After registering steady losses over the past few weeks, the cryptocurrency market hit six-month lows this morning, reaching levels not seen since May of this year. As Bitcoin kept falling, other cryptos followed suit, including Ethereum, XRP, Bitcoin Cash and others. However, the market has recovered slightly since. Over the past week, cryptos were once again impacted by the actions of the Chinese government and this week, investors will be looking for a significant technical indicator.

Today’s Highlights

- Bitcoin Halving

- The Chinese Connection

- The Death Cross

Bitcoin Halving

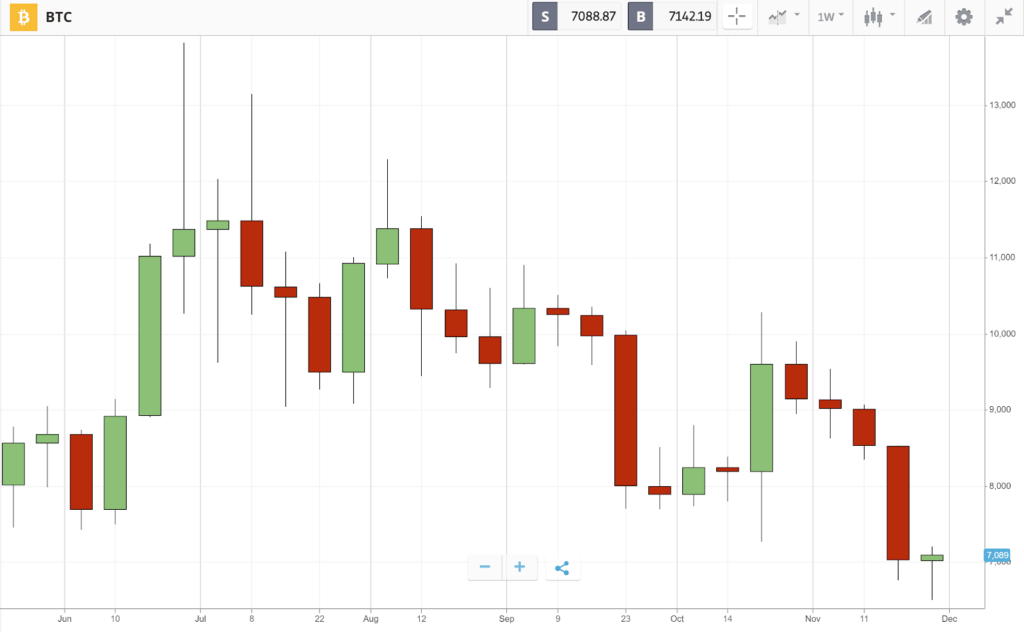

Just four months ago, Bitcoin reached its 2019 peak, climbing as high as $13,000. While back then many traders were optimistic, some predicting a massive bull run to continue until the end of the year, it seems that the current market direction is the exact opposite of that prediction. This morning, crypto traders around the world woke to a harsh reality, which saw Bitcoin prices plummeting all the way to around $6,500 — exactly half of its yearly high.

While prices have recovered slightly since, reaching around $7,000 at the time of writing, this just might be the notorious “dead cat bounce,” meaning this is not necessarily a trend shift.

The Chinese Connection

China is an influential force when it comes to the crypto market, especially of late. Earlier this month, President Xi said blockchain is the future, and the state-run China Xinhua newspaper ran a front-page story about the success of Bitcoin. However, over the past week, the Chinese government once again cracked down on crypto, however, it focused on illegal cryptocurrency exchanges.

Screenshot from Asiatimes.com

If the current downtrend in crypto markets is due to these activities, it may prove to be short-lived, as China’s overall tone has been pro-crypto in recent months.

The Week Ahead

As the crypto markets took a beating over the past week, investors and traders will be looking for any indicator that could provide clues as to the market’s next move. One major technical indicator investors will be looking at is the dreaded “Death Cross,” in which the 50-day moving average falls below the 200-day moving average. Such an indicator is an extremely common sign of an impending bearish trend. The Death Cross has appeared on the Bitcoin chart twice in the past, both times leading to a price drop of at least 60%.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.