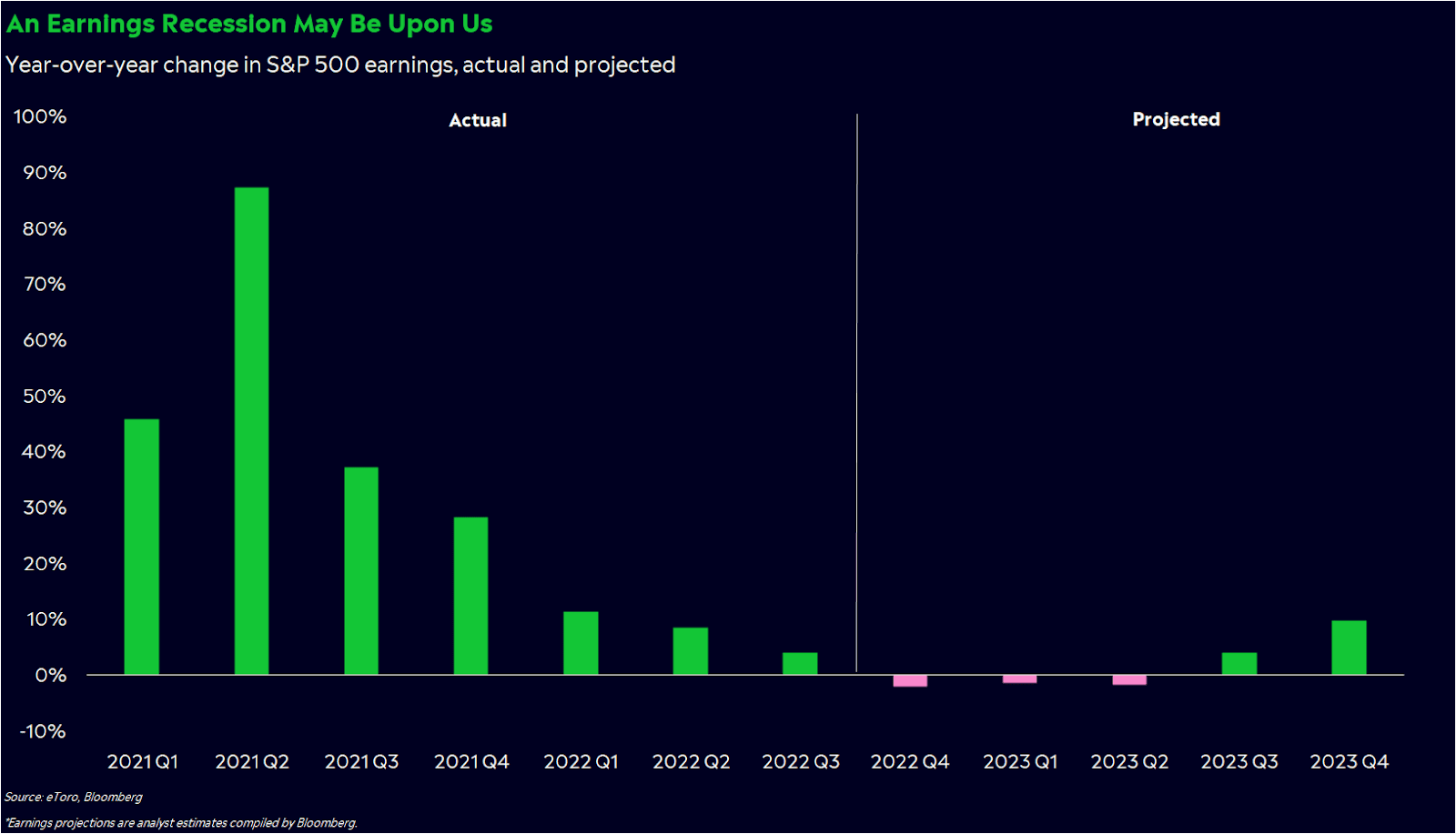

One part of the US economy may already be in a recession.

Earnings for S&P 500 companies likely dropped year over year in the fourth quarter, fitting part of Wall Street’s definition for the start of an “earnings recession.”

But while a drop in profits may not be good news, it also may not be the big recession we’ve been fearing.

Earnings recessions are not economic recessions — even though they sound the same.

