It’s spooky season, and fear seems to be everywhere.

Under your bed, around the corner, and in your portfolio.

The degree of fear in the stock market, however, is a highly debated topic on Wall Street these days. The stock market’s classic fear gauge — the VIX — has been historically quiet this year, despite inflation fears, spiking yields, bank meltdowns, and international conflict.

Some say there isn’t enough fear.

But I think we’re looking for fear in all the wrong places.

How fear has changed

The VIX, which is a measure of supply and demand for S&P 500 options over the next month, is a fascinating way to gauge the market’s mood.

The thinking is that if people are afraid of the future, they’ll buy more options to protect their portfolios (also known as hedging). The VIX itself isn’t a tradable instrument, but it’s essentially the basis for a bunch of different exchange-traded products and options contracts.

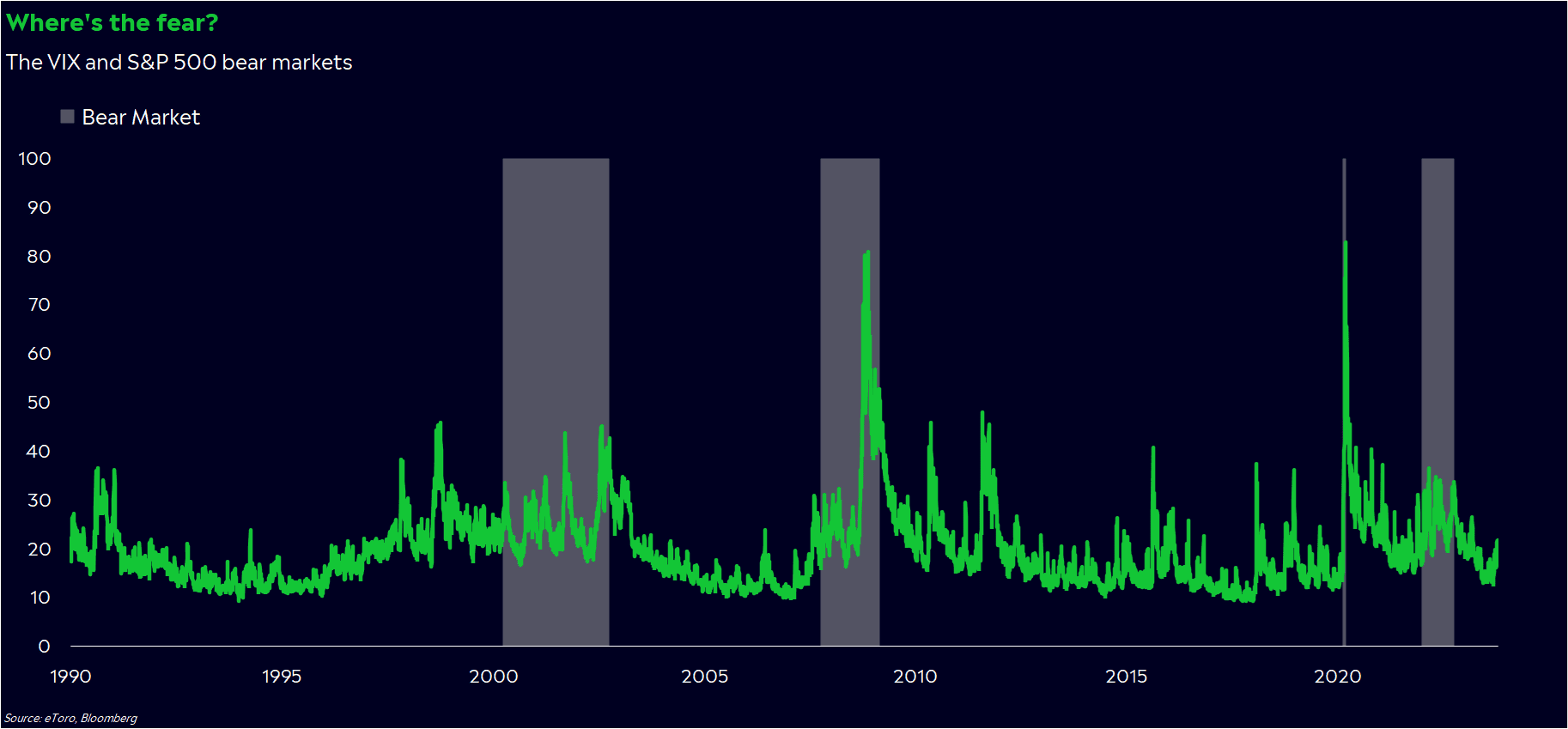

Over the years, the VIX has done a decent job at keeping tabs on stock investors’ fear. Since its inception in 1990, the VIX has moved in the opposite direction of the S&P 500 on 78% of days. It makes sense: stocks fall, fear rises.

