The Fed moved fast, and it broke some things.

That’s the best way to sum up what’s happening with banks right now.

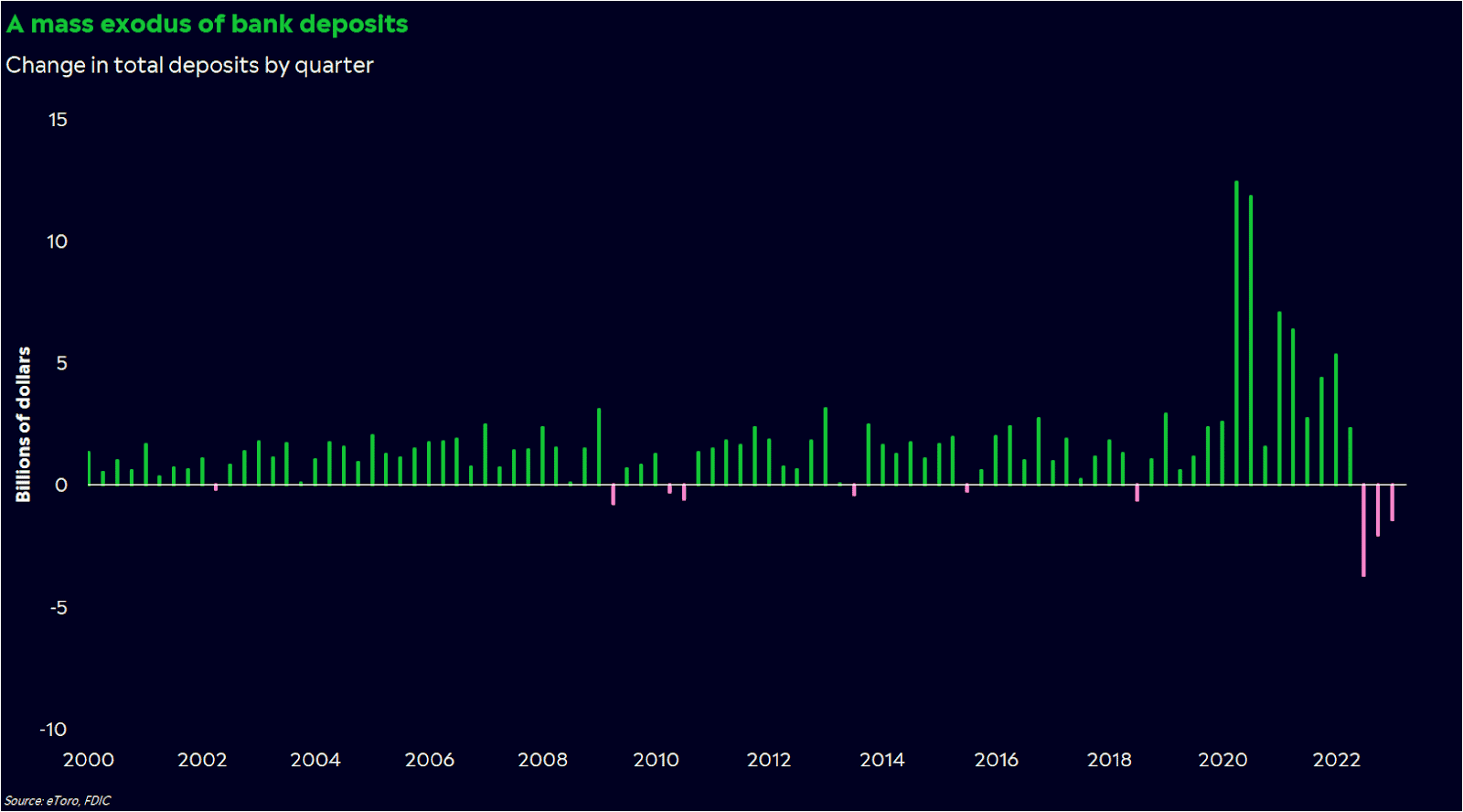

The Fed’s efforts to reduce inflation have boosted rates from zero to almost 5% in about a year, prompting a mass exodus of deposits from the banking sector in search of higher rates. That, in turn, has set off a nasty chain reaction among smaller banks. Many of them are losing capital and can’t use their investment portfolios to make up the difference because higher rates have pummeled their bond holdings.

