Bitcoin has gone mainstream.

Take it from me, who’s attending one of the crypto industry’s biggest get-togethers: Bitcoin 2022. This year’s event hosts 40,000 attendees in the same Miami center that puts on Art Basel. And it has plenty of unique touches — volcanoes, beaches, bull rides, and skee ball machines. But the conversations on stage and among attendees have been reminiscent of a tradfi convention: institutional involvement, regulation, valuations… even compliance.

Over the years, Bitcoin has been the poster child for crypto’s popularity. Now, it’s entering its teenage years, and the secret’s out. Wall Street firms like BlackRock and Goldman Sachs have pledged to embrace crypto. Bitcoin now comes up in casual conversation, and your parents may even own some. It’s clear that Bitcoin is maturing into a more conventional market, similar to those that some crypto maxis have sworn they’d never touch.

Believe it or not, that may be a good thing.

From pizza payment to digital gold

It wasn’t always this way. A decade ago, Bitcoin was a niche digital currency that was used to buy pizza. Then, the crypto narrative took hold, and investors trickled in based on the allure of decentralization, privacy, and digital money.

Fast forward a few years (and a few thousand percent in gains), and it’s now being considered “digital gold” and an investment that sits on the higher end of the risk spectrum. Some even wonder if Bitcoin is the new world order for money.

