Winter is coming.

It’s a bummer for all your warm weather lovers, but it also could be a defining moment for the global economy.

Inflation is stubbornly high in both the US and Europe, as we were painfully reminded of this week.

But that’s where the similarities end. While we’re mainly grappling with demand-driven services inflation — rising rents, insurance, and medical costs — Europe is struggling with soaring energy prices right before temperatures drop.

Different problems require different solutions. And so far, the US’ best solution may be what ultimately tips Europe’s energy issues into a full-blown economic crisis.

A tale of two inflation crises

This week’s inflation-induced market panic caught investors’ attention. Wednesday’s Consumer Price Index report caused the S&P 500’s worst day in over two years, even though it showed that year-over-year inflation slowed for a second month.

The issue? Services-related inflation reached a fresh 40-year high. While you can partially blame rising goods costs on supply chains, services prices are more driven by consumers’ higher incomes and propensity to spend. This urge to spend is what the Federal Reserve is trying to control through rate hikes, so there could be even more aggressive Fed moves ahead.

In Europe, the inflation situation is different, but potentially more dangerous.

Energy costs are soaring, caused by a massive supply crunch of oil and natural gas. Natural gas prices are three times what they were last year, just weeks before temperatures start dropping and Europeans need to heat their homes. It’s not just oil and gas either — European food prices have jumped nearly 13% year over year. Together, food, oil, and gas have accounted for about half of the 8.9% rise in Euro-area CPI over the past year.

Europe’s inflation is driven more by low supply than high demand, and it’s getting more dire by the day. European officials are discussing policies like price caps and energy rationing to ease the burden of energy costs on businesses and households.

The strong dollar’s grip on Europe

You may be tempted to tune me out because you don’t live or invest in Europe. We have our own problems to dwell on, right?

Hold on a second. Europe’s problems could eventually be our problems, too, especially if the Fed keeps hiking.

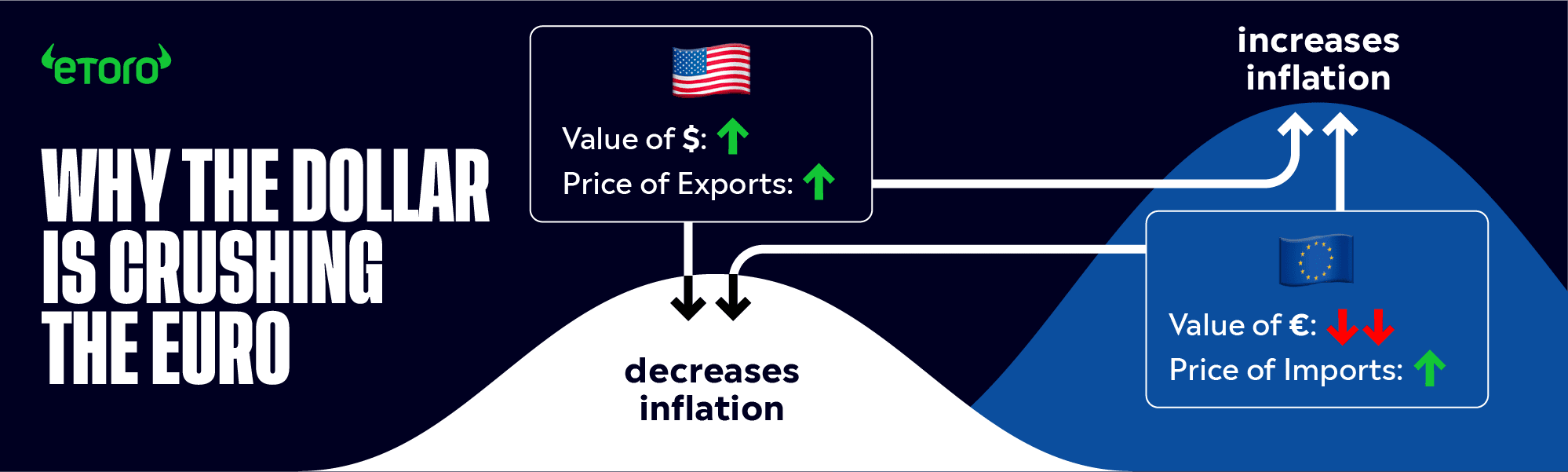

Just look at the dollar, which is currently at a 20-year high versus the euro. That’s primarily a product of the Fed, among other factors. Rate hikes have attracted money into US assets (and out of other countries’ markets).

At first, that sounds like great news. A strong dollar effectively means lofty growth expectations for the economy (relative to the rest of the world) and cheaper prices on overseas goods. The cost of imports is more manageable with a strong dollar, and that custom handbag from Italy is a little more affordable.

However, Europeans are experiencing the reverse scenario. Energy-fueled inflation is rampant, and European consumers are paying more euros for dollar-priced imports. We’re effectively exporting our inflation to Europe at a weak point for their economy. And with the Fed poised to hike rates even more in its fight to control inflation, the dollar’s grip on the euro (and other currencies) may strengthen even more.

Why Europe matters

If economies operated in isolation, this wouldn’t be an issue — at least for the US.

But that’s not how the world works these days. The global economy is more intertwined than ever.

Trade. The US is relatively self-sufficient, but it relies on Europe for about 15% of imports — mainly pharmaceuticals, machinery, and vehicles. Plus, if parts of the Eurozone resort to energy rationing, we may have to deal with reduced manufacturing output and *gasp* more supply chain issues. Watch industrials and materials companies if global trade gets snarled again.

Business. Even if you own US companies, you still have some exposure to the rest of the world. About 40% of S&P 500 revenue comes from overseas, and one-third of S&P 500 companies generated sales in Europe in their last fiscal year. Tech, healthcare, and industrial companies are especially tied to Europe, according to filings data compiled by Bloomberg.

Jobs. Europe’s woes expand beyond your portfolio, too. US companies who rely on Europe for business may have to make tough decisions if their financials weaken. If you’re an employee at a multinational company and one of your biggest markets crumbles, you may have to start thinking about your own job. Sales in Europe accounted for more than 50% of total revenue for companies such as Booking Holdings, CooperCompanies, and Philip Morris last year.

The Fed. Fed chair Jay Powell is laser-focused on US inflation, and other Fed officials have made it clear that the Fed wants to put its own oxygen mask on before helping other economies (yes, I’m writing this on a plane). But a strong dollar could put the Fed in a tough bind, especially if Europe’s problems start to weigh on US growth.

Humanity. There’s a humanitarian angle here that extends beyond our portfolios. Uncontrollable food and utility costs are the most insidious forms of inflation. They impact how you fuel and take care of your body. The risk of political upheaval and conflict increase when people’s lives are on the line. Never mind the fact that many of us have loved ones beyond our borders who are struggling.

If we’ve learned one thing from COVID, it’s that our own actions impact others. What makes sense to you may not make sense for the people around you, may not make sense for the world, and the negative externalities often come back to haunt you.

In this scenario, the US economy could force itself into a nasty dollar-fueled feedback loop if the Fed has to stay aggressive against inflation. Even if a global recession isn’t Fed-induced, it’s a risk that’s rising quickly.

It could be a cold winter.

*Data sourced through Bloomberg. Can be made available upon request.