‘Tis the season for giving, so we should talk about one of the stock market’s oldest gifts.

Dividends are a present from companies to shareholders just for owning the stock. They’re a favorite of legendary investor Warren Buffett, who is expected to collect nearly $6 billion in dividends over the next year.

However, dividend stocks have been treated like that odd pair of socks you’re inevitably getting from your grandma this Christmas: tossed in the trash. This, in a year when yields and consistent income seem to be at the forefront of everyone’s minds.

Nothing in life is free, but dividends come pretty close. So why are people turning them away?

Profits, straight into your pocket

To understand the point of dividends, you first have to understand the connection between profits and dividends.

When a company makes extra money, they have a few choices for what to do with it. The company can either reinvest it back in the business to make its products and processes even better, which hopefully leads to more profits and a higher value for you (the shareholder).

Or, they can simply pay the profits out to shareholders. There are a few ways to do this, and it may not seem like the preferable option to enhancing the business in order to make even more money. But it’s a way to signal financial strength and put cold, hard cash in the hands of the people who support you the most.

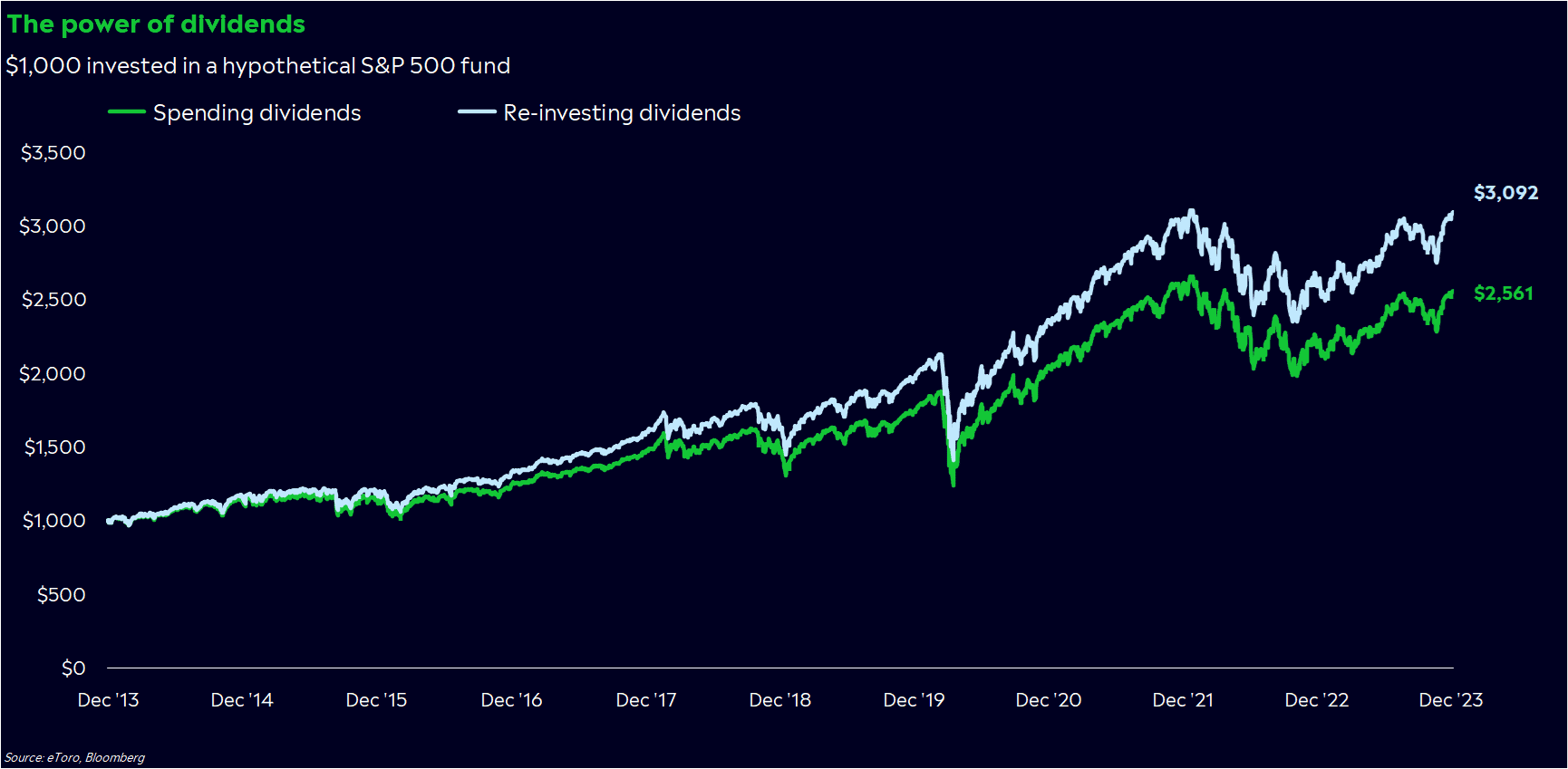

Dividends can make a difference in your portfolio. Consider this: If you invested $1,000 in a hypothetical, no-fee S&P 500 fund 10 years ago and just reinvested the dividends, you’d have $500 more today than someone who made the same investment and spent the dividends. Also, your investment’s value would be at a record high.

It’s not hard to find a company that pays a dividend, either. About 80% of S&P 500 companies offer one.

