For a while, it was awfully quiet out there.

Too quiet.

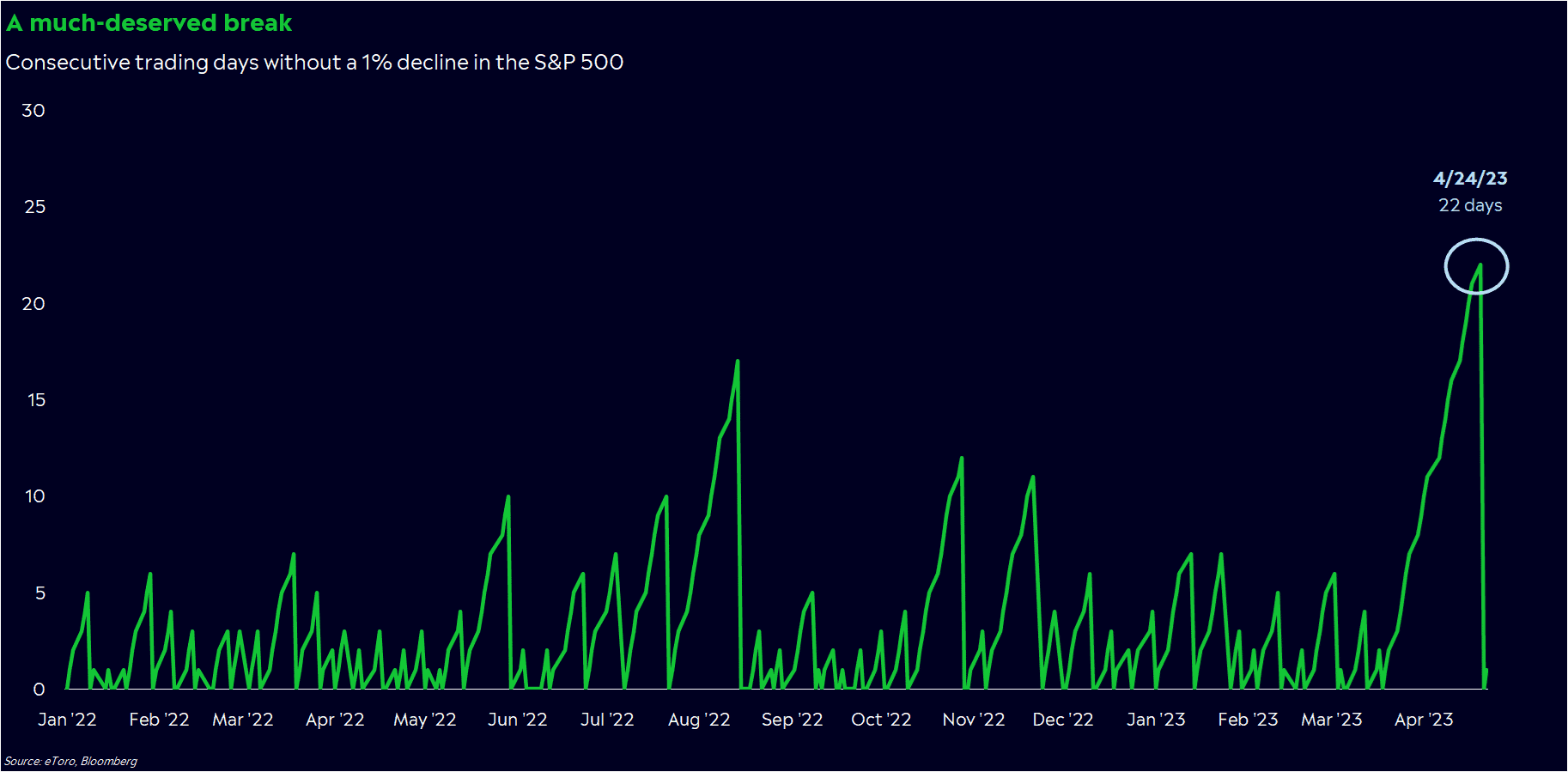

The S&P 500 just went a whole month without a 1% drop for the first time since the bear market began. And the VIX “fear index” of the stock market is near its lowest level in 17 months, indicating that investors expect the calm to continue.

