What you invest in these days may not just depend on your opinion of the economy, the Fed, or the debt ceiling.

Instead, it may be all about your timeframe.

Often, when I hear people arguing about stocks and crypto, they’re seeing the markets through different lenses. One is a short-term investor, feeling pessimistic about a barrage of headlines causing anxiety about the days and weeks ahead. The other? A long-term investor who’s looking at the power of compounding years down the road.Turns out, when you’re looking at different timeframes, your perspective varies drastically.

And right now — with debt ceiling tensions flaring amid a backdrop of somewhat decent economic data — your horizon matters more than ever.

Days and weeks

No matter your timeframe, I think we can all agree on one thing: It’s an emotional time to be an investor — and a human.

Look around you. Politicians are arguing, bank CEOs are offering up their opinions on everything, data is all over the place, and there’s still a war going on in Ukraine.And if you’re a short-term investor — someone who needs their invested money in a month or less — you have to process how all of that impacts your portfolio. Nobody knows what tomorrow will bring or how tomorrow’s news could be interpreted by the market.

Good stretches in the stock market are rarely a straight line up. Take 1954, when the S&P 500 gained 45% in its best year in decades. Even though it was a spectacular year for stock investors, the market was down in nearly 40% of days. And the S&P 500 dropped 1% or more on five of those days.

Same with crypto. Bitcoin went on a nearly parabolic run from March 2020 to April 2021, gaining almost 1200% in a 13-month span. But on a day-to-day basis, it wasn’t as smooth. There were four days in that 13-month period when Bitcoin prices dropped 10% or more in one trading session. Yikes.

