Are you an active or passive investor?

Before you answer, give that question a second thought. If you’ve changed your mind recently, you’re not alone.

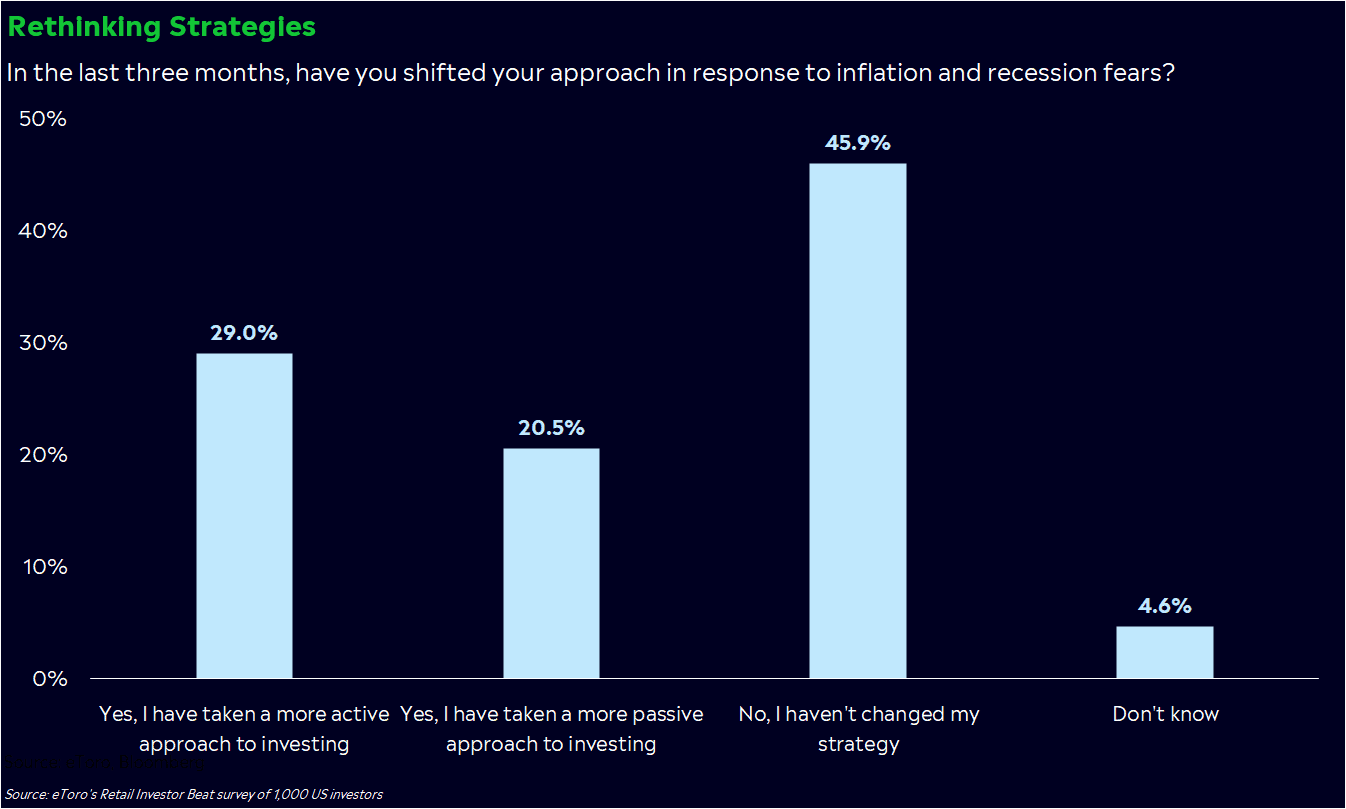

Raging inflation has caused us all to rethink our lives: the brands we buy, the trips we take, the food we eat, and — for some — the way we invest our money. Almost half of all investors have changed their approaches in response to inflation and recessions fears, according to our quarterly global Retail Investor Beat survey, which included 1,000 US investors. And 60% of those who have changed their strategies said they’ve become more active in managing their investments.

Financial experts tell you that investing success comes easiest when you stick to a plan.

But a famous boxer once said that everybody has a plan until they get punched in the mouth.

Surviving the bear

Active investors tend to be more “hands on” with their portfolios, buying and selling more often, while choosing custom mixes of investments. Passive investors are a more “hands off” crowd, utilizing funds and other portfolios to ride the waves of the market rather than fight them. No strategy is a bad one, and they’re not a reflection of your market expertise. It’s a choice based primarily on your personal preferences.

In bull markets, your choice rarely makes much of a difference in portfolio performance. Do what’s best for you — active or passive — and it’ll likely work out well, because most stocks are going up.

Bears, on the other hand, can be a gut check for your best-laid plans. Falling prices can make you question everything: your investments, your allocations, the meaning of life. Add in your cash losing 8% a year to inflation, and it’s tempting to think about what’s making money now (instead of what could make money down the road). You might call yourself a passive investor, but bears can force a change of heart.

That’s likely what we’re seeing this year. Investors of all kinds — including retail — are changing their strategies to match the environment. Many of them fall into the long-term, passive camp. 55% of them told us they hold their investments for a year or longer on average. However, they’re taking some sensible risks because they’re losing confidence in their portfolios and feeling intimidated by inflation.

Changing your strategy

If you fall into this camp of second-guessing your plans, don’t be too hard on yourself. You’re just being human, and this year has delivered quite the ruthless punch to all of our portfolios.

Sometimes, a strategy change can be warranted if it’s the difference between you hanging onto an important position and selling out entirely. In fact, many retail investors are doing just this: making tweaks to adjust to the current environment. 46% of investors who said they’re getting more active noted they’re doing so for more flexibility in the current environment, while 28% said an active approach helps them better hedge against risks.

