2022 has been the year of boring.

Not boring for markets, as scary headlines and Fed rate hikes have taken stocks and crypto on a bumpy ride. Instead, there’s a newfound appreciation for boring investing strategies. The stuff that doesn’t give you bragging rights with your friends, but may offer the consistency you crave during these wild times.

Over the past two years, we’ve glorified exciting investments. Growth stocks have bloomed, hot startups have gone public, and new crypto assets have burst onto the scene. But now, as bears lurk in the periphery, it may be a signal from the market gods to get back to basics: the boring-yet-steady strategies that may help you keep your cool while everybody else is losing theirs.

Searching for value

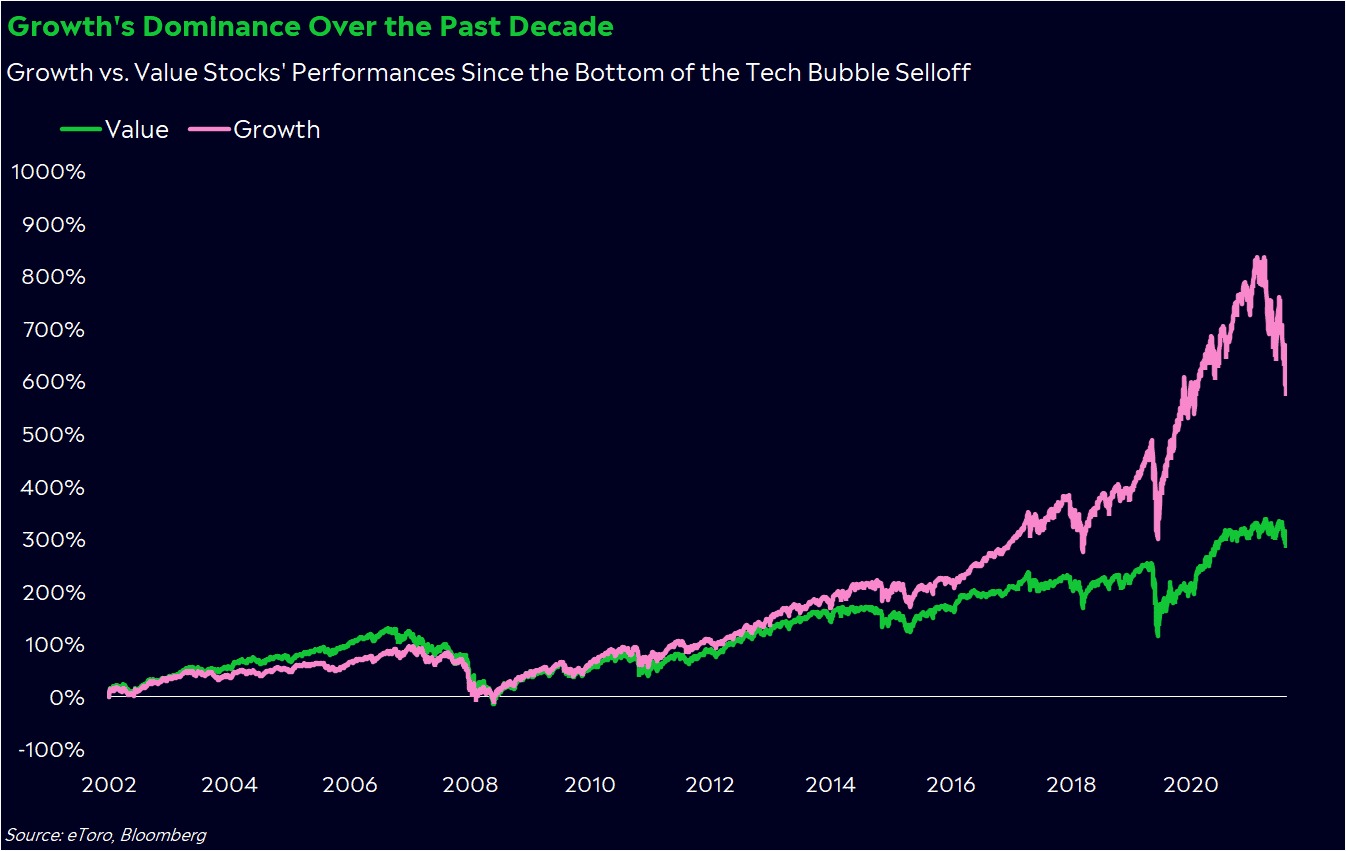

Most stocks are getting crushed this year. But when you dig into sectors, you’ll see a big difference between exciting growth stocks and boring value stocks. The Russell 3000 Value Index has dropped just 10% this year, compared to the Russell 3000 Growth Index’s nearly 27% slide.

What does that mean? Take a look at the S&P 500’s best performers this year. Outside of energy stocks ― which have blown other sectors out of the water ― the top three performing S&P 500 stocks year-to-date have been a potash miner (Mosaic), a fertilizer manufacturer (CF Industries), and a medical supplies producer (McKesson). S&P 500 utilities companies and food, beverage, and tobacco manufacturers are flat on the year. We call these value stocks, which are companies whose shares trade closest to the value they provide today, be it profits, cash flows, or dividends.

Companies with dull business strategies may not be the growth superstars Wall Street has glorified in the past, but they’re often the most reliable products when the economy is in question. We still need power for our homes and food on our dinner tables, regardless of growth or inflation. Right now, investors want some market comfort food in the form of businesses that are delivering on earnings and trading at attractive prices. Value stocks may be seen as a double insurance policy at a time of falling valuations and slowing profits.

Growth has dominated for most of the past decade. However, in times when economic growth has been hard to find, value stocks have stepped up. Growth stocks didn’t catch up to value for several years after the tech bubble burst. Tech and other exciting sectors may have a promising future, but today’s economic environment may uncover beauty in the mundane.

Collecting dividends

Inflation is high, and it’s eating away at the value of your cash ― hence the argument for investing in an inflationary environment.