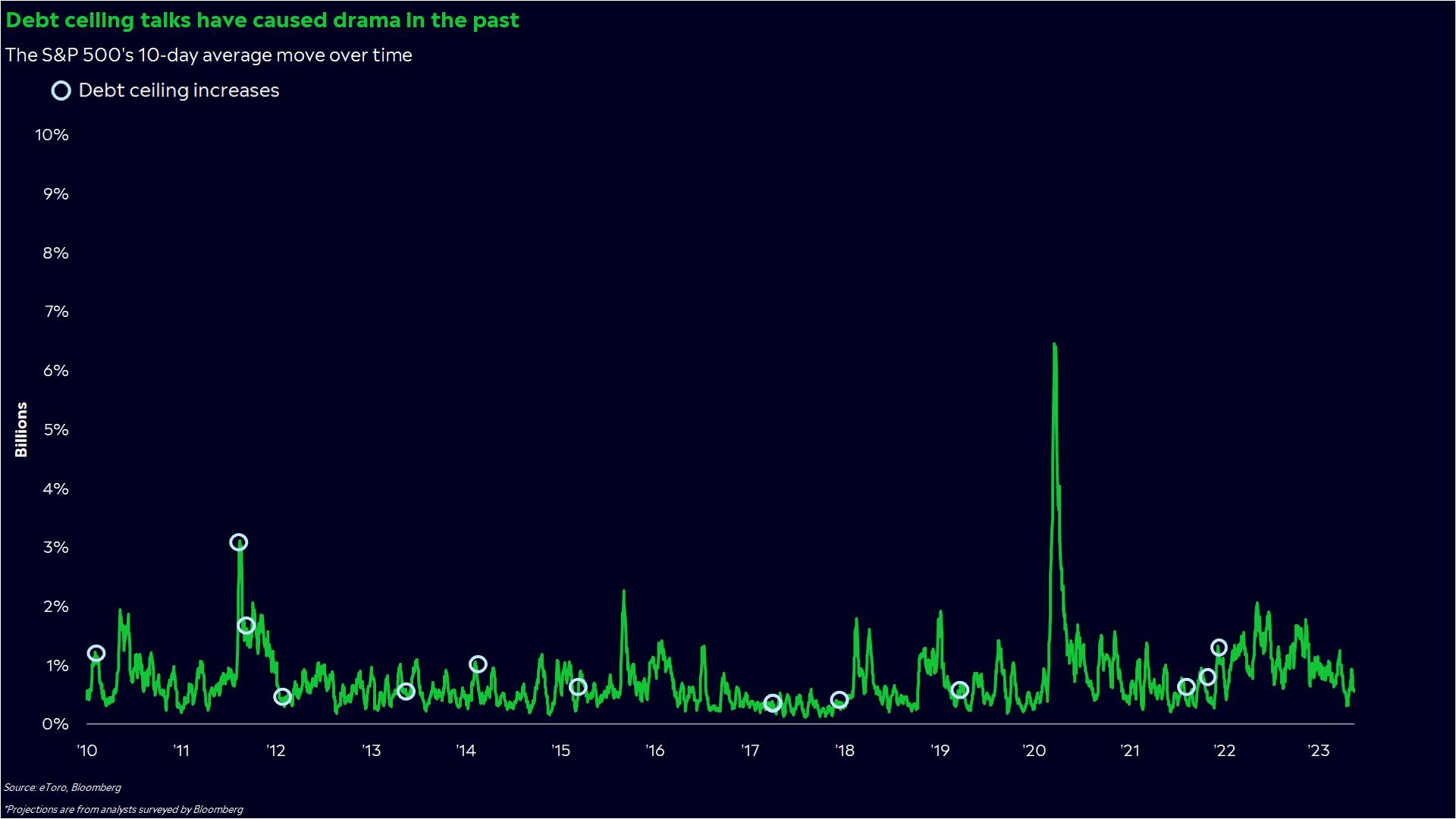

So why does this matter now? Well, we’re in the middle of debt ceiling talks, and they seem to be coming down to the wire. Sure, there’s a lot of incentive for both parties to reach a deal, but that may not eliminate the ups and downs we could experience as we get closer to the X date.

Emotions can run wild around unusual political scenarios, too. Stock market volatility has picked up noticeably in both directions during debt ceiling debates in recent decades. In the 10 days before the August 2011 deal, the S&P 500 dropped 3.9%, including two days of 1% gains and two days of 2% drops.

By the way, I wrote a post on what to make of the debt ceiling drama, including which sectors could be impacted, here.

Months

Maybe you’re not a short-term investor, but you’re investing for some goal coming up quickly — buying a house, a kid’s college fund, a once-in-a-lifetime trip, an eventual retirement. You don’t care as much about the daily swings, but you want to make sure you can get your money out in a year or so at a decent price.

Your timeframe is a little tricky at the moment. You might have time to wait out this debt ceiling debacle — or potentially even buy the dip. After all, the S&P 500’s recovery from the 2011 debt ceiling crisis took just four months.

Unfortunately, there could be another storm brewing on your particular horizon. The economy has been slowing for months, and economists surveyed by Bloomberg now think there’s a 65% chance we hit a recession in the next 12 months. In other words, before you need that money you invested. Even worse, recessions have been disastrous for stocks, and nobody knows how crypto will react if the economy breaks down.