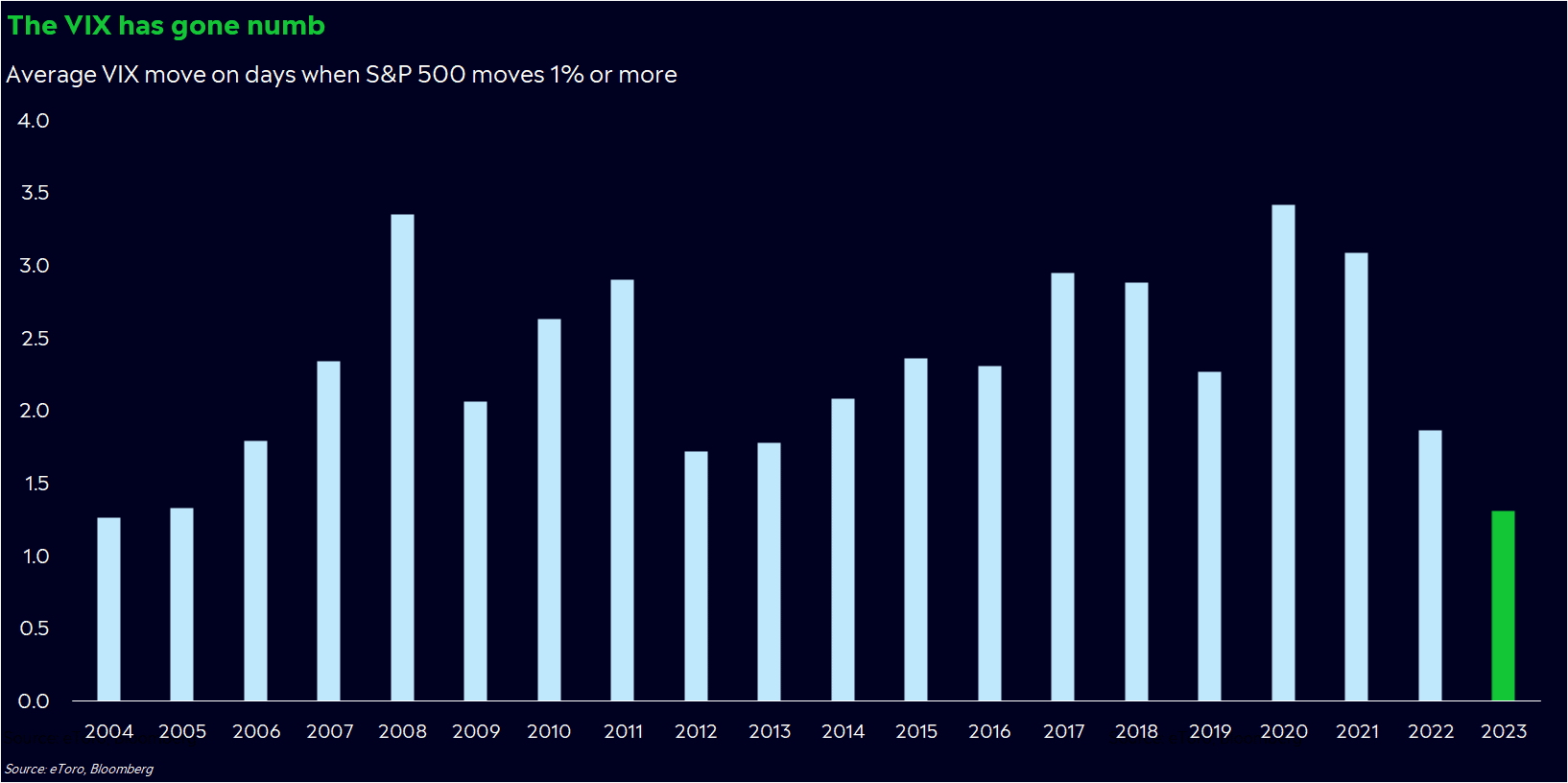

Until now, that is. The VIX made headlines last year because it barely moved relative to the pain the market went through. The S&P 500 fell 25%, yet the VIX only climbed to 36 — a much smaller reaction than the 80+ readings we saw in the past two bear markets. Fear was clearly rampant, but people were expressing it by buying daily and weekly options — not the monthly contracts that the VIX is heavily weighted towards. By the way, I wrote about this phenomenon here.

Turn the page to 2023, and we’re seeing the same muted reaction from the VIX on stressful days. And in this particular selloff, the VIX’s response has been its smallest relative to the size of the drop since 2004. Stocks are still swinging, but the VIX isn’t.

It’s not from an absence of fear, either. People are piling into cash at a rapid rate, and both gold and the US dollar have surged from a rush to safety. In times like these, the VIX’s silence is deafening.

The clown around the corner

The quiet VIX is a story much bigger than just market fear, though.

First, the risks we’ve dealt with these past two years have been more uncomfortable than surprising. Rising inflation and Fed rate hikes were well-telegraphed, and it’s not difficult to prepare for catalysts like CPI reports or Fed days in advance. And let’s be honest — in the era of the Kardashians and social media, there isn’t much out there that surprises us any more.

Also, volume is still shifting to shorter-dated options expiring in days or weeks. These days, about 53% of S&P 500 options volume expires in a day or less, according to CBOE estimates. Plus, more action seems to be happening in individual stocks than the overall market, which could attract options speculators into single stocks and ETFs and away from broad-market hedges.

