Millennials — or adults born between 1981 and 1996 — are a polarizing generation.

Millennials are often pigeonholed into stereotypes of avocado toast and skinny jeans. Some accuse them of being lazy and entitled.

But if you dig a little deeper, you’ll find a group that has been deeply scarred by financial crises and struggled to find its footing in the US economy.

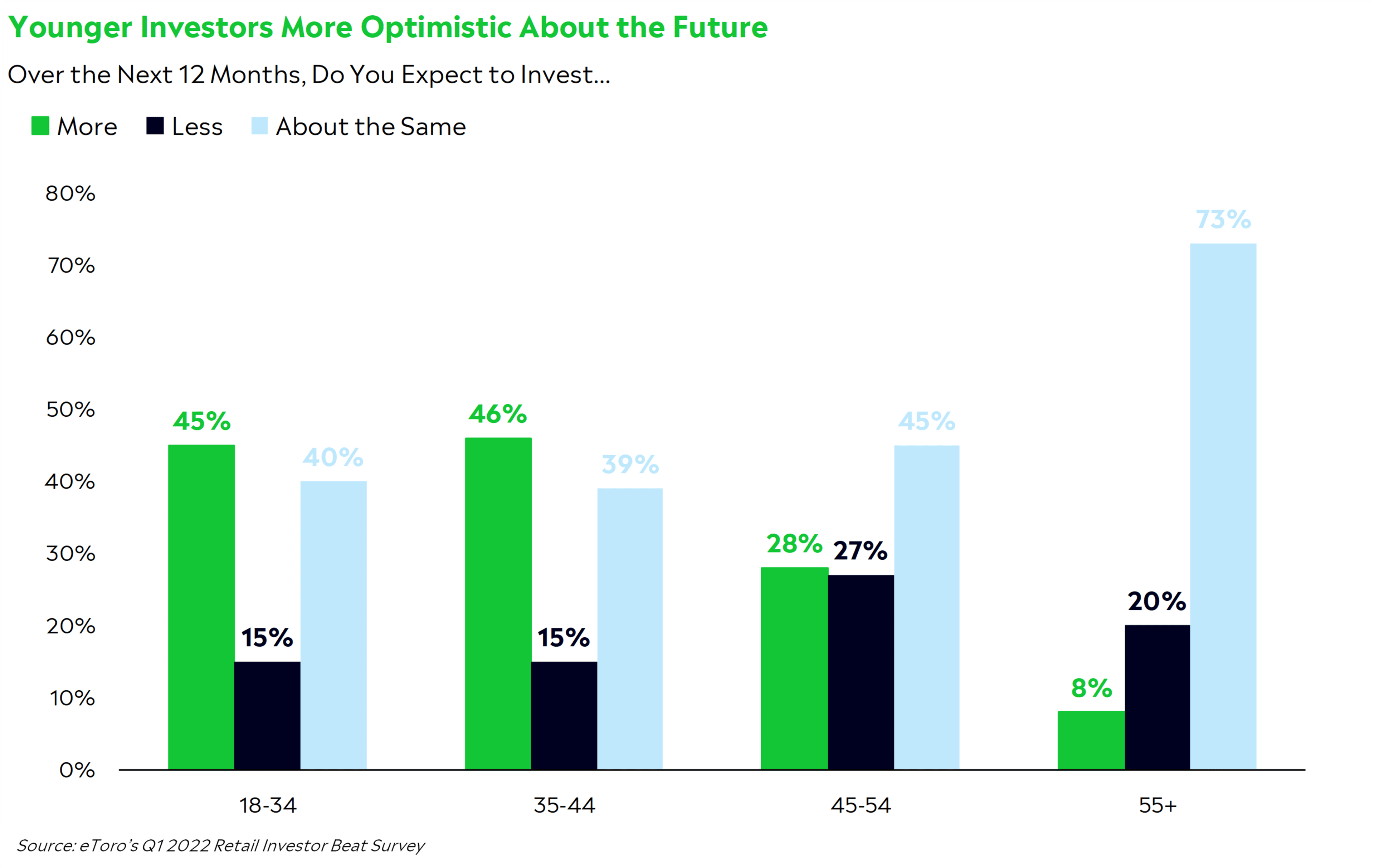

Now, millennials are finally having their moment. Armed with cash and newfound economic power, they’re embracing markets at a time when others are losing hope. About 46% of investors ages 18 to 44 plan on investing more money in the next 12 months, compared to 12% of investors ages 45 or older, according to our quarterly Retail Investor Beat survey of 1,000 US investors.

A coming of age

Most millennials have dealt with multiple life-altering economic crises in their formative years. In fact, the eldest millennials graduated college when the tech bubble burst, and many entered the workforce during the Global Financial Crisis.

