If you’re like me, you’ve got shopping on your mind.

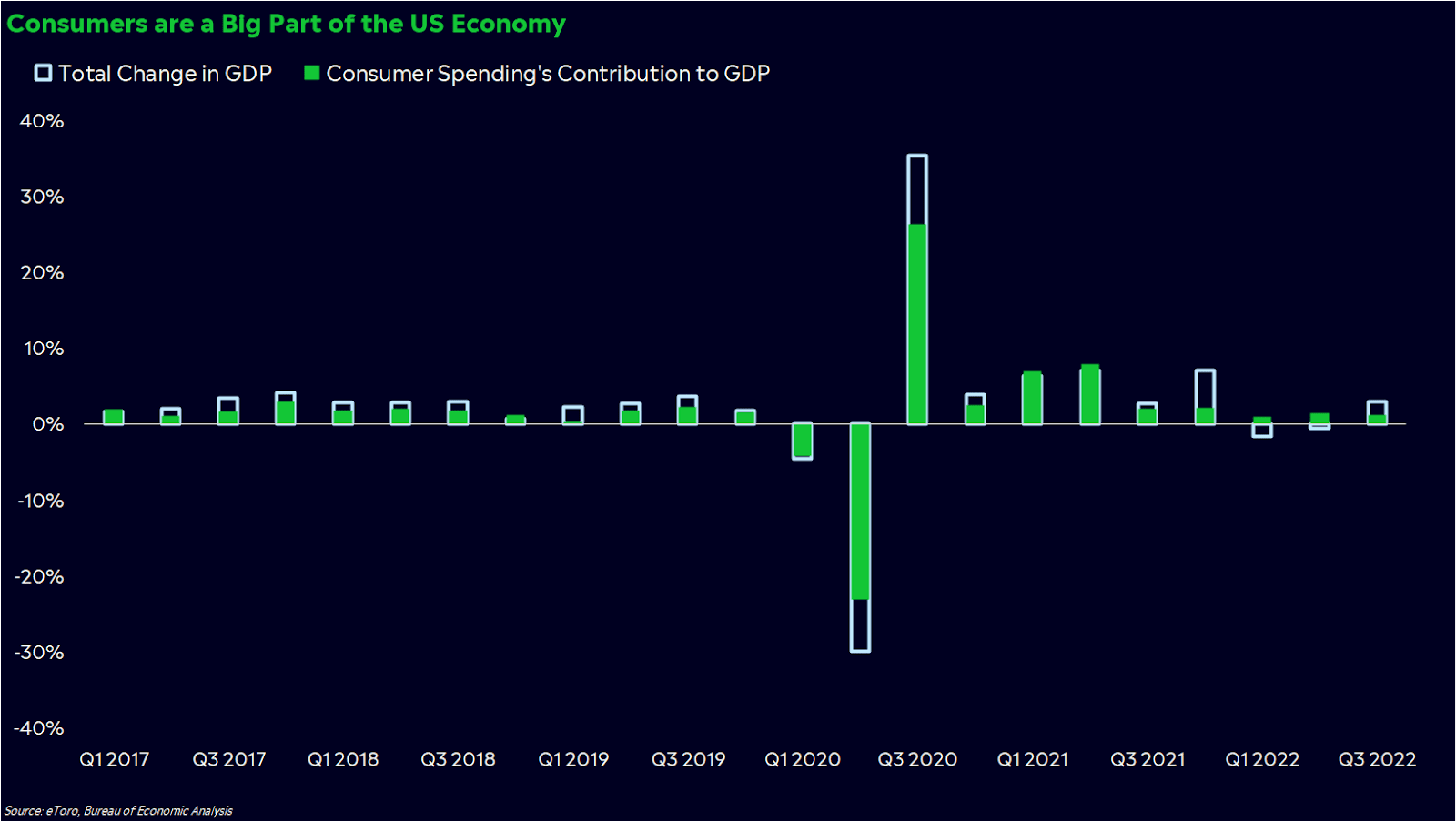

Turns out, so does Wall Street. It’s the holiday season, the gift list is long, and the sales are hot. Americans’ urge to spend money in the face of rising rates, soaring gas prices, and global troubles has been remarkable. In fact, consumer spending is a big reason why we haven’t succumbed to a recession yet.

But this holiday season could be an interesting test. Are consumers still feeling comfortable enough to go all out on the holidays? And are stores well equipped to handle a busy season?

The answers could tell us a lot about where the economy is heading next.

The itch to spend money

While a lot has changed since the beginning of this year, the vibes we’ve been getting from consumer spending haven’t. Even though the world feels uncomfortable, Americans’ propensity to spend largely hasn’t changed. Next time you’re out, take a look around you. Malls are still busy, lines are still long, and restaurants are still bustling.