We’re all getting a much-deserved break from the craziness.

But there’s also a chance we may be falling asleep at the wheel.

A lack of urgency

If you had to use one word to describe your market emotions over the past year, what would it be?If you’re like many other investors, you’d probably say something along the lines of fear and uncertainty (or a few words I can’t put in print). We just endured a vicious bear market that included historic inflation, supply shortages, international conflict, global health fears and a few financial system scares.

Are you exhausted yet? Because I sure am.

But unfortunately, it may not be time to breathe easy just yet – even though it’s tempting to take a nap when the stock market has been unusually quiet.

Things still aren’t going great from a fundamental perspective. Recession risks seem to be climbing by the day, and job market data is starting to deteriorate. Last week, we saw an index of leading economic indicators fall for the 12th straight month. The weakness that plagued certain sectors last year seems to be spreading.

This in itself is a good reason to stay vigilant. But as conditions worsen, it’s becoming apparent that people are starting to suffer from emotional fatigue — at least when it comes to their portfolios. Not only have daily swings calmed down, but hedging has as well.

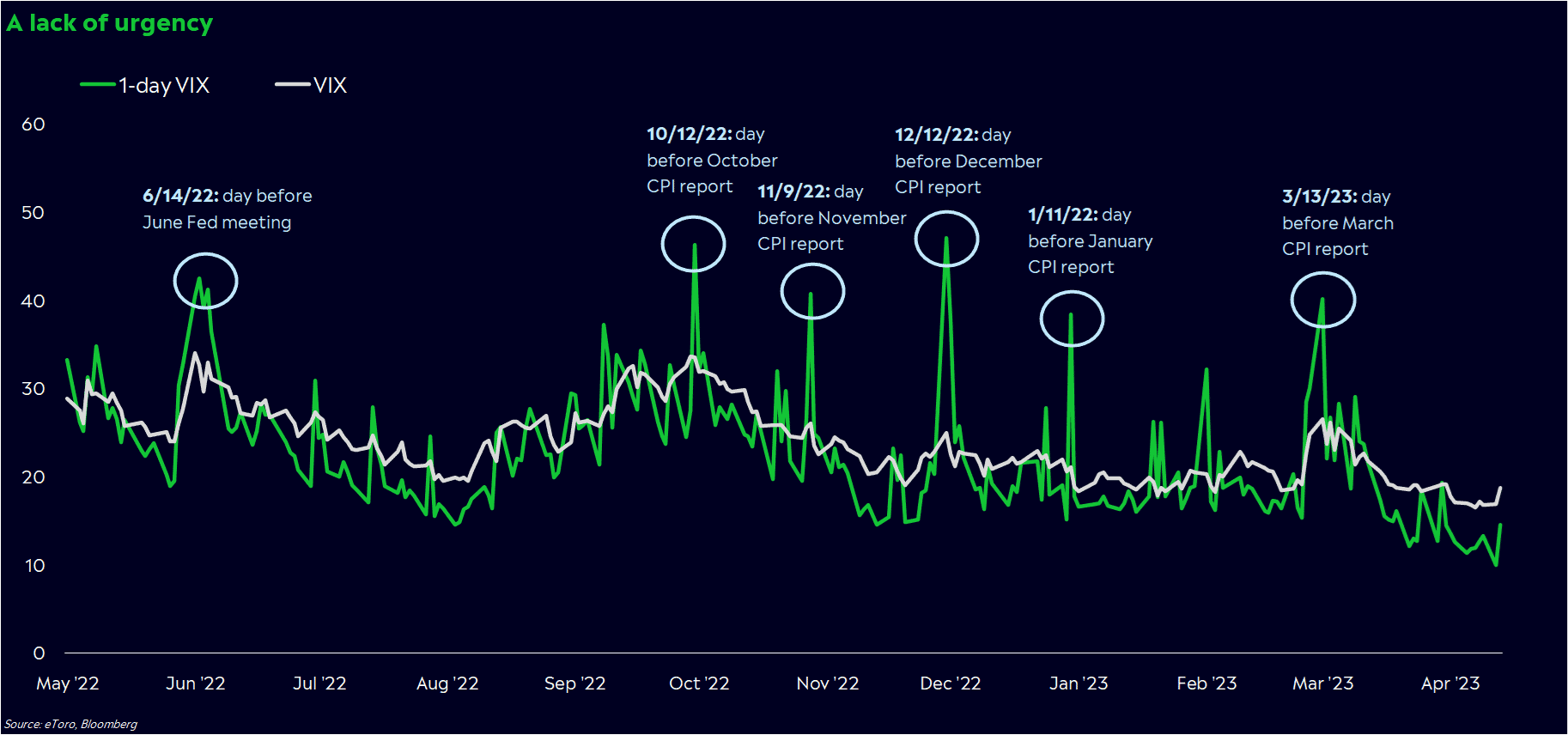

Last October, I wrote about how the VIX — a measure of supply and demand for S&P 500 options over the next month — wasn’t accurately reflecting how nervous investors actually were.

Part of the story was simply about how the options market had changed over the past few years. Instead of trading monthly options, investors have switched to using daily and weekly options — demand that isn’t captured as well by the VIX. But you could see it in other indicators, like a short-term version of the VIX and options volume surges around economic data releases.

Today, signs of fear are much harder to come by. Short-term options hedging has died down, especially around big data days. On the day before April’s CPI report was released, the one-day and nine-day VIX gauges were around the lowest they’ve been preceding a CPI day, indicating that the market has become less worried about inflation data.

Some of this is understandable: inflation has slowed for nine straight months, so investors are less worried about a nasty surprise.

But the lack of urgency — and preparation — around these reports seems abnormally low.

The debt ceiling storm

