Cryptocurrency markets have pushed up over the week to finish the month of May on a high note.

The march north has been led by Ethereum, which has risen almost 20% over the last ten days, dragging its bigger brother Bitcoin back up towards the $10k mark. Meanwhile, smaller altcoins are running ahead of the pack with Stellar and Cardano boosted by positive news.

As we move into June, Ethereum marks 13% gains for the month of May. Bitcoin is up 10%, and the S&P 500 has risen 6% as it approaches pre-covid highs despite somber news that the virus has claimed over 100,000 American lives.

This Week’s Highlights

- Cardano Leads Altcoin Rally

- Dormant Bitcoin Paints Bullish Picture

Cardano Leads Altcoin Rally

As traders recycled profits from bitcoin gains over the past week, altcoins popped and bitcoin dominance dropped.

Ethereum competitor Cardano (ADA) offered the most spectacular performance. The coin skyrocketed 50% to hit highs not seen since July 2019, mirroring the upward trajectory of the SpaceX launch and undoing almost 11 months’ downslide in a single week. The sudden surge comes after a surprise announcement from founder Charles Hoskinson that the Shelley upgrade will be shipped earlier than expected on June 30th. This is a key milestone in the development of Cardano, which Hoskinson claims is basically the “world’s next operating system.”

Close behind, XRP’s little brother Stellar is up 13% this week on news of collaboration with London-based fintech firm SatoshiPay, which plans to use the crypto for fast and affordable cross-border payments.

Dormant Bitcoin Paints Bullish Picture

60% of the supply—or close to 11 million bitcoin—has remained dormant for more than a year, according to data from market intelligence platform Glassnode. This shows “increased investor HODLing behaviour”, indicating that long-term holders are optimistic about future market prospects.

Indeed, Glassnode’s data reveals that the last time so much bitcoin stayed still for so long was in 2016, right before the cryptocurrency bull market of 2017.

The Week Ahead

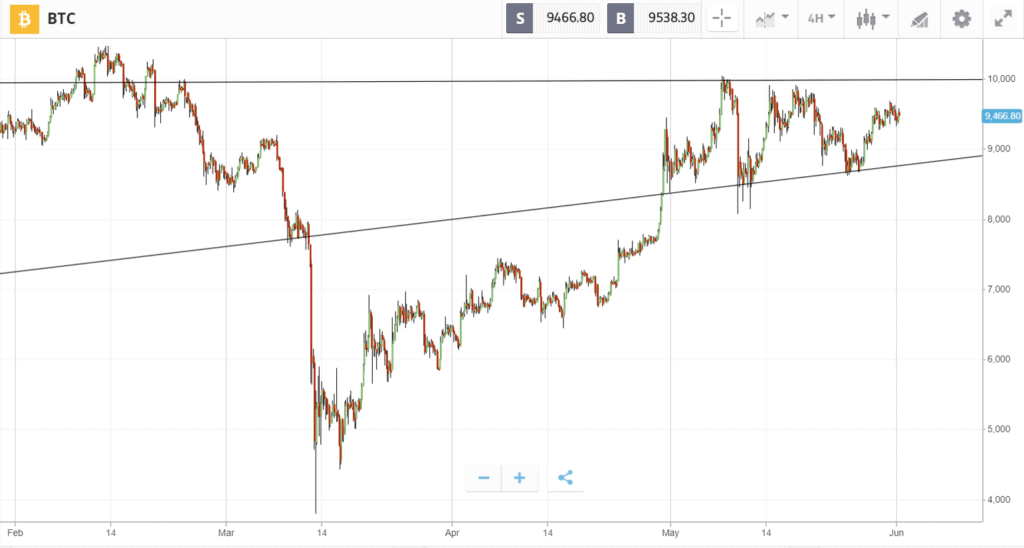

Traders will be watching closely this week for bitcoin to make another attempt at taking $10,000.

The more times bitcoin taps this key psychological level, the more likely it is to eventually break through.

Meanwhile, mounting political turmoil is threatening to blow all global financial markets off course. Protests about the death of George Floyd are popping up around the world, and tensions over Hong Kong mean an economic clash with China could still be on the cards — even if Trump has decided against scrapping his Phase 1 trade deal.

Adding to this risk-off sentiment, a deluge of data due this week is expected to reveal more economic damage from coronavirus. This includes key readings from the U.S. manufacturing and services sectors.