Dividends and the vibes

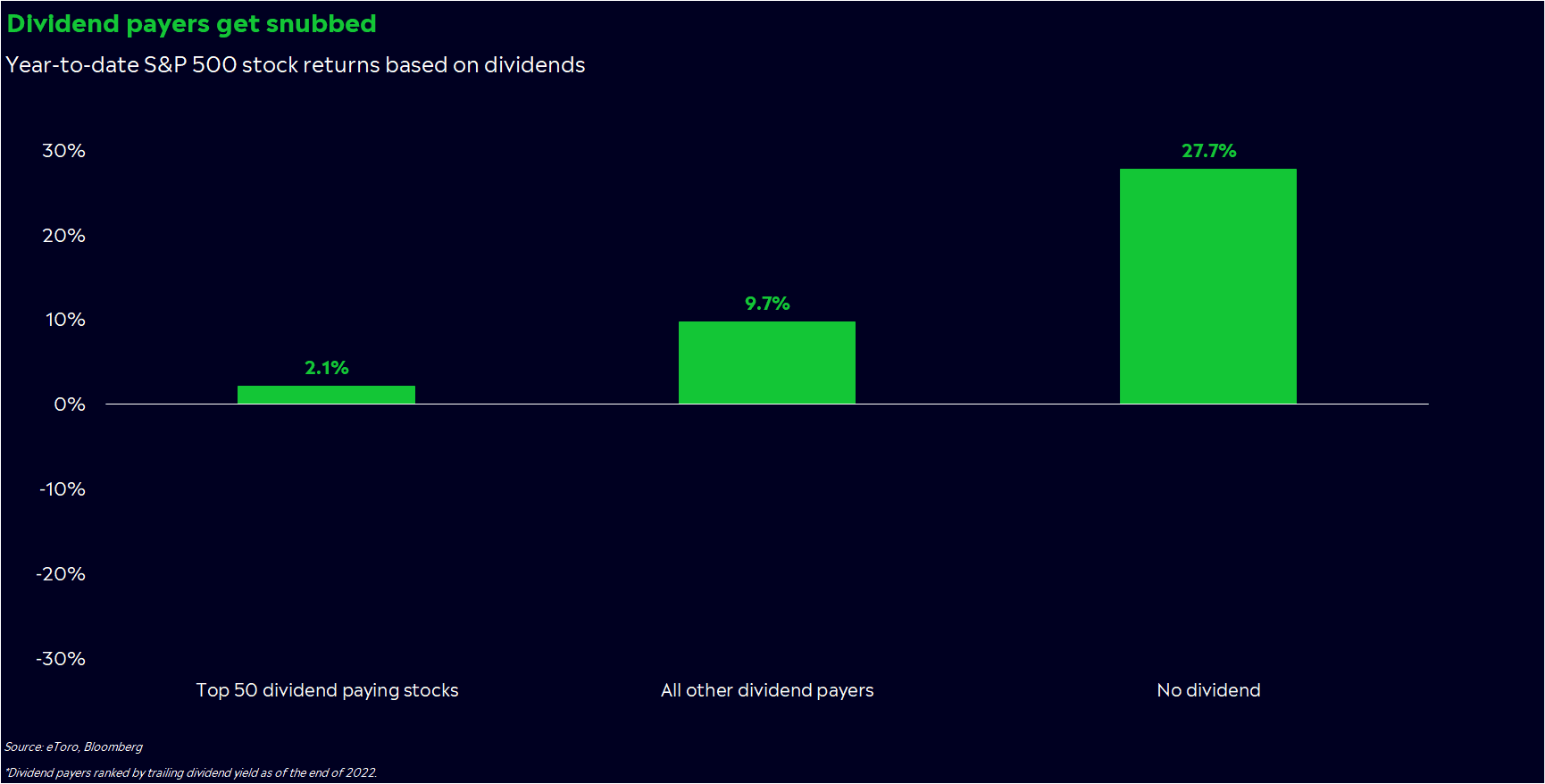

Dividends seem like an obvious perk to take advantage of, yet dividend stocks have been some of the worst-performing names on Wall Street this year. The S&P 500’s top 50 dividend payers have risen an average of just 2.1% this year, compared to a 27.7% gain in the 100 S&P 500 stocks that don’t pay any dividends.

And an index of the “dividend aristocrats” — or stocks that have increased their dividend every year for at least 25 years — have risen 3% this year, lagging the S&P 500 by the most since 1999.

To be fair, dividend stocks go in and out of style depending on the vibes. When rates are low and the economy feels shaky, people tend to gravitate towards dividends. 2022 was one of the best years for dividend payers in recent history because inflation forced them to think about quick returns today versus dreams of profits down the road.

This year, rates climbed to the highest level in over a decade. People were focused on income, but they weren’t comfortable enough with the future to search for income from stocks.

It makes sense if you think about it, though. One-year Treasury bills are yielding about 5%, while the S&P 500’s cumulative dividend yield is under 2%. Why take the risk on stocks when you can get a better payout with stable government debt?

A large swath of dividend stocks were also crushed by sector-specific stories. Energy stocks are notorious for their dividends, yet they’ve been one of the hardest hit industries because of swings in oil prices. Real estate investment trusts (REITS) are required to pay at least 90% of their taxable income to shareholders, and they’ve been ravaged by high borrowing costs and commercial real estate worries. Financial stocks — another group known for dividends — have had their own set of issues after the bank implosions earlier this year.