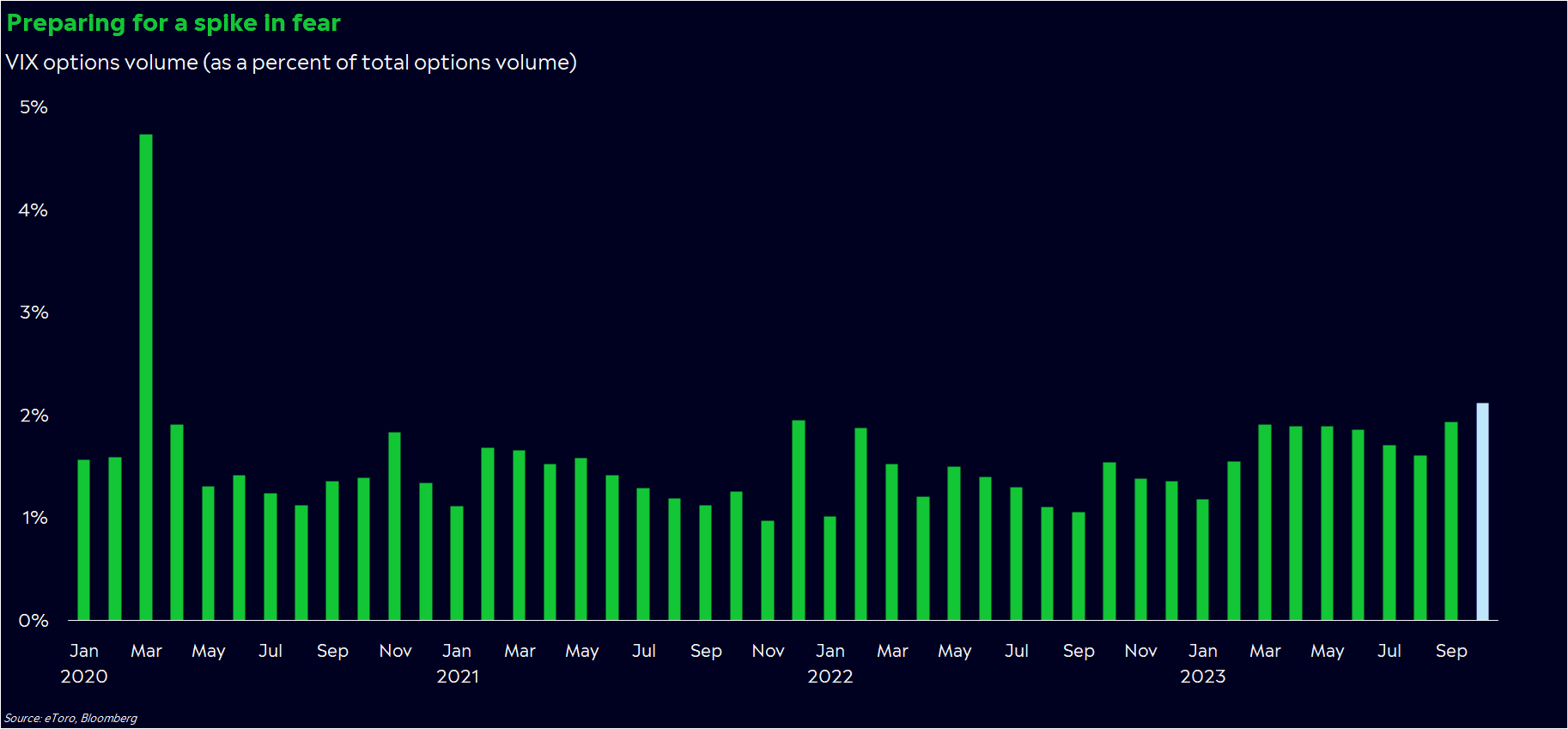

But before you get too comfortable with the “VIX is broken” narrative, know that the story may be changing. Signs of the old VIX are starting to pop up again.

For one, people are starting to prepare for a vicious spike in the VIX. This month, volume in VIX options has climbed to a three-year high, and 60% of that volume is in calls (or contracts that gain if the VIX rises).

Also, VIX November calls are building at 20 and above — with significant positions accruing as high as 45 and 48 (a level the VIX hasn’t reached since March 2020).

We’re also dealing with more nebulous risk these days. Wall Street is worried about a recession, bank meltdowns, and global conflict — three crisis-level catalysts that could hit at any moment. Any of these could be the clown hiding around the corner, so investors are starting to creep back into longer-dated options for blanket protection in case something jumps out.

We saw this in action on October 13. The S&P 500 fell a modest 0.5%, yet the VIX jumped 2.6 points — its second-biggest daily gain of the year. It was a historically large move for such a mundane day, which makes me wonder if the VIX is coming back from the dead.

So what does this mean for me?

Don’t fear fear. These days, investors have a healthy dose of fear in them, and that’s a good thing. If people are braced for the worst, they’re less likely to sell en masse if bad headlines do pop up. Make sure risk doesn’t catch you off guard, either. If you need more guidance, my colleague Bret Kenwell wrote a great explainer on how to prepare for a volatile market.

Hedge wisely. How you approach risk matters as well. If you’re worried about the economy collapsing, it might be best to look at a broad-market hedge. But if you’re worried about one stock, you may get a more effective hedge by just buying a put on that particular stock.

Watch the options market. Even though you may not trade options, It’s important to acknowledge how options positioning influences our perception of risk. Long-term hedges are becoming more popular, but I’d still take the VIX’s signals with a heap of salt.

Test your assumptions. We’re living in weird times, and classic market indicators of fear — the VIX, the yield curve — have led us astray. It may be time to test your assumptions of how markets work in certain conditions. Don’t throw away your finance textbooks just yet, and remember the economic context as you watch markets move. The US economy seems to be in a decent spot, and we’re likely in a bull market until proven otherwise.

*Data sourced through Bloomberg. Can be made available upon request.