Isaac Newton taught us that an object in motion stays in motion — unless an external force comes in to stop it.

That seemed like the best way to explain what’s going on in the stock market. Things were getting better so share prices were rising, and rising share prices made it seem like things were getting better.

(If that’s how you see the world, you’re a momentum investor — or somebody who buys stocks simply because they’re on a roll.)

And chances are, you’ve had a pretty easygoing summer.

Until now.

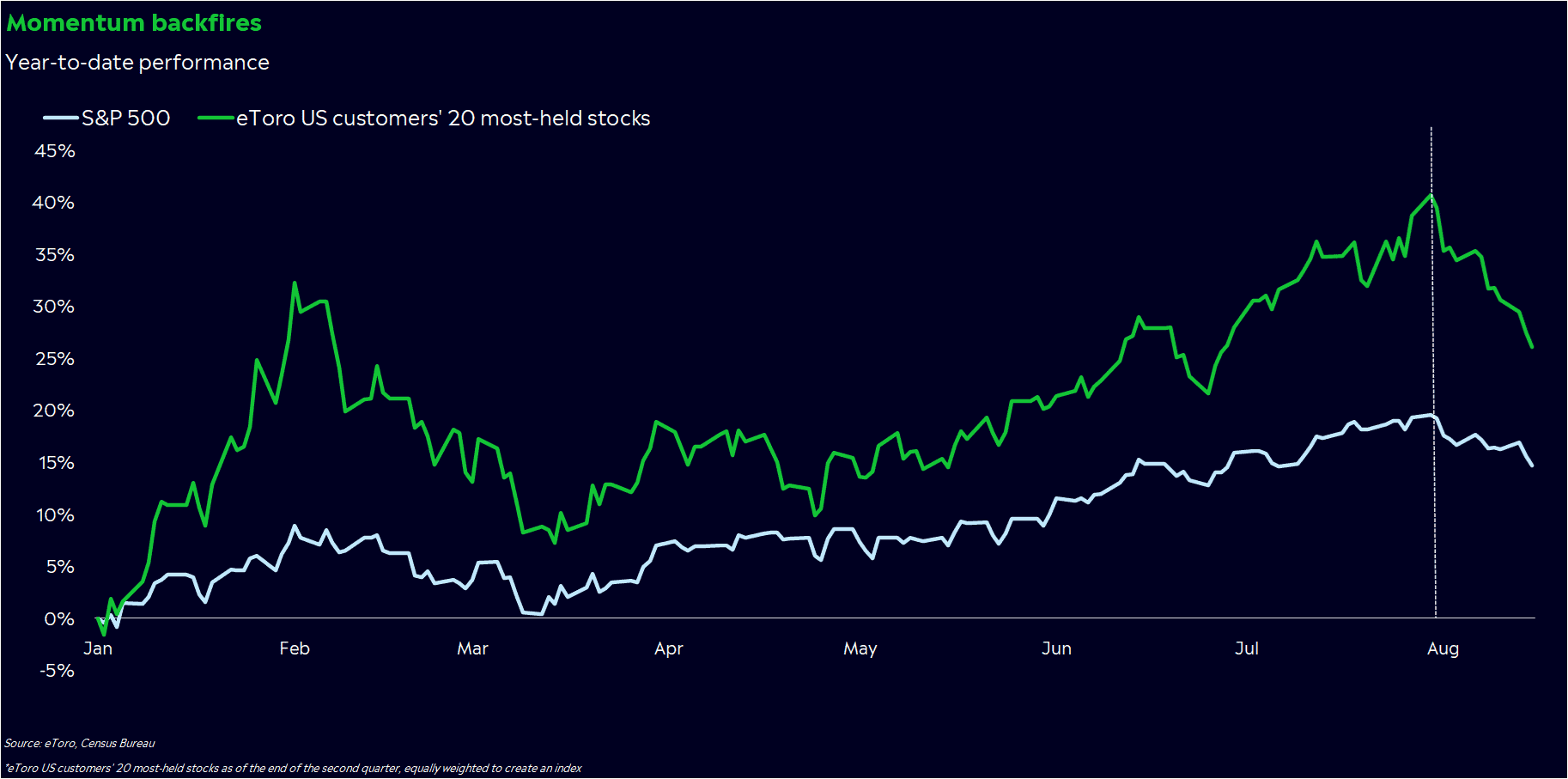

Momentum backfires

This summer’s stock market has been kind to many of us.

If you bought an S&P 500 fund then escaped to the beach on Memorial Day, you’re coming back to a portfolio up 4% over three months. Not too shabby.

Even if you stuck around to invest instead of heading out on vacation, it hasn’t been a particularly painful few months either. The S&P 500 has only dropped 1% or more on two days this summer — a breezy boat ride compared to the five 1% drops we’ve seen during the summer over the past 10 years.

It feels like a classic bull market out there — consistently rising prices caused by a wave of investors getting more optimistic about the future.

This may seem like the dream scenario for momentum investors. Buy the market when it’s moved higher this year, and for the most part, you’ve been rewarded.

But for some of you, the momentum has backfired.

The S&P 500 is mired in a 5% selloff, but your portfolio may be hurting a lot more than that. In fact, if you’re invested in eToro US customers’ 20 most-held stocks, you’re down 11% this month.

An odd-looking bull market

August has taught us a painful — but valuable — lesson. Newton’s law doesn’t apply to every stock. Just because we’re in a bull market doesn’t mean the entire market will rally.

This is especially true in this particular bull market.

Take a look at returns since the October lows and you’ll see what I mean. Only 62% of stocks in the wide-ranging Russell 3000 Index are up since October 14, even though the index itself has climbed 23%.

Half of all financial firms in the Russell 3000 have dropped since October — likely a casualty of the banking scare earlier this year. Just three-quarters of tech stocks are up over the same period, which is shocking given how hot the tech industry has been this year.

Look at company sizes and you’ll notice another trend, too. About 67% of the stocks that are down over the past 10 months are below the median market cap for the Russell 3000. Smaller companies are suffering more than their larger counterparts.

This bull market may be working for big-picture investors buying into funds, but it’s still crushing the in-the-weeds investor who’s picking stocks.

I think you can chalk the uneven market momentum up to one main culprit: high interest rates. There’s less money floating around in the system, and people are being more selective about where they put it. Now that the 10-year yield is above 4% again and the Federal Reserve is still worried about inflation, we’re seeing people favor more reliable, sturdy stocks.

I’m not pointing this out to scare anyone. Some analysts have pointed to bad market breadth — or the amount of stocks going up versus down — as a reason to feel worried about the future. I don’t think that’s a major concern, as I wrote in June.

But if you’re picking stocks on momentum alone, I’d be careful as we head into the fall.

So what does this mean for me?

Think broadly. A bull market is a psychological shift that’s often reflected best in the broader market. Individual stocks tend to deal with bigger swings and more risks. If you truly want to invest in the bull, you may want to look at a basket of stocks instead of your favorite names.

Be picky. Just because we’re in a bull market doesn’t mean your portfolio’s stocks will reflect that. You still need to be picky about profitability and durability, especially in this high-rate environment.

Stay agile. Selloffs can still happen in bull markets. In fact, the S&P 500 has gone through a 5% drop — close to what we’ve seen over the past few days — in the first year of every bull market since 1950. Don’t let the bull lull you into a false sense of security.

*Data sourced through Bloomberg. Can be made available upon request.