Barbie and Oppenheimer just came out in theaters.

But they’ve both been a hit in portfolios for a few months now.

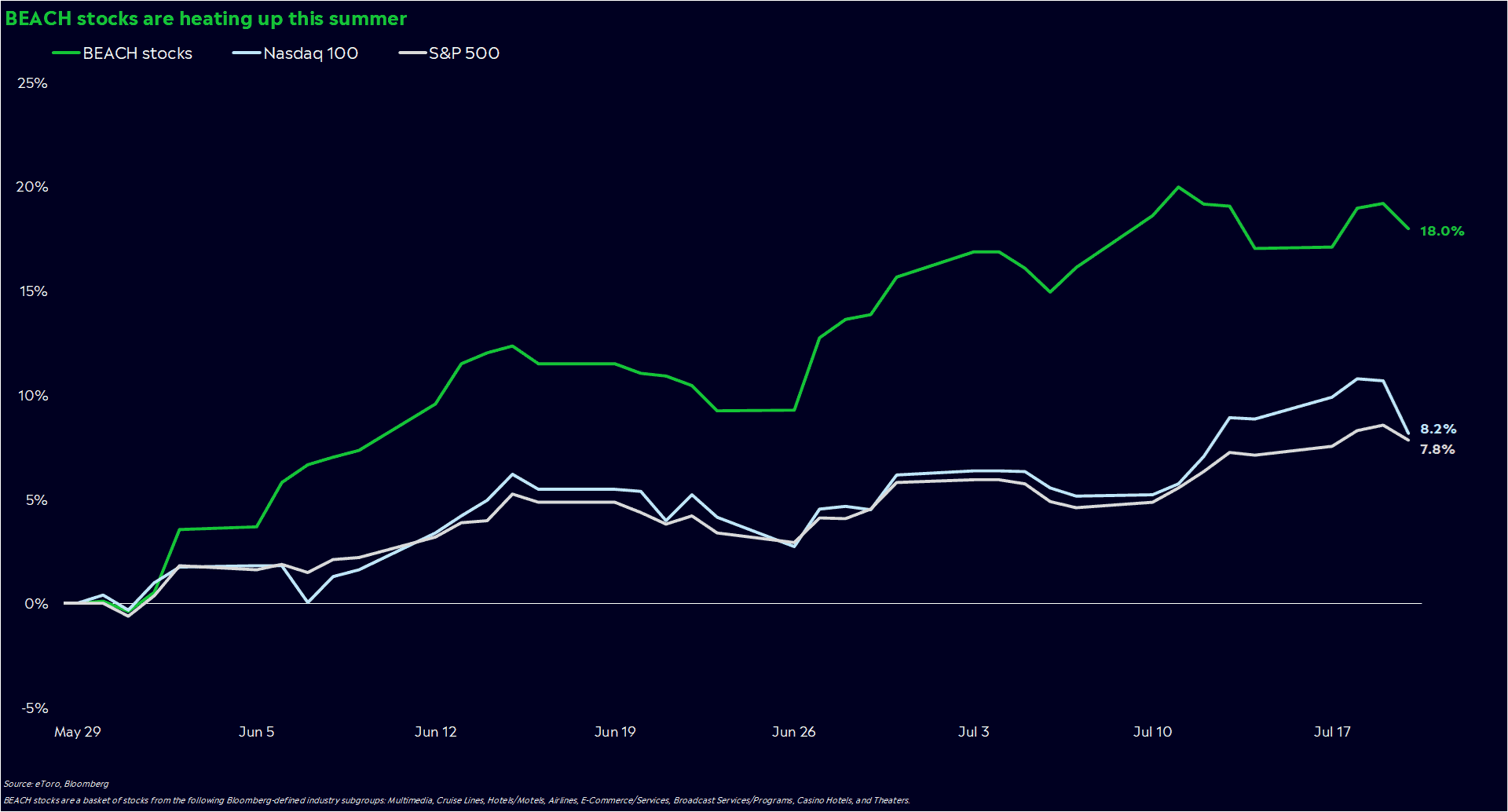

BEACH (booking, entertainment, airlines, cruise, and hotel) stocks have been the story of the stock market this summer, buoyed by an unexpectedly busy season for travel and experiences. A basket of stocks from these five industries has risen 19% since Memorial Day, outpacing both the Nasdaq and S&P 500 by a wide margin.

