It doesn’t take a finance degree to know how weird markets have been acting these past few years.

But lately, markets have been acting even more mysterious.

I’m no detective, but I’ve watched markets for a while and read a few finance textbooks. And right now, there are some trends that just don’t add up.

Let’s dig into a few market mysteries that I can’t stop thinking about.

Stocks and cash

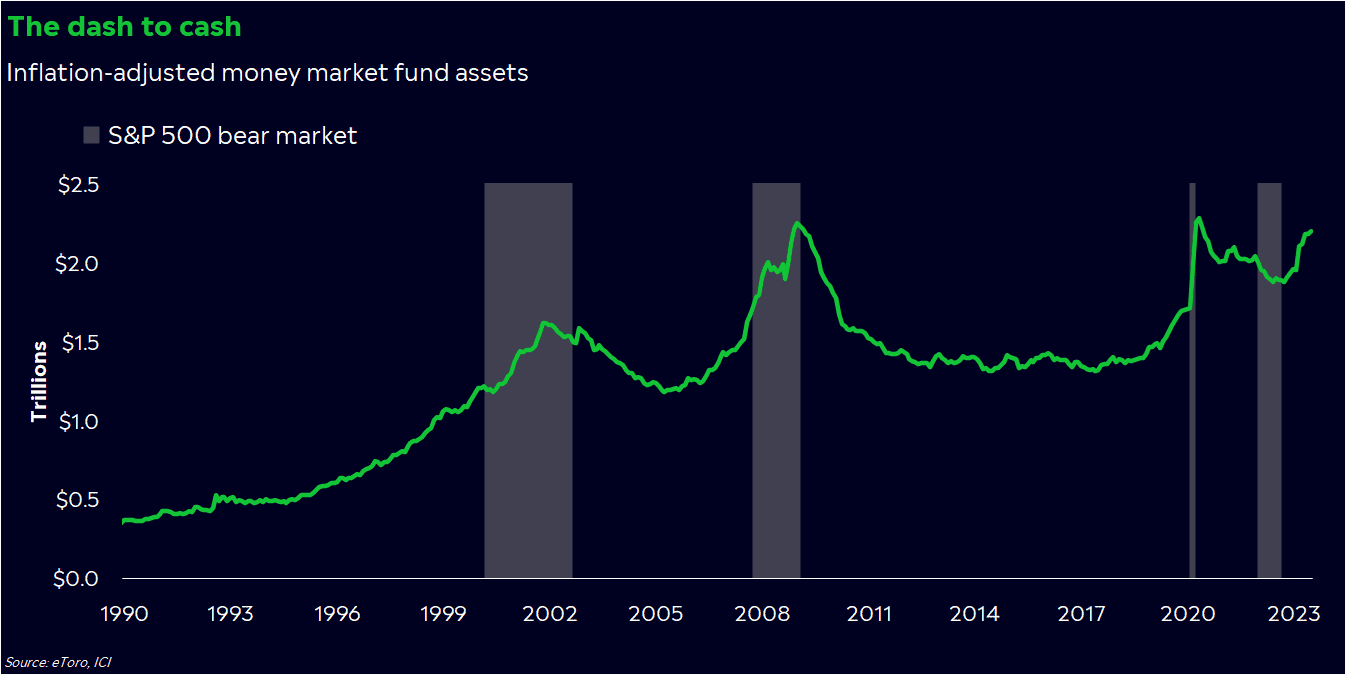

One of the biggest mysteries this year has been investors’ obsession with cash. Cash in money markets — or short-term, fixed-income funds — has grown 18% over the past 12 months, even though the S&P 500 has climbed 14%. Yes, rates are high, but you rarely see people move this much money into cash when the stock market is doing well.

My take: I see two forces at work here. People seem to be hoarding cash because of attractive yields and because they’re worried about the future. Higher yields look like a natural reaction to a strong economy, and typically, strong economies beget strong markets. We all know there can be too much of a good thing, though.

Put these two storylines together, and cash may be attractive right now because inflation still doesn’t seem fully under control. And Consumer Price Index data showed us just as much. Be careful — rates are still high, and there’s a lot of pressure on the economy. But higher cash levels could be a good sign for the future. Investors are understandably skeptical, not irrationally aloof.

