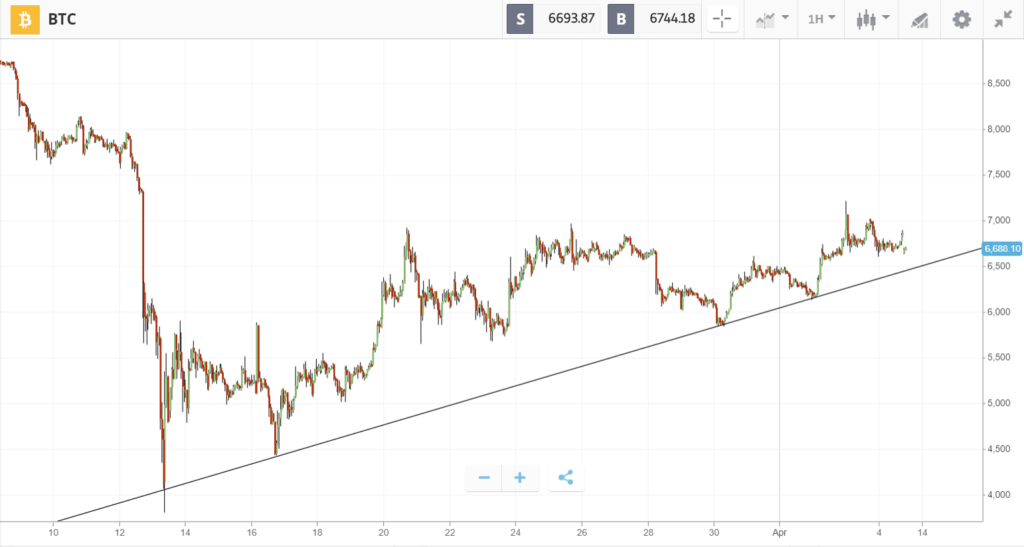

Bitcoin’s drop over the past few days has left traders wondering if the discount is a short-lived gift from the Easter bunny, or a warning of further downslide.

The leading cryptocurrency spent most of last week above $7,000, but fell on the 10th with the observance of Good Friday. This led the price down towards $6,500, and pushed the crypto sentiment gauge into Extreme Fear. According to the psychology of market cycles, this could signal the widespread disbelief that often comes at the start of a long-term recovery.

Altcoin events were dominated by the disappointing Bitcoin Cash halving this week, which had no visible impact on the price. This was overshadowed by surging altcoins like Tezos, which added almost 20% in value after the Tezos Foundation announced it will issue the first tokenized version of bitcoin on the Tezos blockchain — tzBTC.

This Week’s Highlights

- No Fanfare for Bitcoin Cash Halving

- Indian Trading Activity Surges

No Fanfare for Bitcoin Cash Halving

Bitcoin Cash underwent its halving event on Wednesday. This significant milestone is the first such event for the crypto since forking from Bitcoin, and means miners of the cryptocurrency

have had the reward for mining each block reduced by 50%.

As a supply shock, this is typically thought to be bullish, but Bitcoin Cash failed to rally and instead sank around 10%.

Though this was a disappointment to many, It’s likely that the halving of Bitcoin — due in mid-May — will have a much bigger impact on the cryptocurrency markets.

Indian Trading Activity Surges

Indian exchanges are reporting a frenzy of trading activity spurred by both domestic and global events.

In early March, the country’s Supreme Court overturned an order blocking crypto companies from securing banking relationships, opening the floodgates for millions of Indian rupees waiting to enter crypto exchanges.

This positive momentum was strengthened a few days later with the collapse of one of India’s biggest banks, when even more citizens lost faith in fiat currency. Now with the covid-induced lockdown, exchanges in the country have reported another big boost in signups of new traders.

The Week Ahead

The release of more economic data this week threatens to curb the global risk appetite sustained by optimism over Federal Reserve stimulus and signs that the coronavirus curve is flattening.

Tuesday will see the IMF’s new forecast for the world economy released, which is expected to show the grim repercussions of placing a third of the world’s population under lockdown. Then on Thursday, another round of worsening data on U.S. Jobless Claims is expected.

As crypto markets have been caught up in macroeconomic turmoil recently, these data releases are likely to be the biggest catalyst for bitcoin and other major cryptocurrencies this week. If the price of bitcoin does move downwards, buyers could be expected to step in at the uptrend support near $6,500.