We’ve talked a lot lately about how Americans are still spending money, especially on experiences — despite all the angst over a recession in the stock market.

Now, investors are catching on to what consumers have known for a while: the hot vax summer is in its third act.

A turning point in expectations

We’ll explore the BEACH trade — and its pros and cons — this week.

But first, an important question: Are you seeing Barbie or Oppenheimer? Or are you one of those movie buffs going for the double feature on opening day?

I’m planning to see both — but not on opening day, because I’m not fighting the crowds for a good seat.

No matter your answer, the fact that so many people are asking this question is another reminder of the gap between what we see in real life and how we’re investing our money.

For a while, inflation and higher rates caused fears of a recession to spread. And in response, investors fed into defensive, economically resistant stocks. Travel and leisure stocks are largely what we’d call “cyclical” stocks — names that tend to do well when the economy is expected to do well. So in the thick of recession worries, the BEACH stocks lagged for the first five months of the year.

June seemed to be a turning point, though. Paycheck growth is outpacing price growth again, and consumer confidence hit its highest level in a year and a half. At the same time, we learned that companies are still hiring at a moderate pace. The data was getting better — not exactly what you’d expect during an economic downturn.

So investors started re-adjusting their portfolios, and the BEACH stocks rocketed 16% higher in June —– a noticeably strong rally compared to the S&P 500’s 6% gain.

The pros and cons

The BEACH stocks’ success makes sense if you remember that everything is relative on Wall Street.

Many of us thought we’d be in a recession by now, and the banking scare of March intensified those fears. Now, we’re all re-calibrating our expectations — and our portfolios — for a brighter future ahead.

But has the BEACH stocks’ ship sailed? Possibly.

The stock market is near record highs, and the economy seems to be humming along. Yet things still feel tenuous with rates so high. Here’s what you should consider:

Spending could boost profits. Global tourism activity is expected to increase 23% this year, the third straight year of 20%+ growth, according to World Travel & Tourism Council estimates. Airlines’ passenger revenues are also forecast to grow 27% in 2023, with US air travel climbing back to pre-COVID levels.