Oil and the dollar

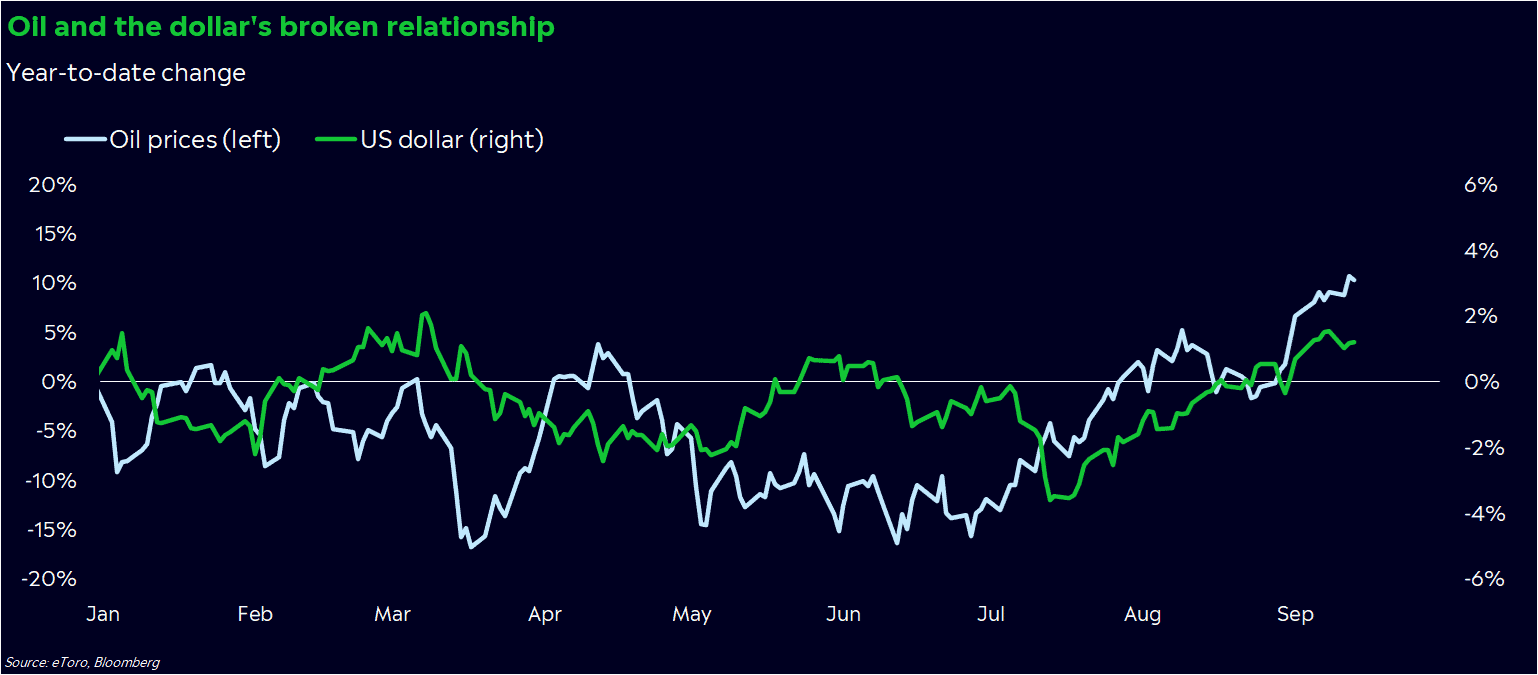

More often than not, oil and the dollar move in opposite directions over long timeframes.

Oil prices are quoted in dollars, so when the dollar gains in value, it naturally takes fewer dollars to buy a barrel of oil.

This quarter, though, that relationship has broken down in a big way. Oil prices are up 26% this quarter — a sizeable jump — while the dollar’s value is 1.7% higher. That kind of movement has only happened eight times in the past 50 years.

My take: Oil and the dollar are separately sending positive vibes. Commodity prices rise when people are driving, flying, and spending money, and a stronger dollar often means people feel good enough about the US economy’s future to buy dollar-denominated assets.

But these two trends happening in unison? Very weird, and possibly more worrying than first glance may imply.

There could be a few factors at play here. Oil supply is unusually low, and scarcity can keep prices elevated. The global economy’s wobbly footing — especially with China’s tepid recovery — could be pushing global investors into dollar-based assets. And we can’t forget how much the global oil trade has changed during the Russia-Ukraine conflict.

Oil might be the liar here. Economic data has been decent — but not impressive — and oil’s supply issues are well-known. And regardless of demand or supply, we’re paying more at the pump at a precarious time for consumer spending.

Yields and…yields?

Speaking of classic finance assumptions, we need to talk about the yield curve.

The bond market has been more interesting than the stock market as of late. The 10-year Treasury yield is now near a 16-year high, and Wall Street is all up in arms about it.

But I’m not just focusing on the 10-year yield today. Rather, I’m watching the relationship between two points on the Treasury yield curve — the two-year yield and the 10-year yield. In normal times, a 10-year bond yields more than a two-year note because you naturally assume more risk if you loan your money out for longer periods of time.