It’s a mess, that’s for sure.

But is it another crisis, or a case of déjà vu?

The good news

This doesn’t look like the beginning of an economic meltdown. Let’s get one thing straight: It doesn’t seem to be a condemnation of the economy’s strength. There is a massive difference between today and 2008.

Banks mainly fail for two reasons: bad loans or funding issues. The former is what caused the financial crisis— people couldn’t pay their mortgages, and the losses cascaded through the system. Right now, the problem is the latter. Rates have changed so much that banks have had trouble keeping deposits and managing their investment portfolios.

The financial system doesn’t seem to be poisoned, either. Far from it, actually. Loan-to-deposit ratios, which gauge a bank’s ability to cover withdrawals and loan losses, are near the industry’s lowest since at least the 1980s. Credit risk, or the chance that borrowers can’t repay their debts, isn’t flaring up. Bank profitability is healthy, and the industry is historically durable.

The inflation situation. Inflation is still way too high, and controlling it is the Fed’s top priority. But in a weird way, banking woes could help the Fed’s efforts. Worries about the financial system could force an air of caution on consumers and businesses. Of course, these issues could be enough to tip us into recession, which isn’t anything to cheer about. But in the best-case scenario, it could help ease the Fed’s pressure on the economy at just the right time.

The bad news

The chasm between big and small banks. This may not be a story about the entire banking sector, but it could be a sign of the times for smaller banks with concentrated customer bases.

It all goes back to how banks operate. Banks make a profit by taking deposits from customers and lending them back out at a higher rate. That’s been a tough proposition post-financial crisis with rates near zero across short- and long-term maturities.

Bigger banks have adapted to this by growing other business lines, but many smaller banks haven’t had that luxury. The result? A growing chasm between the too-big-to-fail banks and the rest of the industry —, one that could break open with the deposit outflows we’ve seen recently.

