Sometimes, investing can feel like you’re listening in on a bad argument.

A lot of noise, a lot of yelling, but you can’t really make out what’s going on.Today, stocks think the coast is clear, bonds are convinced a recession is imminent, crypto’s just picking up the pieces, and the pundits are warning about Lehman moments every other week.

Markets are rarely ever on the same page, but this dissonance is nuts.

Let’s try to cut through the noise to understand exactly what different voices are telling us.

Stocks: Something is happening!

Stock investors are having a moment. We’re just not quite sure what that moment is.

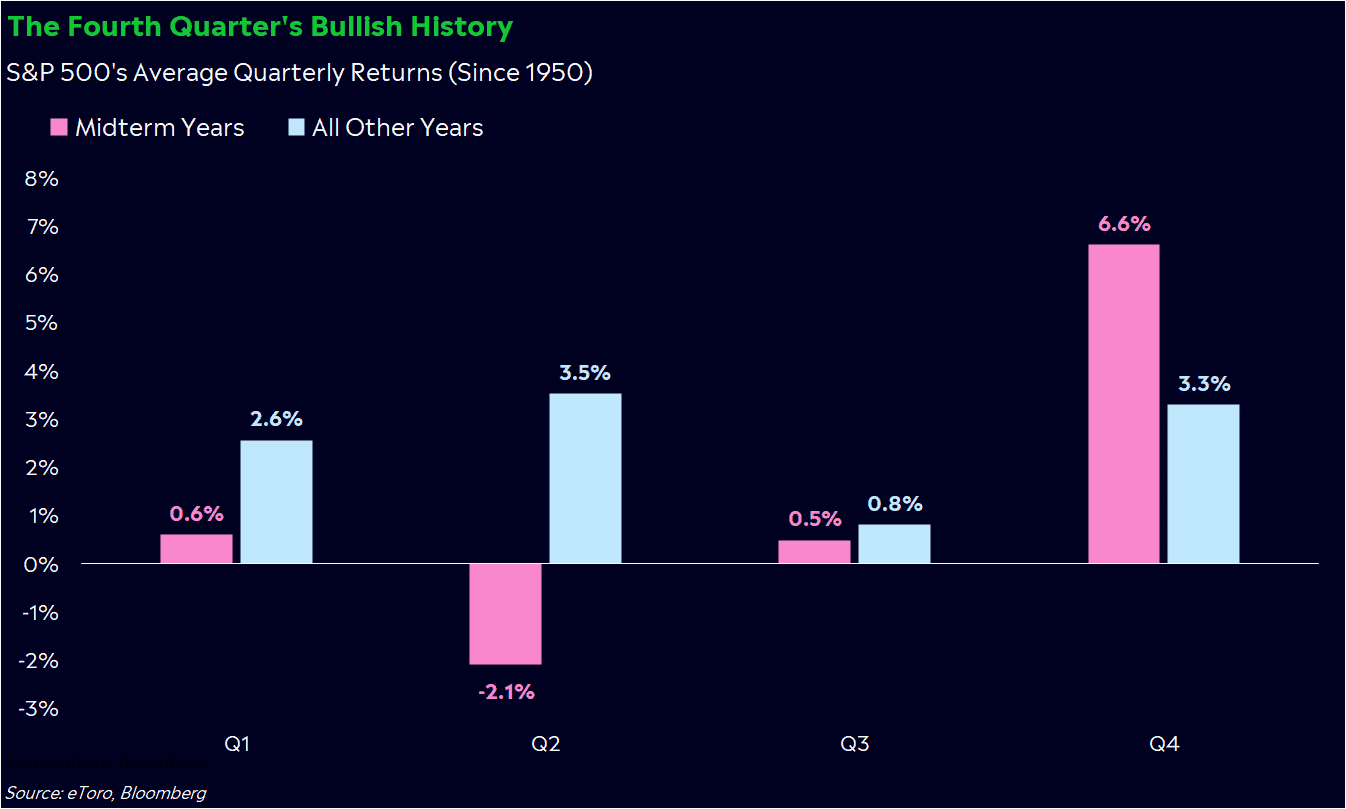

The S&P 500 jumped at least 2.5% on back-to-back days — a fierce rally that we’ve historically seen at the depths of bears or in the early stages of bull markets. The signal isn’t clear, but it’s becoming obvious that stock investors are sniffing out something, even if that something is just an early Santa Claus rally. Yes, the fourth quarter has been historically strong for the S&P 500, especially in midterm election years.