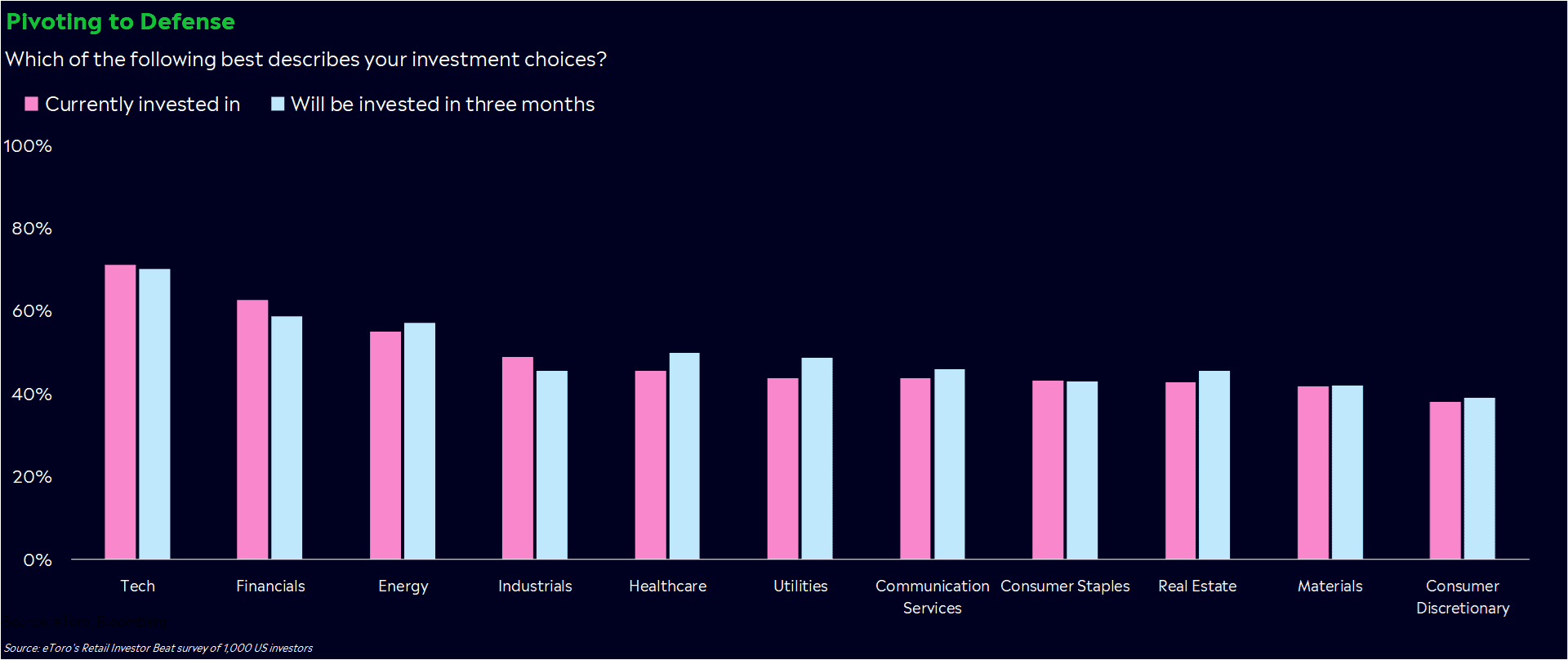

On the positioning side, investors seem to be making changes in a sensible manner. They’re raising cash, investing in different markets, and planning to pivot from cyclical stocks (those that are more sensitive to economic changes) to more defensive holdings. Many are eyeing ETFs instead of individual stocks, hoping to mitigate risk by getting a piece of a bunch of companies in one trade.

Don’t get me wrong — some are looking for opportunity in the rubble, and there’s nothing wrong with that. We’re seeing that particularly among younger investors who naturally have longer time horizons and higher risk tolerances. 25% of investors ages 18 to 34 said they’re becoming more active investors so they can beat the market, the highest percentage of any age group.

In the past, it’s also been easier to pick stocks in a bear market. Generally, market crises cause a lot of indiscriminate selling, which means that well-run, profitable companies can get hit hard in the process.

At this point in the bear, many stocks are down, but some not as much as others. 251 S&P 500 stocks are doing better than the actual index this year, while 87 stocks are still up year-to-date. Certain sectors have also held up better than others, with consumer staples, utilities, and healthcare down less than 12% year-to-date. And of course, we have energy stocks, which have rallied a casual 52% on the back of higher oil prices.

You don’t have to swing for the fences in this environment, but if you’re intentional and patient enough, you could take some calculated risks. By the way, if you’re in a good spot to take risks, I wrote a guide to surviving bear markets with some tactical portfolio tips that can help.

Staying focused, yet nimble

So, back to my question: Are you an active or passive investor? In this environment, the best balance may be a mix of both. Stay focused on your goals, but nimble enough so you can reach them. Most importantly, be kind to yourself.

If you want to protect yourself or take advantage of the brutal bear, understand the risks that you’re taking and set some targets so you don’t get carried away.

On an encouraging note, these swings haven’t been enough to shake out the retail investors en masse. Investors are bracing for more swings, but also ensuring that those swings won’t take out their portfolios. Some are even stashing cash to buy back in at a later date. That’s a promising sign of resiliency.

*Data sourced through Bloomberg. Can be made available upon request.

**The Q3 2022 Retail Investor Beat was based on a survey of 10,000 retail investors across 13 countries and 3 continents. The following countries had 1,000 respondents: UK, US, Germany, France, Australia, Italy and Spain. The following countries had 500 respondents: Netherlands, Denmark, Norway, Poland, Romania and the Czech Republic.