Who’s ready for the big game on Sunday?

Each year, we gather with friends to watch the pro football championship. It’s more than just football, though. It’s a cultural moment featuring the hottest celebrities, brands, memes and players of the year. It’s also a pinnacle of American consumerism.

But this year, your traditional celebrations may look a little different. Your party bill may cost noticeably more. You may have to wait a while to get that pizza, wing, or TV delivery. And your best friend will probably complain about rate hikes between plays.

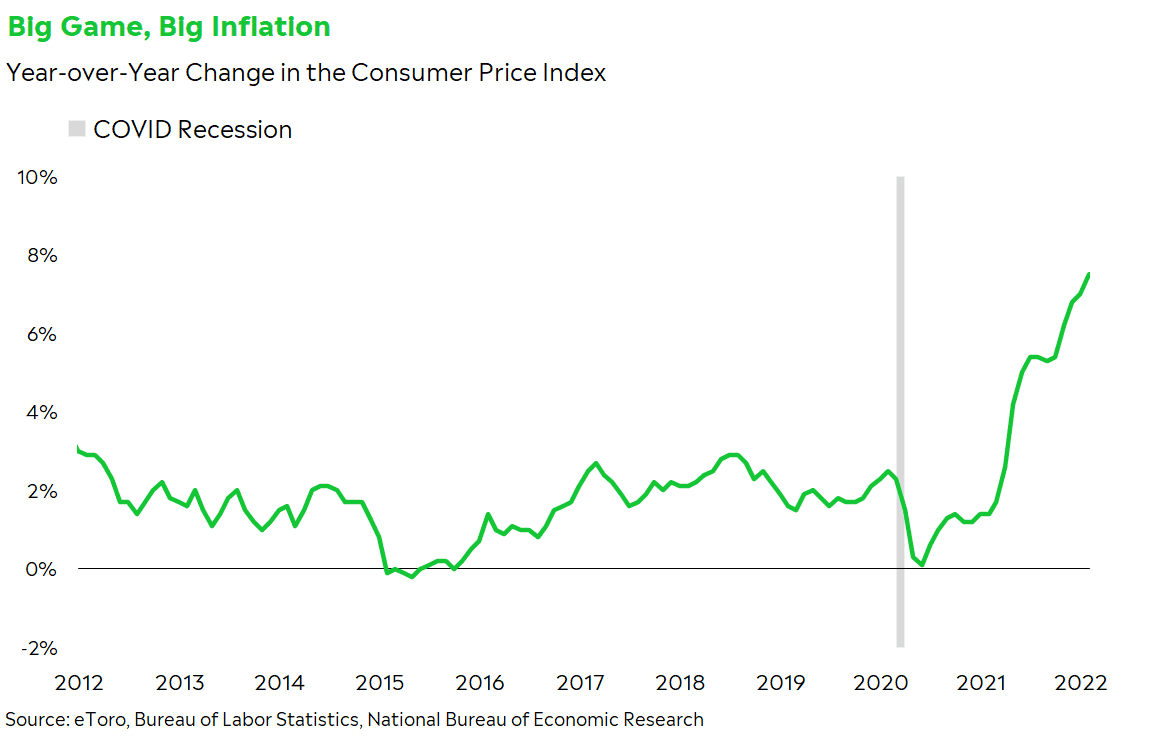

The markets have gone mainstream, and they’ve become a part of the big game. But recently, so has anxiety over finances and the economy, especially with inflation at a 40-year high.

Big spenders

The pro football championship is a big moment for the American economy. It’s arguably one the biggest nights of the year for takeout, tortilla chips, and beer. The National Retail Federation counts the game as one of the top 10 spending events for US consumers, with the average American planning to spend about $80 this year.

Americans are ready to spend, too. Retail sales have increased 17% year over year, and the average American is still flush with savings. Hello, big-screen TVs and upgraded sound systems.

But as big as Sunday promises to be for spenders, it may also reveal just how painful decades-high inflation, broken supply chains, and labor shortages can be. Avocado prices have hit a record high. Chicken wing prices have soared. Even the price of potato chips is climbing. Wells Fargo economists estimate that the price of snacks for the game could rise 8 to 14% from last year.

To make matters worse, we’re in the middle of a historic labor shortage. Hiring is strong, but companies still can’t find enough workers to meet demand. And the system is breaking down. It’s a moment of power for the American worker — the “great resignation,” if you will — but it’s led to empty shelves, long waits, and delivery delays. Coincidentally, Sunday is also one of the most tempting nights to ditch work. Cue a three-hour wait for your pizza that’s 10% more expensive than last year.

Some companies are already planning for issues. Companies such as Little Caesar’s and Chipotle have already raised prices in the past few months. And Domino’s just rolled out a campaign to give customers a $3 credit if they pick up their own pizza, in an effort to cope with the worker shortage.