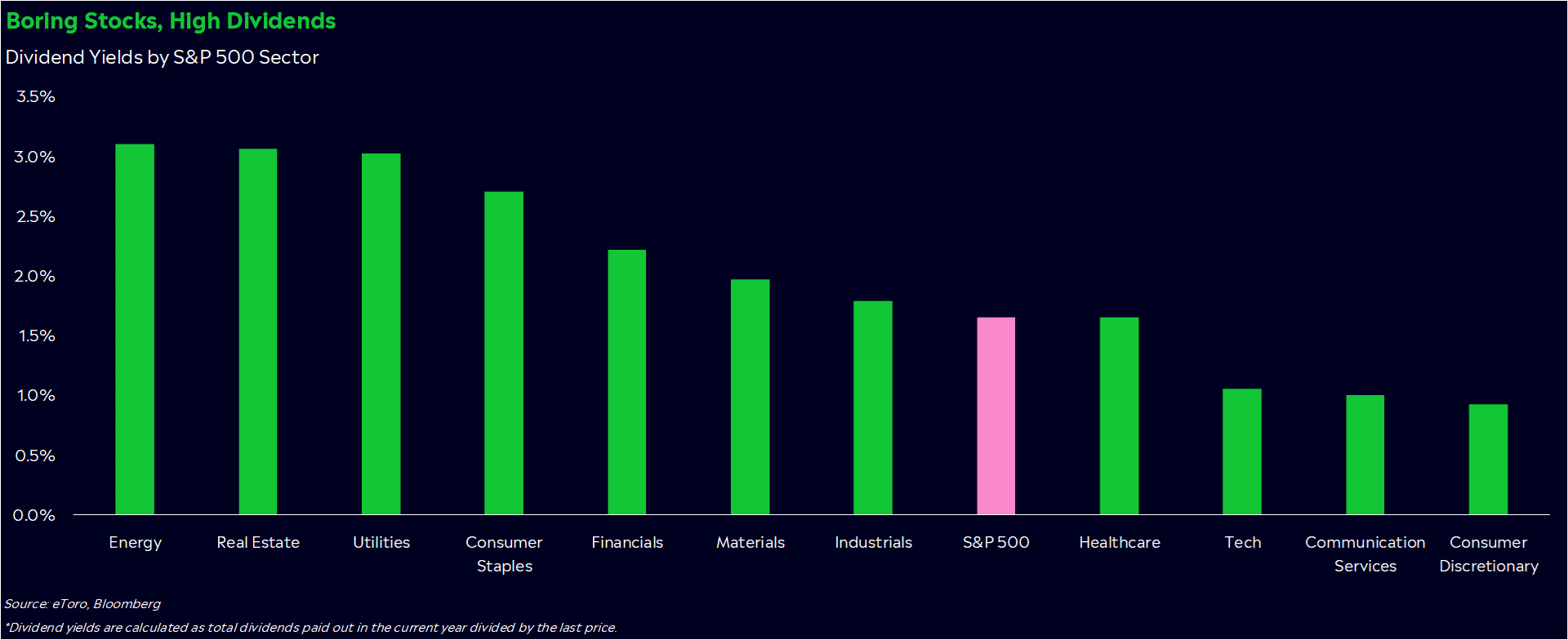

Let’s take this a step further. Inflation can progressively reduce future earnings as time increases, so it may be extra important now to prioritize quick cash flows over growth potential. Enter dividend stocks. They’re not the sexiest ― think toilet paper producers, power companies, food distributors ― but their dividends may provide some near-term income without having to wait and risk the snowballing impact of inflation. And if you re-invest those dividends, history shows it could add up over time. If you invested in a hypothetical S&P 500 fund 20 years ago and reinvested your dividends, you would’ve gained about 427% through Wednesday, compared to a 255% gain without dividends.

Dividend producers are holding up well in this environment. Many of them are actually value stocks with cheaper prices relative to earnings. The “dividend aristocrats” ― a group of S&P 500 stocks that have paid and increased their dividends for at least the past 25 years ― are down 11% this year, compared to the S&P’s 18% drop. It makes sense: if you’ve boosted your dividend each year for over two decades, you’ve probably had some solid financial performance over the booms and busts.

Right now, energy, real estate and utilities are paying out the highest dividends relative to their share prices, according to Bloomberg estimates.

Dollar-cost averaging

Investing isn’t the easiest task when markets are falling. It’s difficult to see the other side when prices drop like they have over the past few months.

Let’s rewind the clock a few months, when markets felt a lot more manageable. Last year, you may have felt more confident about buying the dip. Big drops don’t happen often and when they do, they typically unlock opportunities that you rarely see again. Look at any chart of the stock market over time and you’ll see this. You can capitalize on the moment… IF you’re able to keep your head on straight during wild swings. That’s a big if.

Enter the quintessential boring strategy: dollar-cost averaging, where you invest based on your own calendar instead of the market’s every move. Basically, you toss a set amount of money into your portfolio on a set schedule, like every two weeks or month, in hopes of “averaging” out your entry points. Since the dollar amount you’re investing doesn’t change, you’ll naturally buy more shares at lower prices and fewer shares at higher prices. It’s a wise approach if your emotions are getting the best of you.

Nobody brags to their Tinder dates about their dollar-cost averaging approach. But in crazy times, automating your investments may keep you from overthinking or bailing out when gains may be just around the corner.

Being boring

We tend to idolize investors who hit it big on a savvy stock pick. But for many of us, success depends on our mental strength. You have to tame your emotions and stick to your plan even when stocks are falling. That sounds easy until you face a market like the one we’re grappling with today.

In most cases, you don’t need to hit a home run to reach your goals. Boring returns over a long-enough time period can be enough for you, especially if you lean into the power of compounding. Ultimately, you have different wants, needs, goals, and money constraints compared to everybody else, so build the portfolio that works best for you.

*Data sourced through Bloomberg. Can be made available upon request.