Markets have given us a dose of humility this year.

The S&P 500 just recorded its worst first half of a year since 1970. Bitcoin’s price was cut in half. Even bonds dropped 11%.

Naturally, we all have some questions about what the rest of the year holds. Economic data seems fine, yet the environment feels like it could crumble at the slightest touch. And honestly, I don’t have many answers. It’s a tough environment to navigate, and those who thought they had answers six months ago were probably proven wrong.

So let’s try to figure this market out together. Here are the four biggest questions I’m asking as we head into the second half of the year.

What happens to company earnings?

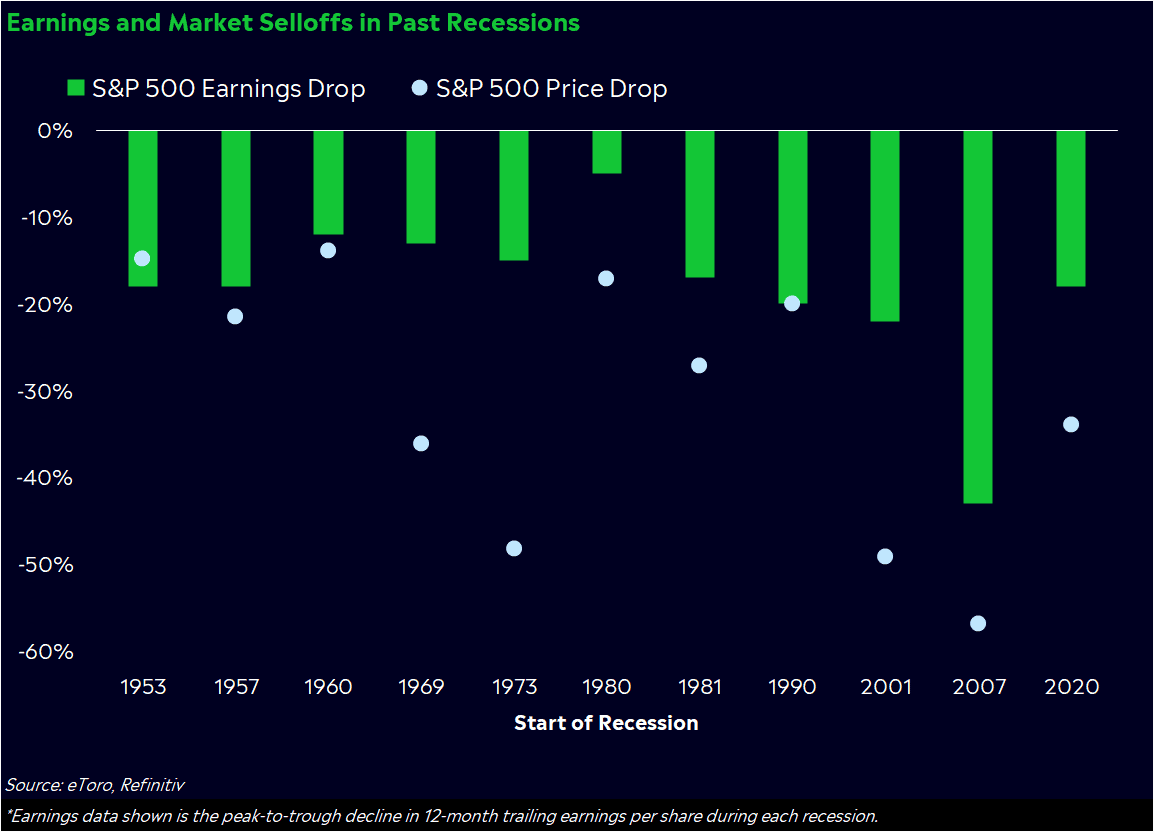

Economic growth is slowing, yet earnings estimates for the next year have barely flinched — at least on the surface. That’s unusual, especially when there’s talk of a recession coming. S&P 500 earnings have declined an average of 18% in the past 11 recessions, according to Refinitiv data. Either Wall Street is behind, or corporate America really is holding up well, the latter of which would be a good sign for the future.

To be fair, the tea leaves can be tough to read. Index-level earnings may be stable, but there are shifting tides underneath. Profit estimates for some auto and semiconductor companies have come down in the past month, due to profit warnings from individual businesses. On the other hand, energy and materials companies’ projections have risen even as commodity prices have fallen in recent weeks. Sector trends tell the story of a slowing, but not recessionary, economy grappling with high inflation.

But if we really are on the precipice of recession, we could start hearing about it from companies. If there’s a wave of warnings coming, this selloff may have further to go. Look out for the start of the second quarter earnings season, to be kicked off by JPMorgan on July 14th.

Who flinches first: Americans or Powell?

There’s a battle raging in the economy right now. The Federal Reserve is fighting inflation and hoping to stave off a recession, but the conflict goes even deeper than that. It’s really a game of chicken between the Fed and Americans’ wallets. Will the Fed keep cranking up the heat and potentially tip the economy into a downturn? Or will consumer spending buoy the economy enough to carry it through this controlled burn?

Well, it’s getting complicated. There’s evidence that Americans are starting to rein in their spending, yet the Fed seems to be full speed ahead, with Fed chair Jay Powell laser-focused on getting gas and other prices down. Historically, it’s taken a year or more to get inflation under control, but it doesn’t look like the Fed has that kind of runway today. It doesn’t help that the commodity markets’ structural supply issues may make the Fed’s efforts extra difficult.

