We’re almost 10 months into this bear market.

We’re almost 10 months into this bear market.

And this week, we learned that the trouble could be far from over as markets plumbed the lows once again. The Fed is coming for your job, Europe feels out of control, and we may be on the brink of recession.

If you’re feeling worn down, you’re not alone. For years, markets were thriving. Now, it seems like many of us are barely surviving.

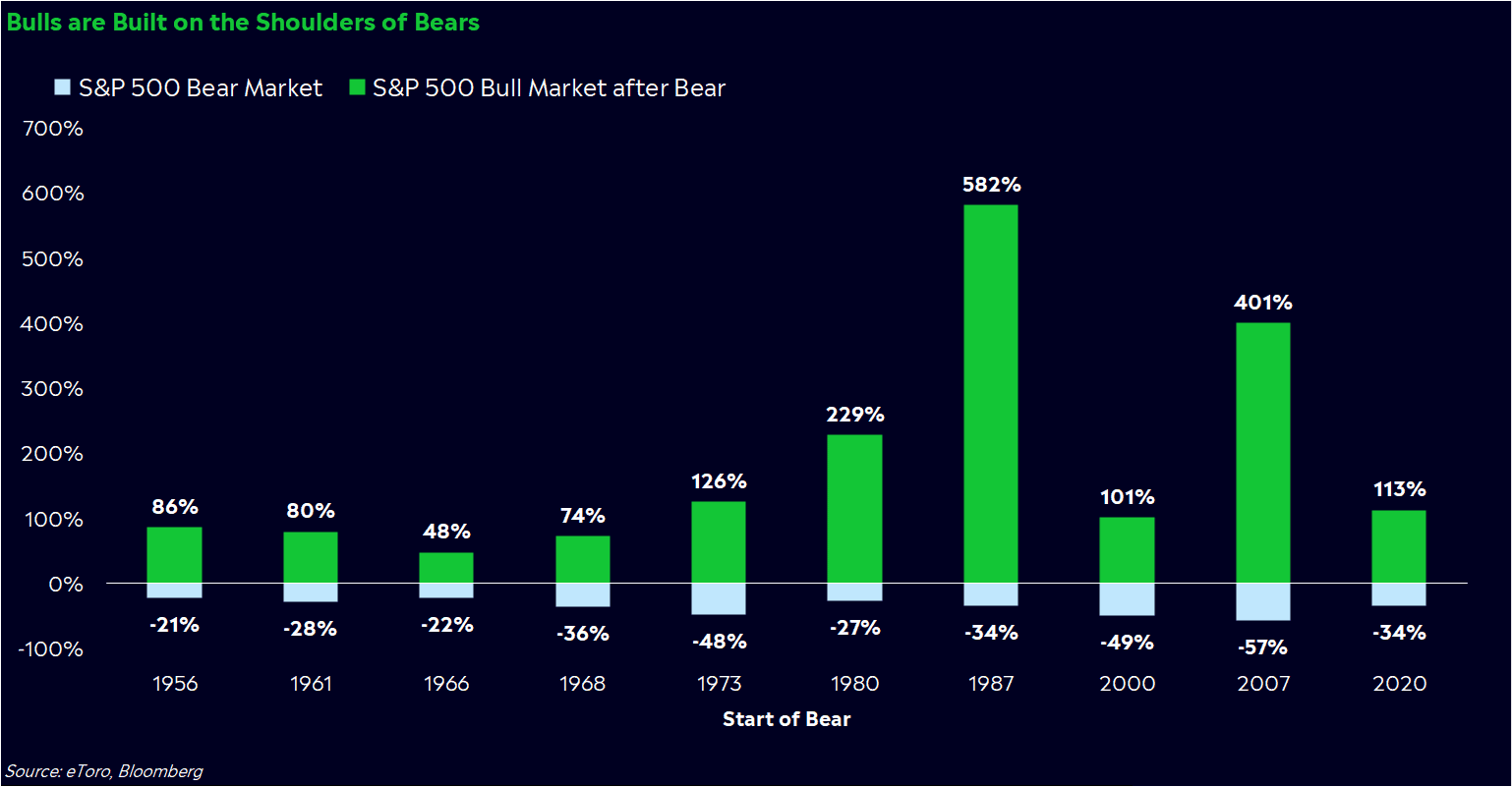

Still, we know from history that bull markets are built on the shoulders of vicious bears.

So how do you make it through the bear fight?