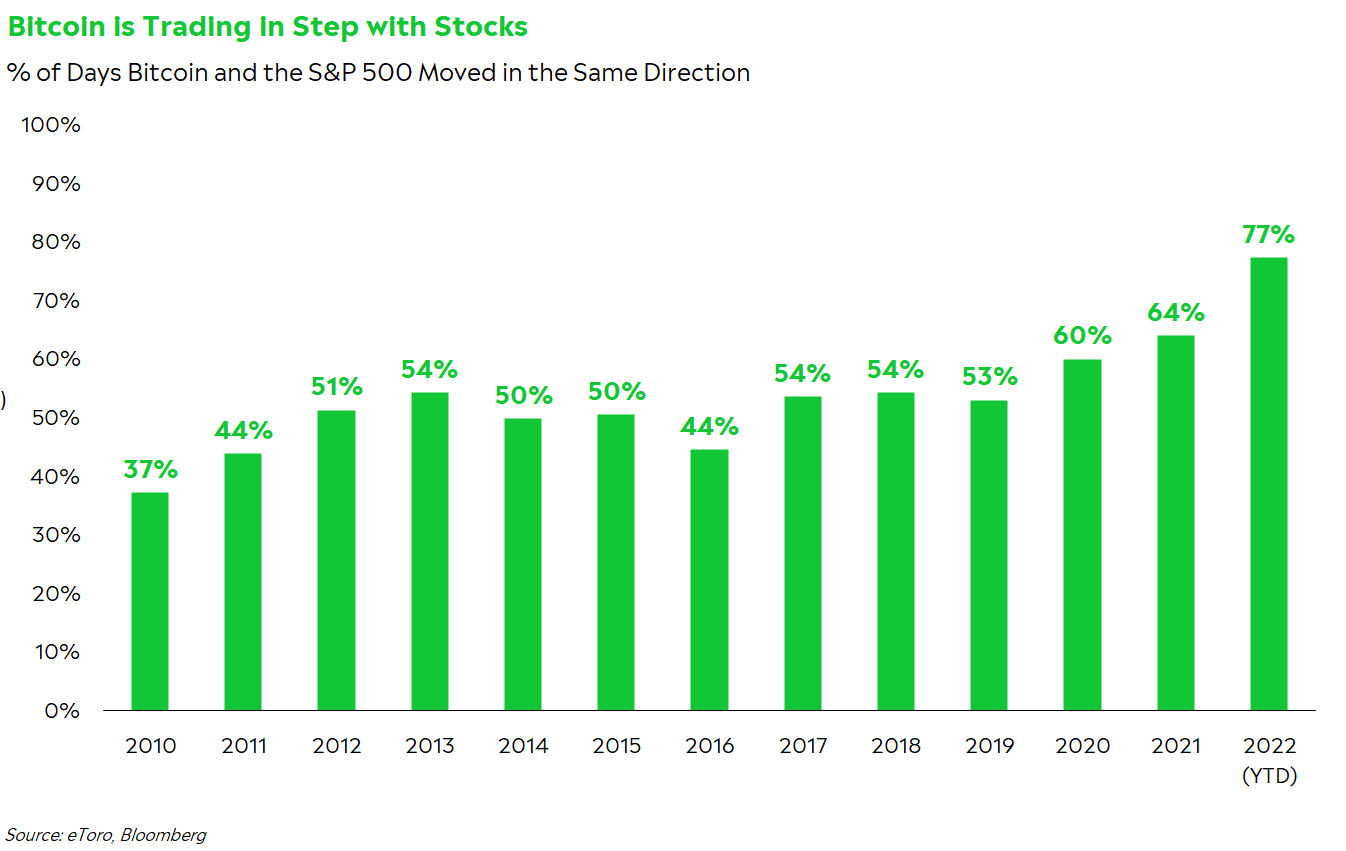

For what it’s worth, Bitcoin is acting a lot like the stock market right now, and the ties between Bitcoin and the S&P 500 have never been this high. In fact, the S&P 500 and Bitcoin have moved in the same direction in 77% of trading days this year, the highest correlation since my data started in 2010.

Bitcoin is finally reaching the masses, too. Bloomberg Intelligence estimates that 52% of institutions held crypto positions in 2021, up from 33% in 2019. About 10% of investors ages 55 and older own Bitcoin, according to a survey of 1,000 retail investors that eToro conducted in March. The data also shows that in the 18-34 group, more investors own crypto than US stocks. Investors now have a litany of new choices for trading and investing in Bitcoin. The first-ever US-based ETF tracking Bitcoin futures launched in October, a big development for those who want to include crypto in retirement accounts with less hassle.

Bitcoin may be losing its edge as the radical neo-currency it once was. But before we demonize Bitcoin’s metamorphosis into an investment your parents have infiltrated, remember the benefits of broad acceptance. Every market has its blue chips. While Bitcoin is still a high-risk investment, more money could help stabilize the price and attract more skeptical investors into the space. Bitcoin is becoming a well-known gateway into crypto and blockchain technology. And the inclusionary aspect of crypto is a rare (and welcoming) trait for a financial product.

Most importantly, more money could mean more power. Bitcoin may have gone mainstream, but it’s also forced more people to take crypto’s values seriously. Establish your voice, and you’ll be heard when you talk about decentralization.

What’s next?

So where’s the edge, if you will?

For one, Bitcoin is still a high-risk investment. Since 2010, it’s gone through a bear market every six months, on average. And it’s about 35% from its November highs at the moment. It still has some growing to do in order to find its identity as a stable investment vehicle or an established currency.

I talked to Anna Stone, Director of Growth NFTs and CSR at eToro, on the evolution in Bitcoin, and where the narrative may be heading now:

Bitcoin was once the spiritual soul of crypto, the center of conversation and innovation. Today, that conversation has shifted to other areas, like the potential for decentralization to empower smaller creators and artists. NFTs (non-fungible tokens) are largely built on the Ethereum blockchain, for example, and web3 is grabbing venture capital attention.

The next step for Bitcoin may be in applications as the asset matures. It’ll be interesting to see Bitcoin’s uptake in emerging markets as a currency and an investment, as we watch places like El Salvador. Bitcoin emerged as a powerful enabler in quickly bringing funds into Ukraine. And there’s still building in Bitcoin — think NFTs and mobile-first payment solutions layered on the Bitcoin blockchain. Institutions may lean more into Bitcoin yield farming, especially in such a yield-starved world.

There may still be innovation in Bitcoin. You just have to look for it.

The narrative shifts

Bitcoin is going mainstream, but it’s a trend to be embraced. The crypto market is growing up, yet it’s still a fairly young market. If you’re looking for innovation, you may need to think more about Bitcoin (and other token) projects, not Bitcoin itself.

And whatever you invest in, always consider your goals, needs, and risk tolerances. Don’t get too caught up in the hype cycle of chasing the hottest trends.

*Data sourced through Bloomberg. Can be made available upon request.