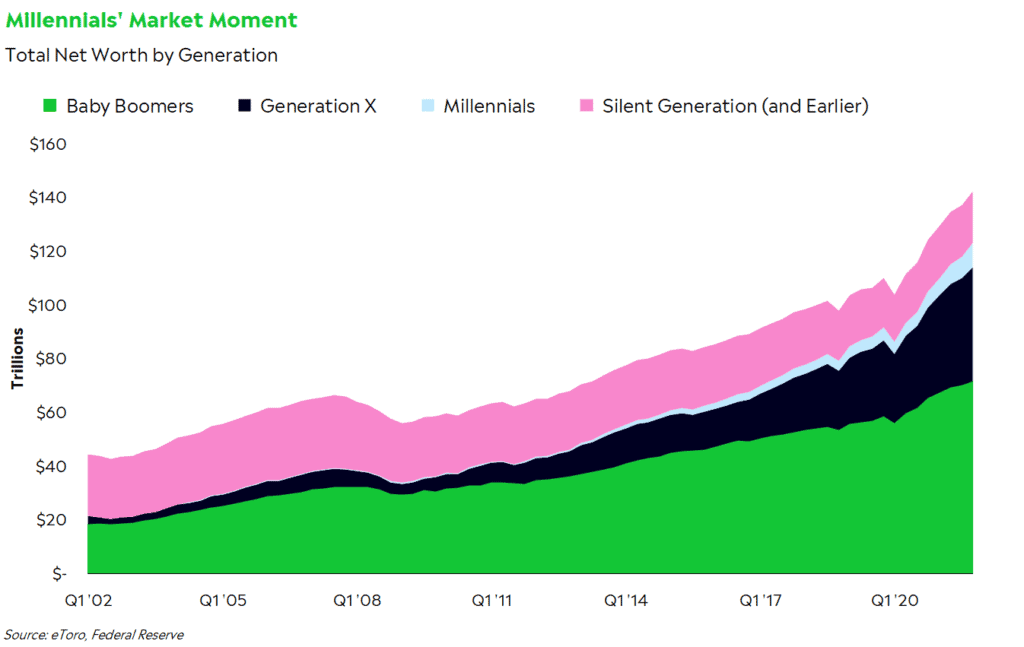

The COVID-19 pandemic was another major shock to society, but policy actions from the Federal Reserve and the government helped cushion the economic blow. Millennials’ net worth more than doubled from the start of 2020 to the end of 2021, more than any other generation (according to Federal Reserve data).

Why? A large swath of millennials started investing over the past two years.They’ve generally been willing to make more growth-minded investments, a strategy that’s worked well during stocks’ and crypto’s impressive recoveries. The total value of millennials’ stock investments rose by 167% from Q1 2020 to Q4 2021. They’ve benefitted from the strongest job market and wage growth in decades. Plus, many millennials reached their prime home-buying years during a stretch of historically low mortgage rates. Millennials made up the largest percentage of home buyers in 2021, according to the National Association of Realtors. Some of them may even have mortgage rates lower than the 10-year yield.

Don’t get me wrong. It hasn’t been an easy two years for anyone, and plenty of millennials are still saddled with student loans and facing a double whammy of now-rising mortgage rates and home prices.

But after years of drawing the economic short straw, millennials may have finally been on the right side of an economic shift. The result: more cash in pockets, more confident investors, and a quiet yet powerful underpinning to markets as the largest generation alive puts its money to work.

Optimistic and confident

The millennial cohort has also seen the power of investing firsthand. Yes, many grew up during the Global Financial Crisis, but they were also around for the S&P 500’s 11-year bull market afterwards. They’ve largely learned that pullbacks can be seen as opportunities instead of times to panic. That may be why they’re feeling so optimistic in a time when Wall Street and older investors are backing away from the market.

It’s remarkable to think that everyday investors haven’t lost hope in a year when so few markets have actually risen. But in a way, it makes sense. People quickly forget that many everyday investors tend to invest when they have the money to do so – not necessarily when the market environment feels comfortable. About 60% of investors ages 18-44 said they invest monthly or less often, contrary to the day-trading stereotype surrounding retail investors. Sure, they may check their portfolios more, but they’re less likely to flinch during a selloff.

Younger investors also seem less fazed by inflation’s risk to their investments, according to our survey. 47% of investors ages 18-44 see inflation as the biggest risk to their portfolios over the next three months, compared to 61% of investors ages 45 and older. To be fair, older investors have scars of their own. They’re more likely to remember the runaway inflation of the 70s and 80s, and our survey found that they’re generally more concerned about the economic outlook.

While the jury’s out on which side is right, millennial portfolios may have more time to recover if inflation upends the market. And younger investors with bigger risk appetites and longer time horizons may feel more emboldened to buy during selloffs.

How millennials are changing markets

Millennials coming of age could be changing the way markets work, too. There’s a reason why Elon Musk is waging a social media campaign to buy Twitter. Yeah, I’m going there.

It’s no secret that younger investors are turning to social media and online forums for advice. So naturally, companies are flocking to the Internet to promote their interests and lure in retail investors. Musk has become a pro at harnessing the power of network effects for his own business ventures – for better or worse.

It’s not just Elon, either. Gamestop and AMC have introduced off-the-wall shareholder initiatives – free popcorn and NFTs – to woo the younger crowd. Activist investors have turned to social media to announce their latest positions. Big names like Google and Tesla are splitting their stock to make their shares more affordable. And who can forget the meme stock phenomenon of 2021?

Younger investors are keen to embrace technology and invest in groups. And while the pros outweigh the cons, technology and social media have made markets more vulnerable to wild moves and groupthink. It’s easier than ever to get swept up in the crowd, or fall victim to the whims of a billionaire leveraging his network.

Still, it’s refreshing to see companies pay more attention to the new generation of investors. Wall Street has been focused on wooing institutions for years, but it seems like the tide is shifting.

Throughout this recovery, we’ve consistently underestimated the wealth effect: the simple act of spending and investing more as the value of your assets rise. Over the past two years, millennials have come into their economic power, and their investments could provide a crucial foundation for an otherwise rocky point for markets.

After all, markets are simply supply and demand. If there are more buyers than sellers, prices go up.