Perception or reality?

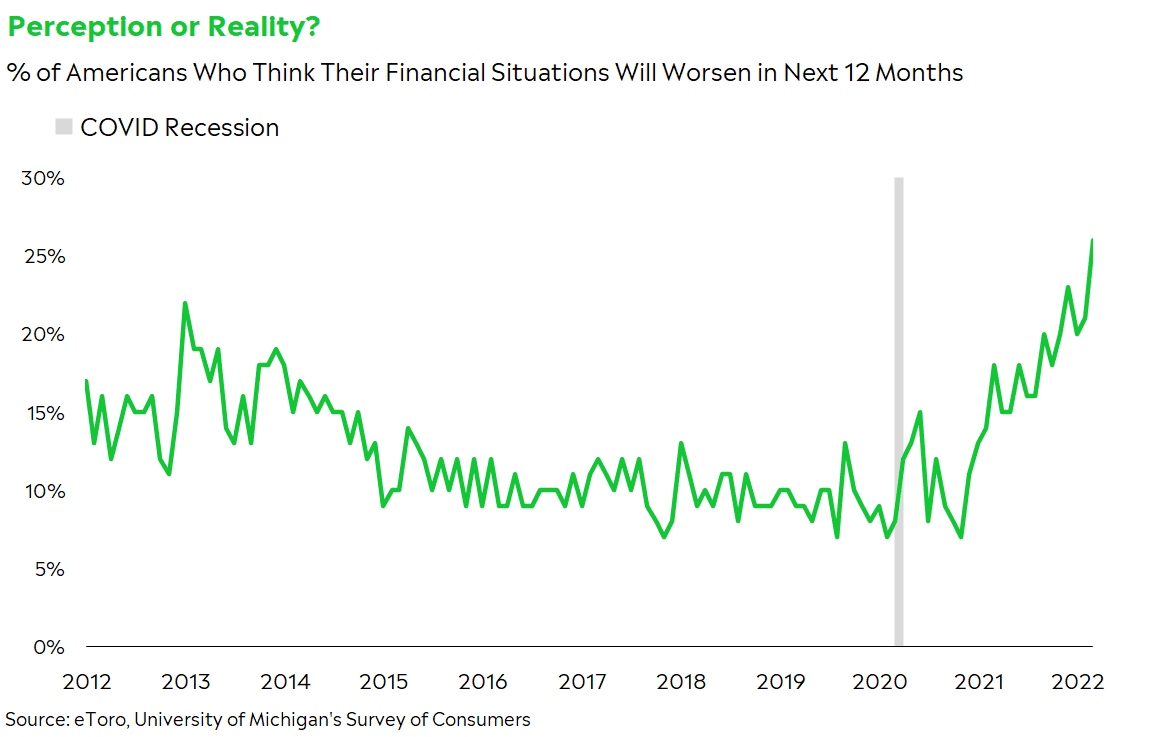

On paper, the economy may be doing OK. But in real life, it doesn’t feel like the economy is doing OK.

Look at consumer confidence. There’s an unusually wide disparity between how Americans feel about the economy now and what they’re expecting in the future, according to Conference Board data. When the spread between current and future expectations has been this wide in the past, spending has typically slowed over the following 12 months. The percent of Americans who expect their financial situation to deteriorate over the next 12 months is around a 42-year high, according to University of Michigan survey data. And 47% of respondents think prices will rise faster than their incomes.

The friction from inflation and shortages hasn’t done much damage up until now. The risk, though, is if perception becomes reality. Will consumers become so fed up with friction and pessimistic about the future that they spend less? If you’re nervous about the future, you may be hesitant to upgrade that TV for your watch party. When hoards of consumers pull back on spending, the impact can add up. After all, consumer spending accounts for about 70% of gross domestic product.

Plus, the consumer’s safety net is disappearing. Savings rates are historically high, but falling. Credit card balances are relatively manageable, but growing.

Party foul

To be clear, an anxious consumer feels like a small risk at the moment. Spending is still strong and company earnings look decent. We’re still optimistic about the U.S. economy’s prospects this year, especially if the Fed can successfully control inflation without upsetting growth. Consumers and Wall Street alike see a strong job market, and it’s hard to deny the “wealth effect” of capital markets’ and crypto’s rallies. Plus, there are signs that inflation could calm down over the next several months.

But Sunday could be an interesting litmus test for the consumer’s ability to spend in the face of economic pressure. How many wings will we collectively order if our favorite wing shops close early? Are we willing to wait for that pizza? Is our souped-up TV stuck in a shipping container somewhere?

For some, those headaches may be enough reason to save money and cancel the party.