The past week has been less eventful than the previous one, as the crypto market was not as volatile and trading volumes reverted to the levels before the massive spike seen two weeks ago. Over the past 24 hours, it seems that the market shifted into green territory, however, volatility was still low, as 5 of the top 10 cryptos showed price changes lower than 1%.

Today’s Highlights

- The rally subsides

- Litecoin back in the spotlight

- Lagarde takes center stage

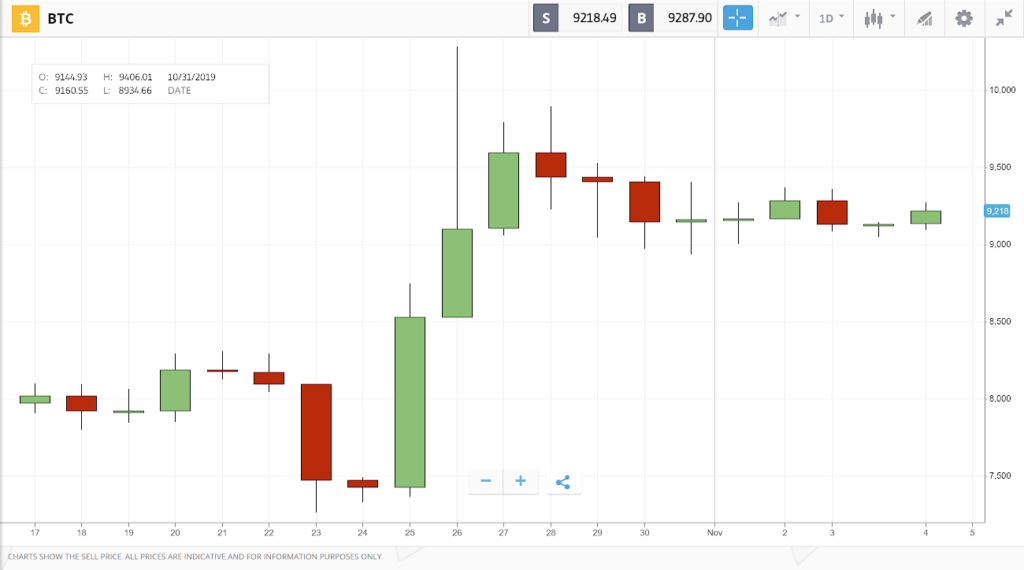

The Xi Pump Subsides

With so much of the traditional market’s activity being impacted by the ongoing US-China trade war, it came as less than a surprise that a new front would open on the crypto battlefield. And, mere days after Facebook founder Mark Zuckerberg told Congress “If America doesn’t innovate, our financial leadership is not guaranteed,” Chineses President Xi Jinping made his move, resulting in a massive crypto spike the week before last. However, the trend has subsided since, and Bitcoin remained stable above the $9,000 level this week.

While some crypto traders may find this low volatility disappointing, just looking at the chart shows how much better off the world’s largest crypto is now as compared to two weeks ago.

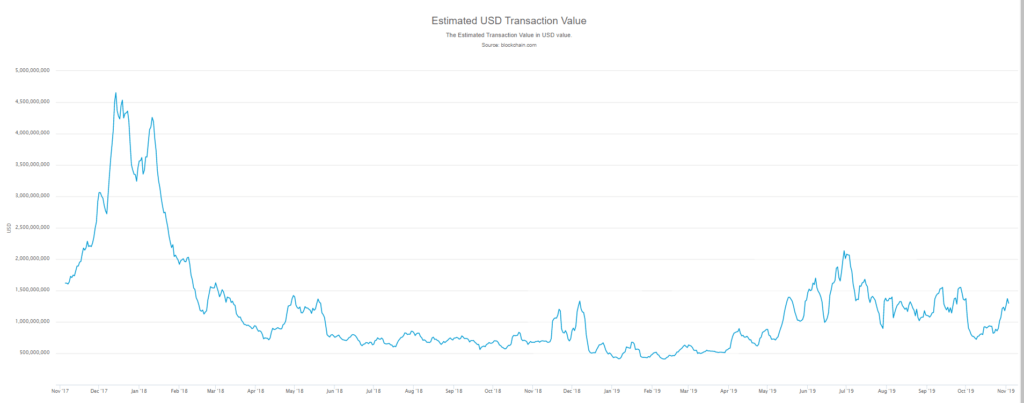

However, while trading volumes for all top cryptos resumed to the levels seen before Xi’s announcement, Bitcoin transaction volumes were on the rise, returning to their normal levels of an average of about $1.3 billion per day.

Litecoin Takes Center-Stage

The Litecoin Foundation hosted an event in Las Vegas last week, including a speech from eToro’s very own Senior Analyst Mati Greenspan. You can check it out here. The event was all about the future of the world’s first altcoin, in which founder Charlie Lee admitted that the blockchain’s progress has been slow, mostly due to lack of programmers. However, that has now been resolved, as Lee announced on Twitter.

The Week Ahead

Today, new European Central Bank President Christing Lagarde will be giving her first public speech in Berlin (1:30 p.m., ET), most likely outlining some of her future monetary policy. While there’s no guarantee she will discuss crypto, it has only been two months since Lagarde said that Europe should be open to regulating cryptocurrencies. Lagarde is no stranger to the spotlight, as she was previously the head of the IMF. If Lagarde does put digital currencies on the agenda, it may open the floodgates for central banks’ discussing the asset class, including Bank of England Governor Mark Carney, who is scheduled to hold a press conference on Thursday to discuss the inflation report. However, this is all speculation at this point.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.