The big story in markets this week is a potential government shutdown. If lawmakers don’t reach an agreement by September 30, key federal programs and pay for federal workers will be ground to a halt.

And if history is any guide, investors could struggle with this news… but not for long.

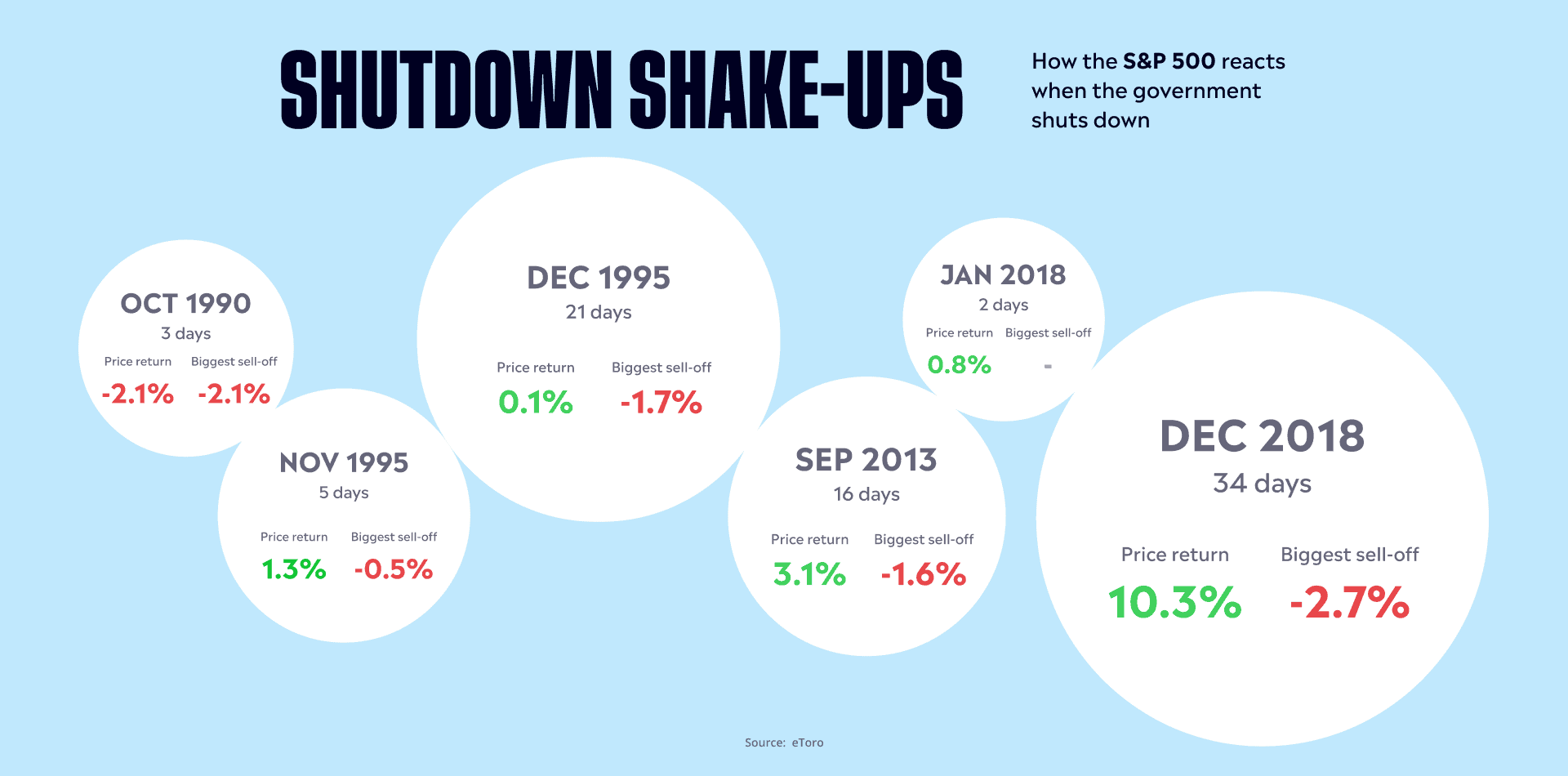

While government shutdowns have been less frequent recently, they’ve been more amplified and drawn out. In three out of the last six shutdowns, the S&P 500 declined as much as 1.5% during the standoff. Americans’ confidence also tends to decline, an insidious consequence if you consider how tough it is to drown out the headlines.

But government shutdowns rarely cause a bear market or crisis. And since 1976, funding gaps in the federal budget have lasted just eight days, on average. In a way, a shutdown could be less of an obstacle and more of a distraction.

The risk, though, is if the negative consequences from the shutdown are what ultimately tips the economy into a recession — or investors into a panic.

So as we stare down the Saturday deadline, here’s a good plan to follow:

Scale the wall. I’m talking about the wall of worry. Markets thrive when people are skeptical of the future and keep cash on the sidelines. We don’t see many reasons to be worried about the economy yet, so this may be a small bump in the grand scheme of things.

Check the technicals. The S&P 500 just broke its 100-day moving average, which has served as an important line of resistance over the past six months. The next stop could be the 200-day moving average, which sits around 4,200.

Stay grounded. Don’t make any sudden, emotional moves. That’s good advice no matter the situation, but it’s especially good advice during such an uncertain and inflammatory time.

*Data sourced through Bloomberg. Can be made available upon request.