The US economy is dealing with some challenges right now.

But confidence isn’t one of them. At least not any more.

Throughout 2022, the US economy suffered from a crisis of confidence. Consumer anxiety grew as inflation heated up and product shortages led to bare shelves and lots of friction in our daily lives.

Now, we’re facing the opposite scenario. Shelves are stocked, furniture delivery times are better, and paychecks are finally growing faster than prices.

And in turn, Americans are feeling better about the economy, even as Wall Street braces for an oncoming recession.

The vibes are improving

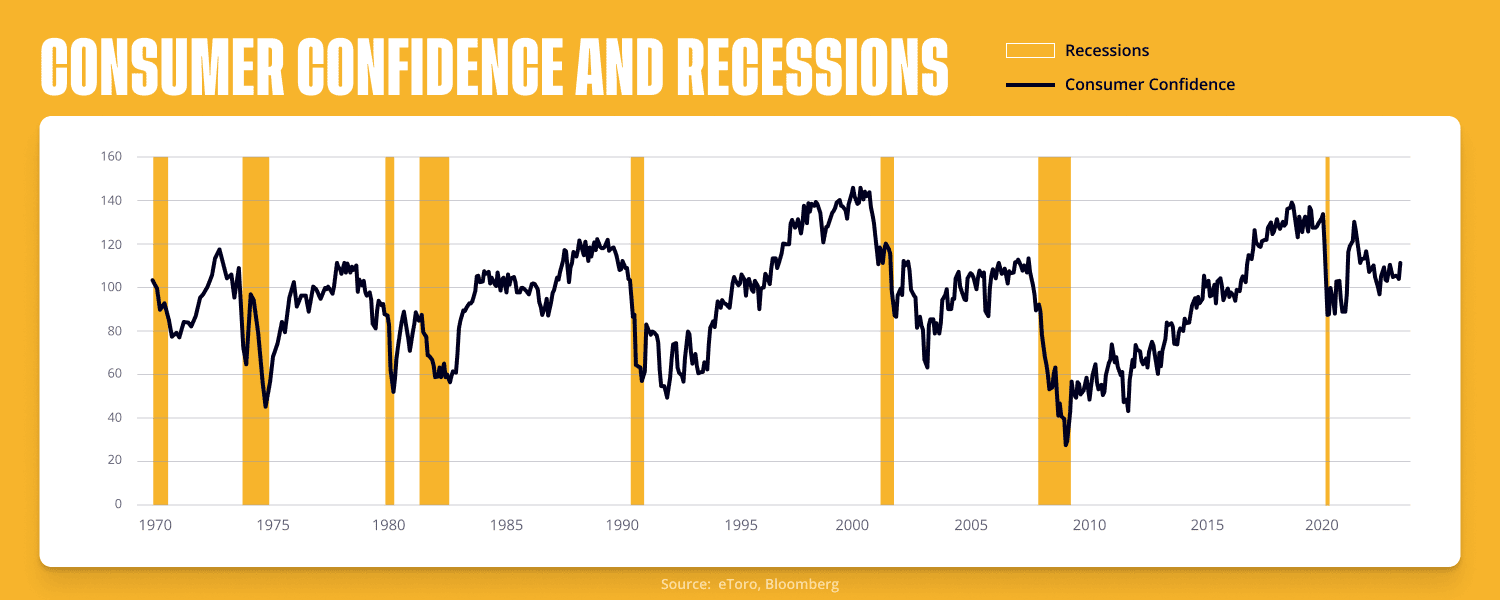

Low confidence was one of the earliest signs of trouble.

The Conference Board’s gauge of consumer confidence started sliding back in July 2021, around the time when rising costs started to weigh on our wallets — and before the market turned. The economy was doing well, but it didn’t feel like the economy was doing well.

Americans started to feel more pessimistic about the future, and they trimmed their budgets in response. Spending growth stagnated towards the end of last year, with the worst point hitting in December — right in the middle of the holiday shopping season.

Americans didn’t necessarily stop spending, though. They just prioritized their purchases more. And that key difference has been one reason why the economy has stayed afloat. The “vibecession” — as my friend Kyla Scanlon calls it — didn’t turn into an actual recession.

Today, it seems like the vibecession may be over, too. This month, consumer confidence reached its highest level since the beginning of 2022. People are feeling especially encouraged about the current state of the economy. Confidence about current conditions reached its highest point in two years, according to Conference Board data, while the outlook for the future brightened.

And who can blame them? Americans’ most relatable economic indicators are improving. The stock market is up nearly 5% this month. The price of an unleaded gallon of gas is down 27% over the past year. And year-over-year wage growth is now faster than inflation for the first time in two years.

…but not everybody is happy

Nature seems to be healing, and it could be a powerful force for the economy. If you’re feeling better about your financial future, you’re more likely to spend money on that vacation or new car. Now think about millions of Americans going through that psychological shift at the same time, with consumer spending accounting for about 70% of economic growth. Perception can become reality quickly.

But will it? Lower confidence didn’t tank the economy, so will higher confidence boost it that much? It’s tough to tell.

One thing is becoming apparent, though. Not every American is suddenly feeling more upbeat. Make no mistake — damage has been done to the economy through layoffs, long-standing inflation, and financial instability. You can’t shake that off easily.

