It’s one thing to expect volatility, but it’s another to actually prepare for violent swings.

Investors are constantly searching for tools, research, resources; anything that can help them mitigate — or maximize — the ups and downs that have become commonplace in today’s market.

There’s more information available than ever before, but you have to be diligent about who you listen to. People have different time horizons, trading styles, and portfolio makeups — and all of these factors could impact your investing approach. Honoring your own perspective is crucial when a market storm is incoming.

Here’s how to devise your own plan for a volatile market.

Step 1: Understand your view

Most investors have some sort of view or bias on the market, even if they don’t realize it.

And when you’re making portfolio decisions, it’s important to lean on your views.

But your view isn’t just your opinion of where prices go next. It’s actually an evaluation of what you’re trying to achieve in your portfolio.

Arguably, the most important factor to consider is your timeframe. If you’re a long-term investor contributing a set amount of money to the market for a goal years down the road, your best plan may be to stay the course.

But if you’re a more active trader looking for opportunity over days and weeks, you might want to ask yourselves these questions:

- What asset classes am I interested in?

- Am I bullish (expecting prices to go up) or bearish (expecting prices to go down)?

- How far do I think prices will rise or fall?

- What kind of move can I handle financially?

- How long will it take for that move to play out?

Step 2: Evaluate your options

Once you’ve determined your view, it’s time to put your plan in action.

To do so, you need to consider which markets act as good hedges against a stock portfolio. There are several investments that often fit this bill — like bonds, gold, and crypto.

But today, I want to introduce you to the most versatile of them all: options.

If you have a high appetite for risk and a sense of adventure, you might find options useful in a moment with so many moving parts and risks to consider.

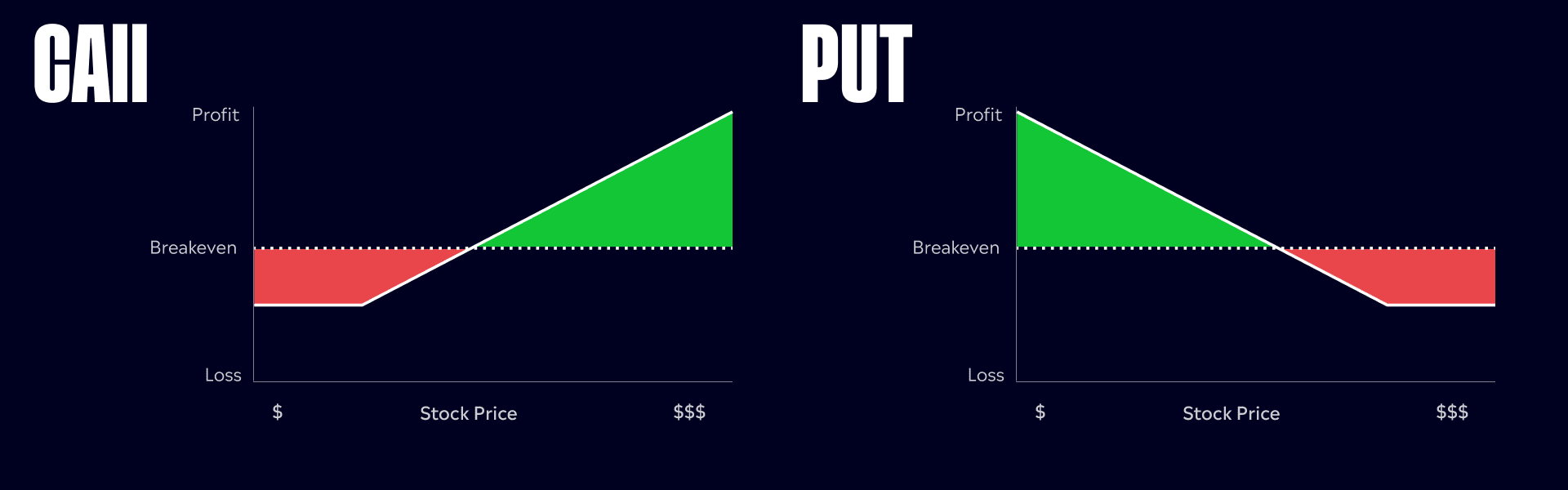

Like an onion, options may seem simple on the surface — like buying a call when you’re bullish or a put when you’re bearish. But when you peel back the layers, options can become far more complex.

Calls vs. Puts

Quite honestly, sometimes options have too many options, but without getting so deep your eyes start to water, investors can utilize options in a plethora of ways. When used correctly and responsibly, they can act as a unique tool that delivers controlled bursts of leverage for a reasonable cost.