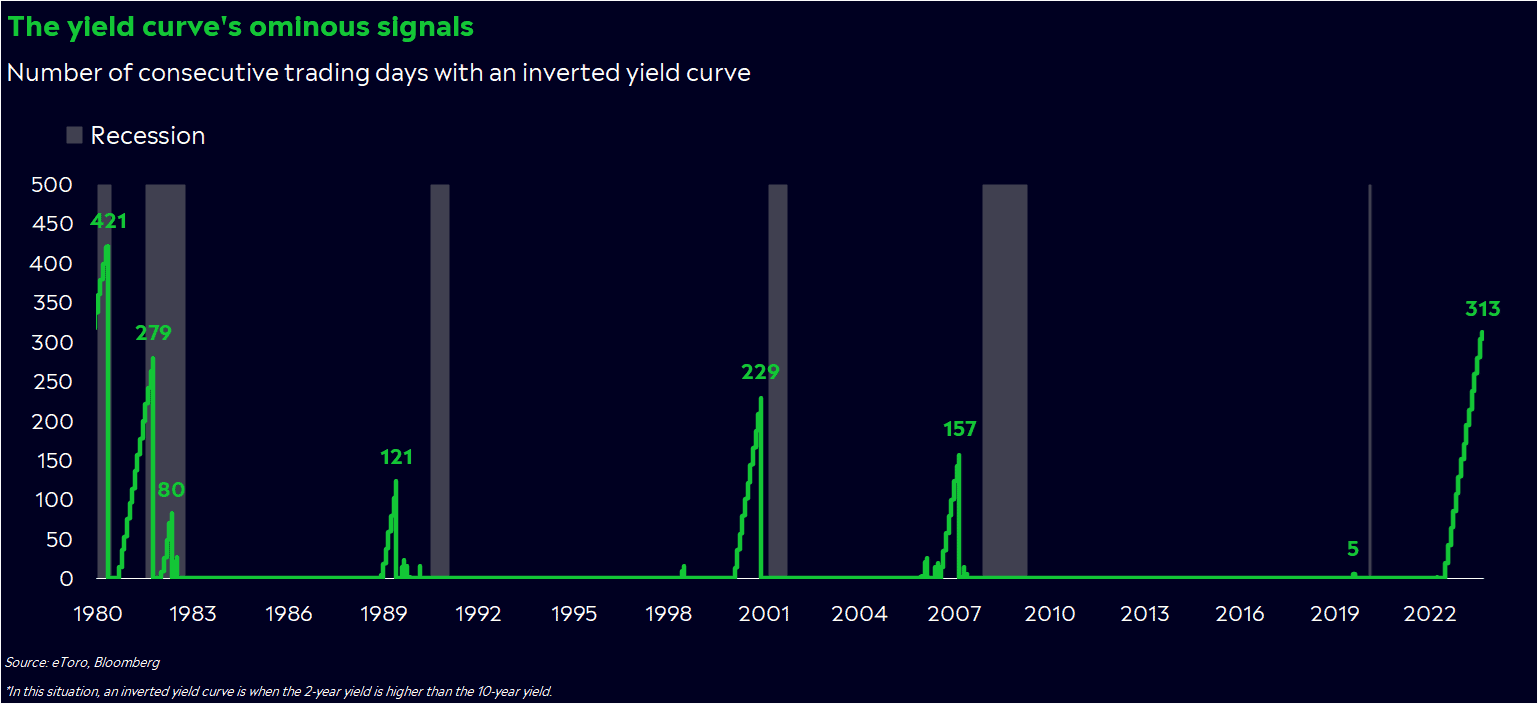

Yet, over the past year and a half, two-year Treasury notes have yielded more than 10-year bonds, despite the fact that they’re less risky — at least from a time risk perspective. That’s the longest streak in over 50 years.

My take: While this is a wonky mystery, it’s an important one to watch. Historically, an inverted yield curve — or this phenomenon of short-term Treasuries yielding more than long-term Treasuries — has often preceded a recession.

But I’m not sure we can trust the yield curve’s recession signals if it’s cried wolf for 313 straight trading days. Perhaps yields are trying to tell us that inflation can’t stay this high for long — a story of slower growth, but not necessarily of economic crisis.

Don’t get me wrong — the inverted yield curve can warp our sense of risk and cause problems for rate-sensitive sectors like banks and real estate. In fact, it already has. Still, your reaction to the yield curve may look different than in past cycles. And if you’re truly worried about a recession, remember that bonds often act as a good sanity hedge in times of crisis.

So what does this mean for me?

Pay attention. Breakdowns in correlation and weird market moves could mean change is afoot. But change isn’t necessarily a bad thing — it could present you with opportunities if you keep your eyes peeled.

Don’t over-correct. Weird moves don’t always resolve themselves quickly. And sometimes, weird turns into the new normal. Watch for mysteries, but try not to base your whole investing strategy on one indicator or assumption.

*Data sourced through Bloomberg. Can be made available upon request.