For investors, 2021 was heaven and 2022 was hell.

And in 2023, we could be stuck in purgatory.

Purgatory was a middle state where souls account for past sins and make themselves fit to enter heaven, according to a well-known expert named Dante. Today, it’s a word used to describe a period of miserable waiting, often for something that feels like it’ll never come.

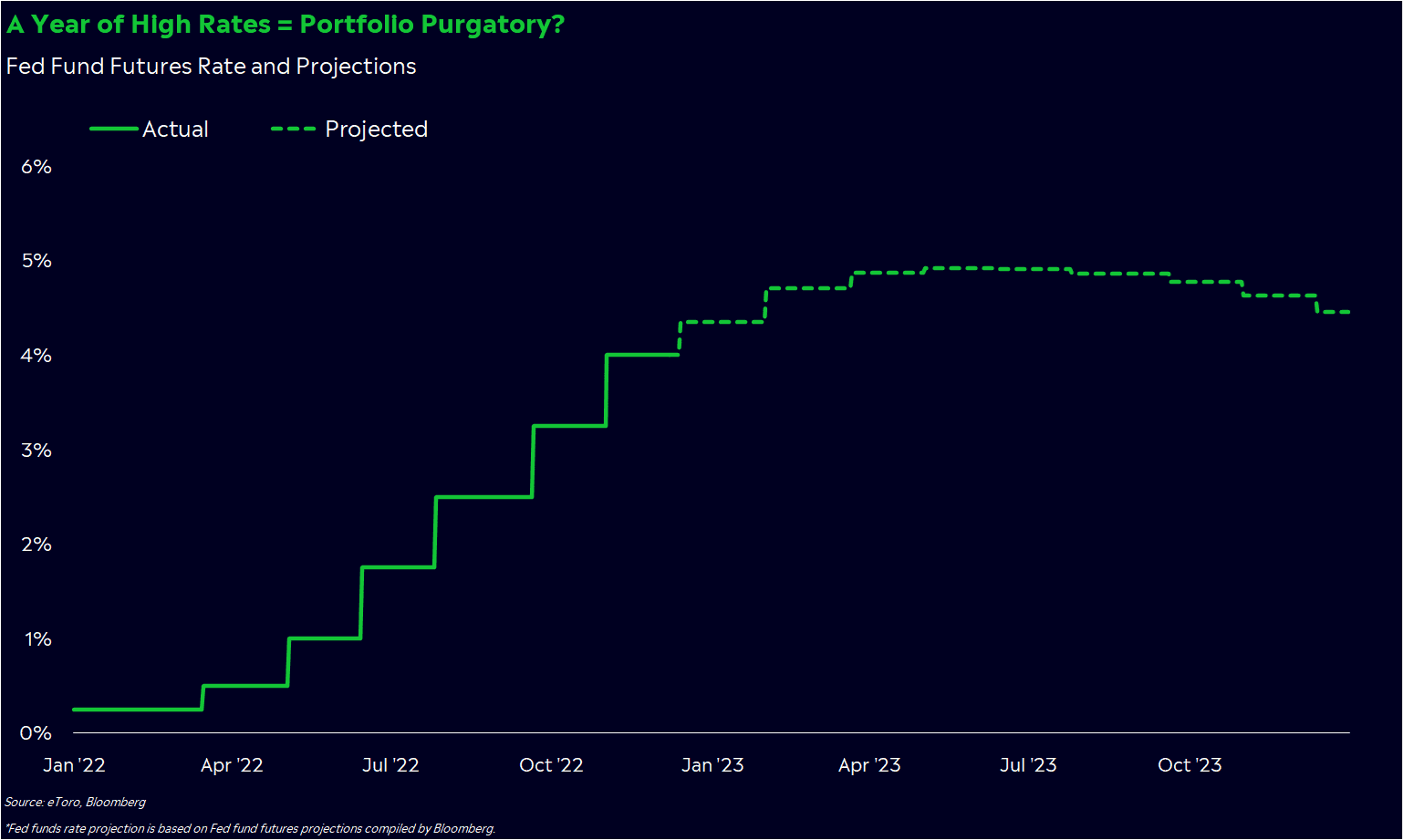

If that sounds familiar, you’ve been paying attention to both market headlines and English class. Inflation is still high, the Fed is still hiking rates, and markets are still volatile (even though they’re not in freefall). Stocks may be in a new bull market, yet they may not reach record highs any time soon. And it’s looking like we’ll still have to navigate through high rates and high inflation, an environment that isn’t as conducive to growth or innovation.

Purgatory, but for your portfolio.

A pinball machine

Recently, the stock market has been a little like a pinball machine. We climb higher, take a step back on a hot economic report, make up some ground on signs inflation is slowing, get batted down by a Fed speaker. Wash, rinse, repeat.

Markets have found a lot of reasons to be optimistic recently. The economy may be faring better than we think, and inflation has slowed. The Fed has even started hinting that it could let up on rate hikes.

However, there are still trends holding the market back. The Fed says it’s planning to keep rates high for a while in order to bring inflation down even further. High rates often discourage investment, especially when savings rates and bond yields look more enticing. Then there’s the inverted yield, plunging oil prices, Europe’s energy crisis, China’s COVID policy, and, of course, the black swans (or the unknown unknowns).

These are just some of the reasons your portfolio may feel stubbornly stuck in purgatory. We may be past the lowest point of the market selloff if we’re able to avoid a recession. But it may not be easy to get back to new highs, either. We may have to wait a while for a bull market that actually feels like a bull market.