So why do I care so much about fear — or the lack thereof?

Fear is an uncomfortable feeling, but I think it’s actually helped keep us afloat for much of the bear market.

Think about it this way. If you knew somebody was going to punch you in the stomach, it’d likely hurt less than if you’re expecting it. Why? Because you’d be braced for the blow.Fear works the same way in markets. If more people expect bad things to happen — i.e., they brace for the punch — the actual punch could hurt less versus a surprise jab in the gut. Last year, both professional and retail investors were historically bearish for months. They were braced, and that helped cushion the blow.

Now, investors seem to be turning more complacent, lulled to sleep by a market rally that’s now six months old. And while long stretches of gains like these rarely happen in bear markets, they’re not unprecedented. In late 2001, the S&P 500 rallied for nine months after a 37% decline, then turned around and fell to a fresh low.

There may be some storms popping up on the horizon, too. One I’m keeping a close eye on is the debt ceiling debate. Bond markets are already starting to prepare for a close call, with 3-month yields climbing to the highest point on record versus one-month yields. Gold prices have also been on a tear, rising more than 10% since the beginning of April. Time is winding down for a deal, with the Fed’s checking account rapidly diminishing.

To be clear, investors aren’t completely aloof. Other data backs this up, too. Wall Street portfolio managers are the most pessimistic on stocks relative to bonds since 2009, according to Bank of America data. Retail investors are also relatively cautious, with the percent of bears in the American Association of Individual Investors survey right around the five-year average.

But it does seem like stocks have been slow to digest what could be a serious situation that could eventually exacerbate recession risks, even if Congress agrees on a solution in time.

More sensitive to bad news

Enjoy the quiet while you can, but don’t get too comfortable. Stocks are still fumbling their way through a host of problems, and the lack of fear could make prices more sensitive to bad news.

On the bright side, the VIX is showing us that options prices seem to be especially cheap. So if you’re worried — or feeling opportunistic — it may be more cost-effective to beef up your portfolio with hedges these days.

*Data sourced through Bloomberg. Can be made available upon request.