Here’s a survival guide, written with the help of my boss, eToro US CEO Lule Demmissie.

Understand the moment

It’s not an easy environment to invest in. Rates have risen at the fastest pace in over a decade, with the 10-year yield nearing 4%. Now, the market is dealing with a bunch of issues, plus the allure of enticing rates on bonds and cash.

Sure, high rates could make it tougher for smaller, speculative companies to raise money and grow. We may even see some fail, if past bear markets are any guide.

But luckily, the market isn’t just small, speculative companies. And even in a high-rate, high-inflation environment, there are still strategies working, even if they’re the boring kind that you’d never brag about. 75 S&P 500 companies are still positive year to date (and before you get snarky, just 19 are energy stocks). High rates are tough for risk, but they also force investors to think about what’s working now versus what could work in the future.

If you’re trying to find short-term opportunities in this market, think about how your companies could fare in a recession. Companies with dull business strategies may not be the growth superstars Wall Street has glorified in the past, but they’re often the most reliable products when the economy is in question.

Invest intentionally

When times are tough, you need to be intentional while maintaining enough risk exposure to reach your goals. It’s a fine balance, but an important one.

Think like an owner. In down times, you want to be more selective with who and what gets your money and attention. That’s especially true when rates are high because borrowing is inherently more expensive. But there’s a difference between being more selective and stepping out of the market entirely. Wise investors search through the rubble for worthy opportunities while being aware of the risks they’re taking.

Trust your tools

These days, it feels like nothing is working. And that’s kind of true — stocks and bonds are down more than 15% this year for the first time in four decades.

But your tools aren’t broken. You just need to give them time, because not all tools work in every market environment.

Take buying the dip for example. Buying into a stock selloff has worked well in bull markets because stocks have rebounded quickly. But in bear markets since 1950, only 42% of people who bought the dip — or at least a 1% drop in the S&P 500 — were up 12 months later.

There are cycles in which momentum investing shines, and others in which fundamental investing shines. This particular bear has some wild momentum swings, and once-popular stocks have been crushed. It’s all about what risk you’re willing to take on. Just remember that every market cycle is different, and conditions can change quickly.

Think of emerging trends

When the ground shifts underneath our feet, new trends tend to emerge. Go back to the Global Financial Crisis. The US financial system almost imploded, yet big tech and cloud technology were both born out of that crisis. You could argue the bank meltdown was the breeding ground for other industries, too.

Right now, we’re in the midst of a crisis — broken supply chains, the job market’s Great Reshuffle, a pivotal moment for crypto and digital payments, and a bottomless need for alternative energy sources.

Tomorrow is being built today, and stock prices are 20% off.

Stay grounded

For now, take a breath. Smile. Stay alert, understand your goals and calibrate your expectations.

But even more importantly, don’t cave into the negativity.

You’ve probably read a lot of headlines about how retail investors are getting crushed in this market. And no doubt, it’s painful out there — for everyone, not just you. 55% of professional large-cap portfolio managers have trailed the S&P 500 over the past year, according to S&P data. Yes, even with the S&P 500 down 10 to 15% over that time.

It’s a cold world, period. That’s why you need to keep your mental game strong. And many of you are — our June Retail Investor Beat survey data showing over 80% of you have bought or held stocks during this year’s selloff.

Remember that many of you have a powerful advantage, too: time. Wall Street doesn’t have the luxury of time. They have to beat benchmarks and answer to shareholders. Professional investors are rightfully intimidated because the short-term has rarely felt this uncertain. But if you’re thinking long-term, you should take comfort in two facts:

The Fed hasn’t lost the plot. Bond market expectations for inflation five years down the road have hovered around 2% over the past three months. In other words, Americans still think the Fed can pull this off and eventually get inflation back under control. That’s great news, especially if you’re eyeing growthier, concept-driven investments for years down the road. One of the biggest benefits of a low-rate environment is the focus on growth and innovation instead of what works now.

Bears are normal, but infrequent. Cycles of joy and pain have been the heartbeat of the stock market for decades. Humans innovate, businesses adapt, profits rise, shares increase. Then, a crisis hits. We react, we mourn, and then we rebuild.

Since 1950, the S&P 500 has only spent 17% of its days in a bear market. This, too, will pass, even if it gets more painful from here.

By the way, Lule shared her own bear market stories with us a few months ago. Read more about how she’s survived past crises here.

*Data sourced through Bloomberg. Can be made available upon request.