Hi! Callie Cox here. We’re on the precipice of a historic moment for crypto called the Merge. It could be a big step forward in Ethereum’s operations, and on a broader scale, crypto’s ability to evolve and adapt as an emerging technology.

This week, I invited Anna Stone – director of growth, NFTs & corporate social responsibility at eToro – to write a guest post answering all your burning questions about the Merge.

The Merge is here! The Merge is here!

Ethereum is the second largest crypto asset by market cap — so it’s likely you’ve heard the murmurings.

Why the Merge?

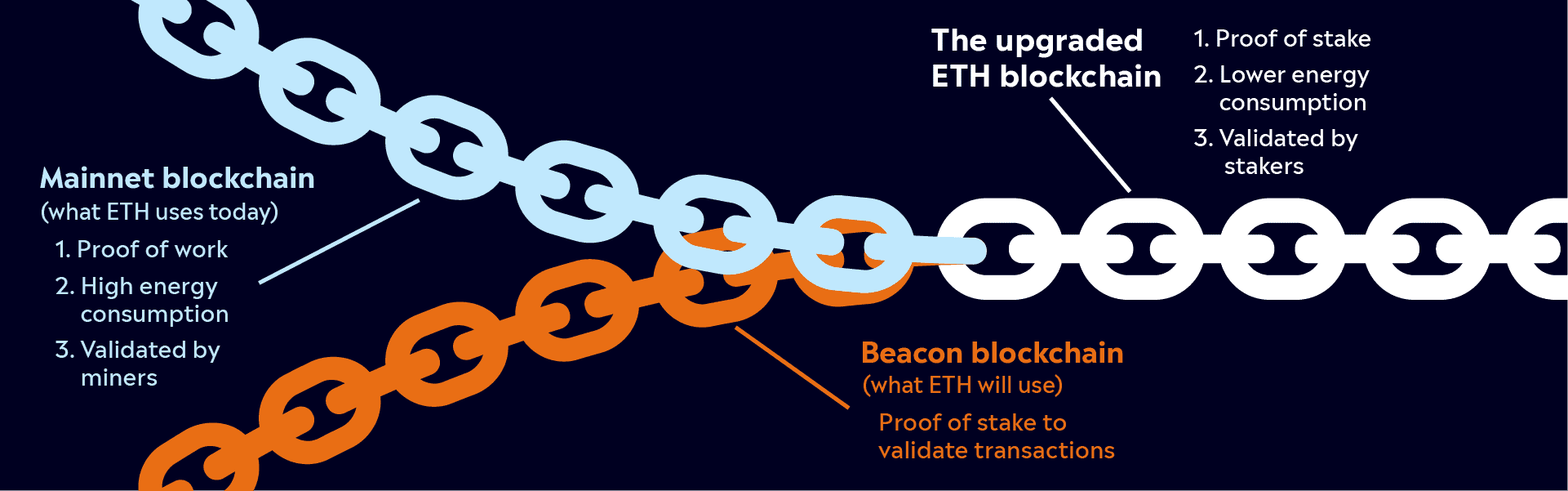

The Merge refers to a major update on the Ethereum blockchain. Today, Ethereum is the largest and most dominant smart contract blockchain, with thousands of applications, spanning DeFi, decentralized autonomous organizations (DAOs), and NFTs operating on it valued in the billions of dollars. The Merge refers to Ethereum’s evolution to a new consensus mechanism: from the consensus mechanism Ethereum uses today, called proof of work (PoW), to a new consensus mechanism called proof of stake (PoS).

What is a “consensus mechanism,” you ask? In short, it’s a blockchain’s way of reaching “agreement” around what qualifies as a legitimate entry or transaction. A consensus mechanism influences how transactions are verified, how much energy is used, network fees, transaction speed, security, and other details for how a blockchain works and its application layer. The Merge will mark the end of proof of work for Ethereum as well as the full transition to proof of stake consensus mechanism.

Why is proof of stake seen as an improvement?

Many in the Ethereum community see the Merge as one of the most exciting events in crypto history and a key upgrade that is critical for Ethereum to evolve to a new phase that enables scalability, security, and sustainability.

From its launch in 2015, Ethereum used a PoW consensus mechanism. PoW is the original consensus mechanism used by the Bitcoin blockchain, in which “consensus” is derived from massive amounts of computing power racing and competing to solve for mathematical proofs, a show of computing “work” that verifies a transaction on the blockchain. As blockchains become more widely adopted, it becomes increasingly competitive, requiring miners to invest in more advanced, state-of-the-art computing technology to “win” the race to prove new blocks. PoW is expensive and uses significant resource overhead to compensate miners for their services (Bitcoin and Ethereum pay out tokens to network miners, respectively). As a result of these higher costs of entry, PoW has relatively fewer parties who can participate in maintaining the security of the blockchain. PoW also uses a tremendous amount of energy — Bitcoin’s energy consumption rivals some countries and has received criticism as being environmentally unfriendly and unsound.