2024 could be a comeback for dividend stocks, though. The Fed basically confirmed the end of rate hikes this week, which sent yields tumbling. A recession is still a huge risk on the table as we turn the calendar, too. Investors may be lured back into what we call “teddy bear assets,” or companies with strong financials that can survive a slowdown. Many of those teddy bears pay dividends.

You’ve probably noticed I haven’t mentioned tech stocks yet — an oddity for a Wall Street research report these days. About half of S&P 500 tech stocks pay a dividend, the lowest percentage of any industry. If you’re running a cutting edge tech company focused on innovation, you’d probably benefit more from using your profits to fund research and development than just giving it back to people.

So what does it mean for me?

Remember dividends. Higher prices aren’t the only way to make money in the stock market. Dividends can be a steady source of growth in your portfolio, especially if you invest in companies with a history of payouts.

Stay nimble. The rate cut trade is working for now. But as the Fed looks toward a victory on inflation, it may be time to pay attention to parts of the market that have been unloved as of late.

Don’t get attached. Dividend income is nice, but the biggest benefit to your portfolio can come from reinvesting it. Investing small amounts can snowball in your portfolio over time, but you have to handle dividends with your future self in mind.

Think about taxes. I’m not a tax advisor, but I do know that dividends are taxed as ordinary income while stock gains can be taxed at a lower rate under certain circumstances. Keep that in mind when choosing what to invest in.

Thanks for reading The Bottom Line this year! We’re taking a holiday break for the rest of 2023, and we’ll be back in 2024. Happy holidays!

*Data sourced through Bloomberg. Can be made available upon request.