It’s election season.

But hey, you probably don’t need me to tell you. You’re already getting the mail, seeing the billboards, and hearing about it every other commercial.

To be clear, I’m not here to talk politics. Generally, your political stance doesn’t mesh well with your portfolio — although, if you want your politics in there, be my guest.

However, elections can be a catalyst for change, and markets tend to react to change in one way or another. And you, dear reader, have to process what that change could mean for your money. Or at the very least, you have to argue with your parents about it.

Either way, let’s get some things straight.

Elections are events with uncertain outcomes

This may sound like the understatement of the year, but it’s an important thing to understand if you’re investing before an election. Investors tend to see elections as upcoming events with a wide range of outcomes, and that uncertainty can seep into their portfolio decisions. Markets hate uncertainty, and elections are a big dose of it.

But in these days of massive uncertainty, an election outcome could be a surprisingly welcome shot of certainty. Markets have had a rough few months, and investors are overly pessimistic about the future. They’ve also been quick to rush into rallying prices — almost like they’re ticking off a “to-do” box of obstacles, instead of evaluating a mixed bag of data.

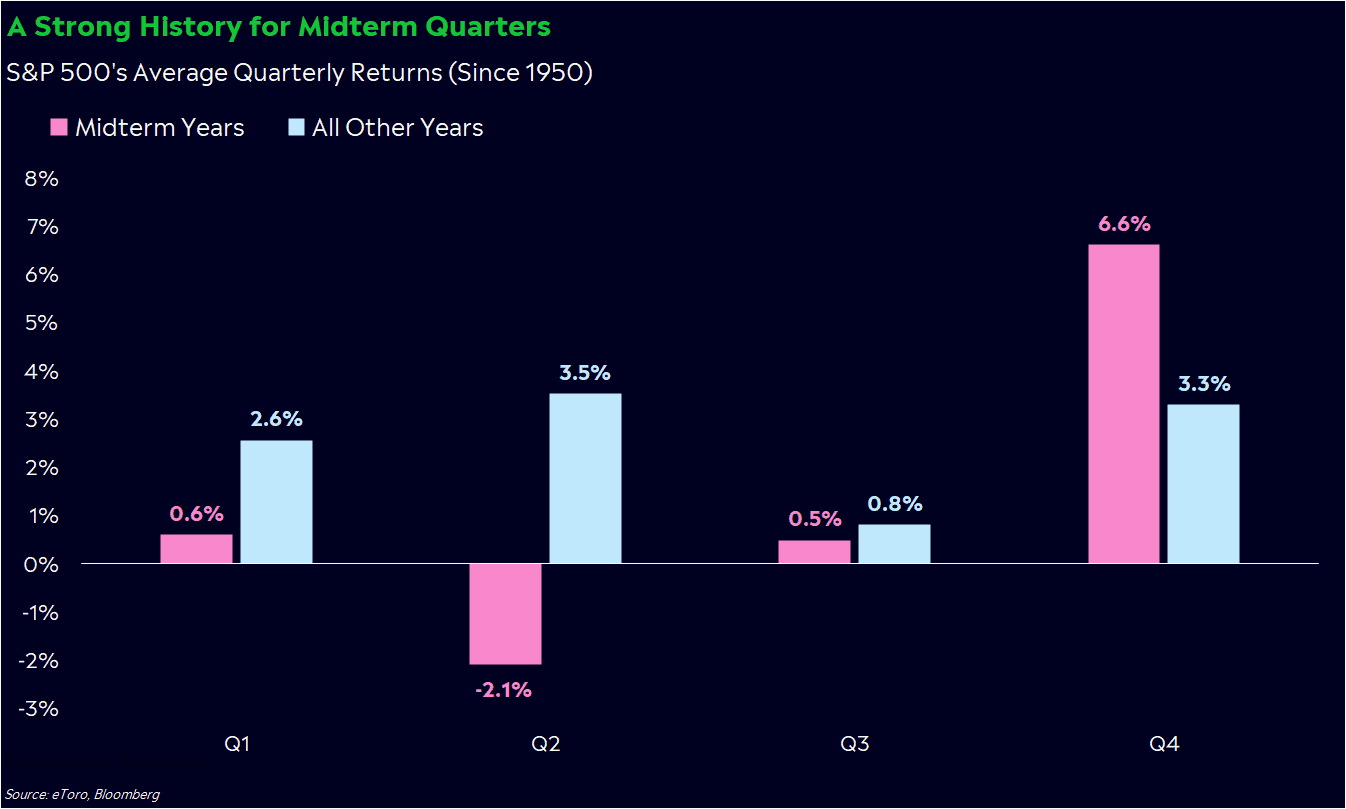

That mentality could work in our favor as we approach midterms. More often than not, Election Day can jump-start an end-of-year relief rally. In fact, in all elections since 1950, the S&P 500 has gained from Election Day through the end of the year 67% of the time. The S&P 500 has also risen an average of 6.6% in the fourth quarter of midterm years over that period, compared to a 3.3% average climb in other years.