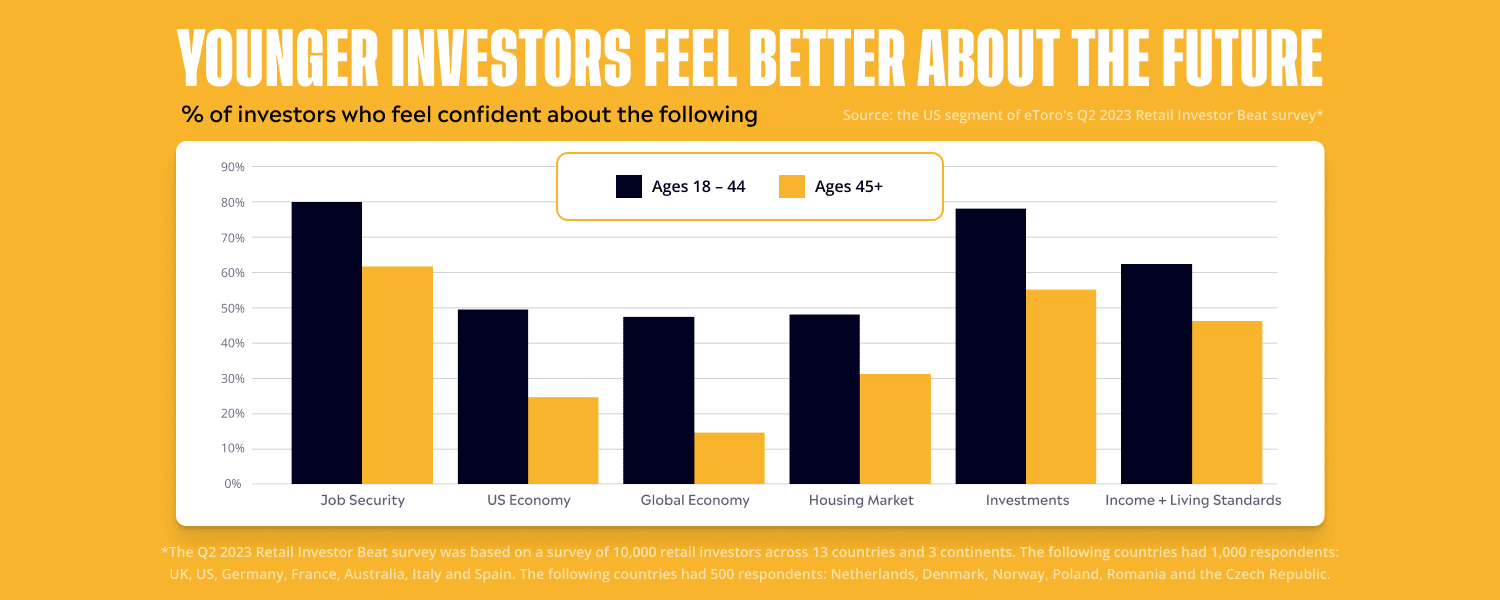

Our own Retail Investor Beat survey shows that there’s a noticeable difference between the attitudes of younger and older investors. In the US segment of our June survey, investors ages 18-44 — think Gen-Z and millennials — were more confident about topics like job security, the economy, and their own investments.

It makes sense. Younger workers have benefited more from wage growth and strong hiring. Many of them reached their prime home-buying years during a stretch of historically low mortgage rates, and a large swath of them found out they’d have at least part — if not all — of their student loans forgiven (if the courts agree).

And to be clear, the majority of investors feel good about their own financial situations, regardless of their age. 71% of respondents in our survey said they feel confident about their job security, while 67% feel confident in their investments. Compare that to the 40% who feel confident about the US economy and the 33% who feel confident about the global economy. The vibecession may not be over after all, but it also may not be a big deal if people stay employed.

Things can change quickly. The Fed is still hammering the economy through higher rates, and the job market is showing growing cracks in certain areas. Plus, we can’t forget about the resumption of student loan payments coming this fall.

So what does this mean for me?

Examine your situation. Think about your own spending patterns, and ask yourself if you’re a part of the vibecession. What does this dissonance tell you about the economy?

Think about what confidence is telling you. Confidence rarely rises this quickly in recessions. In fact, the Conference Board’s consumer confidence index hasn’t hit a 12-month high during a recession in nearly 50 years. An improving mood could be an important shift for the economy.

Re-visit your investments. We haven’t talked much about your investments this week. But economic trends can dictate which stocks do especially well over the next days and months. While better confidence is encouraging, the Fed still has a good argument for keeping rates higher for longer. Economically sensitive sectors could see another revival here, but the economy’s overall potential could be capped until we see lower rates.

We’re taking a summer break next week, so there will be no TBL. Have a happy and safe Independence Day.

*Data sourced through Bloomberg. Can be made available upon request.

**The Q2 2023 Retail Investor Beat survey was based on a survey of 10,000 retail investors across 13 countries and 3 continents. The following countries had 1,000 respondents: UK, US, Germany, France, Australia, Italy and Spain. The following countries had 500 respondents: Netherlands, Denmark, Norway, Poland, Romania and the Czech Republic.