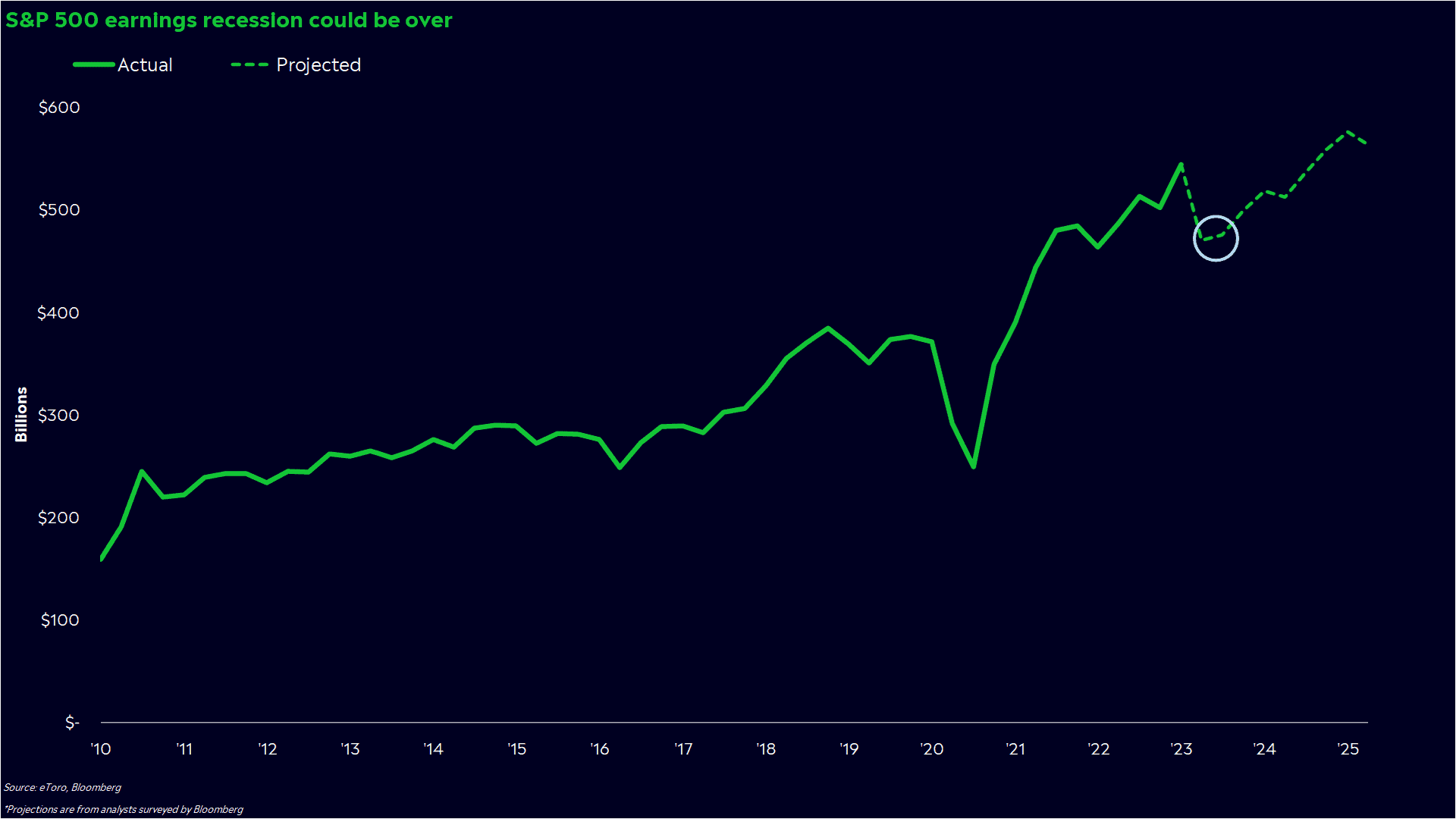

But a recession isn’t a foregone conclusion, and we could’ve already felt the pain of a mild recession in our portfolios with the S&P 500’s 25% drop. The stock market isn’t the best proxy for the economy at the moment, and we’re still seeing mixed signals in the data, too. Growth is slowing, but earnings projections show that profits could start rebounding next quarter.

Years

Pay attention here, because this is a group many of us fall into. You’re investing to build wealth, and you have years before you’re planning to sell.

Sound familiar? Good. You may be the most well-positioned type of investor at the moment. The S&P 500 is 12% below its all-time high, and it’s been well below highs for a year now. Sure, you’re still faced with the daily headlines and market drama. But when you’re looking years down the road, the noise doesn’t matter as much as your belief in collective human adaptability.

Here’s what I mean. Over time, the stock market generally follows company profits, and profits grow when the economy is expanding and companies are operating more efficiently with improved technology. That’s why the S&P 500 has taken an average of two years to recover from every bear market it’s encountered since 1950. And over that period, it logged average returns of 8% a year.