Could we be staring down the perfect setup for a post-midterms Santa Claus rally?

Elections can be a catalyst for change

Like I said earlier, elections are typically the harbinger of change. I think we can all agree on that, no matter which side we’re on. I’m not even talking about individual politicians, some whose roles have obviously changed a lot over the decades. Congress’ party control alone has changed in nearly half of elections since the 1980s.

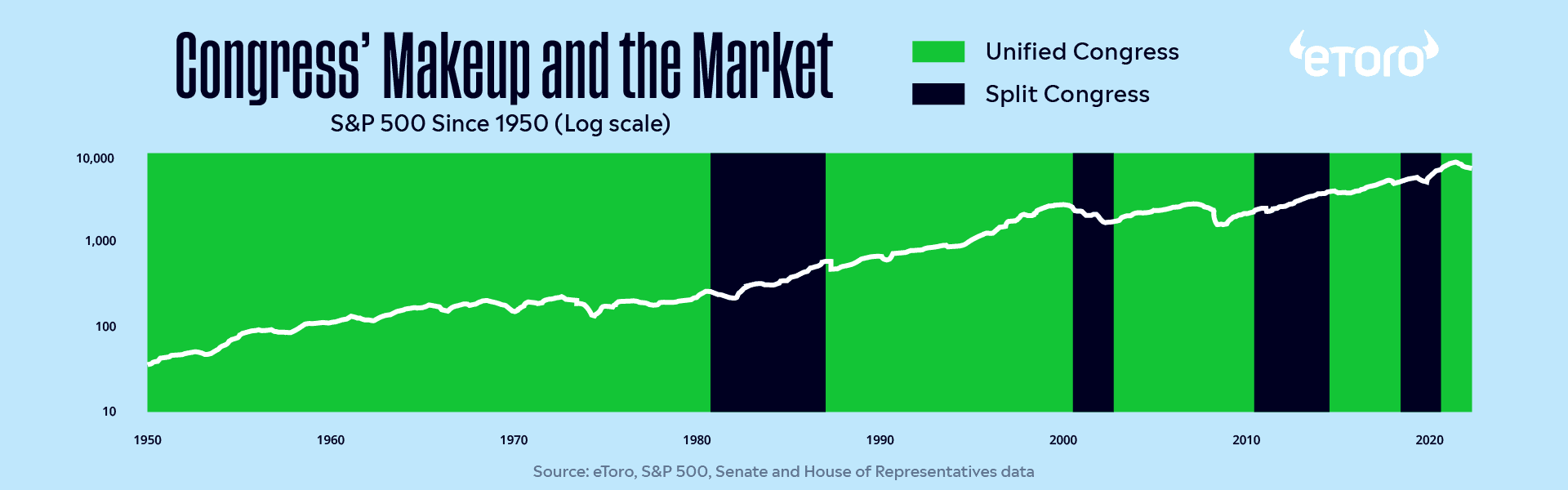

Congress’ makeup can make or break the potential for new policy. Sometimes Congress is ruled by one party, and other times it’s split: one party controlling the House and the other controlling the Senate. Theoretically, a unified Congress could have an easier path to passing policy (change), while a split Congress could face a tougher road (no change).

Historically, the market has slightly preferred Congress in gridlock. Since 1950, the S&P 500 has returned an average of 20% in a two-year term of a split Congress, versus an average of 19% in a unified Congress.

My point? The market doesn’t move exclusively on Congress’ decisions. But in these economically tumultuous times, Congress’ decision-making ability could be pivotal. Markets are becoming increasingly convinced that we’re on the edge of a recession. If the economy tips into distress in 2023, the Fed and Congress may have to collectively take action. And as we’ve seen this year, less government action may equal more Fed action.

Elections can have different implications for different industries

Government policy doesn’t often define an entire economy. However, the decisions Congress makes aren’t exactly trivial, either. Often, policy can have far-reaching effects for certain companies and industries. As an investor, you could easily find your portfolio in the crosshairs of policy risk, regardless of who you voted for.

These days, there are conversations swirling around crypto regulation, commodity controls, international relations, and antitrust concerns. Chances are good that they’ll be hot-button issues in three months. Congress has also passed a few crucial laws, including the Inflation Reduction Act, that have helped lift stock prices in clean energy companies. A U-turn in policy momentum could threaten this sector after a strong year.

It’s difficult to protect your portfolio against individual policy changes. I hate to sound like the industry’s broken record, but the best solution is to diversify — or spread your money out across multiple assets and markets so you’re not overly exposed to an unfortunate headline.

Elections aren’t a crystal ball

If you remember one thing from this post, remember this: Election outcomes don’t drive markets over the long term. Earnings and the economy do, and neither seem to have any obvious correlations with who’s making decisions on Capitol Hill. Think about this: 43% of Congressional terms since 1950 have overlapped with a recession. Many of these recessions weren’t the result of a certain party controlling Congress, but more a mixture of timing and luck.

Booms and busts will happen, regardless of who’s in office. Prepare your portfolio accordingly.

*Data sourced through Bloomberg. Can be made available upon request.