Many of us have learned the hard way that stocks and crypto can go down, instead of up.

We’ve invested through a grueling period of high inflation and global turmoil. And with fears of high inflation, global turmoil, and a recession still flaring, we could be in for a rocky road ahead.

Instead of staring at the market feeling defeated about the future, maybe it’s time for you to learn the art and science of hedges.

What’s a hedge?

Hedges are investments you make to soften the blow of a selloff on your portfolio. This could be a drop in a single stock, or a slide in prices across multiple assets.

Newton’s third law of motion states that for every action, there’s an equal and opposite reaction. While this isn’t always true in markets, it’s a good way to think about how hedges work. When one market slides, there’s usually another that’s faring better (or maybe even rising). As an investor, you can use that to your advantage.

Pairing one investment with another can help protect your portfolio against a catalyst that impacts the two markets differently.

With that in mind, let’s talk about why hedges could be a good idea.

The unexpected

Any seasoned market-watcher will tell you that headlines usually drive daily moves.

Not only do you have to think about headlines, but you also have to consider how markets could react to those headlines. Sometimes, good news can be perceived poorly because investors expected it to come out differently.

Instead of trying to guess which way your investments will move next, it could be smarter to prepare for a range of scenarios. For example, you may own a stock you’re excited about, but you have a bad feeling about its next earnings report because of ominous comments from the management team. You want to hold this stock for a few years, but you’re nervous about how much the price could swing over the next few days. Buying a put option on the stock could help you pad your portfolio against a loss that could push your emotions to the brink.

In this case, you’re not necessarily preventing a loss. You’re just trying to limit it. This might be a small but important difference, if it keeps you engaged and focused on your goals.

The predictability

We all want life to be just a bit more predictable, especially after these last few years of “unprecedented times.”

Unfortunately, that’s not how life works. Markets have an especially bad reputation for being unpredictable, too. Even if you can handle day-to-day swings, it can be tough to plan for the future if your portfolio’s performance is all over the place.

Hedging can help with that. Mix in a few more conservative assets or strategically placed options trades, and you could potentially smooth out the swings.