That’s been good news for the economy. Consumer spending is about 70% of gross domestic product, and historically, it’s been rare to have a recession without a breakdown in demand. But it’s also led to a lot of speculation of when — or if — Americans will feel worried enough to cut their budgets.

Now, it’s the most wonderful time of the year: the two months in which retailers derive an average of 19% of their annual sales (according to National Retail Federation figures). You’d think if any changes in consumer behavior would emerge, it’d be now — even though many of us tend to throw financial caution to the wind during the holidays.

And right on cue, it seems like conditions are turning back in the consumers’ favor. Holiday discounts have been huge, as stores try to clear out big inventory backlogs. NRF data noted that a record number of Americans shopped this past weekend, showing people are hungry for good bargains.

Falling oil prices could add a few extra dollars to people’s wallets, too. GasBuddy analyst Patrick De Haan even thinks the average price for a gallon of gas could drop below $3 later this month, with oil prices slipping 10% over the past month.

And then there’s the job market, which is slowing, but still strong. Jobs are many Americans’ primary source of income, and when we make more money, we’re usually more inclined to spend it.

If you’re still expecting a recession, you may be discounting the power of the consumer once again.

Not all holly jolly, though

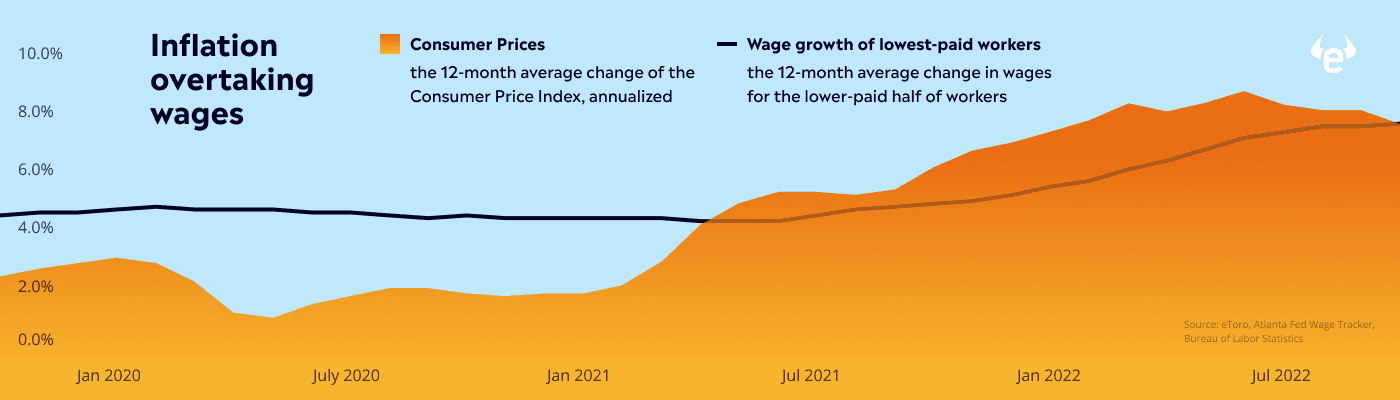

Broadly speaking, spending could be decent this holiday season. But if you zoom in, you’ll see that it may not be a holly jolly holiday for all Americans.

There’s evidence that lower- and middle-class Americans are losing ground in inflation-adjusted wage gains, something both the Fed and Wall Street need to be attuned to given income inequality these days.

Credit card delinquencies, while low, have risen steadily since this summer. People are becoming pickier about spending on big ticket items — cars, TVs, appliances — and they’ve been more likely to sacrifice brand and quality for price. That trade could spell trouble for high-end retailers and benefit more discount-oriented stores.

Speaking of stores, there’s a reason why retail stocks have been hit so hard this year. Yes, Amazon and Tesla are nearly 40% of the S&P 500’s consumer discretionary sector, and they’re both down more than 40% year-to-date.

