A lot has been said about AI’s potential over the past several months.

According to some headlines I’ve seen, ChatGPT could write our emails, manage our money, read our minds, rebuild the middle class, and achieve world peace. AI could also be saving your portfolio, with the Nasdaq 100 soaring 27% this year and stocks like Nvidia popping 25% on earnings.

Will AI actually live up to the massive hype, though?

It could all depend on productivity.

Sure, AI can help us be more productive as individuals. But gains in collective productivity — the amount of economic value created per hours of work — could be what makes AI a truly groundbreaking technology (and a smart long-term investment) versus another passing tech fad.

A productivity boom

AI has been all over the headlines recently, but one article in particular caught my eye last week. Paul Tudor Jones, a well-known hedge fund manager, said he thinks AI could spark the next boom in productivity.

He’s not the only one saying this, either. In April, Goldman Sachs estimated that generative AI could add nearly $7 trillion to the world economy, and 1.5 percentage points to productivity growth over the next 10 years.

In theory, it makes sense. Getting robots to do our mundane tasks could not only make us more efficient, but it could be cheaper in the long run, as we focus more on projects that require a human touch. And let’s be honest — robots can do a lot of what we do at a lower cost.

But in practice, it hasn’t been that simple.

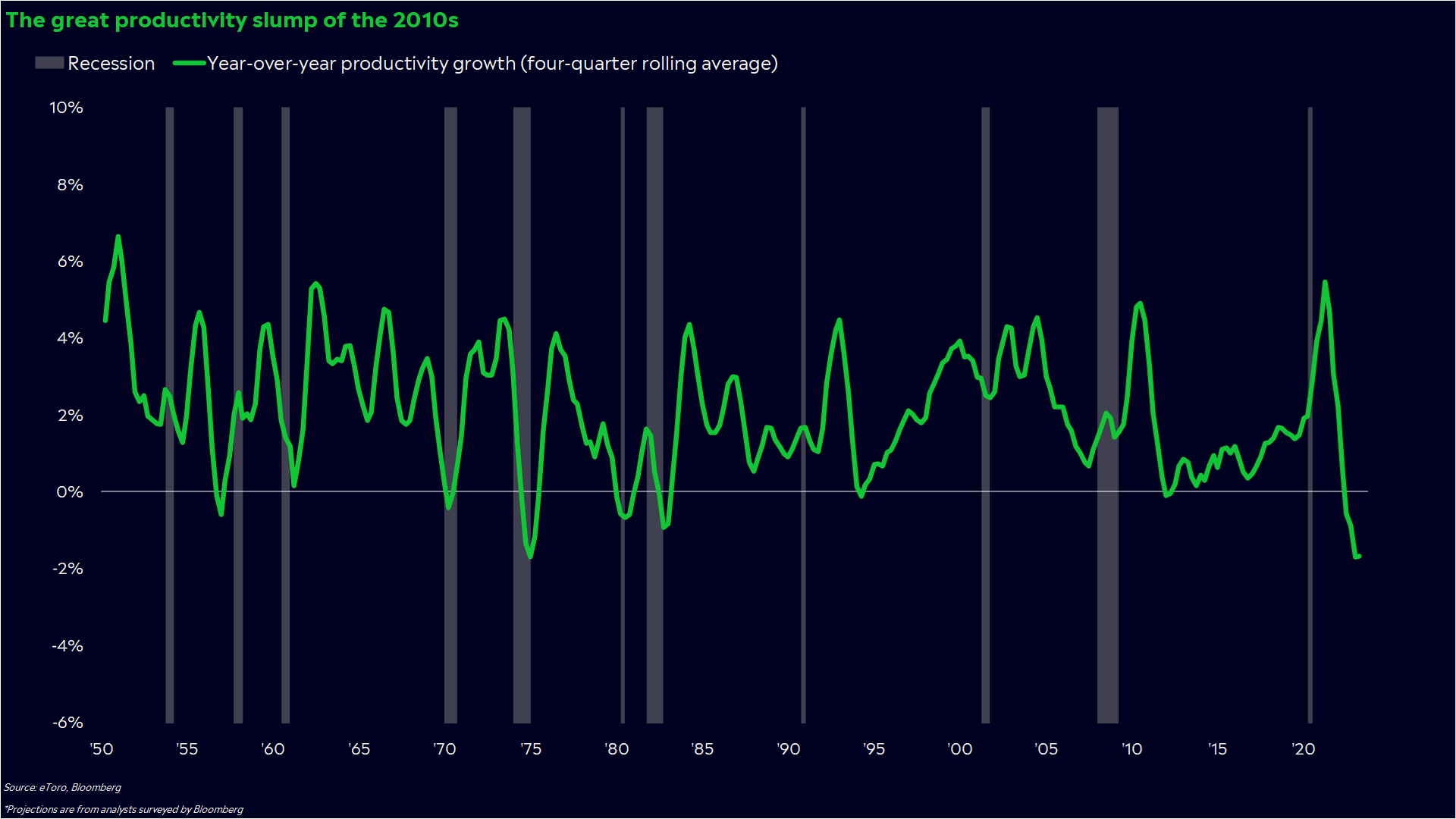

In fact, productivity was unusually sluggish in the 2010s, an era marked by the rise of big tech and an explosion in innovation and development. Even though market returns were impressive, the economic progress was relatively lackluster. Wages stalled, companies focused on downsizing instead of investment, and GDP gains crept along at the slowest pace for an expansion since at least the 1940s.

There are a few theories as to why a tech boom didn’t do much for the economy. Maybe the best tech breakthroughs — think electricity and the internet — are behind us. Or maybe economic data doesn’t adequately measure just how much tech has improved our lives. And some tech developments — like social media — may be cutting into our productivity instead of helping it.