Fed fund futures are now positioning for the Fed to finish hiking by the end of this year — four hikes and six months away — so the next six months could be pivotal. Watch inflation expectations to gauge if the Fed is winning the battle (and can stop hiking soon) or losing control (and set to hike into a recession). Make sure you’re prepared in case the economy slides off the rails.

Are we ready for this recovery?

Let’s ponder the other side of the coin: What if markets have already bottomed?

It’s possible. Markets are forward-looking, and the stock market turned before the economy in 10 out of the last 11 recessions.

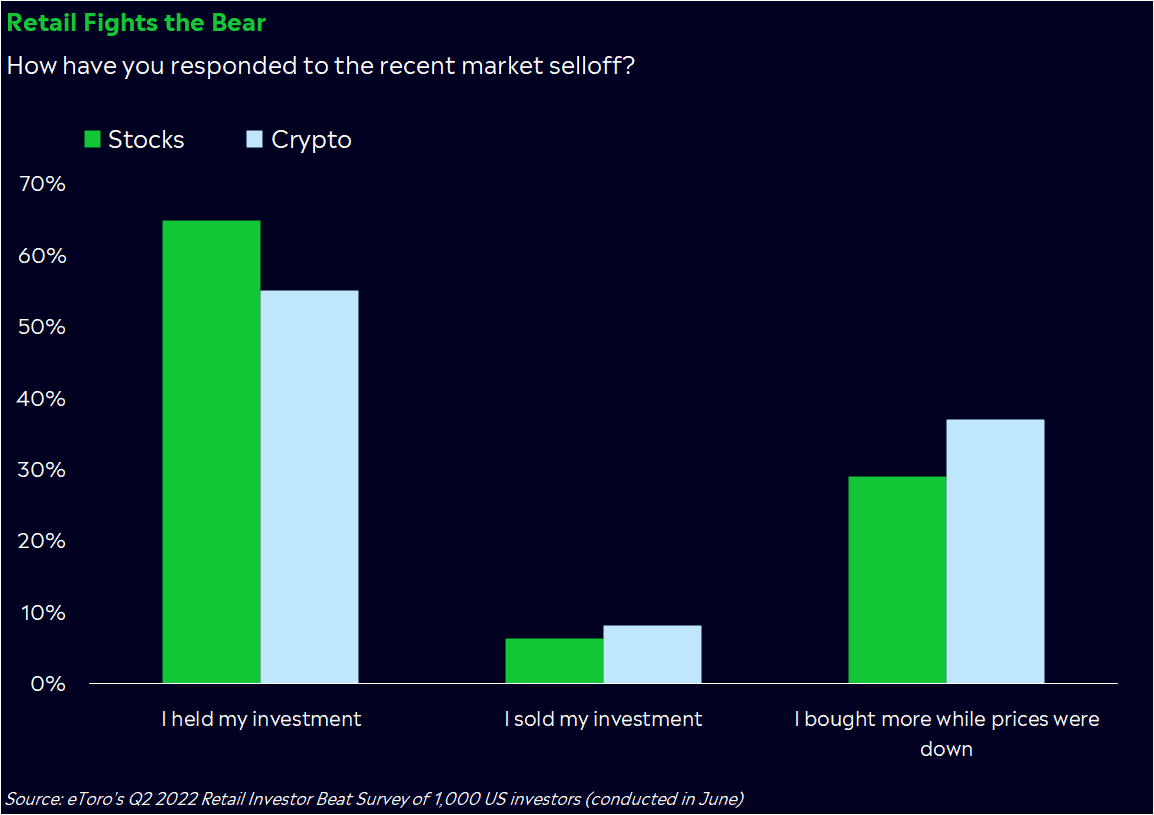

Retail investors haven’t run away from the bear just yet, either. Many have held onto their investments during this selloff. 29% bought more stocks, and 37% bought more crypto, according to our quarterly Retail Investor Beat survey completed in June.

Individuals have had the luxury of thinking long term when most professionals have benchmarks to beat and shareholders to please. When the short-term looks uncertain but the long-term looks promising, patient investors have the upper hand.

Still, retail may be underestimating just how grueling an eventual recovery could be, especially if rates and inflation stay high. Growth stocks and crypto just endured stunning selloffs that led to liquidity shocks and a wave of layoffs. Broad structural damage isn’t easy to bounce back from. It took tech stocks 15 years to recover their highs after the dot-com crisis, and many companies didn’t survive. It may take a while for investors to fully trust tech and crypto again, especially stocks and projects that prioritize concepts over cash flows.

If you’re one of those investors buying the dips, remember that recoveries can be tests of endurance. And if you’re hoping for a quick snap back, you may need to lower your expectations.

What’s lurking in the shadows?

There will always be unknown unknowns. But when markets seem to be hanging by a thread, the hidden risks feel extra unsettling.

One risk that may be lurking in the shadows? Midterm elections in November. Politics aside, elections can have big implications for the future of policy, especially on a sector level. These days, there are conversations around crypto regulation, commodity controls, international relations, and antitrust concerns. Congress’ makeup could determine how these issues are dealt with. Even the thought of change could scare markets.

But, on the other hand, midterm election years have historically had strong finishes. Since 1950, the S&P 500 has gained an average of 6.6% in the fourth quarter of midterm years, compared to 3.3% in other years. In an odd way, the election could provide certainty in an otherwise uncertain environment.

At this point, there may be more questions than answers. Don’t feel hopeless, though. To prepare for the unexpected, it’s smart to maintain a well-anchored portfolio with exposure to lots of different assets and sectors, because different types of investments react differently to shocks. This is especially true when there are several ways the story can play out. You can’t control the markets, but you can control how you react to them.