The stock market has rocketed higher this year.

But somehow, higher prices have only confused us — and all the smartest minds on Wall Street — about what’s to come.

Even though S&P 500 record highs seem far away, with inflation and rates still high, this market doesn’t want to go down. It’s portfolio purgatory, and it can feel paralyzing. So much noise, so little direction.Instead of trying to anticipate what’s next, it might be time to get your mind right.

Don’t take it from me — learn from some of the greats below:

“Somebody is sitting in the shade today because somebody planted a tree a long time ago” – Warren Buffett

You can’t write a piece about famous investing quotes if you don’t include the legendary Warren Buffett.

Buffett — the head of Berkshire Hathaway — has amassed a $100 billion fortune, mainly through buying companies he believed in and holding them for decades. Yes, literally decades. He’s owned the top five stocks in his portfolio for an average of 17 years. It’s a strategy that makes sense, though. Buffett buys companies he believes have value and resilient business strategies, and that hypothesis is rarely proven in days.

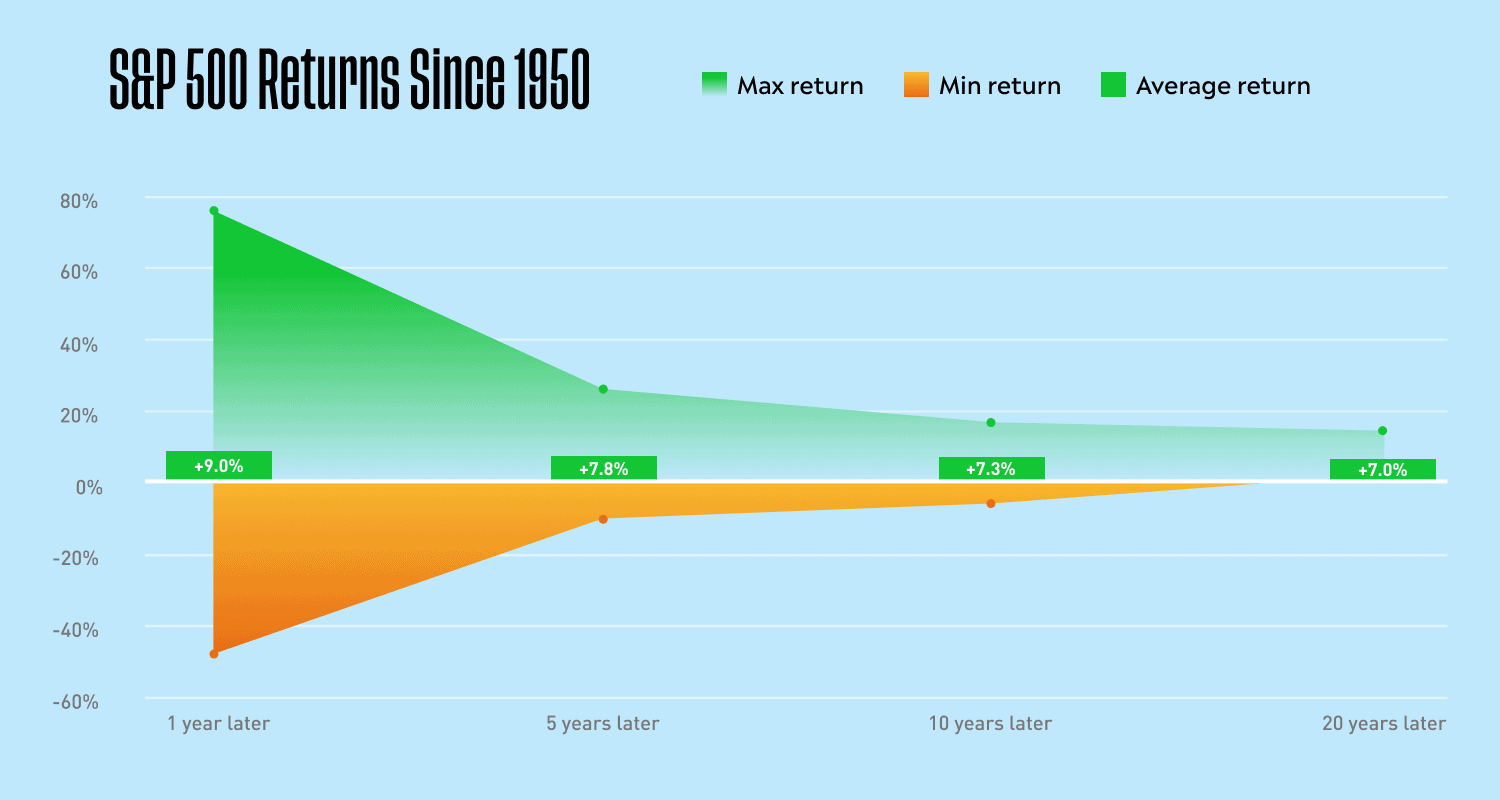

Buffett is also vocal about how he thinks time is a competitive advantage. For many of us, investing is like planting an oak tree. You sow your seeds with the understanding that you won’t see sprouts for years because growing a tree takes time. As you can see, the stock market has been the rare example of something that becomes more certain with time.