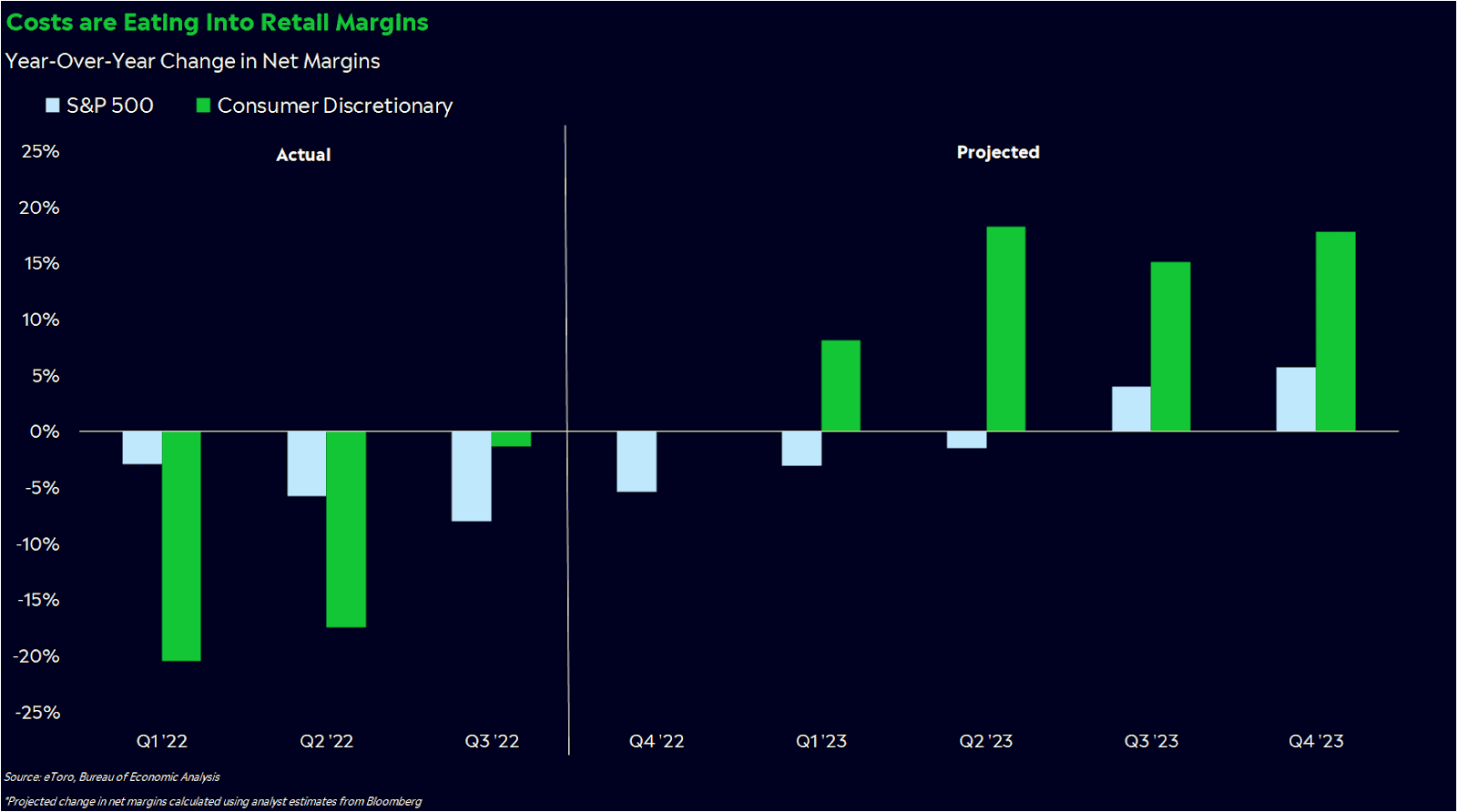

But there’s another more fundamental reason. While Americans may be spending, that doesn’t mean consumer companies are exactly thriving. Sales for consumer discretionary companies have held up well, yet retailers have struggled to keep up with rising costs, shifting supply chains, and a growing shortage of workers. As a result, retailers’ margins — and profits — have fallen noticeably relative to other companies.

Inventory management is difficult in normal times, but it’s especially challenging when inflation is high. Why? Because when retailers can’t anticipate costs or demand, they often spend too much on inventory. When demand turns, they may not be able to sell products for as much as they bought them for. Depending on how your retail stocks do their accounting, they could get hit by high inventory costs for months to come.

Even if the consumer keeps spending at this rate, retailers could face uniquely tough obstacles as supply chains and inflation continue to sort themselves out. And these days, investors may care more about cost management when they’re evaluating which stocks to buy.

Luckily, Wall Street feels more optimistic that consumer discretionary stocks will figure it out. Margins are expected to recover next year, according to Bloomberg analyst estimates, which ironically looks like the most likely time period for a recession.

If one happens — it’s still an if!

Trends vs. trades

Spending is holding up better than most people anticipated this far into a miserable year of surging inflation. It’s an encouraging trend, and it could eventually help the Fed cool inflation while avoiding recession. Fed chair Jay Powell is actively lowering demand via higher rates, and he may be able to land the plane without veering off the runway.

But the outlook for retail stocks is more complicated than that. While this holiday season may be a busy one at the mall, it may not be a profitable one for some consumer-focused companies. Sometimes, obvious trends don’t always translate to good trades, so it’s important to study the underlying numbers to understand what’s going on.

*Data sourced through Bloomberg. Can be made available upon request.