessimism can be difficult at times. And while tech is here to stay, what has worked well in the past may not work as well with rate hikes on the way.

Above all, stay focused on your goals, and position your portfolio so you’re in the best spot to reach them.