We all get by with a little help from our friends.

The appeal of community is hard-wired in our brains. Humans are social creatures who crave acceptance and belonging.

Social investing has been an important development for the everyday investor, now that the world is more connected than ever before. But the wild moves we’ve seen show the market may be falling into the trap of groupthink — when you make decisions based on the crowd instead of your own needs and responsibilities.

After all, every trade requires a buyer and a seller. That’s what makes a market.

What happens if we’re buying or selling because we’re all convinced the Fed will hike rates? Or when we’re frightened by single-stock swings?

When community becomes groupthink

Community can be an enriching environment, especially for an investor. The basis of investing is all about knowing your “why”: to build wealth, to learn, to speculate. Social investing has provided a why to a whole new group of investors: to make friends. And investing feels less intimidating when you’re beside a bunch of like-minded people. Community investing is especially popular among younger investors, too. About 57% of investors ages 18 to 34 use social media and online forums for research, according to our latest Retail Investor Beat survey.

But the rise of community presents a new challenge for investors. When people spend a lot of time together, they tend to act more and more like each other. Psychologists call this mimetic desire: the subconscious pull to make decisions based on what other people think.

Mimetic desire is a decades-old phenomenon. Before we rushed to our phones to buy the latest hot stock, we were standing in long lines for sneaker releases or fighting other parents for popular toys. Now, groupthink takes place online — in our social media feeds, in our streaming preferences, and in our memes.

Combine social investing and mimetic desire, and you have the perfect concoction for groupthink. We’ve seen groupthink take hold of fringe investments like meme stocks and altcoins. But now, the crowds have descended into more traditional parts of the market, which has fueled some mind-blowing moves.

Just this year, we’ve seen:

- The biggest one-day loss of market value on record (Facebook, on February 3).

- The biggest one-day creation of market value on record (Amazon, on February 4).

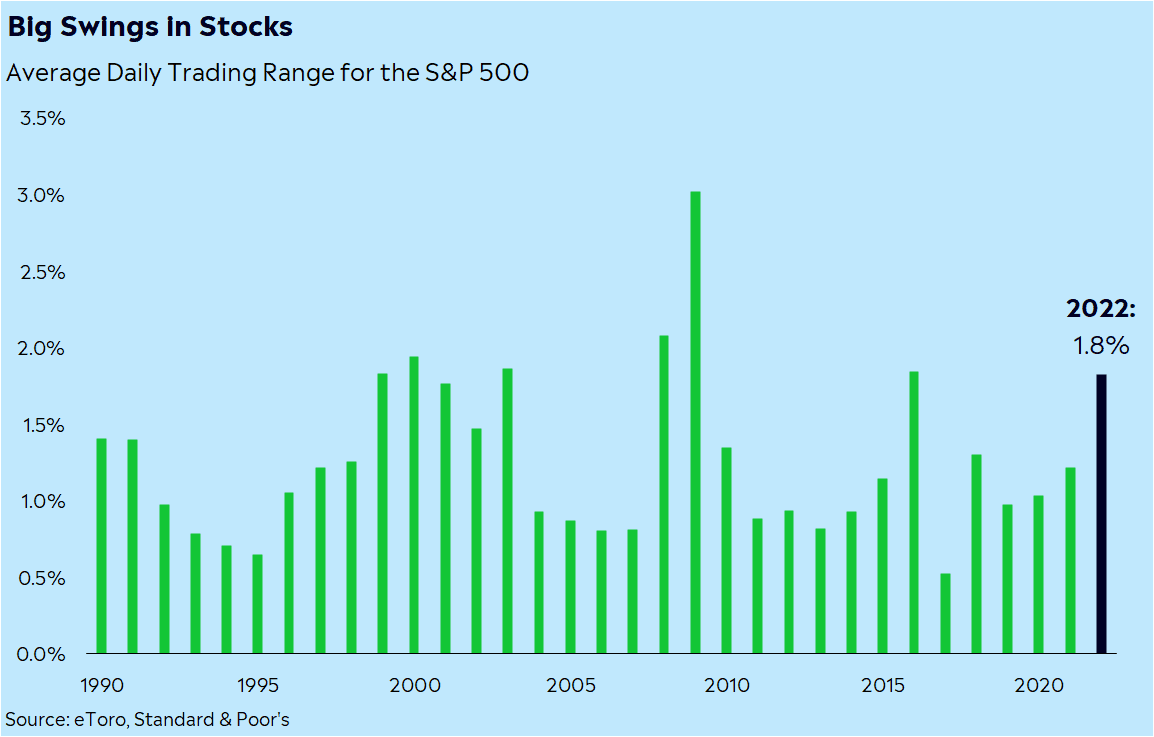

- The S&P 500’s biggest intraday reversal since 2008.

- Energy stocks’ best start to a year since 1990.

- Tech’s worst start to a year since 2008.

You can blame the Fed’s rate hike and geopolitics for much of this craziness. It’s not easy to invest in a topsy-turvy market with an especially cloudy outlook. But investors’ tendency to chase trends may have something to do with it, too.

Take the market’s track record this year. The index has moved an average of 1% each day this year as investors have navigated decades-high inflation, Fed speculation, and the Russia-Ukraine conflict. We’ve seen several days when the market was trending one way, only to change directions on a dime. January 26 comes to mind, when the S&P 500 dropped 3% in three hours after Fed chair Powell hinted that rate hikes could happen faster than we think.

The hype cycle

It’s easy to get swallowed up in groupthink. The highs can be high. You’re investing with your friends, everybody’s making money, and the wind is at your back. But the tide can turn quickly, and that euphoria can quickly turn to despair. We call this the hype cycle. If too many investors crowd into one trendy stock, there’s a greater chance they’ll all rush out at the same time if bad news strikes.

Case in point: Wednesday’s dramatic stock moves. ViacomCBS, a meme-like stock that surged more than 100% in the first three months of 2021, dropped as much as 22% as investors digested news of operating losses and heavy spending. Viacom’s trading hinted at a mad dash to the exits: Investors traded nearly 20 times the shares they do on an average day.

Same thing happened with Roblox, another retail favorite. Roblox stock dropped 27% on Wednesday after a rough earnings report. Roblox was the fourth-highest traded stock of the day, and its shares plunged right at the open.

The hype has infiltrated this market. Other popular names — Peloton, Affirm, Shopify, AMC Networks, Palantir — have suffered through dramatic drops this year after negative headlines.

Ironically, the bottom of the hype cycle — panic and depression — may be a good opportunity to step in and buy, especially if you’re willing to wait for the panic to subside. But if you’re caught up in the hype, you may find that you’re too jaded from groupthink to try again.

Stay true to yourself

If you’re investing with a community, stay aware of how groupthink could skew your investment objectives. In this environment, it’s easy to paint investments as good or bad, depending on the news of the day. And the crowd moves quickly these days, thanks to social media and lightning-fast news dissemination.

But no investment is truly black or white. What the community favors may not be the right investment for you to reach your own goals. What your friend wants may not be what you want, either. Mimetic desire is a common trap for investors. Lean on community for support and encouragement, but don’t lose yourself in the process.

*Data sourced through Bloomberg. Can be made available upon request.