The crypto market continued its bearish trend over the past week, as all cryptocurrencies showed significant declines. The ongoing coronavirus pandemic has shocked markets across the board, and cryptos are no different. One main reason for this could be that investors are hesitant to keep their capital in markets and would rather maintain the liquidity of their funds.

This Week’s Highlights

- Bitcoin Falls Below $5K

- CME Group Suspends Trading

- The Week Ahead

Bitcoin Falls Below $5K

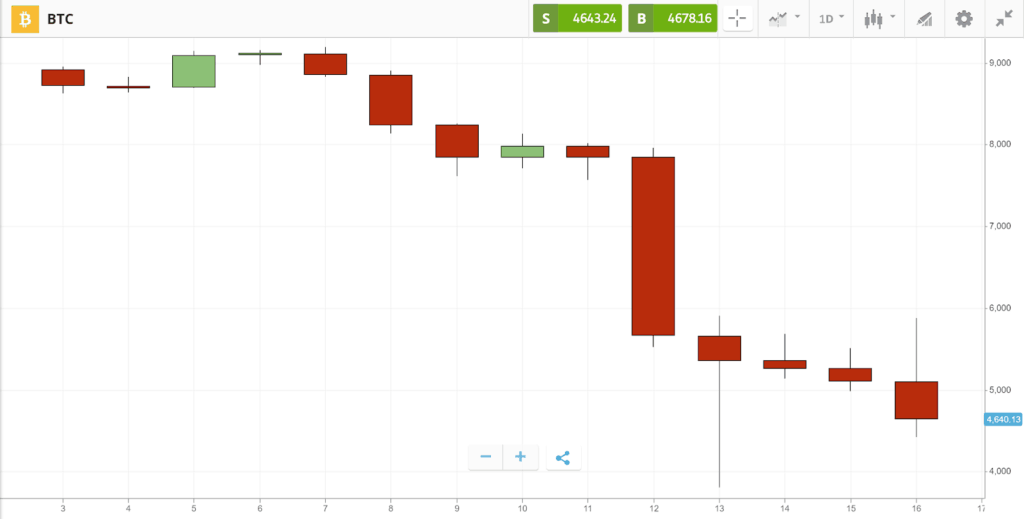

As the downtrend in cryptocurrency markets continued, Bitcoin, the world’s largest crypto by market cap, has reached lows not seen in nearly a year. After falling below $8,000 on Wednesday, Bitcoin showed a massive drop on Friday, falling below the $4,000 mark before recovering slightly.

The crypto community has been trying to grasp what led to this massive drawdown. Initially, some believed that the catastrophic declines in mainstream markets would lead to an increase in Bitcoin prices, as some investors could consider it a safe-haven asset. However, as time progressed, the crypto market moved in the same direction as all other markets, joining the global downtrend.

CME Group Suspends Trading

On Thursday, CME Group, the world’s largest derivatives exchange, closed its trading floors due to the spread of the coronavirus. Alongside common derivatives, such as commodity futures, CME is also one of the few mainstream exchanges to offer crypto futures. Therefore, it is possible that this took its toll on crypto markets. However, since much of crypto futures trading is done online, this may have had little impact on the cryptocurrency market.

The Week Ahead

As the reaction to the coronavirus intensifies, and a growing number of countries are issuing strict measures to battle its spread, it is likely that the downtrend in global markets can continue. Whether or not this will continue to impact cryptos remains to be seen. In China and South Korea, countries in which much of the global mining of cryptocurrencies takes place, the pandemic appears to be subsiding and lives are returning back to normal. However, global markets are still in shock, and there is no guarantee that this improvement will have an immediate positive impact on crypto markets.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk