As the supermoon lit up the sky last week, bitcoin reached a moon of its own — surpassing 10k on halving hype before slipping back to the $8,700 mark.

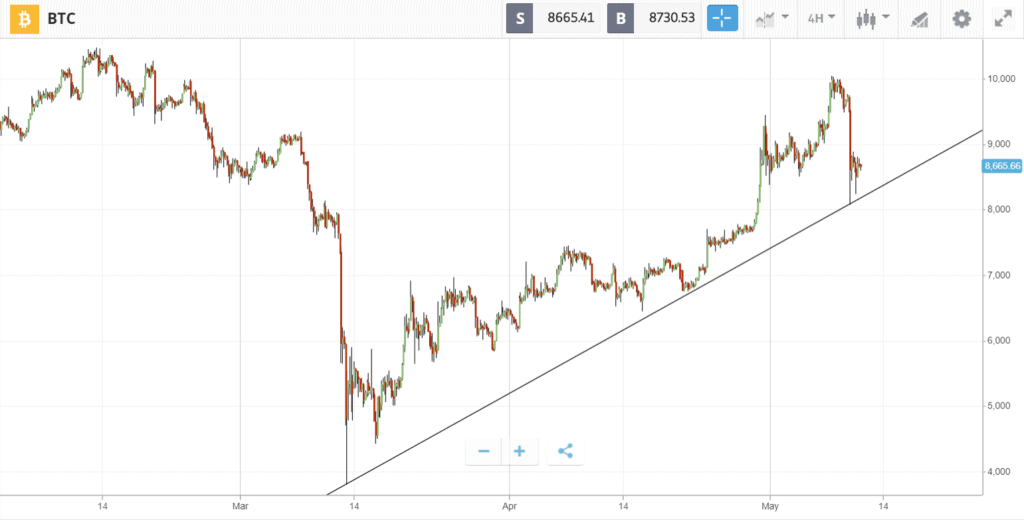

With the long-awaited event just hours away, bitcoin is now testing support at the bullish trend line that extends back to the Black Thursday crash of March 13th.

Bullish equities may have helped the cryptocurrency market to stay buoyant. Wall Street brushed off a record-breaking report of job losses on Friday, with the S&P 500 pushing up to finish the week 4% higher. The stock index has now risen 33% from its March low, compared to bitcoin which is sitting pretty at 126% higher than its own low of $3,800.

This Week’s Highlights

- Hedge Fund Legend Buys Bitcoin

- Halving Chatter Hits Fever Pitch

Hedge Fund Legend Buys Bitcoin

Pioneering hedge fund magnate Paul Tudor Jones II told investors last week that he is keen to invest in bitcoin, joining one of the most successful hedge funds ever—Renaissance Technologies’ Medallion—which has also been eying the bitcoin futures market.

Jones, who correctly predicted the 1987 stock market crash, told clients that bitcoin is one of the assets likely to respond first to “the massive increases in global money” from central banks fiscal stimulus, and that the cryptocurrency reminds him of the role gold played as a hedge against inflation in the 1970s.

The news coincides with surging activity for bitcoin futures contracts on the CME exchange. Open interest—defined as the number of futures contracts held by market participants at the end of the trading day—hit an all-time high on the exchange last week, as noted by Norwegian crypto data firm Arcane Research.

Halving Chatter Hits Fever Pitch

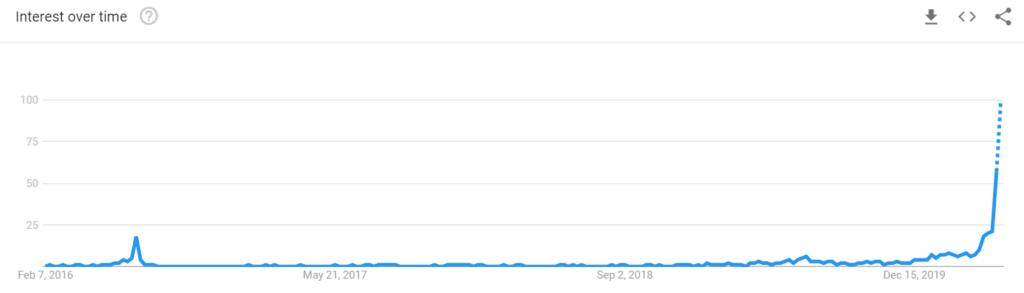

Google search data and social media metrics reveal a buzz of activity around the bitcoin halving.

The number of mentions of the term bitcoin halving on social media has been climbing since early April, and turned parabolic in May. This is shown in data collected by social media monitoring firm LunarCRUSH. Meanwhile, Google searches for bitcoin halving have hit a peak over eight times higher than in July 2016 when the last halving took place.

The Week Ahead

The supply of new bitcoin is set to be halved today at 20:30 UTC, but traders expecting fireworks might be disappointed. In previous halving events in 2016 and 2019, the price did not react immediately, but instead consolidated in the same area for weeks before the supply shock eventually triggered an uptrend.

On the macroeconomic front, rising tensions between the U.S. and China are now threatening to interrupt the recent equities bull run — but whether bitcoin will follow the stock market or regain its safe haven appeal remains to be seen.