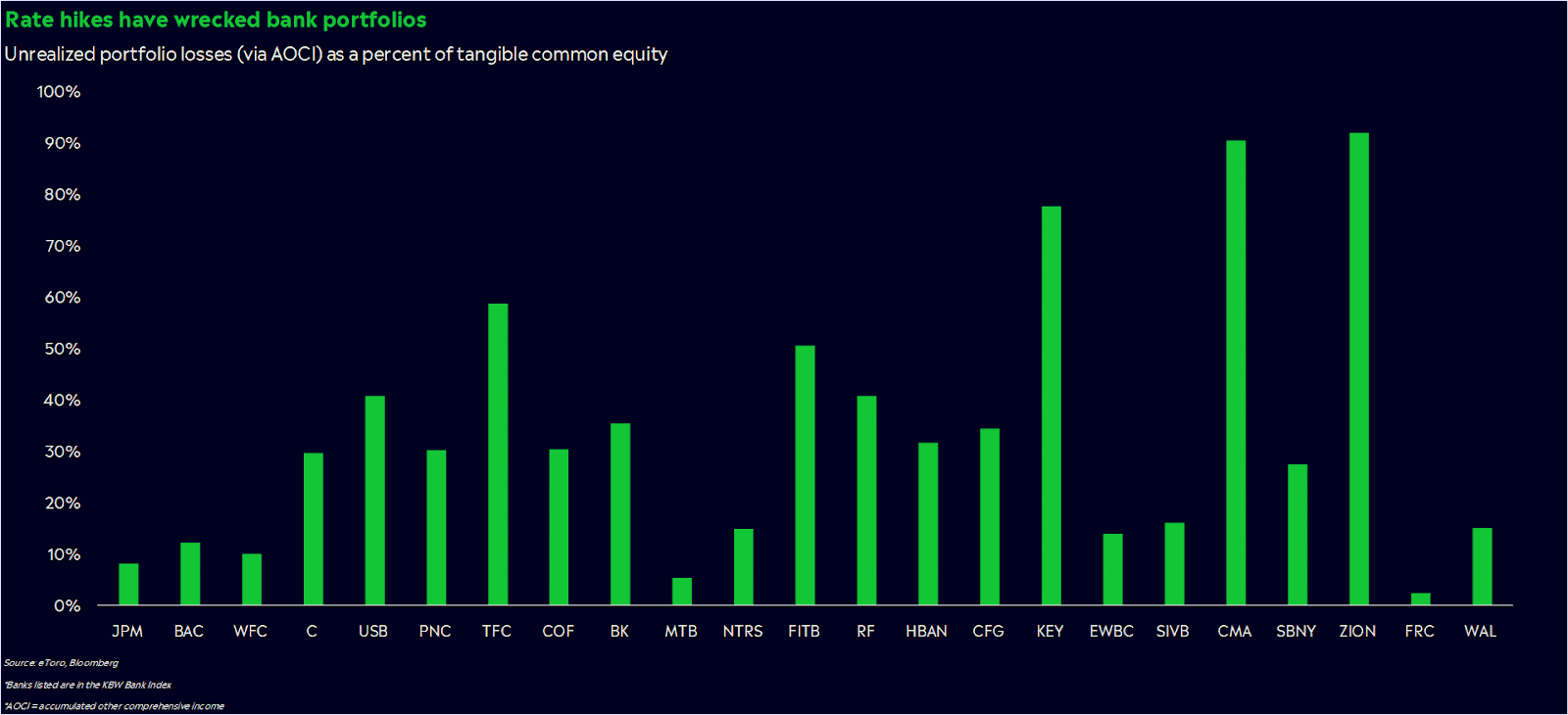

Rate hikes have pummeled bank portfolios. Yes, many banks invest for growth and income just like you — but they focus on long-dated bonds. As rates have risen, banks’ investment portfolios have dropped, cutting into their equity.

Smaller banks have also increased the amount of held-to-maturity bonds they own, and accounting rules don’t require them to disclose the full losses on that part of their portfolio. At the end of 2022, held-to-maturity securities made up 60% of banks’ portfolios, much higher than the 39% at the end of 2020. There could be more carnage than we realize underneath the surface, and that may be why the Fed rushed to offer emergency funding.

Ultimately, this was what took Silicon Valley Bank down — deposits left quickly, and SVB couldn’t rely on its portfolio to cover all of the lost capital. Other banks could be in a similar spot.

Small banks matter. You may hear a lot about the JPMorgans and Goldman Sachs of the world, but small banks matter a lot to the economy and Americans’ well-being. Many mid- and small-sized banks service small businesses and local communities. What’s happening in national headlines right now could eventually be felt locally through tighter lending standards and lost jobs.

Markets have the power to manifest problems. To me, this is the biggest wild card of today’s situation. Fear can spread like wildfire these days, even if it’s misplaced. And the main risk here seems to be bank runs, which can be spurred by public perception. Hopefully, the Fed’s $25 billion funding facility will help protect against this, but it could face its own issues of public perception — like banks not using it, because they fear it’ll send a message.

What happens next?

Is this 2008 all over again? Probably not, even though it could include more harrowing headlines and a wave of bank M&A.

But ultimately, nobody knows how this situation will unfold. Not even the smartest analysts and influencers, despite all the confident takes on social media.

The banking system touches many areas of our lives, from our own money to the money of the companies that employ us and the economic stability of those companies. It’s hard to know how far the cracks will spread. The Fed seems willing to protect depositors, but there’s no guarantee that bank stock investors will make their money back.

We can’t say we saw this coming. But it does look a lot like a scenario we’ve warned about — rising rates tightening the screws on smaller businesses with weaker balance sheets.

If you’re an investor heavily involved in tech, financials, or real estate, your focus on quality is more important than ever. Know how your companies make money and what their balance sheet risks are. And don’t be afraid to hedge, especially if it helps you sleep at night.

*Data sourced through Bloomberg. Can be made available upon request.