If you’ve held a hypothetical, no-fee S&P 500 fund for any 20-year period since 1950, you haven’t lost money. And on average, you would’ve earned about 7% a year. Do the math — investing for 20 years at a 7% annual growth rate can nearly quadruple your initial investment.

Unfortunately, it isn’t easy to take a long-term view these days. The world is wired toward instant gratification and we’re bombarded with information and headlines. It’s the perfect recipe for emotion-fueled decisions, which is why the average holding period for a stock has steadily declined over time. People worship Buffett, but they’re acting less and less like him.

Time is a super-power in investing. Instead of trying to catch short-term swings, think about ways you can let your portfolio blossom over time.

“The biggest risk of all is not taking one” – Mellody Hobson, co-CEO of Ariel Investments

What’s the best thing to do when you’re feeling paralyzed by uncertainty?

Something… anything, according to Mellody Hobson. And she would know about risk-taking — she helps manage over $16 billion in assets at Ariel and is the chairwoman of Starbucks’ board of directors.

Remember, uncertainty is the price you pay for eventual returns. And while this period in history seems especially uncertain, you need to get used to it. Why? Because the market has a habit of powering through peril over time. The S&P 500 has gone through 11 economic recessions over the past seven decades, and yet it’s returned an average of 8% a year since then.

The next time you’re feeling stuck, just eat the frog (Mark Twain’s words, not mine). Evaluate what’s causing your anxiety and make a plan to overcome it. Take that first small strategic step — like checking your finances or setting targets for your investments — can get the ball rolling so you don’t just freeze under the weight of headlines.

Be careful, though. Action is a delicate balance — you want to be strategic, not just doing things for the sake of doing things.

“Investing isn’t about beating others at their game. It’s about controlling yourself at your own game.” – Benjamin Graham

Benjamin Graham was known as the “father of value investing”, or finding stocks that were trading below their true values, according to their earnings. His career spanned the early 1900s, but if he were alive today, he’d probably be getting crushed by the growth-fueled rally we’ve seen this year.

Thankfully, Graham knew how to play his own game. He didn’t follow trends, because he knew his why and his skillset.

These days, it’s far too easy to get distracted by what other people are doing. It’s also tempting to hold yourself to an unnecessary measuring stick — like how the S&P 500 has performed this year, or how much money your buddy made YOLO’ing into an AI stock.

If you’re feeling unmoored by all this back and forth, anchor yourself by revisiting why you’re investing. Everybody has a why — no matter if it’s to build up a retirement fund, save up for a beach house, learn a new skill or simply just to make money. Once you figure out your why, you’ll have a better understanding of what your own measuring stick is — what you should invest in, how long you should hold it, and what you ultimately need to achieve your goals.

Don’t overextend yourself trying to play somebody else’s game. Your own goals may take less YOLO’ing than you think. And like Graham, it could be better to look for value in the long run.

“It is better to be roughly right than precisely wrong” – John Maynard Keynes

John Maynard Keynes was a famous economist of the early 1900s. He was the brainchild behind Keynesian economics, of which the central tenet is that the government could — and should — stabilize the economy when supply and demand fall out of balance.

Ironically, he also said something you’d never hear a modern-day economist utter: that it’s better to be somewhat correct than precisely incorrect. Remember that the next time you hear a market prediction.

Snark aside, he has a point. You don’t have to guess the market’s next move in order to be a successful investor. Don’t even pressure yourself to do so — nobody can predict the future. And if you’re not sure where the market should be trading given earnings and economic data, you don’t have to pick a side. After all, the market can stay irrational longer than you can stay solvent (also a famous Keynes quote).