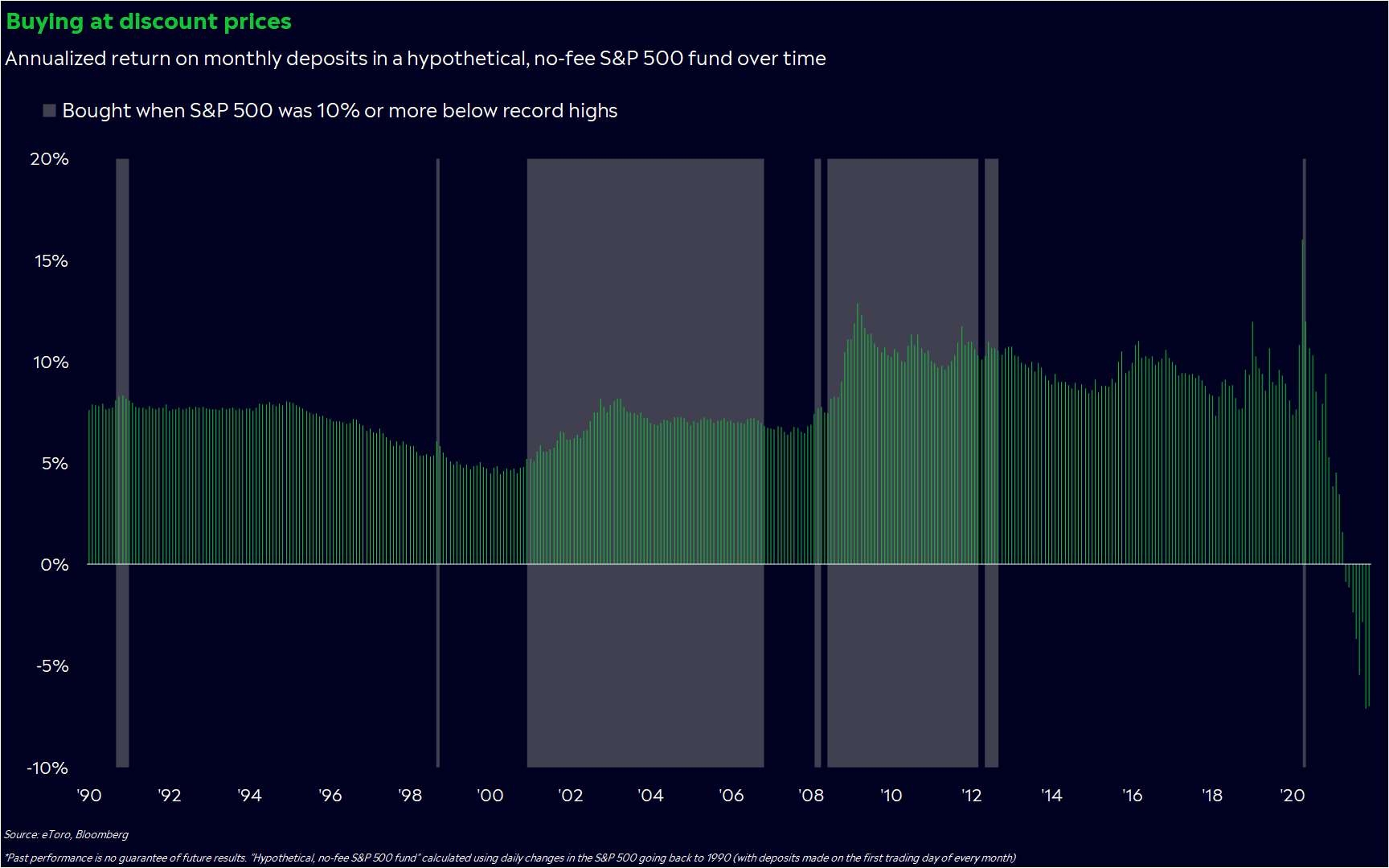

You also have the opportunity to buy at discount prices, which has rewarded investors well in the past, if they’ve had the patience to wait. Lucky for you, you’ve got time on your side.

So what does this mean for me?

Like I said, it all depends on your timeframe.

Days or weeks: It’s understandable if you’re feeling nervous. You may need to keep abreast of debt ceiling deadlines and focus on how they’d impact your specific investments. Keep your emotions in check, too. If Congress’ stalemate continues, we could be in for a rough few weeks. There’s nothing wrong with a short-term horizon — just make sure it fits what you’re looking for.

Months: You have a lot of positives and negatives to consider — plus short-term bond yields make bailing out of the market even more enticing. But it may not be as simple as being bullish or bearish if the outlook is this confusing. Perhaps it makes sense to hold onto some riskier assets in the event that prices rise from here, while turning defensive in other parts of your portfolio in case they fall.

Years: Don’t get too distracted by the headlines. Your smartest move at this point could be to stick to it, so society and compounding can do the rest. Make a plan for your portfolio, including how often you’ll check your investments and when you’d like to make changes. Get your financial house in order so you can weather a recession without having to dip into your invested money.

And most importantly, stay grounded and true to yourself.

*Data sourced through Bloomberg. Can be made available upon request.