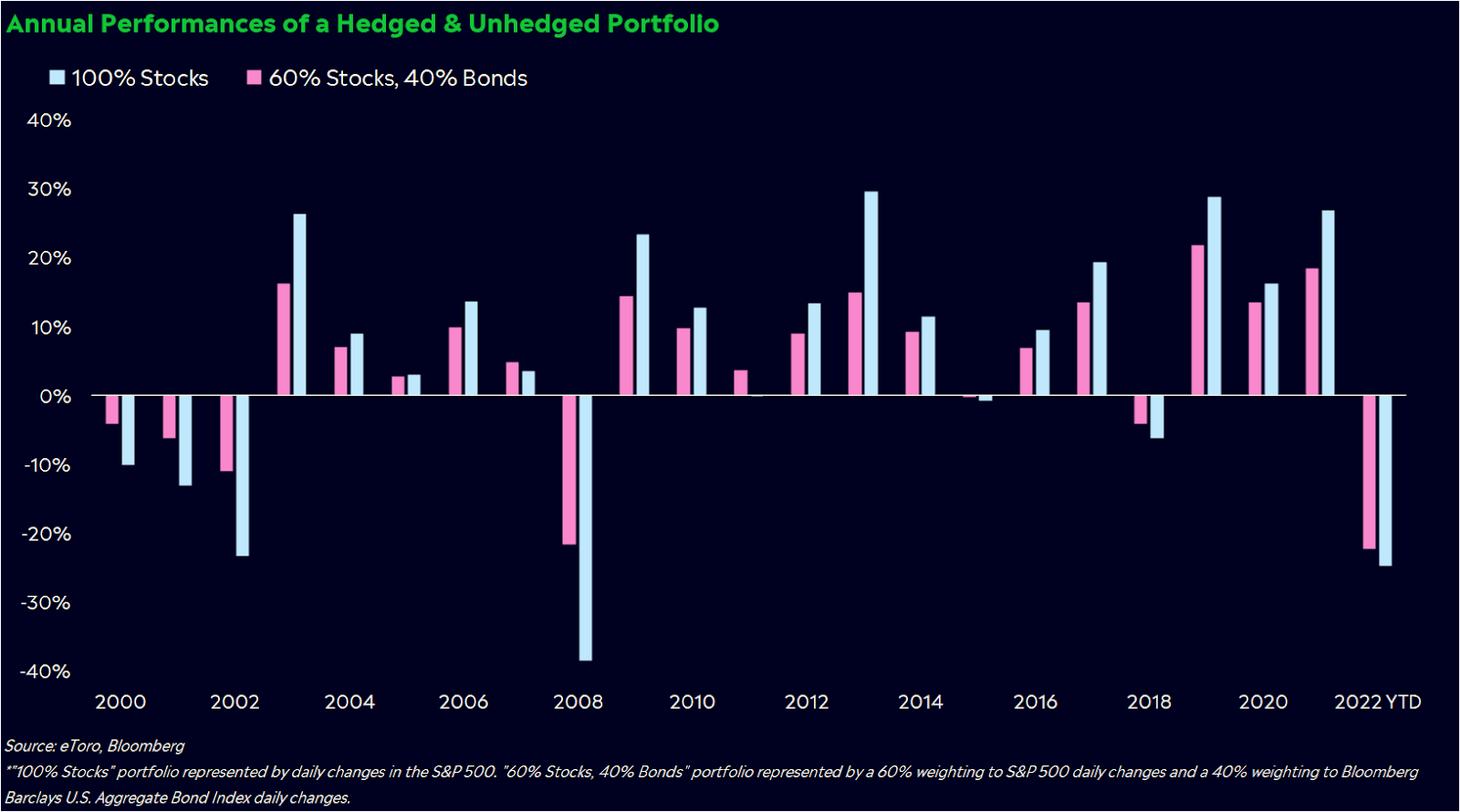

Let’s take a look at some data.

Since 1990, the S&P 500 has wiped the table with bonds in terms of performance. But to realize those returns, you would’ve had to hold your stocks through four vicious bear markets. Bonds, on the other hand, have logged more consistent returns through big market selloffs, even though their returns haven’t been as impressive.

Predictable hedges don’t always rise when markets fall, either. The 2022 bear market was the perfect example. Both stocks and bonds had swiftly sold off since the beginning of the year. Neither asset had been a fireproof hiding place from volatility, but bonds hadn’t dropped as much as stocks. This matters when a little more stability in portfolio performance may be the difference between sticking to your plan and bailing out.

The sleepless nights

Sometimes, what works best for your portfolio isn’t what makes sense on a spreadsheet. It’s what helps you sleep at night.

Everybody is different. But for some reason, people throw their individual needs out the window when it comes to investing. You may not have the time or emotional capacity to adjust your portfolio every day, but you still buy into some of the most risky and volatile stocks and crypto. Ultimately, this could lead to you being stressed and miserable.

It doesn’t have to be that way, though. Some of the wisest and most successful investors weren’t aggressive stock pickers, but they had the patience and portfolio protection to watch their investments goals come to fruition. In fact, legendary investor Warren Buffett amassed most of his fortune later on in life because he rarely touched his investments — he let them compound over time instead.

Like Buffett, many investors don’t have to swing for the fences to reach their goals. Instead, they just need to invest enough for long enough. Even if you don’t have time on your side, managing your emotions can help you strike a good balance between your portfolio and your stress levels.

Think of it this way: a portfolio can rise 5% a year for three straight years, or it can rise 10%, fall 20%, then rise 31.5%. Both paths get you to the same return. Which one is better for your sanity?

Breathe a little easier

There’s nothing like a bear market to get the world focused on risk again. But the time to prepare for a storm is before, not while the winds and rain are beating on the side of your house.

In crazy times, think about how hedges may help you breathe a little easier.

*Data sourced through Bloomberg. Can be made available upon request.

Options involve risk and are not suitable for all investors. Please review Characteristics and Risks of Standardized Options prior to engaging in options trading.