That something may also be a pause in rate hikes, though. And honestly, we may have seen this movie before. The difference between now and July is that we’re seeing more signs of a material slowdown and a serious energy and austerity crisis brewing in Europe. On the other hand, the Fed has made it crystal clear that its goal is getting US inflation to a workable level, and that’s still a lofty goal.

Another head fake or the real thing? It’s too soon to tell. But it could be something.

Bonds: A recession is coming! (maybe)

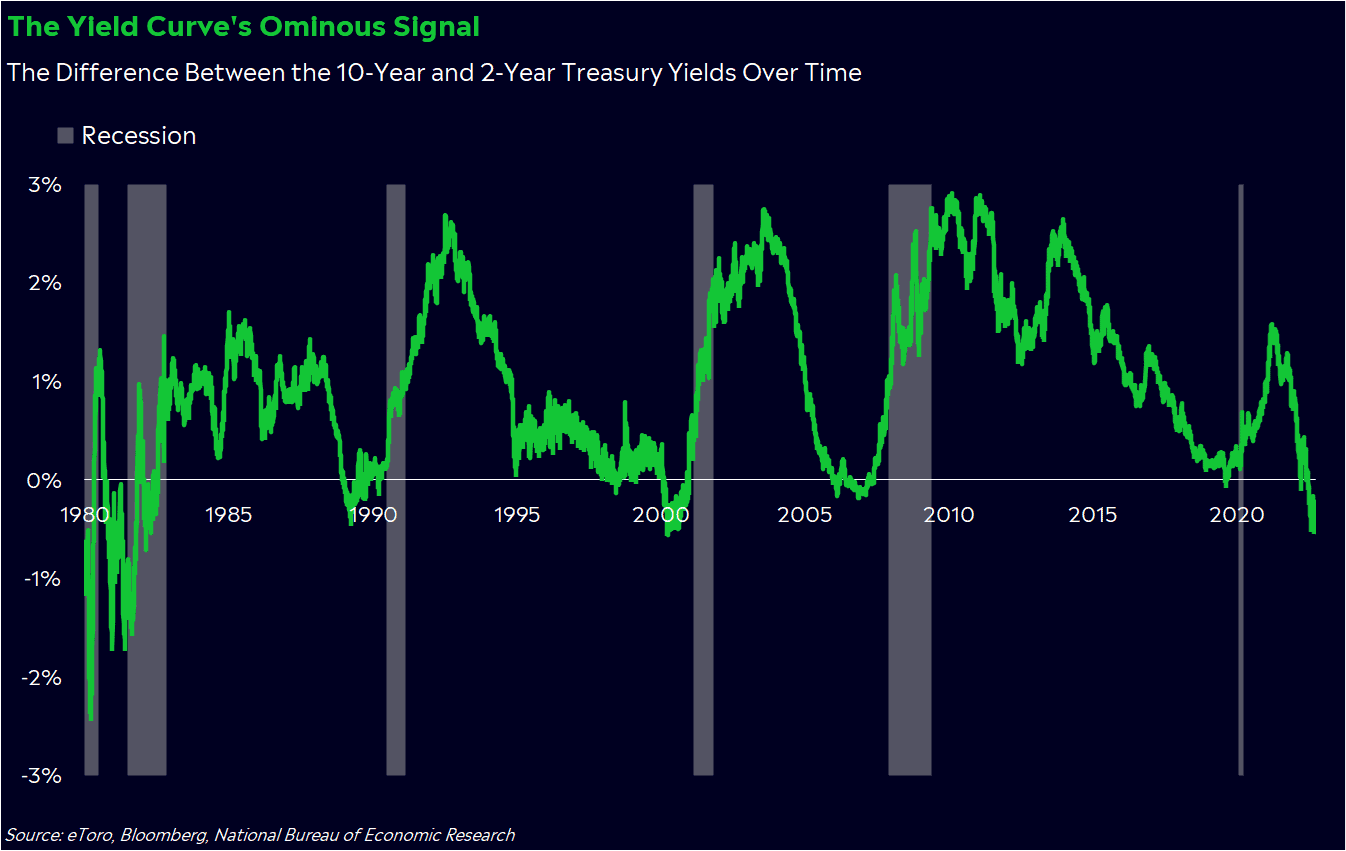

The bond market’s message has been clear all along: A recession is coming, and, honestly, we’re probably already in one. The spread between the 2-year and 10-year yields — a classic recession indicator — has been flashing red for three months, and now it’s the most negative it’s been in two decades.

But to understand what bonds are actually saying, you first have to understand their reputation. Bonds are the “cry wolf” market. Bond analysts are known as the pessimists of Wall Street, and the yield curve has forecasted 12 out of the last six recessions. Yes, you read that right.

Why? Because bonds are a weird mix of stock hedges, rate speculation, and places to park your money. Short-term yields tend to rise when the market expects the Fed to raise rates, so as you can imagine, they’ve rocketed higher this year. Long-term yields — think the 10-year — should reflect economic prospects, but they’ve been whipped around by international buyers flocking to US assets, baby boomers searching for safety, and the Fed’s own efforts to sell Treasuries.

If the stock market’s noise is loud, the bond market’s noise is deafening. Nevertheless, the global bond market is even bigger than the global stock market, so we can’t ignore it. And even though Treasury yields are sending sinister messages, yields on company bonds are barely near levels seen in past recessions. Bond investors may think the US economy is trouble, but they’re fine with the companies making up that economy. Hm.

Crypto: Could be better, could be worse!

Then, we have crypto. It’s been a rough year for crypto investors, who have had to question the foundational principles of a decentralized market after a brutal selloff and a solvency crisis.

You’d expect a crypto convert to be jaded by now, but we’ve seen an interesting change of heart over the past few weeks. While the UK budget panic pushed stocks to new lows, crypto held up surprisingly well. In fact, Bitcoin hasn’t closed within 5% of its year-to-date low at any point in the last three months, and it was one of two major asset classes that rose in the third quarter.