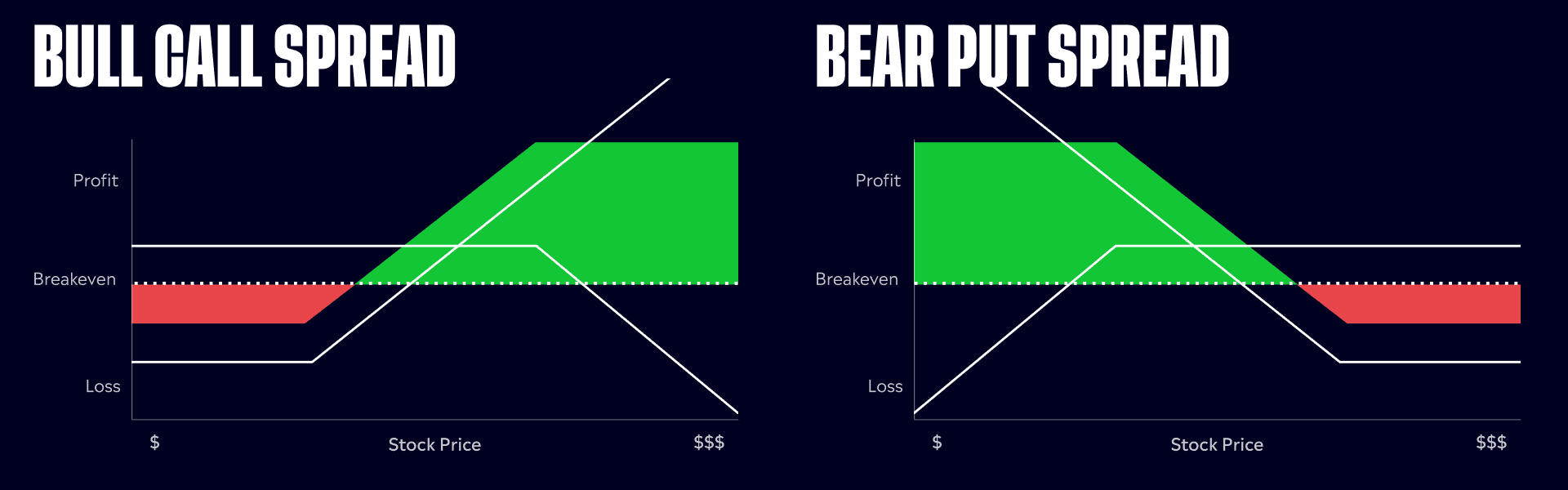

For instance, slightly more aggressive positioning — like long calls, puts, or utilizing debit spreads — can help you create a complex trade. Being long these positions does come with the risk that they can go to zero. However, they could end up being worth several times — or in some cases, many times — the original investment.

And if you use multi-leg options strategies, you could cut costs even more or express a multi-dimensional view — remember that onion as strategies get more complex. Are you stressed about the next month, but optimistic about the year ahead? You can set up a trade like that with options.

Bull Call Spread vs. Bear Put Spread

Step 3: Know your risks

Many traders and investors shy away from options over worries that the position will become worthless. However, just like in life, this can serve as a liability and an asset.

When trading long puts, calls, or debit spreads, knowing the most that you can lose is a valuable tool. It allows you to use position size to get a sense of your maximum risk — what you paid for the option*.

Say a trader wants to take a position in shares of $TSTR, a company that manufactures smart toasters, but doesn’t want to lose more than $200. By using an option that is worth $200 or less, they can have exposure to these names without taking on excessive risk — and most importantly, they are in control of their maximum loss*.

Options allow you to dig deep on individual names or specific sectors and indices (via ETF options and index options). However, respecting the risk that comes along with options is critical to using them correctly.

Step 4: Learn to live with swings

You’ve built your portfolio according to your views and exposure.

Now, you buckle up for market storms.

Ups and downs are par for the course — no matter if you’re focused on the bigger picture or individual companies. Economies change, companies release new products, unexpected crises pop up. You have to be ready for everything the market gods throw your way, even when your emotions are running wild. And they will — we’re human, after all.

Here’s an example. You invested in Tesla because you’re a fan of Elon Musk and electric vehicle technology. And it helps that the stock has turned $1,000 into nearly $240,000 in just 13 years.

But being a Tesla investor hasn’t been easy, even if it’s been wildly profitable for some. Tesla stock has gone through three selloffs of 50% or more since going public in 2010. That’s difficult to stomach.

Luckily, you don’t just have to grin and bear it through vicious selloffs. The best investors have a plan in place in case volatility happens at any moment.

Settings numbers-based targets on your investments can help you make level-headed decisions when markets are moving against you. Think about what return, share price, or investment value seems reasonable for you, and stay focused on that target above anything else.

So what does this mean for me?

Set some goals. If you’re feeling stuck, it might be time to re-assess exactly why you’re investing. Set goals for your portfolio and pick the investments you need to get there, while remembering there’s often a tradeoff between risk and reward. And if you’re not ready to make money moves, commit to learning more about a new investment or strategy. The eToro Academy has a number of resources to help you add some investing knowledge to your repertoire, and Virtual Portfolio and Draft Trading are tools that can help you practice new strategies before you commit.

Remember the moment we’re in. Interest rates are high, and the economy seems to be creeping closer to a recession. Nobody knows what the future holds, but the environment seems to be especially fragile. Now may be an especially good time to make a plan for a volatile market.

*There are certain edge cases in which you may be exposed to greater loss than your initial investment. Although these instances are rare, they can occur.

**Data sourced through Bloomberg. Can be made available upon request.