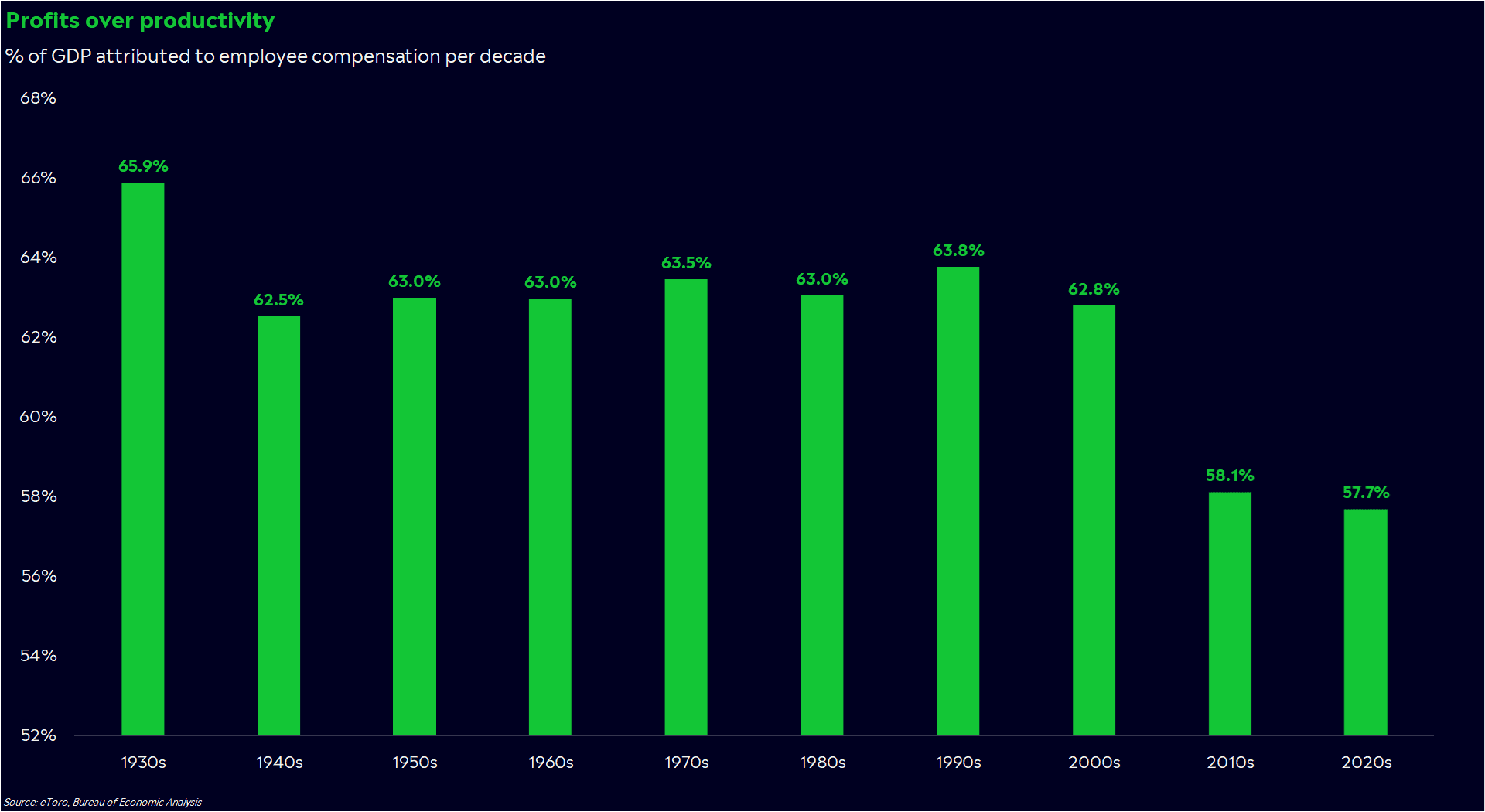

For me, one chart explains it all: the share of GDP growth attributed to labor versus capital. The benefits we reaped from tech have increasingly gone to maximizing corporate profits and pleasing shareholders over empowering workers and striving for long-term resiliency.

This shift from financial engineering to capital investment is crucial. If companies focus on improving their workforces, their employees get better training and tools to work with.

Eventually, this could turn into wage growth accompanied by higher output, an ideal situation that could help ease societal tensions like income inequality.

Right now, we’re facing the opposite scenario — broken supply chains, high inflation, low output. There’s a reason why 2022 was the worst year for productivity since the 1980s. There have been signs of improvement, like strong wage growth among lower-income workers. But there still may be a ways to go.

How AI could change the world

This is where AI comes in.

Productivity is how technology takes hold in a sustainable way. If AI is going to change the world, it’ll need companies to invest meaningfully in it — not just to boost profits, but to make our systems more efficient and resilient. This is the productivity boom that Wall Street is talking about — one we haven’t seen since the early days of the Internet.

The good news? Companies may be willing to spend serious money on AI if this earnings season is any indication. Over 65 S&P 500 companies mentioned AI in their earnings calls this quarter — ranging from restaurant operators to online marketplaces and dating apps. COVID-era struggles have also forced companies to think about operational resiliency, so this could be AI’s moment to shine.

I’m excited about AI, just like many of you are. I’m just not sure if it’ll solve all the problems we’re claiming it will. And after the recent productivity slump, I’m inclined to wonder if there may be more hype than substance, at least from an economic standpoint.

In a broader sense, I’d like to see productivity make a comeback in this next expansion — for the sake of our economy.

So what does this mean for you?

Think about how AI fits in your portfolio. While you may also be excited about AI, you have to recognize that it’s a young and emerging field. It may be a better investment for people with longer timeframes and the ability to hold through ups and downs.

Watch the data. Economic data could eventually tell us if productivity is truly growing. I like keeping an eye on durable goods data to gauge business investment. And of course, there’s the productivity report, which comes out about a month into every quarter.

Choose your investing tools. People may be flocking to tech stocks, but there’s more than one way to invest in a theme. Think about the suppliers that could power the AI boom and the industries that could embrace AI the most. Plus, with an emerging trend, it’s hard to tell which companies could turn out to be leaders in the space.

No matter how you feel about AI, we wish you a safe and pleasant long weekend. This Memorial Day and every day, thank you to all who have served our country.

*Data sourced through Bloomberg. Can be made available upon request.