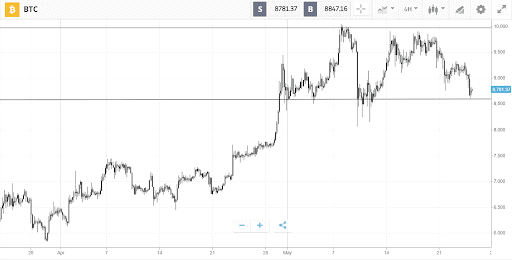

A sudden movement of Bitcoin from 2009 spooked the market this week, with the price falling almost 10% as rumors swirled that Satoshi was preparing to sell a huge stack of coins. Combined with the failure to surpass $10k, this dampened market sentiment and pushed the crypto Fear and Greed Index back into negative territory.

Despite Bitcoin’s drop, rival cryptocurrency Ether has maintained its position above $200.

This means bitcoin dominance — the percentage of cryptocurrency market share held by BTC — is shrinking in what could be a sign of impending alt season. In this stage of the crypto market cycle, Bitcoin consolidates and small-cap cryptocurrencies surge as profits are recycled into altcoins.

This Week’s Highlights

- Big Banks Eye Bitcoin

- Transaction Fees Soar After Halving

Big Banks Eye Bitcoin

The same banks that once scorned Bitcoin are now coming round to the new asset class.

Goldman Sachs, once the most vocal crypto critic, has arranged a conference call for Wednesday May 27th with the title: “US Economic Outlook & “Implications of Current Policies for Inflation, Gold and Bitcoin”. This suggests the narrative of Bitcoin as “digital gold” is taking hold amidst unprecedented money printing from central banks.

News of the conference call comes after Goldman’s archrival J.P. Morgan announced it would provide banking support for two major cryptocurrency exchanges, and investment pioneer Paul Tudor Jones revealed his own allocation to bitcoin.

Transaction Fees Soar After Halving

Booming demand for bitcoin appears to be reflected on the network, with average fees spiking to $6.60—the highest level for more than two years.

Higher costs for executing transactions indicates network congestion, suggesting buying activity. But the fees could also be explained by a lack of miners, who may now be pulling the plug on hardware as the reduced block reward from the halving damages profits.

The Week Ahead

Trading volumes are likely to be lower on Monday as Americans step away from their desks to

commemorate Memorial Day with backyard barbecues and lakeside picnics. The resulting thin order books could lead to more volatility, especially as Bitcoin is now sitting right on support at the bottom of the trading range.

If Bitcoin and Ether manage to stay steady, we could see funds cascade out from these coins, creating an “alt season” where smaller cryptocurrencies push higher.

Meanwhile, rising geopolitical tensions around Hong Kong threaten to spill over into the cryptocurrency market. Bitcoin traded at a premium in the city last summer amid widespread civil unrest, and recent protests over Beijing’s proposed national security laws look set to continue.