Then again, bull markets rarely feel like bull markets in the beginning. Stocks tend to rebound before the earnings, the economy or headlines get better. It’s also rarely a straight path higher. Since 1950, seven of 10 S&P 500 bull markets have had at least one pullback of 5% or more in the first year.

Innovation versus conservation

Instead of panicking, consider that purgatory could just be part of the process. If you’re wise enough to realize that, you could find some decent portfolio opportunities at especially affordable prices.

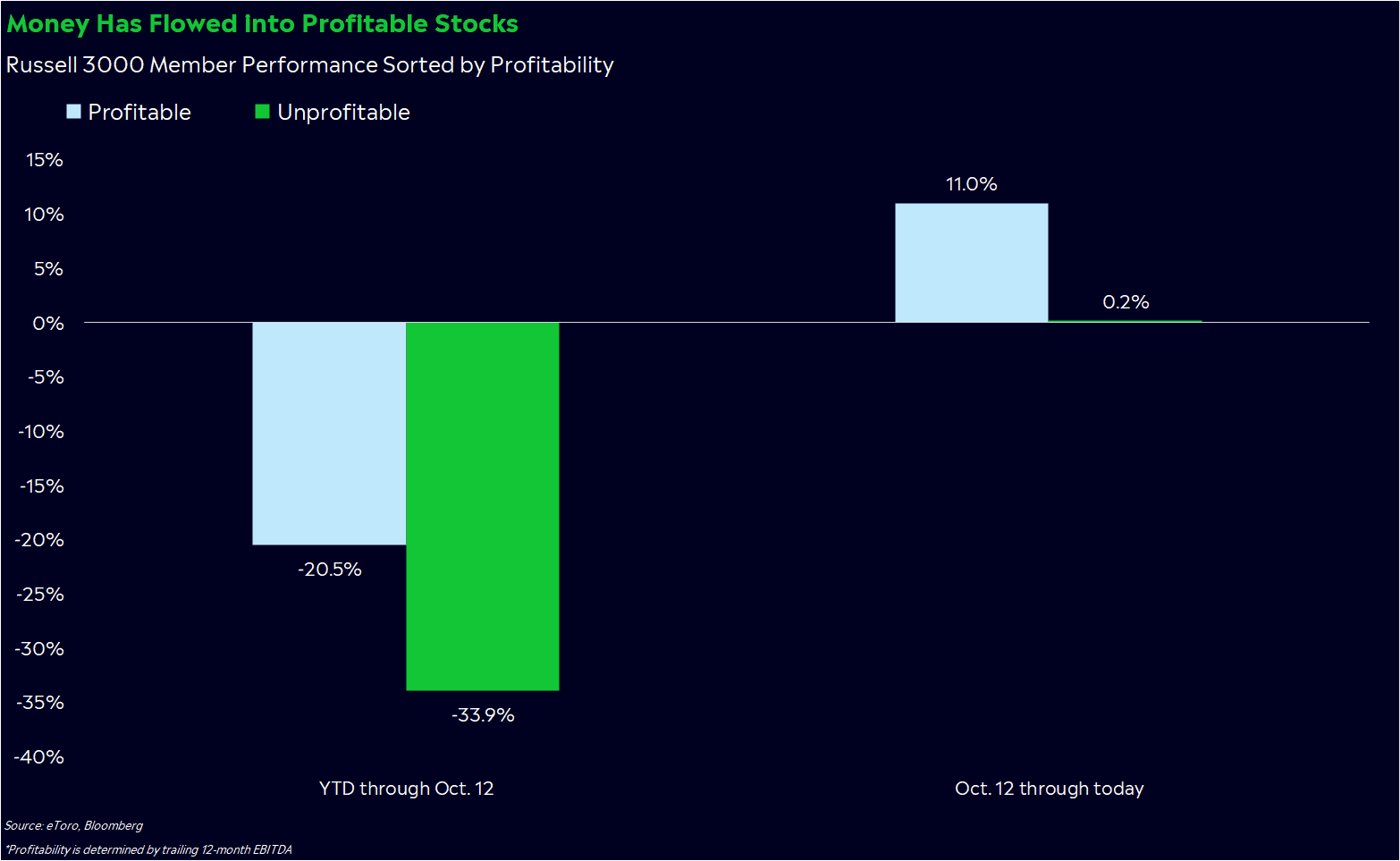

Proceed with caution, though. It may not be smart to dive headfirst into risky markets and speculative stocks. When rates are high, there’s typically less capital to go around. Weaker companies die off because money tends to flow into more profitable names (in other words, they’re purged). As a result, the big could get bigger, and innovation could take a back seat to conservation.

We’re already seeing this happen, too. Unprofitable stocks were hit hard in the first half of this year, and they’ve barely recovered in the rally we’ve seen since mid-October.

Cash management and financial strength are especially important in a high-rate, low-growth environment. Keep this in mind when you’re going through your market wish list.

A recession is still a real possibility, too. Up until now, the economic pain has been largely localized to tech and other growth industries. But, as the days go by, the chances of the Fed’s rate hikes doing serious damage are growing. We’re watching earnings and the job market for early warning signs, but frankly, we don’t see many at the moment. The cracks we do see are in oil prices, market expectations, and consumer confidence, but not in the more fundamental parts of the economy.

Sowing the seeds

Lower your expectations for the upcoming year. Purgatory comes with its own set of challenges, and we’re already starting to feel them.

But if you believe the market can shake off this bear — as it’s done countless times in history – it may be time to start sowing the seeds in hopes of higher prices sometime in the future.

*Data sourced through Bloomberg and the S&P 500. Can be made available upon request.