Proof of stake, however, works a bit differently. Instead of running big mining rigs that require the cost of equipment, electricity, and security, the network is validated based on token holders “staking” their tokens into nodes called validators. To be a validator, you just need capital — not hardware and computing expertise like you need to mine Ethereum today. This lowers the investment needed as a network validator, because the investment is the opportunity cost of staked capital. In Ethereum’s transition to PoS, one must stake 32 ETH (approximately $50,000) to become a validator.

Multiple validators validate each transaction, which further contributes to the decentralization of the network. Proof of stake also enables more fine-tuned incentives for validators, enabling good validators to be rewarded, and bad validators to be penalized, therefore further reducing the corruptibility of the network.

Put it all together and Ethereum could undergo several changes as a result of these efficiencies, including a reduction in the rate of ETH issued every year and the number of participants needed to validate the Ethereum network. And most significantly, the Ethereum foundation estimates this will reduce Ethereum’s energy consumption by ~99.5%!

Okay, but why Merge?

With thousands of builders and billions of dollars running on Ethereum, the priority in executing this upgrade was to do so without causing disruption to current activity. The approach is the Merge: a joining of Ethereum’s existing mainnet layer (what we use today) with its new proof of stake consensus layer, the Beacon Chain. Beacon has been in testing for several years now and is an “empty” blockchain that only performs proof of stake.

At the moment of the Merge, the execution layer of Ethereum Mainnet will join and merge with the consensus mechanism of Beacon, thereby completing the upgrade. The Merge won’t occur at a set date or time. Instead, the Merge is completed once block production hits a certain level, which is predicted to occur around September 15-16. This is a major security change, in real time — stay tuned!

What does this mean for Ethereum and its investors?

The transition to PoS is intended to improve Ethereum’s sustainability, security, and scalability, and it’s seen as a major opportunity for its future adoption. It also reflects the largest upgrade produced by a highly coordinated but distributed developer community on an active, public blockchain, to date. And it sets the stage for a number of future upgrades on Ethereum. In short, we’ve never seen anything quite like this in crypto before!

Sustainability: One of the Ethereum blockchain’s biggest critiques — and a big selling point for other base layer chains — has been its massive use of energy, from its PoW structure. PoS could lower Ethereum’s energy usage by a wide margin, addressing the environmental critiques builders and investors who have avoided Ethereum due to its energy wasted. Ethereum’s PoS upgrade could also steal some attention from blockchains such as Algorand, Solana, and Cardano, all of which promote themselves as “sustainable” alternatives to Ethereum.

Security: With more network participants able to participate as validators in the network, Ethereum’s security will theoretically be more decentralized, making it more difficult for bad actors to gain control and corrupt the blockchain. Theoretically, there could now be millions of everyday Ethereum investors acting as validators on the network, who otherwise would never be able to open up costly mining rigs (422,000 validators were opened in testing the Beacon chain, according to Glassnode). Of course, decentralized validators also come with their own risks. If validation is a matter of capital staked, there is the possibility of large actors banning together and taking control of the network. However, with Ethereum as big as it is, the likelihood of a network attack by validators could be rare.

Scalability & proven adaptability: Ethereum is already regarded as one of the most secure and decentralized smart-contract blockchains, and the merge is its biggest step yet in proving out its ability to adapt, scale-up, and improve on its weak points. The Merge sets the stage for Ethereum’s next major upgrade sharding, which could greatly lower gas fees and congestion on the network — addressing the other major criticism lobbied against Ethereum. If the Merge goes off without a hitch or with minimum disruption, it could cement Ethereum as the most decentralized and future-proof blockchain of choice for certain types of developers and builders. This proof point could also speak to institutional investors about the Ethereum asset and the long-term validity of decentralized finance (based on Ethereum).

The rate of Ethereum issuance: Finally, because of the improvement in Ethereum’s efficiency, the blockchain will issue significantly less Ethereum every year because it no longer needs to pay miners the same rewards for higher security costs. Currently, Ethereum’s rate of issuance to miners is 4.3%; after completing this upgrade, it will fall to 0.43% (according to Bankless estimates). Because the overhead costs of being a validator are greatly reduced, Ethereum’s total issuance could drop around 90%. If you’re familiar with Bitcoin, this could be seen as a “triple halvening.” Combine this with a recent upgrade (EIP: 1559) that burns more Ethereum for executing transactions, and we could see less Ethereum supply, higher demand, and a potential deflationary impact. Take from that what you will!

What’s coming next?

Does this go off without a hitch? Is there a security failure? Can a bad actor exploit this vulnerable moment? There are the known unknowns, and then the unknown unknowns to monitor.

Ethereum stands to benefit for all of the reasons that we discussed above, making it both a more attractive environment for developers, and a potentially more attractive asset. If there are problems or disruptions, it doesn’t mean that Ethereum is dead, but it will be fascinating to monitor how the community responds, and if it functions efficiently enough to solve its own problems.

The bottom line

The core baseline crypto infrastructure is still building itself, innovating in real-time and making steps forward. Continued improvements that finesse the infrastructure layer will create a better environment for all applications and the larger infrastructure — all of which show positive steps for greater adoption!

We will be watching along with you! Stay tuned!

*Data sourced through Bloomberg. Can be made available upon request.