Why profits matter

Let’s get one thing straight: Company profits matter, even if you’re not a shareholder or C-suite executive.

For about a year now, the economy has been under pressure from the double whammy of rising inflation and rising rates. Making products and finding the cash to operate are both becoming more expensive, a tough prospect for businesses large and small. While companies can raise their prices in response, they can only go so high until people decide they can’t — or don’t want to — pay those higher prices. Sales slow, costs stay high, and then it’s just simple math — profits are sales minus costs.Yes, these are corporate America’s problems, but deep down, they’re our problems as well. When companies can’t make money, they’re more likely to cut costs and lay off people. And if you’re like most Americans, you rely on your job as your primary source of income. If companies lay off people en masse, then we could fall into a recession pretty quickly.

Luckily, if job market stats are any guide, we’re not there yet.. Hiring is still strong, open jobs are aplenty, and unemployment is historically low. But are profits a sign the economy is falling apart?

The short answer: TBD, but maybe not.

Here’s why.

It’s an (educated) guess…for now. Most S&P 500 companies haven’t told us that they’ve had a bad quarter yet. In fact, fourth quarter earnings season just started today. The earnings recession prediction is based on the fact that Wall Street analysts think profits are about to slide. That’s fair, but it’s important to point out that they’re usually wrong. Over the last four quarters, an average of 75% of S&P 500 companies reported earnings higher than what Wall Street expected.

Also, lower profits don’t seem like a consumer spending problem. Analysts actually project sales to continue growing through the end of this year, which doesn’t seem bad at first glance. It’s tough to have a real recession when people are spending money. Of course, sales can naturally grow when prices are rising, even if people buy the same amount of product, but this profit drop strikes me as more cost-driven than demand-driven. Costs may be less of a problem than we think, too, with goods prices cooling down and supply chain pressure abating.

The stock market isn’t the economy. Great example: The Atlanta Fed’s forecast for fourth-quarter GDP growth is around 4%, yet we’re worrying about a drop in profits. Come again?

Public company profits can fall without the economy crumbling. S&P 500 earnings actually fell for five straight quarters back in 2015 to 2016, thanks to a slowdown in global demand and oil industry issues. Yet the economy survived, and the bull market raged on. We may be in the same situation — a slowdown that doesn’t roil growth and spark massive layoffs.

The machine vs. the gears. If we’ve learned one thing from 2022, it’s that the economy is a complex machine made up of a bunch of gears that may not be turning in the same direction. Paint the economy with a broad recession-colored brush, and you could miss important context.

Yes, from a bird’s eye view, profits are slipping. But if you look on an industry level, profits from about 60% of S&P 500 industries are expected to decline year over year in the fourth quarter. In fact, manufacturing-based industries like capital goods and construction materials could post year-over-year profit gains through the end of 2023, if estimates prove correct. Banks — a classic barometer of consumer activity — are expected to deliver a year-over-year drop in profits in the fourth quarter, but then see their earnings start growing again this quarter. Same with tech, for both software and hardware companies.

There are worrisome signals popping up in particular industries, though. Retailers could see another rough year of profit declines in 2023, according to analyst estimates. Services activity — the big driver of economic growth last year — could be fading as well, with 70% of services industries expected to post profit declines in the fourth quarter.

The almighty dollar. One of the biggest stories of 2022 was the US dollar’s strength versus other currencies. The dollar’s dominance attracted money into US-based assets (and made that cute Italian handbag a little more affordable for Americans), but it also boosted prices and dampened demand for US products overseas. That’s been a big blow to S&P 500 companies, which generate about 40% of revenue outside our borders.

We saw this trend reverse late last year, though. In the fourth quarter, the dollar plunged 7% versus other currencies, its biggest quarterly drop in 12 years. A dramatically lower dollar could ease up pressure on international prices and boost overseas demand, and we may not know the extent of this positive driver until we start seeing earnings roll out.

Too pessimistic?

This earnings season may be the first indication that corporate America is struggling. And as time goes on, it seems like we’re creeping closer to the recession everybody’s bracing themselves for.

But once again, there’s a chance we’re all getting way too pessimistic. It may be too early to jump to conclusions about an economic recession, even though we could be at the beginning of an earnings recession.

*Data sourced through Bloomberg. Can be made available upon request.