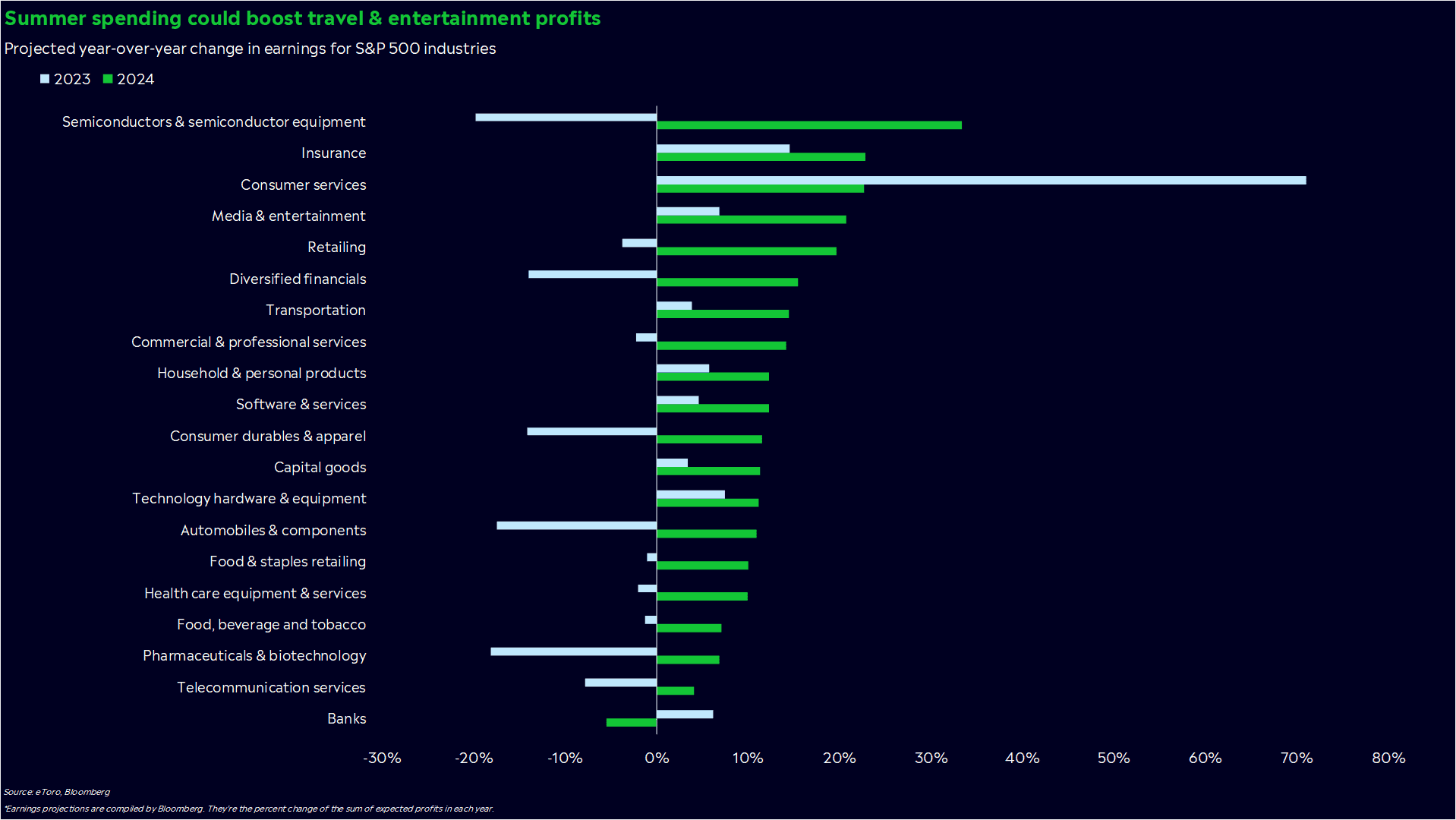

That growth could show up in companies’ bottom lines, too. Profits for S&P 500 consumer services stocks – think hotels, restaurants, and hospitality – could grow 23% next year, while media and entertainment businesses earnings could increase 21% (according to Bloomberg estimates). Earnings expectations are brightening for next year, and BEACH stocks are leading the charge.

Growth often comes at a cost. The insane demand we’ve seen for experiences over the past few summers could help profits. But it’s also pushed service industry workers to the brink.

Strikes are popping up in travel and entertainment, like what we’ve seen among writers, actors, and airline pilots. We’re all for people getting paid what they’re worth. But strikes could snarl the capacity for new movies and more flights, potentially hampering those lofty profit expectations for 2024. At the very least, they could cause enough uncertainty to weigh on the BEACH stocks.

Does spending actually get better from here? The Federal Reserve is still determined to get inflation back down to 2%, and that could mean that rates stay around these levels until something breaks. The pressure is on, so it’s hard to see consumer spending getting much better than this, especially with other obstacles on the horizon like student loan payments restarting.

So what does this mean for me?

Pay attention to the data. Jobs and earnings data have painted a stronger picture of the economy than other survey-based indicators like confidence. Don’t lean on your emotions too much when it comes to your portfolio. So far, our recession fears have misled us.

Tread carefully. Ultimately, nobody knows what happens next with BEACH stocks — or any other trade, for that matter. But now that the S&P 500 is within 5% of a record high, it could be smart to tread carefully, especially with a Fed meeting on tap for next week.

Act tactically. Investing isn’t black or white — or more appropriately, buy or sell. You can be optimistic about one area of the market while being pessimistic about another. When the future is getting better but the trend is unclear, it may be time to look for opportunity while preparing for a recession on the side.

*Data sourced through Bloomberg. Can be made available upon request.