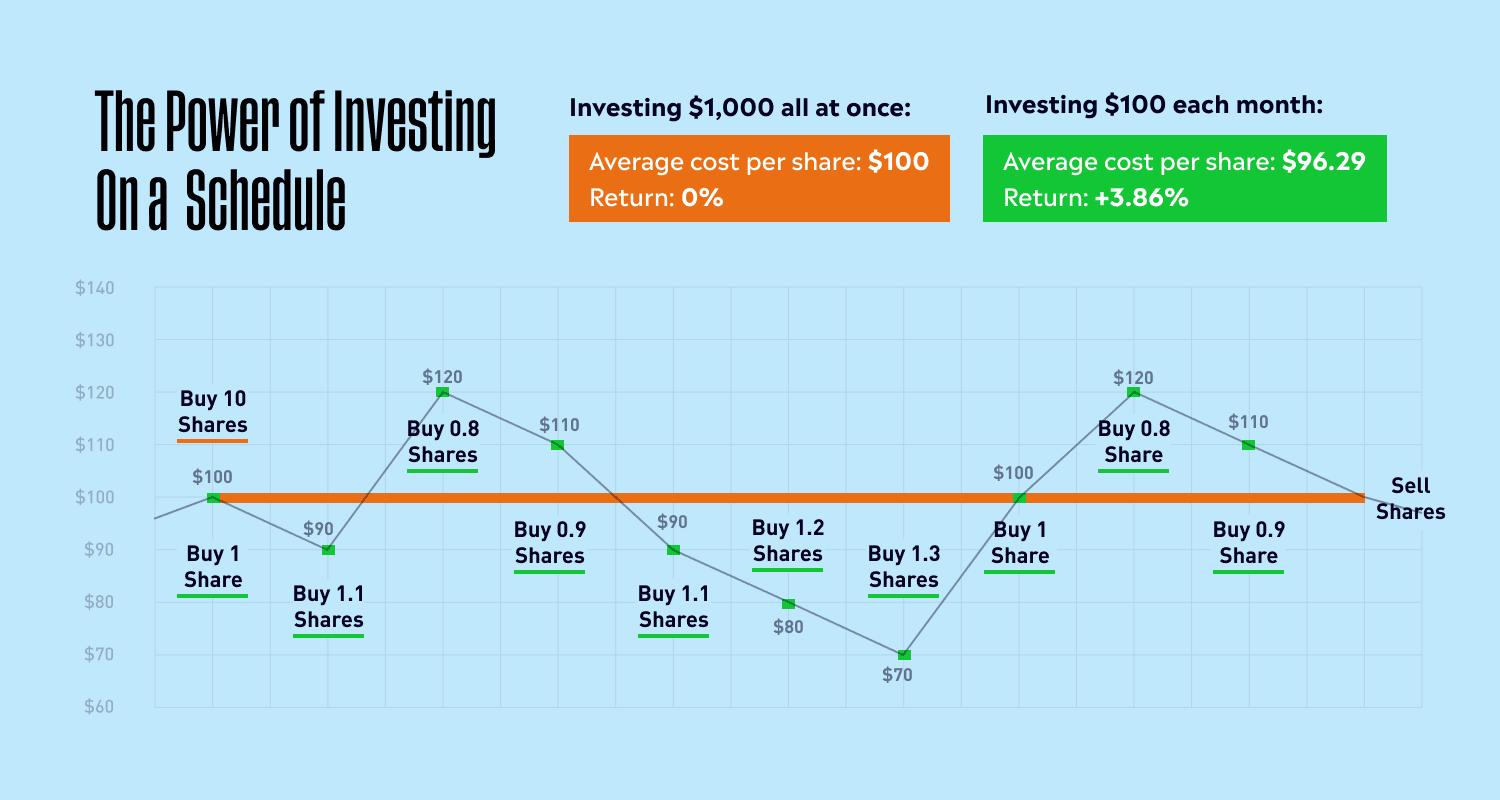

Instead, try dollar-cost averaging. It’s a strategy that rewards consistency over timing, allowing you to protect against the unpredictable nature of markets. In dollar-cost averaging, you invest the same amount of money at regular intervals, allowing you to catch the highs and lows of market action. You’ll naturally buy fewer shares at the highs and more shares at the lows.

At this juncture, if you’re worried about buying before a potential downturn, you may want to consider the risk of missing another rally as well. That seems to be the path of least resistance.

Just don’t be precisely wrong.

“There is a time to go long. There is a time to go short, And there is a time to go fishing” – Jesse Livermore

Jessie Livermore is one of the most infamous characters in Wall Street’s history. He was an aggressive stock trader who made a fortune by shorting the market during the Great Depression, then lost it all because he couldn’t manage his risk.

I’ll admit it — he’s not the best example to take investing advice from. But I think he got this part right: there’s more to life than obsessing over the markets.

Take action, revisit your goals, think long-term and make a plan in these days of purgatory.

Most importantly, don’t forget to breathe.

*Data sourced through Bloomberg. Can be made available upon request.