It’s hard to read too much into a young market, but crypto’s resilience could be telling a bullish story. When markets are in panic mode, investors tend to be more discerning about the risk in their portfolio. Crypto has been a victim of that trend, but in this latest selloff, Bitcoin held up better than the tech-heavy Nasdaq 100. Yes, even in the face of a surging US dollar and rising interest rates. Maybe we’re seeing a new foundation being built in crypto prices.

Don’t get me wrong — crypto still has a lot of growing to do, and Bitcoin is still 70% away from its 2021 highs. However, Bitcoin’s relative stability at the $20,000 level feels like progress.

The pundits: A Lehman moment!

Ah, the noisiest of them all: the take machine. It seems like there’s a new crisis showing up on our social media feeds every day. A few days ago, social media exploded with a narrative about a European bank’s financial standing after an ominous tweet from a reporter.

Look — we’re all (understandably) in a sour mood about these markets, and more information empowers everybody. But these days, people are almost searching for the next “Lehman moment”. And while there’s always trouble brewing somewhere, we need to understand the magnitude of what we’re saying. Risks pop up from time to time (remember Evergrande a year ago?), but they’re rarely on the same level as a prominent US bank going bankrupt before stringent post-financial crisis rules were in place.

There’s also something to be said about the worst hits happening when we least expect it. Right now, individual investors are the most bearish in decades, so that also means they’re hedged and bracing for trouble. A punch in the stomach may not hurt as much as we think.

Elon Musk: The deal is back on!

Just kidding. I’m not touching this one.

The signal in the noise

Yes, this environment is especially noisy. But which market voice is speaking the truth?

It all depends on your perspective. If you’re willing to take on risk and you have time on your side, you might find yourself listening to riskier markets. If you’re a retiree trying to preserve the purchasing power on your cash, you may have to heed the bond market’s warning.

Just remember that optimism tends to win in the long run. And sometimes, tuning out the noise entirely is the best option for your sanity.

*Data sourced through Bloomberg. Can be made available upon request.